Written by: Ouke Cloud Chain Research Institute

Looking back on 2022, the encryption industry has encountered difficulties and obstacles caused by various uncontrollable factors, and it is also gestating vitality and vitality in change and development.

This year, we have witnessed the Luna storm, institutions that were once considered "too big to fail" such as Three Arrows Capital and FTX have collapsed one after another, and market confidence has been seriously frustrated; but this year, we have also witnessed the collapse of Ethereum. The historical moment of merger has seen the determination of Hong Kong, Singapore and other regions to compete for the Web3 center, and the positive signals revealed by traditional institutions still pouring into the encryption market, some positive changes are taking place.

Under the common memory of 2022, looking forward to 2023, everyone may have different perceptions. Based on its long-term observation of the encryption market, Ouke Cloud Chain Research Institute proposed seven major trend predictions for the encryption industry in 2023 , trying to find the foreshadowing that has been secretly laid under all trajectories amidst the many uncertainties.

It should be noted that no one can predict the future, and most predictions will be falsified by time, so the predictions here do not represent our investment opinions.

Trend 1: Global encryption regulation has entered a new stage, and embracing compliance will become a must.

A series of security incidents and thunderstorms are prompting stronger encryption supervision. Major countries and regions around the world, especially those that have been relatively friendly to crypto assets in the past, will have to rethink how to deal with the risks and challenges behind virtual asset innovation after 2022.

A clear signal is that after experiencing several black swan events in 2022, we will see more strict virtual asset regulatory policies in 2023. Although we do not want to see excessive regulation inhibit innovation, as regulators have a deeper understanding of the field of virtual assets, the era of barbaric growth is ending, and the global regulatory trend is inevitable. For institutions in the crypto world, the importance of supervision is becoming more prominent, and embracing compliance will become a must for the healthy development of the industry.

Trend 2: Web3 industrial application kicks off, triggering creative destruction together with AI3.0

Web3 is still the most interesting technology concept in 2022, and a large amount of real money and excellent talents have flowed into it this year. Although the concept of Web3 is still controversial among all parties today, Web3 is profoundly changing our world. Many institutions have also joined in this year, combining Web3 with the fields they are involved in, and finding ways to "upgrade" their original businesses. , and at the same time, it is a solution that can "implement" Web3.

Although there are not many native disruptive innovations, the development of Web3 at the industrial level has just begun, and everything is worth looking forward to. In terms of technology, the popularity of ChatGPT at the end of 2022 made us pleasantly surprised to see the powerful explosive power of AI at the application level. AI's improvement in production efficiency is expected to solve the productivity problems in the Web3 era and make up for key shortcomings in the development of Web3.

Image source: Internet

We believe that the collision of Web3 and AI3.0 will trigger creative destruction and inspire more imaginative application innovations in 2023.

Trend 3: The importance of the Web3 security track is highlighted, and more institutions will pay attention to the field of on-chain data

This is not a prediction, it is a fact that is happening.

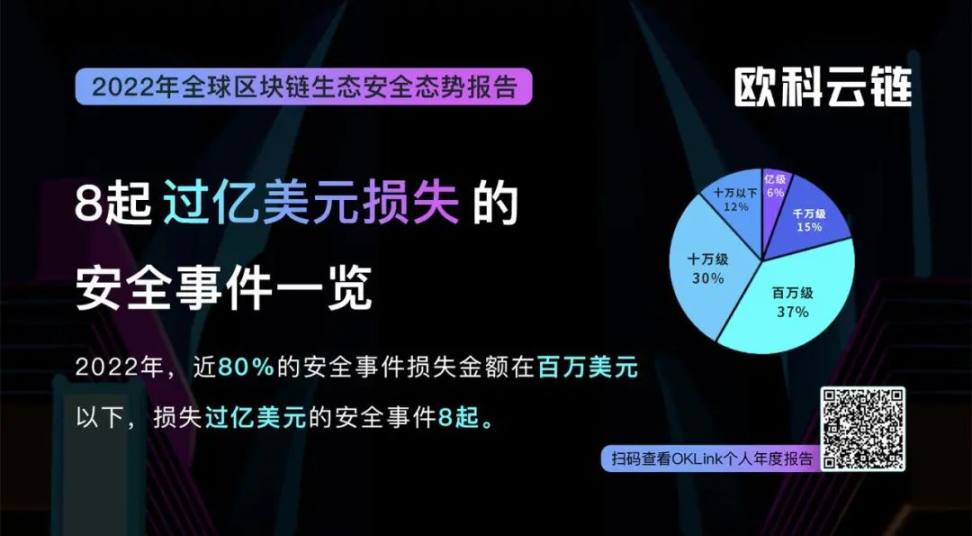

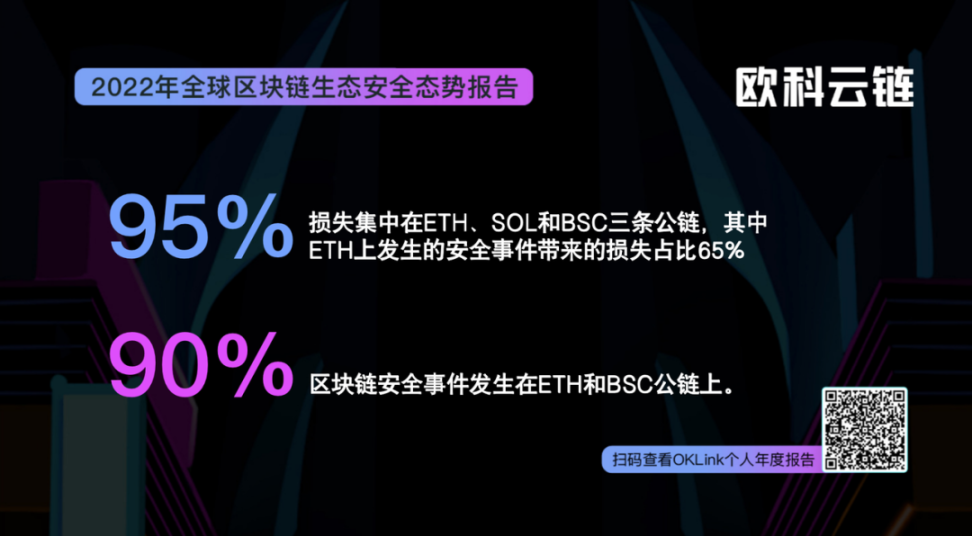

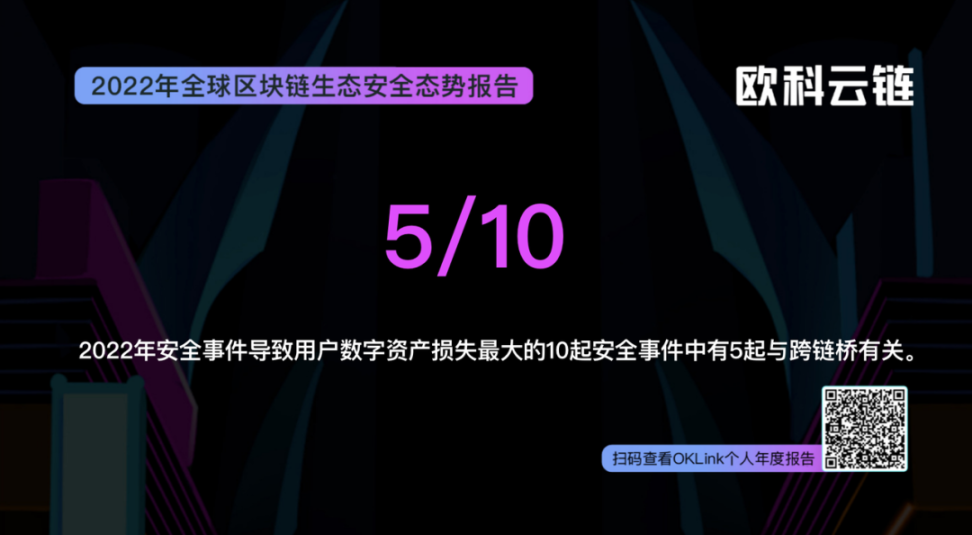

According to incomplete statistics from the Ouke Cloud Chain Research Institute, there were 275 security incidents in the blockchain ecosystem in the first 11 months of 2022, causing a total loss of approximately US$2.769 billion (more details: " Global Blockchain Ecosystem Security in 2022" Report: More than 80% of losses are concentrated in DeFi and cross-chain bridges, with phishing attacks being the most common method ”). These endless hacker attacks and scams are causing some users to leave in frustration and fear, and are also causing the outside world to question the security of Web3. Of course we hope that users will be responsible for their own assets, but in the face of many professional attackers, individuals sometimes appear powerless. At this time, we need more professional Web3 security agencies to protect the entire industry.

