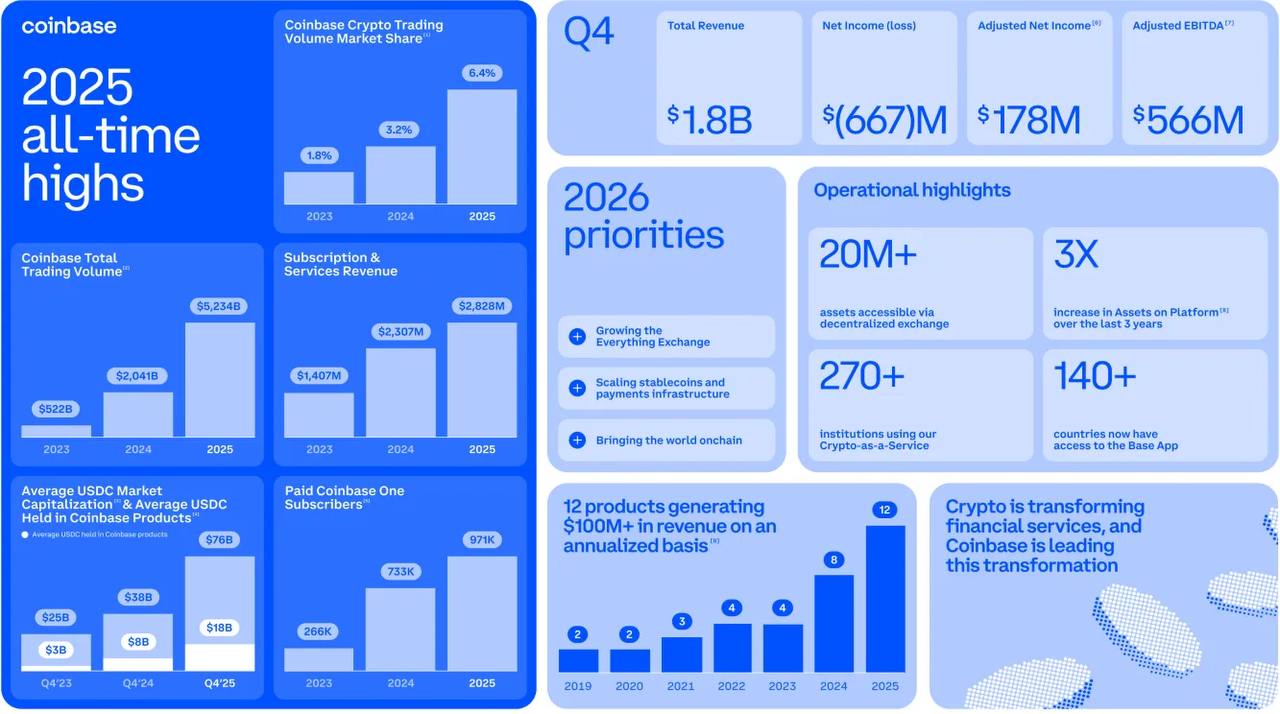

Coinbase failed to meet Q4 expectations with a net loss of $667 million and a 20% drop in revenue. Coinbase's revenue in the fourth quarter fell more sharply than expected, by 20% to $1.8 billion, as declining Token prices reduced trading activity on digital assets. After recording unrealized losses to reduce the value of its cryptocurrency holdings and investments, the company reported a net loss of $667 million compared to a profit of $1.3 billion in the same period last year. These results were announced as BTC had fallen 50% from its October peak, forcing exchanges to quickly scale back operations: • Rival exchange Gemini said last week it plans to cut up to 25% of its workforce and scale back international operations. • Kraken 's chief financial officer has left the exchange, which reported fourth-quarter revenue lower than the previous quarter. Robinhood announced this week that its cryptocurrency trading revenue has decreased by 38%. However, despite the significant losses, Coinbase's diversification strategy is showing results: • Revenue from Services & Subscriptions reached $2.83 billion this year, double that of 2023. • The actual market share of cryptocurrency trading has doubled compared to the previous year. • The platform currently has 12 products generating over $100 million in revenue annually, more than 270 institutional customers, and a presence in over 140 countries. With COIN down nearly 37% this year, Coinbase hopes that it is entering this downturn as another company that has made efforts to reduce its reliance on spot trading and has launched new business models such as stock trading and prediction markets. 🔗 bloomberg.com/news/articles/2026-02-12/coinbase-posts-667-million-loss-sees-revenue-tumble-20

This article is machine translated

Show original

Sector:

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content