Market Update aims to provide readers with the latest market reports and key digital asset data.

Article author: Chang

Article source: ME News

ETF Directional Data

According to SoSoValue data, the SOL spot ETF saw a total net inflow of $478,900 yesterday (February 11, Eastern Time).

Yesterday, only the Invesco Galaxy Solana ETF (QSOL) saw net inflows, with a single-day net inflow of $478,900, bringing its total historical net inflow to $894,900.

As of press time, the SOL spot ETF has a total net asset value of $674 million, an SOL net asset ratio of 1.49%, and a cumulative net inflow of $871 million.

According to SoSoValue data, yesterday (February 11, Eastern Time), the XRP spot ETF saw no net inflows or outflows throughout the day, remaining unchanged.

As of press time, the XRP spot ETF has a total net asset value of $993 million, an XRP net asset ratio of 1.18%, and a cumulative net inflow of $1.231 billion.

Bitcoin spot ETFs saw a total net outflow of $276 million yesterday, with Fidelity FBTC experiencing the largest net outflow at $92.5958 million.

According to SoSoValue data, Bitcoin spot ETFs saw a total net outflow of $276 million yesterday (February 11, Eastern Time).

The Bitcoin spot ETF with the largest single-day net inflow yesterday was the WisdomTree ETF BTCW, with a net inflow of $6.777 million. The total historical net inflow for BTCW is currently $66.2583 million.

The Bitcoin spot ETF with the largest single-day net outflow yesterday was the Fidelity ETF FBTC, with a single-day net outflow of $92.5958 million. Currently, FBTC's total historical net inflow has reached $11.074 billion.

As of press time, the total net asset value of Bitcoin spot ETFs was $85.765 billion, with an ETF net asset ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 6.35%, and a historical cumulative net inflow of $54.724 billion.

Ethereum spot ETFs saw a total net outflow of $129 million yesterday, with Fidelity FETH experiencing the largest net outflow at $67.0874 million.

According to SoSoValue data, the Ethereum spot ETF saw a net outflow of $129 million yesterday (February 11, Eastern Time).

The Ethereum spot ETF with the largest single-day net outflow yesterday was the Fidelity ETF FETH, with a single-day net outflow of $67.0874 million. Currently, FETH's total historical net inflow has reached $2.515 billion.

The second largest outflow was from the BlackRock ETF ETHA, which saw a net outflow of $29.4426 million in a single day. ETHA's total historical net inflow has reached $12.015 billion.

As of press time, the total net asset value of the Ethereum spot ETF was $11.273 billion, with an ETF net asset ratio (market capitalization as a percentage of Ethereum's total market capitalization) of 4.78%, and a cumulative net inflow of $11.751 billion.

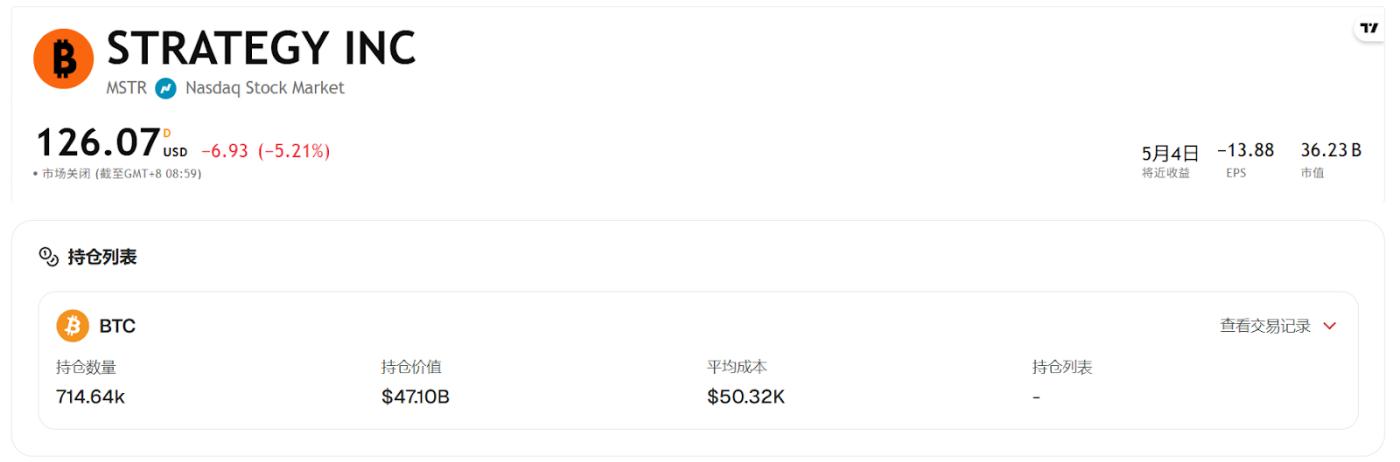

BTC direction

According to CoinFound data, 195 listed companies currently hold a total of 1,206,554 BTC, accounting for 6.06% of the total Bitcoin supply. Among them, Strategy Inc (MSTR) holds 714,644 BTC, accounting for 59.23% of the total holdings of listed companies.

