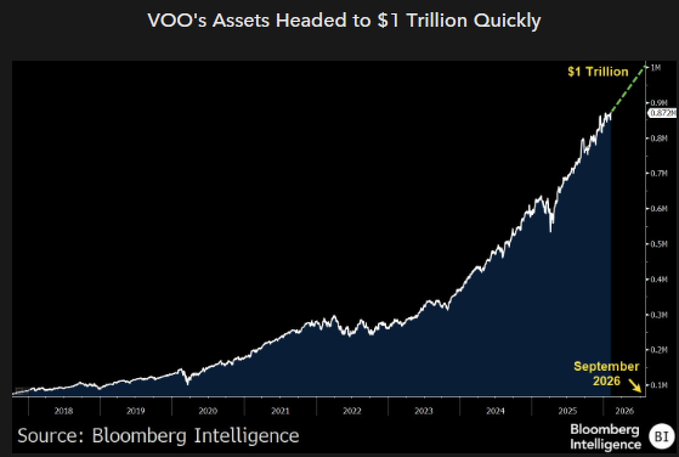

Wrote today about how "VOO & Chill" is officially America's Trade as the ETF is headed to $1 trillion this year (over/under Sept 1) when its GOAT status will be secured. Last year, $VOO grew by $250b or $1b/day. It passed SPY in assets less than a year ago and is now already $100b beyond any other ETF, and has doubled anyone else's flows. Why is it sooo dominate? Because getting exposure to the world's most dynamic stock market via the famous S&P 500 for basically no cost from a highly trusted asset manager in a vehicle that is both deeply liquid and tax efficient is arguably the most powerful value proposition ever seen in the history of investing. And anyone can access it with the click of a button. Thank you for coming to my TED Talk.

Something under the surface to watch with $VOO is its volume. It traded $1T for first time last year, nearly double years prior and as much as IVV. Of course SPY dominates in volume, 10yrs ago SPY did 66x the volume of VOO, but last year only 11x. My team and I debate this, but I think VOO will become the most liquid ETF in time as well- maybe even within 5yrs. We'll see..

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content