The asymmetrical information advantage brought by insider information has always been a persistent point of contention in prediction markets such as Polymarket.

Previously, during the US military's arrest of Venezuelan President Maduro, the odds for related contracts on Polymarket showed abnormal fluctuations in advance (see "When War is Settled Before News: How the Prediction Market 'Priced' Maduro's Arrest 6 Days in Advance"). If the suspected insider trading that time could be dismissed as a fluctuation in the "pizza index," then this time, it has been completely confirmed that someone on Polymarket used insider betting.

Israel has indicted two suspects, accusing them of using military secrets to place bets.

On February 12, The Jerusalem Post, Israel's largest English-language newspaper, reported that a Tel Aviv district court formally charged a civilian and an Israel Defense Forces (IDF) reservist on Monday, accusing them of profiting from betting on Polymarket using classified military intelligence . The court further stated on Thursday that Israeli authorities determined this behavior posed a significant operational security risk in wartime.

According to a statement approved by the prosecution, the suspect was apprehended in a joint operation by the Israeli National Security Agency (Shin Bet), investigative units under the Ministry of Defense's security agencies, and the Israeli police. Investigators suspect that some reservists were using classified information accessible to them in their military positions to gamble on the timing of military operations.

Following the aforementioned investigation, prosecutors stated that they had obtained evidence of illegal activities by the civilian and the reservist, and therefore decided to formally indict them on charges of "serious security crimes," bribery, and obstruction of justice. At the same time, prosecutors requested the court to extend the suspects' detention period until the conclusion of the trial.

Beyond what has already been made public, further details of the case remain subject to legal regulations, including the defendant's identity, the specific bets placed, and the alleged channels through which information was transmitted.

Suspect account "Rundeep": All six of its military predictions were correct.