RWA direction

According to CoinFound data:

- Market capitalization of commodities: US$7.04 billion

- Market value of government bonds: US$1.52 billion

- Institutional fund market capitalization: US$2.57 billion

- Private lending market capitalization: $37.63 billion

- Market value of US Treasury bonds: $10.75 billion

- Market value of corporate bonds: US$1.62 billion

- Market capitalization of tokenized stocks: $1.73 billion

Market Dynamics:

- The Hong Kong Securities and Futures Commission (SFC) plans to allow BTC and ETH to be used as collateral for financing.

- Institutional consensus ahead of the 2026 Crypto Finance Forum (HKU)

- BlackRock BUIDL Fund achieves 24/7 dividend payouts and steady market capitalization expansion.

Summarize:

From US Treasury bond issuance to private equity growth, RWA is taking over the main course of institutional asset allocation. The core driving forces include the improvement of the regulatory environment and the maturity of infrastructure, which promote the tokenization of assets such as Treasury bonds, private credit, commodities and equities and their integration into mainstream finance. RWA is in a stable period of transition from speculation to practical use. Its valuation is rising but its volatility is low, making it suitable for long-term allocation rather than short-term speculation.

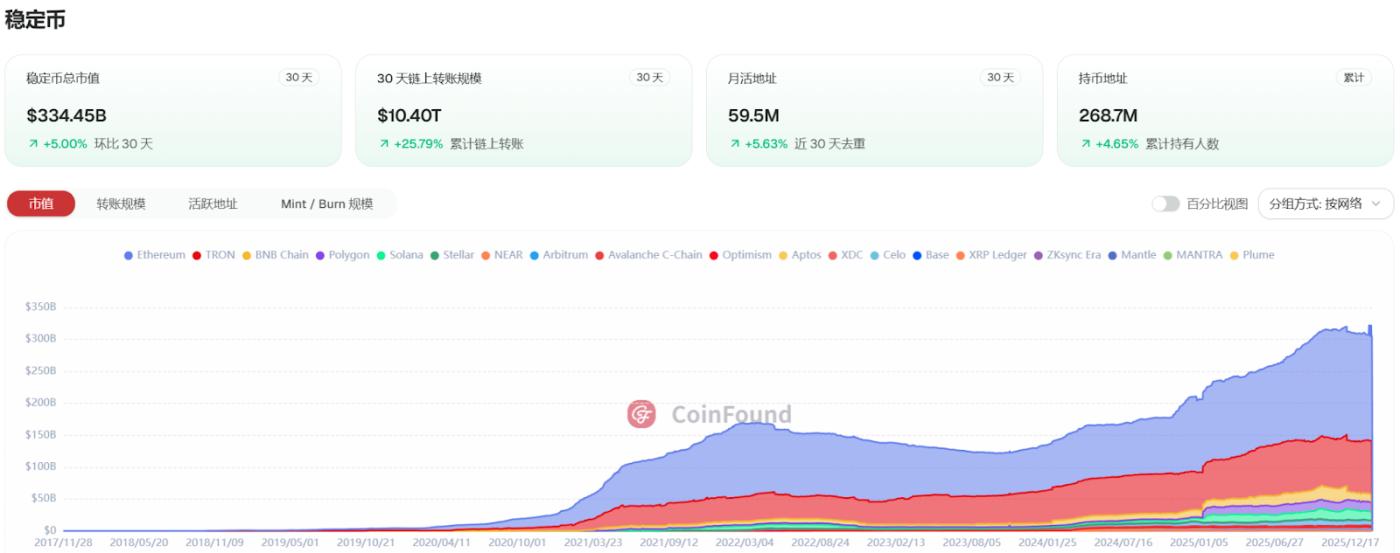

Stablecoin direction

According to CoinFound data:

- USDT market capitalization: $195.24 billion

- USDC market capitalization: $75.11 billion

- EURC's market capitalization: $12.27 billion

- USDS market capitalization: $11.18 billion

- USDe market capitalization: $6.49 billion

- PYUSD Market Cap: $3.92 billion

- USD1 Market Cap: $5.42 billion

Market Dynamics:

- US banks intensify lobbying against interest rate bans on interest-bearing stablecoins.

- Superset has raised $4 million in seed funding to address liquidity fragmentation.

- Visa Direct stablecoin pilot accelerates and enterprise-level treasury applications.

- Tether invests $150 million in Gold.com.

Summarize:

The stablecoin market as a whole has shown relative resilience. Despite significant volatility in the cryptocurrency market, the stablecoin market has remained relatively stable. This reflects investors seeking safe havens amid market uncertainty, with funds shifting from volatile assets to stablecoins as a "safe haven." Overall, growth may slow in the short term due to macroeconomic uncertainties and the interconnectedness of the crypto market.