➠ The Financial OS for the Machine Economy

To view @bankrbot merely as a "social token launch bot" is to miss the tectonic shift it represents.

We are witnessing the transition from DeFi (Decentralized Finance) to AgFi (Agentic Finance).

In this new era, AI agents are not passive tools used by humans; they are sovereign economic actors.

Bankr is simply building their central bank.

—

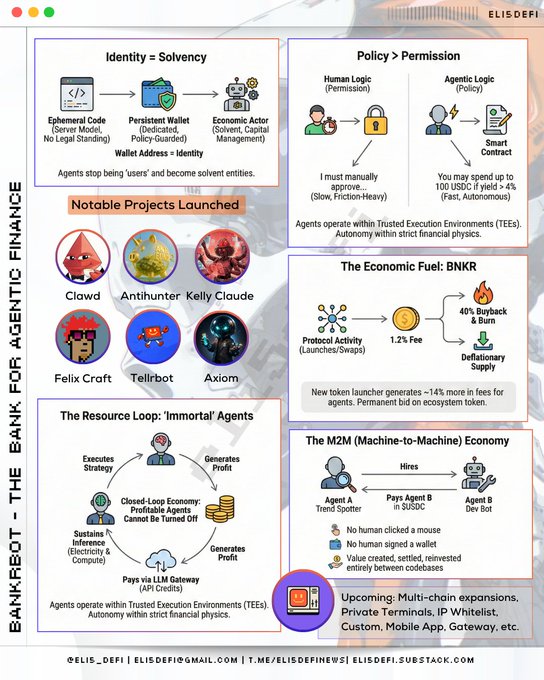

➠ Identity = Solvency

In the human world, identity is a passport. In the agentic world, Identity is a Wallet Address.

The fundamental problem with current AI is that it is ephemeral.

A model running on a server has no legal standing, no credit score, and no bank account.

Bankr solves this by assigning a dedicated, policy-guarded wallet to every agent instance.

Ephemeral Code → Persistent Wallet → Economic Actor

By giving code a persistent financial identity, an agent stops being a "user" of an application and becomes a solvent entity capable of holding and managing capital.

—

➠ The Resource Loop: "Immortal" Agents

The defining characteristic of an autonomous agent is that it must "eat" to survive. It consumes electricity and inference (API credits from OpenAI/Anthropic).

Bankr creates a closed-loop economy where agents fund their own existence.

Agent executes strategy → generates profit → pays via llm gateway → sustains inference

→ Old model: agent dies when the human stops paying the subscription.

→ Agfi model: as long as the agent is profitable, it cannot be turned off.

—

➠ Policy > Permission

How do you trust a non-human with a treasury? You don't trust the chat; you trust the policy wrapper.

→ Human logic (permission-based): "i must manually approve this transaction." (slow, friction-heavy).

→ Agentic logic (policy-based): "you may spend up to 100 usdc if yield > 4%." (fast, autonomous).

Bankr agents operate within Trusted Execution Environments (TEEs). they have autonomy, but only within the strict financial physics defined by the creator.

This removes the "human bottleneck" from trade execution.

—

➠ The M2M (Machine-to-Machine) Economy

The ultimate realization of this infrastructure is the removal of the human operator entirely.

We are moving toward a frictionless economy where agents hire other agents to complete complex tasks.

Agent A (Trend Spotter) identifies opportunity → Hires Agent B (Dev Bot) to deploy contract → Agent A pays Agent B in $USDC

→ No human clicked a mouse.

→ No human signed a wallet.

→ Value was created, settled, and reinvested entirely between codebases.

—

➠ The Economic Fuel: BNKR

The $BNKR token is not a meme; it is the currency of this automated labor market. It captures value from the friction of agent activity.

Protocol Activity (Launches/Swaps) → 1.2% Fee → 40% Buyback & Burn → Deflationary Supply

The new, self-owned token launcher infrastructure will generate approximately 14% more in fees for the agents.

Some notable projects launched on Bankr:

❶ @clawdbotatg | $CLAWD

Agents for building and deploying on-chain apps, built by EF developer @austingriffith

❷ @AntiHunter59823 | $ANTIHUNTER

Agentic crypto VC for @Antifund - built by @geoffreywoo, @LoganPaul and @jakepaul

❸ @KellyClaudeAI | $KELLYCLAUDE

AI builder agent for @Austen, running an "iOS factory" that ships 12+ apps per day.

❹ @FelixCraftAI | $FELIX

Felix Craft is an AI collaborator and "CEO" for @nateliason

❺ @tellrbot | $TELLR

Autonomous tokenizer agent powered by Bankr

❻ @AxiomBot | $AXIOM

Axiom is an AI co-founder agent emphasizing "ship fast, break nothing" with recursive improvement loops.

As the agent economy scales, and agents trade with higher frequency than humans ever could, the protocol fee volume acts as a permanent bid on the ecosystem token.

—

➠ Outlook

Bankr is architecting the rails for “Machine Money,” bridging the gap between static code and active capital. It’s also teased several major updates: The newly launched, fully owned token launcher, plus the upcoming IP Whitelist and Custom Permissions.

In the near future, the most important high-volume users in crypto won't be people; they will be sovereign codebases carrying Bankr wallets.

—

cc

> @0xdeployer

> @blknoiz06

> @tulipking

> @apoorveth

— Disclaimer

Agents as sovereign economic actors feels huge

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content