By Suvashree Ghosh, Bloomberg

Compiled by: Saoirse, Foresight News

Editor's Note: The global crypto market has recently experienced a prolonged downturn, and China has further tightened regulations on cryptocurrencies and stablecoins, explicitly prohibiting the issuance of RMB-pegged stablecoins overseas without approval. This directly impacts Hong Kong's development as a digital asset center. This article focuses on the market reaction and industry impact following the policy's implementation, revealing the core contradiction between capital controls and crypto innovation. Against the backdrop of intensified industry consolidation and accelerated capital flight, the crypto sector is returning to pragmatic development; the relevant regulatory boundaries and future trends warrant continued attention.

A cryptocurrency exchange storefront in Hong Kong on November 26, 2025. Photo: Lam Yik/Bloomberg

Setbacks in the digital field

Last year, a growing number of crypto industry commentators believed that China's attitude toward digital assets might be changing.

Since Pan Gongsheng, governor of the People's Bank of China, put forward the vision that the RMB could challenge the dominance of the US dollar, there have been continuous claims of a "policy easing" in the market.

But on February 7, all these expectations came to an abrupt end.

During the latest cryptocurrency crash, China tightened its regulations on cryptocurrencies and the tokenization of physical assets, prohibiting domestic institutions from issuing digital tokens overseas and banning the issuance of stablecoins pegged to the yuan abroad without approval. Officials stated that this move was to prevent currency sovereignty risks.

Angela Ang, Head of Policy and Strategic Partnerships for Asia Pacific at blockchain intelligence firm TRM Labs, said: "China's attitude toward stablecoins has been exploratory at best, and has become increasingly lukewarm in recent months."

She stated that the central bank's announcement "completely dashed any hope of launching an offshore RMB stablecoin in the short term—Hong Kong is certainly out of the question, and other regions are likely to follow suit as well."

This is a major setback for Hong Kong and its long-standing goal of becoming a digital asset hub.

Last June, Hong Kong's Secretary for Financial Services and the Treasury, Christopher Hui, stated that based on regulatory requirements, he did not rule out the possibility of pegging a Hong Kong stablecoin to the renminbi. Now, it is widely believed that he has completely closed that door.

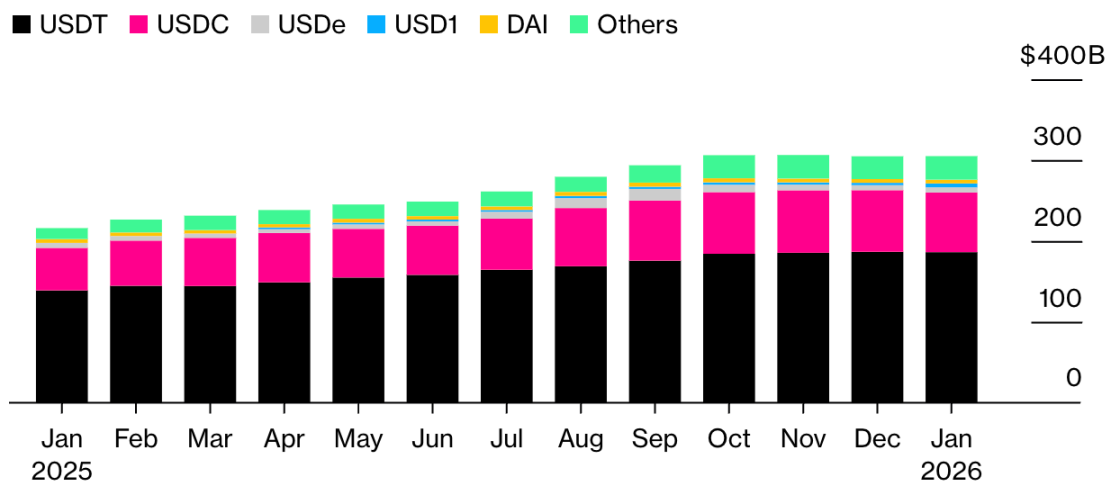

During Trump's presidency, the supply of dollar stablecoins surged.

Source: Artemis Analytics

As Angela Ang stated, this signal of tightening regulation had already been evident.

As early as August last year, China had already required local securities firms and related institutions to stop publishing research reports on stablecoins and holding related promotional seminars in order to curb overheated market sentiment.

Patrick Tan, general counsel for blockchain intelligence firm ChainArgos, said last week's policy announcement "removed the uncertainty that had been hanging over the market regarding the private issuance of RMB stablecoins. Issuers now know exactly where the red lines are."

Institutions applying for licenses can only focus on issuing stablecoins pegged to the Hong Kong dollar.

Bloomberg News previously reported that as many as 50 companies in Hong Kong planned to apply for stablecoin licenses last year, including tech giants Ant Group and JD.com. However, according to a Financial Times report in October, these companies were forced to suspend their stablecoin plans after Beijing intervened.

Neither Ant Group nor JD.com responded to requests for comment.

As of Tuesday, Hong Kong has issued licenses to 11 cryptocurrency exchanges and approved 62 companies to conduct digital asset trading for clients. The list includes Chinese-funded institutions such as CMB International Securities Limited, Guotai Junan Securities (Hong Kong) Limited, and Tianfu Futures Limited.

However, industry insiders worry that if RMB access cannot be established, the entire plan may be in vain.

"The issue has never been Hong Kong's regulatory framework, but rather whether China will tolerate the circulation of renminbi-denominated instruments outside its control," Patrick Tan said. "Capital controls and stablecoin liberalization are fundamentally mutually exclusive."

Market data continues to weaken

Bitcoin perpetual futures open interest continues to decline

Source: Coinglass

Bitcoin perpetual futures open interest has failed to rebound since its decline began last October, highlighting a lack of confidence supporting the current rally. Coinglass data shows it has fallen approximately 50% from its October high.

Capital outflow: $3.3 billion

Data compiled by Bloomberg Intelligence shows that since the plunge in early October, investors have withdrawn approximately $3.3 billion from U.S. Ethereum ETFs, with year-to-date withdrawals exceeding $500 million. The data also shows that Ethereum ETF assets have fallen below $13 billion, the lowest level since July of last year.

Industry perspectives

"The market is consolidating around areas that are truly effective. Even well-funded crypto-native VCs are heavily shifting towards fintech, stablecoin businesses, and prediction markets, making it difficult for other areas to gain attention."

— Santiago Roel Santos, Founder and CEO of crypto private equity firm Inversion

Crypto venture capital funds are shifting their focus to higher-performing areas such as stablecoin infrastructure and on-chain prediction markets, and expanding into related adjacent sectors.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush