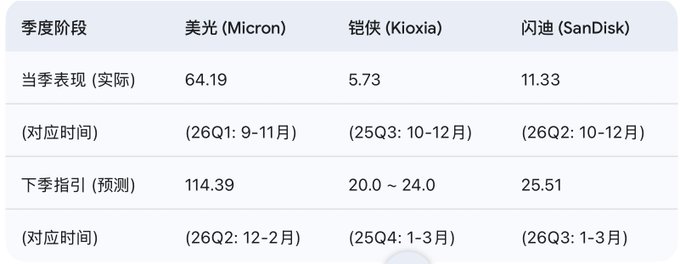

Kioxia Holdings (stock code: 285A) released its latest quarterly financial results (third quarter of fiscal year 2025, i.e., October to December 2025) on February 12, 2026. Kioxia's financial performance was extremely strong, especially in that it publicly disclosed its previously undisclosed full-year profit forecast for the first time, and the amount far exceeded market expectations. Here is a concise and accurate summary of the data: Kioxia Q3 2025 Financial Report Key Highlights Reporting Period: October 1, 2025 - December 31, 2025 Exchange Rate: 1 USD ≈ 153.14 JPY (converted at the real-time exchange rate on February 12, 2026) 1. Core Financial Performance (Q3, October-December) Revenue: US$3.4 billion; Net Profit: US$573 million. 2. Cumulative Performance (April-December 2025) Cumulative Net Profit for 9 Months: US$958 million. 3. Most Important Announcement: Full-Year Earnings Forecast (to the end of March 2026) Kioxia had previously not publicly disclosed its full-year profit forecast, but today's financial report provides it for the first time, demonstrating strong confidence in the market: Expected Full-Year Net Profit: US$2.96 billion ~ US$3.35 billion Interpretation: With total net profit for the first three quarters at only $958 million, Kioxia expects its net profit for the final quarter (January-March 2026) to surge to approximately $2 billion! That's a fourfold increase compared to the previous quarter! In comparison, Micron and SanDisk expect their net profit to double in the next quarter! Incredibly alarming! The financial reports for the storage industry in March and April this year are collectively quite alarming! Not just compared to the full year, but compared to the previous quarter, all show a several-fold increase in net profit! newsfile.futunn.com/public/NN-PersistNoticeAttachment/7781/20260212/JPX/20260212556330.PDF…

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content