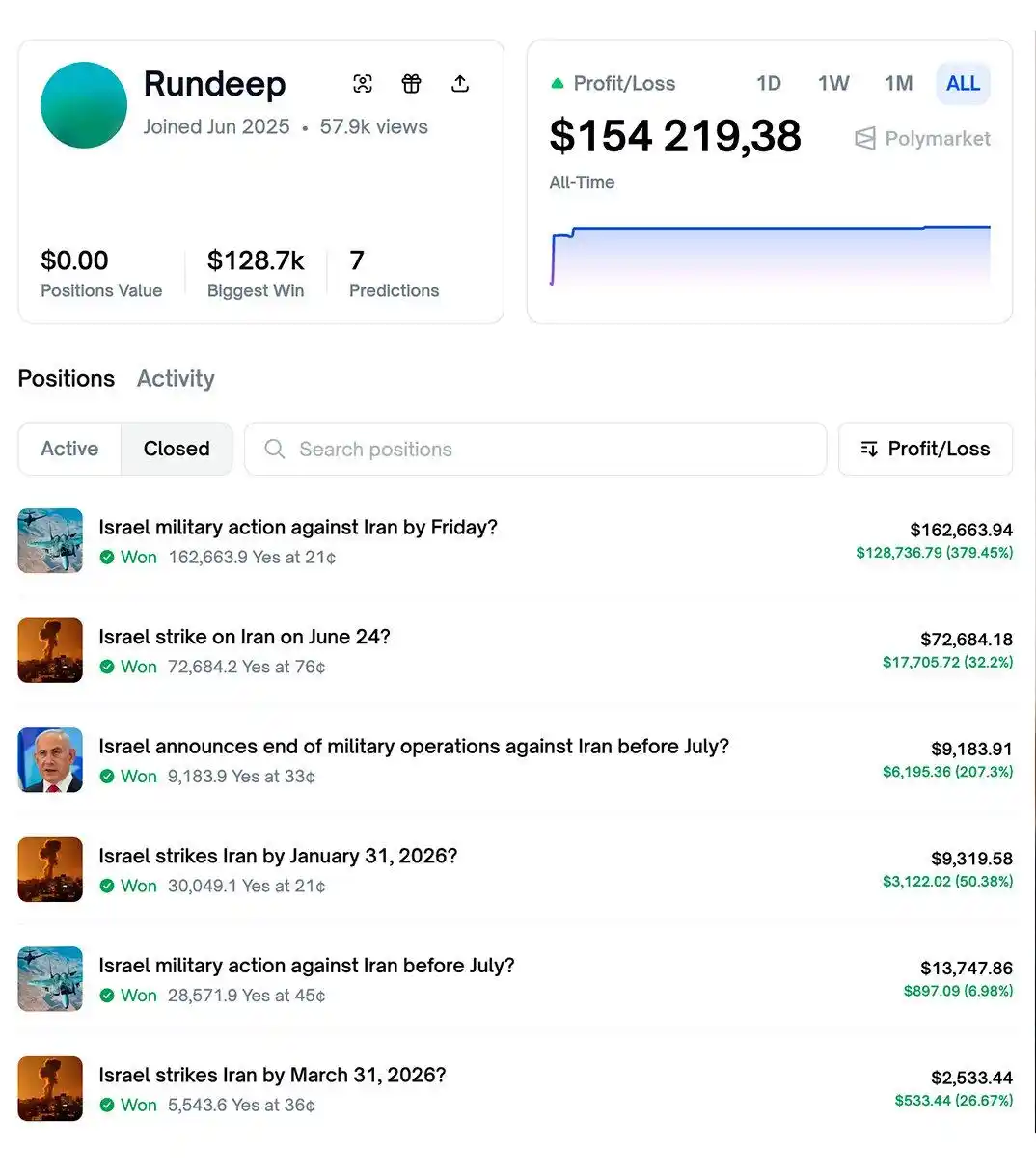

While we cannot yet confirm the mole's true identity and account, the X community had already identified an account on Polymarket with clearly unusual behavior. The Jerusalem Post also included screenshots of the account's profits in its report.

As shown in the image above, the user named Rundeep joined Polymarket in June 2025 and subsequently achieved a 100% win rate in six prediction markets related to Israeli military operations. Five of these predictions were made when the odds were below 50%, ultimately resulting in a profit of over $150,000.

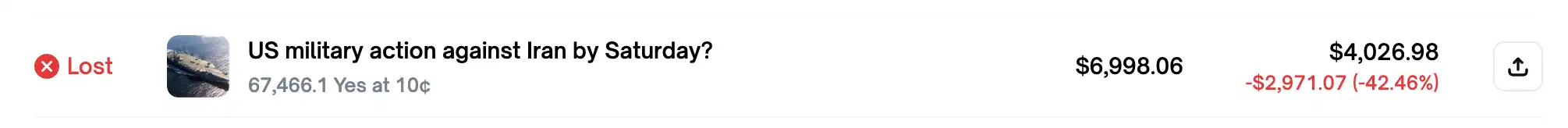

Interestingly, according to Odaily Odaily, besides these six wins out of six predictions, Rundeep had one other misjudgment on Polymarket. However, that prediction was not directly related to Israel, but rather to "whether the US military will launch an operation against Iran before Saturday (June 21, 2025)"—it seems that the intelligence of the allies is ultimately not very useful.

The double-edged sword of market prediction: a convenient channel for monetizing intelligence.

Due to Polymarket's open and permissionless nature, anyone can freely place bets on the platform. This objectively provides a more convenient way for those with an intelligence advantage to "monetize information." Driven by profit, those with an asymmetric information advantage often find it hard to resist the temptation, so it is inevitable that there will be insiders trying to make money.

If such events occurred in general fields such as sports and entertainment, the impact might still be within a controllable range. However, when the scene shifts to highly sensitive fields such as politics or even war, the chain reaction that such insider betting may trigger is truly chilling.

Taking this case as an example, if the opposing camp had sensed the direction of the operation in advance through insider betting on Polymarket, would it have had a significant impact on the subsequent development of the situation? Most people may find it difficult to empathize with Israel, but in fact, such events could happen to any country.

In the traditional betting industry, public affairs such as political elections, legislative outcomes, and military operations are usually subject to explicit restrictions. Predicting whether the market will face similar regulatory constraints in the future will likely involve a long process of regulatory struggle.

Related reports

Related reports

Can we track down the next Polymarket insider trader? Absolutely, and the barrier to entry is low.