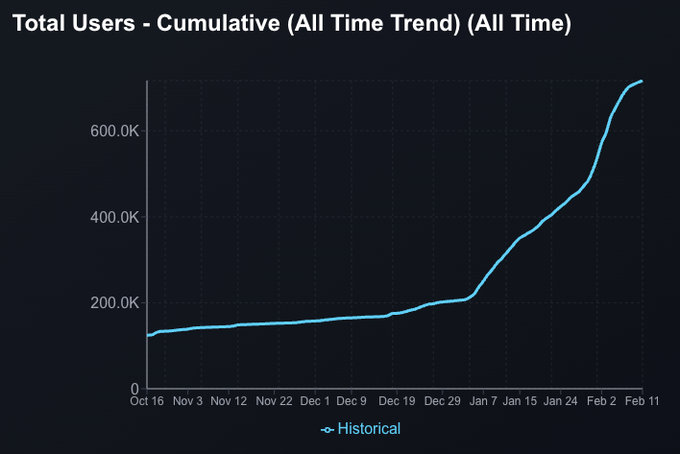

TermMax just crossed 700,000 users (Feb 12, 2026) and is on track for 1M by early March.

This growth reflects strong alignment across product, incentives, and market timing.

1/ Product fit: Fixed-rate DeFi

@TermMaxFi offers:

• Fixed-rate lending & borrowing

• No liquidation risk

• 1-click leverage up to 5x

• Structured products (FT / GT)

TVL grew from $34.9M to $44M in 2025, with strong demand from users seeking stable yield. Around 60% of growth came from retail prioritizing predictability.

2/ Incentive engine

XP (lending, borrowing, check-ins) + MP (content, referrals) + TMX airdrop created powerful momentum.

Campaigns in Jan 2026 pushed users from 300K to 540K in two weeks, contributing roughly 50% of recent growth.

3/ Institutional alignment

Backed by Cumberland, HashKey, and a $4.25M seed round.

Integrations with:

• Ondo (tokenized securities collateral)

• Binance Web3 Wallet (128K DAU peak)

• Brevis (ZK proofs)

• UnifAI (AI lending)

Institutional flows drove ~30% of expansion, with Q4 revenue up 86%.

4/ Narrative + macro tailwind

Strong community branding, KOL campaigns, and fixed-rate positioning during a volatile bull cycle added another growth layer.

Big picture

TermMax sits at the intersection of:

• Fixed-income DeFi

• Structured products

• RWA integration

• Aggressive community growth

The next phase will be defined by retention and competitive execution.

Fixed-rate DeFi is gaining real traction.

Good share mate

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content