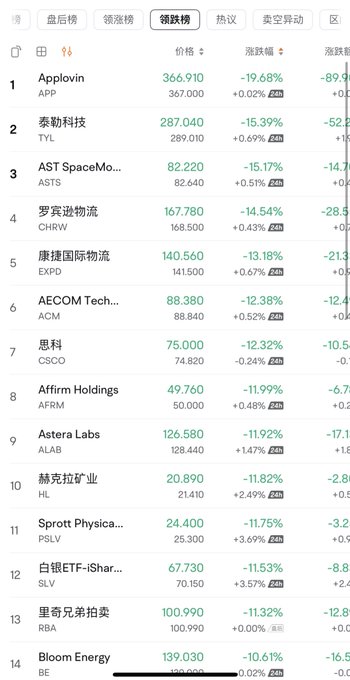

Recently, many industries have suffered consecutive sharp declines due to the evolution of AI. This has resulted in very few stocks rising and a huge number falling. Software stocks were hit hard a few days ago, and logistics stocks were hit hard yesterday. But we should be thinking more deeply about what AI is indispensable for. High-end chip manufacturers? TSMC and Samsung. High-end memory manufacturers? Samsung, Micron, SanDisk, and Hynix. These two have extremely high moats and are unshakeable. Industries without moats but likely to rely on AI expansion include: Electricity: copper for power construction, tungsten ore for nuclear power plants, and transformers for transmission equipment. The future belongs to AI; every penny invested that doesn't go into AI-related sectors is a waste. If you're afraid of risk, then stay in low-risk, high-moat sectors. You might earn less, but you'll sleep soundly and eat well. That's why I envy SanDisk and Kioxia, but I still stay in the Korean stock index; I can't let Korea be destroyed, can I? 😂

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content