Binance has completed the conversion of $1 billion to Bitcoin for its user emergency fund, amid record low crypto market sentiment and increased short positions by "smart money" traders.

Binance has completed the conversion of $1 billion to Bitcoin for its emergency fund, committing to holding Bitcoin as its core reserve asset.

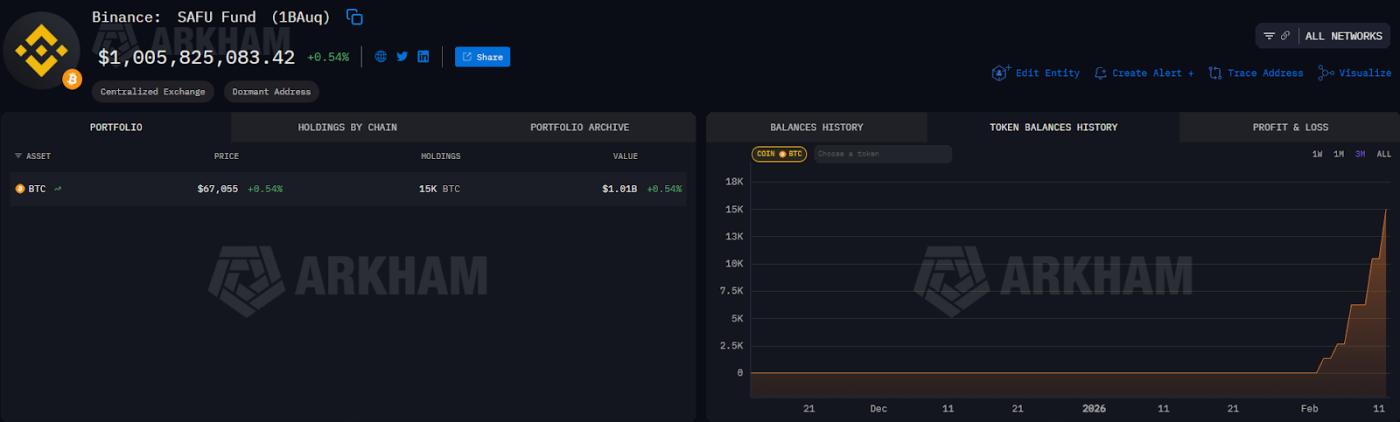

According to data from Arkham , Binance purchased an additional $304 million worth of Bitcoin on Thursday, completing the conversion of $1 billion to Bitcoin for the Secure Asset Fund for Users (SAFU) wallet.

The fund currently holds 15,000 Bitcoin, worth over $1 billion, purchased at a composite Medium Capital of $67,000 per coin, Binance said in an X post on Thursday.

“With the SAFU Fund now held entirely in Bitcoin, we reinforce our confidence in BTC as a leading long-term reserve asset.”

The latest BTC purchase took place three days after Binance's earlier $300 million acquisition on Monday.

The exchange first announced on January 30th that it would convert its $1 billion user protection fund to Bitcoin, initially committing to a 30-day timeframe to complete the purchases, but completing them in less than two weeks.

The exchange stated that it would rebalance the fund if volatility caused its value to fall below $800 million.

Crypto investor sentiment has fallen to its lowest level ever recorded.

The transition is taking place against a backdrop of extremely negative overall market sentiment.

Investor sentiment suffered another shock after Bitcoin's short-term correction below $60,000 on February 5th, sending the index down to 5 on Thursday — its lowest level ever recorded — signaling extreme investor fear, according to data from alternative.me.

This index is a multi-factor measure of crypto market sentiment.

Top-performing profit-driven traders, known as "smart money," are also hedging against the possibility of a further decline in the crypto market.

According to crypto analytics platform Nansen, smart money traders are holding a net short position of $105 million in Bitcoin and are net shorting most major cryptocurrencies, with Avalanche being the only notable exception, recording a net long position of $10.5 million.

The Bitcoin correction also caused a large amount of the Token supply to fall into a loss-making state, equivalent to 16% of Bitcoin's market Capital , marking the highest level of "pain" recorded in the market since the collapse of Algorithmic Stablecoin issuer Terra in May 2022, Glassnode wrote in an X post on Monday.

However, in a bright spot of this correction, the market structure is showing initial signs of stabilization, according to Dessislava Ianeva, a dispatch analyst at the digital asset platform Nexo.

“Positions in the Derivative market remain cautious. Funding rates are neutral to slightly negative, reflecting low leverage demand, while open interest in underlying BTC has returned to early February levels, suggesting stability rather than a new expansion phase,” the analyst told Cointelegraph.