The outstanding performance of a number of Web3 security agencies in the financing market in 2022 has proved the market's emphasis on Web3 security, and this trend will not change in 2023. Along with Web3 security, attention has also been paid to the field of blockchain data.

On-chain data can not only provide support for Web3 security governance, but also provide in-depth analysis of on-chain activities, revealing key information such as Web3 user behavior, emerging trends, and investment opportunities. Even though a number of excellent on-chain data analysis companies such as Nansen and OKLink have emerged at home and abroad, we believe that there is still huge room for development in this field, and more institutions will pay attention to and participate in it in various forms.

Trend 4: Capacity expansion solutions continue to innovate, ZK series L2 ecology welcomes spring

In the past few years, we have seen the blockchain ecosystem grow rapidly at an exponential rate. The completion of the Ethereum merger in 2022 has made the market even more excited about the future development of the blockchain ecosystem. However, merger cannot solve the core expansion problem of blockchain. Various expansion plans will still become the focus of attention of all parties in 2023, and innovation will continue under the pressure of market demand.

Among them, ZK-based Layer 2 public chains may explode in 2023. We will usher in the mainnet launch of multiple ZK-based L2 public chains including Starknet and Zk-sync this year. Competition among zkEVMs will further intensify as a result. With similar performance improvements, security and cost will be the decisive factors affecting market choice.

Trend 5: With the rise of Ce-DeFi, institutions will use “another way” to re-participate in the crypto market

Although many investment institutions have suffered setbacks in the encryption field in 2022, there are still many traditional institutions trying to re-understand encryption innovation in a more in-depth way.

In November 2022, the Monetary Authority of Singapore MAS announced the implementation of "the first real-world use case of an institutional-grade DeFi protocol", that is, JPMorgan Chase, DBS Bank and SBI Digital Asset Holdings used the Aave protocol on Polygon to complete Ethereum Forex and government bond trading on the Internet. Cases of such institutions directly applying DeFi are becoming common in the crypto field. Many financial institutions that were previously opposed to cryptocurrencies, such as JPMorgan, have also begun to be optimistic about and bet on related businesses.

Image source: Internet

We believe that in 2023, traditional institutions will continue to become more sensitive to DeFi innovation, and a group of forward-looking financial institutions will continue to pay attention to and participate in it. They will combine institutional-level risk management capabilities with code-mandated transparency to explore more ways to support Business models from the real business world. And those fast-growing and relatively mature DeFi services will be more likely to be favored by institutions.

Trend 6: Institutions continue to deleverage, and retail investors become the key force supporting market confidence.

In the past two years, due to the release of water by global central banks and the increasing acceptance of traditional financial markets, investment institutions in the virtual asset market have expanded rapidly, and the market leverage ratio has expanded rapidly. However, as the Federal Reserve tightens its policy in 2022, a large amount of funds begin to flow out. Coupled with the domino effect caused by a series of thunderstorms, many centralized institutions have encountered serious liquidity crises, and institutional deleveraging has become the main theme.

To this day, we are still not sure how long it will take for institutions to deleverage, but what is certain is that compared with retail investors, institutional deleveraging takes a longer period and has a more far-reaching impact. Although institutional entry was the main reason for the last cycle, in today's process of institutional deleveraging, retail investors are becoming a key force supporting market confidence.

Trend 7: The global CBDC research and development process is accelerating, and digital renminbi further expands pilot projects

Currently, more than 100 countries and regions around the world are exploring central bank digital currency (CBDC). These countries account for more than 95% of global GDP, and 11 of them have fully launched CBDC. In the upcoming 2023, the surge in cross-border payment demand and the impact of crypto black swan events such as FTX will once again promote the research and development process of global CBDC.

Among them, the United States has begun to make efforts in CBDC. In Executive Order No. 14067 signed by US President Biden, the design and deployment of CBDC research and development work has been given the highest priority. In September 2022, the White House Office of Science and Technology Policy (OSTP) The release of the "U.S. CBDC System Technical Assessment" also clarified the policy goals and technical design plan of the U.S. CBDC system.

Image source: Internet

In addition to the United States, countries such as Turkey, Kazakhstan, and Australia will also accelerate CBDC research and development or pilot work in 2023. China's digital renminbi has always been in the first echelon of global CBDC research and development. Recently, the pilot areas have been expanded again, and 17 provinces and cities have launched digital renminbi pilots in all or part of the region. We expect that the scope of the digital renminbi pilot will be further expanded in 2023 and it will assume a more important role in the international market, but it may still take some time before it is fully launched.