When Wall Street analysts finished digesting Robinhood and Coinbase's Q4 earnings reports during their February 13th morning meeting, a harsh reality was laid out before them: despite both giants' desperate attempts to "diversify" and escape the pull of Bitcoin's price cycles, they were still seen by the market as high-beta derivatives of Bitcoin.

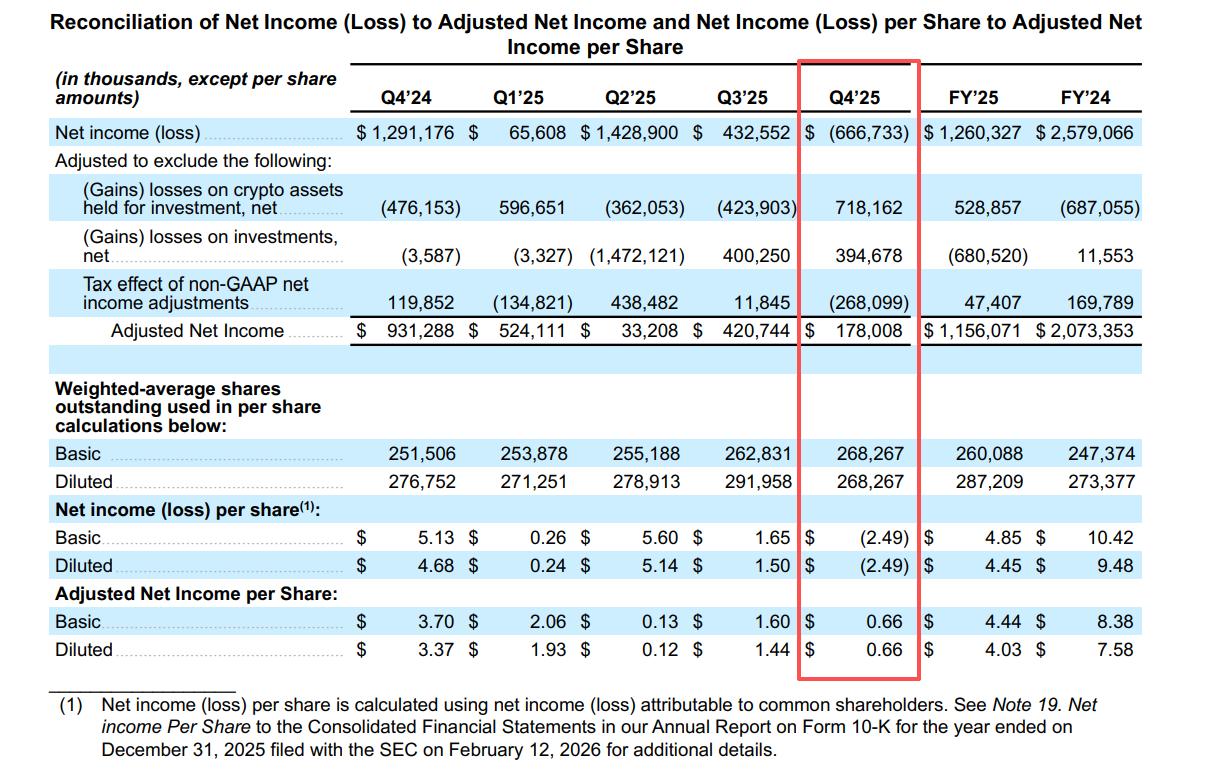

On one hand, Robinhood delivered its strongest revenue report ever, yet its stock price plummeted by half; on the other hand, Coinbase swung from profit to loss, posting a massive $667 million loss in a single quarter. These two financial reports are not only health checkups for the two companies, but also tombstones for the retail sentiment in the entire crypto market.

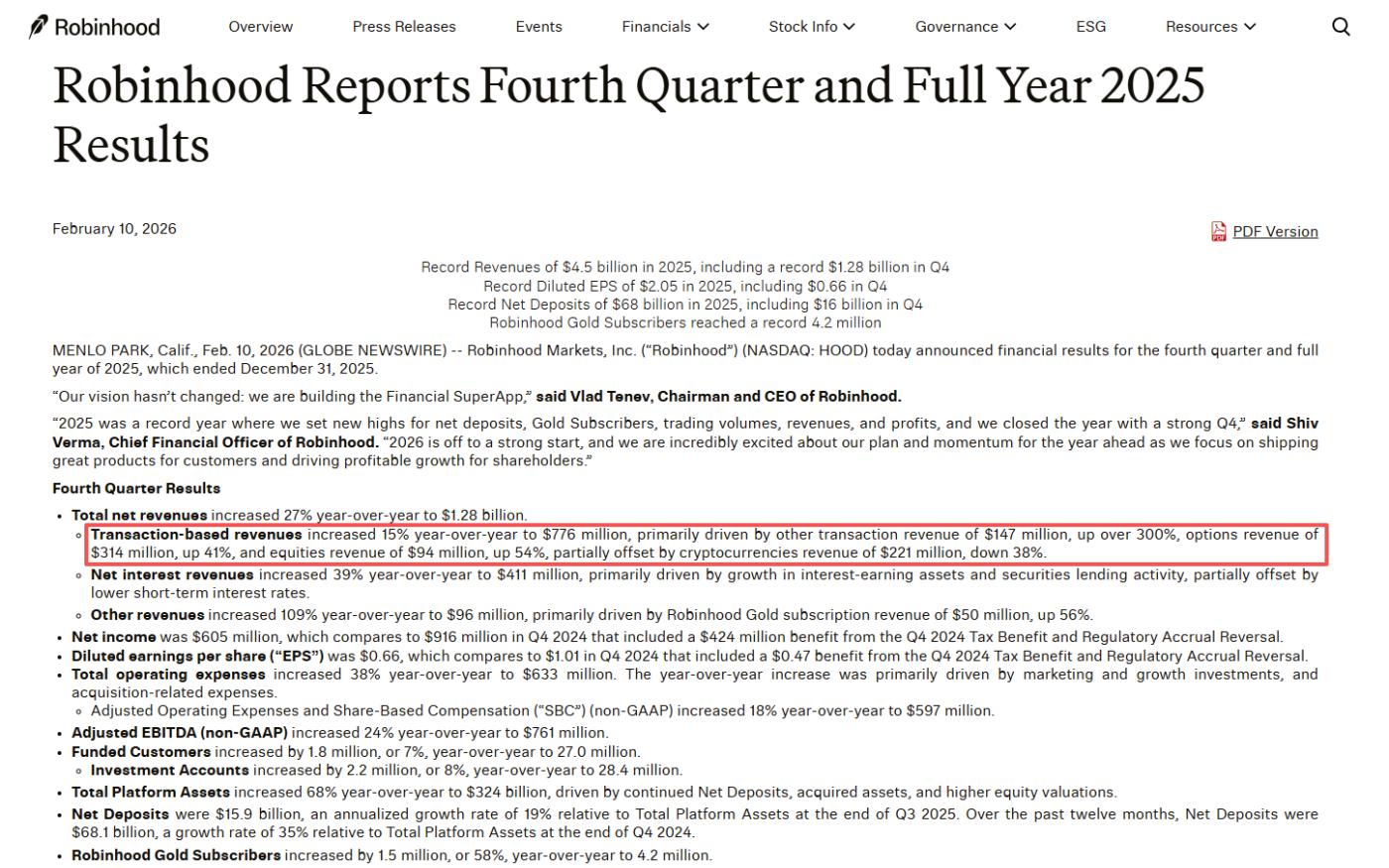

Robinhood : A luxury casino without gamblers , its financial reports are surreal. If you only look at the first half, it's a fintech giant at its peak: record-breaking $4.5 billion in revenue for 2025, $1.9 billion in net profit, and a 58% surge in Gold members to 4.2 million. CEO Vlad Tenev confidently declared in a conference call: "We're building a financial super app."

But the market is only focused on the lower half: retail investors have stopped participating.

The most glaring figure in the financial report is undoubtedly the collapse in cryptocurrency trading revenue. In Q4, this revenue was only $221 million, a sharp drop of 38% year-over-year. Correspondingly, in January 2026, the nominal cryptocurrency trading volume on the Robinhood App halved by 57% year-over-year, falling to just $8.7 billion.

Robinhood's traditional financial services (TradFi) are booming, with stock trading revenue up 54%, options up 41%, and even prediction markets becoming a new growth engine, with over 12 billion contracts traded in its first year. However, their crypto business is cooling rapidly: as Bitcoin retreated from its $126,000 high last year to around $65,000, FOMO has turned into fear itself. Retail investors have not only stopped trading but have even begun to exit through redemptions.

To Wall Street, Robinhood is like a newly renovated, luxurious casino with the latest slot machines (options) and poker tables (prediction markets), but the most profitable VIP room (cryptocurrency) is completely empty.

The market has voted ruthlessly with its feet: Despite Robinhood's desperate efforts to prove it's more than just a "crypto brokerage," investors still view it as a shadow stock of Bitcoin amid the Crypto Winter. Its share price has fallen 50% from its October high, a valuation drop not driven by its performance, but by its "crypto content."

Coinbase : The Winter of the Naked Swimmer. While Robinhood can hedge against the winter with its stock and options businesses, Coinbase is completely exposed to the storm. Its Q4 financial report shows that Coinbase's revenue fell 21.6% year-on-year to $1.78 billion, and even more shocking to the market was its net profit turning into a huge loss of $667 million. This massive loss mainly stemmed from investment losses in its crypto asset portfolio—a classic case of "bull market assets, bear market liabilities."

(Image source: Coinbase 2025 Q4 Shareholder Letter)

Coinbase's data reveals a deeper industry crisis than Robinhood:

- Retail investors are completely out of the picture: Consumer trading volume was only $59 billion, compared to institutional trading volume of $237 billion. Retail investors are practically "missing" in the Coinbase ecosystem.

- The only bright spot comes from institutional business and derivatives (thanks to the integration following the acquisition of Deribit), but this low-fee traffic cannot make up for the loss of high-fee retail trading.

- USDC Dependence: Stablecoin revenue reached $6.4 billion, becoming the "pillar" of its revenue. With trading volume drying up, Coinbase is increasingly resembling a bank that lives off dollar interest rather than an exchange.

Coinbase's current predicament is strikingly similar to a replay of 2022. Brian Armstrong's vision of an "Everything Exchange" appears utterly ineffective during a period of declining Bitcoin prices. When the prices of underlying assets (cryptocurrencies) plummet, exchanges, acting as the "shovels," not only cannot sell their shovels, but their own inventory of shovels also depreciates significantly.

By comparing the financial reports of the two companies, we can clearly see the underlying logic of the crypto market in 2026: neither Robinhood (Web2) nor Coinbase (Web3) has yet emerged from Bitcoin's Beta phase. Over the past year, both companies have been attempting to build their own Alpha opportunities.

Robinhood is betting on "decryptification," attempting to dilute the volatility of its crypto business through breadth, such as acquiring Bitstamp and even venturing into the Indonesian brokerage market. Coinbase, on the other hand, is betting on "depth," focusing on Layer 2 (Basechain), derivatives, and payment infrastructure in an attempt to retain institutional funding.

However, the data ruthlessly shows that whenever Bitcoin falls, retail investors leave the market, and trading frequency drops to zero. Robinhood's monthly active users (MAU) decreased by 1.9 million, which is not just a decrease in numbers, but a loss of faith.

MicroStrategy's (MSTR) Q4 financial report corroborates this—a book loss of $12.4 billion in a single quarter due to Bitcoin impairment. Whether it's MSTR, which directly holds Bitcoin, or HOOD and COIN, which provide trading services, their stock price charts still overlap with Bitcoin's candlestick chart by over 90%. This is a "false diversity." No matter how many business lines you have (Robinhood claims 11 businesses generating over $100 million annually), as long as the core narrative—Crypto Adoption—fizzles out, the market's valuation system will collapse rapidly.

For those in the financial industry, these two financial reports send three clear signals:

Overcapacity in infrastructure versus scarcity of users : The bull market of 2024-2025 spurred massive infrastructure development (Layer 2, wallets, payments), but Q4 financial reports show a sharp contraction in real active users (especially high-net-worth retail investors). 2026 will be a year of "supply-side reform," and only leading platforms will survive the downturn.

The "stable content" of revenue structure is crucial : Coinbase's USDC revenue and Robinhood's Net Interest Income are their lifelines. Until the next bull market arrives, those with cash flow more like banks are safer.

A restructuring of valuation logic: The market is punishing "betas masquerading as tech companies." Unless Robinhood's prediction market proves itself to be an independent growth flywheel, or Coinbase's Base Chain generates massive non-transactional revenue, their stock prices will continue to fluctuate with Bitcoin until the market is convinced that a bottom has been reached.

Robinhood's Tenev said at the end of the call, "We're building a financial ecosystem for the next generation." But right now, the next generation of investors is staring at a screen full of red candlestick charts and has closed the app.

For Coinbase and Robinhood, the "record-breaking" achievements of 2025 are now history. The theme for 2026 will no longer be "growth," but "resilience." As Warren Buffett said, only when the tide goes out do you discover who's been swimming naked. Now that the tide has gone out, although these two giants are wearing swim trunks, the cold wind is biting, and they must prove to the market that they have enough cash flow to survive until next summer.