Original Author: CapitalismLab

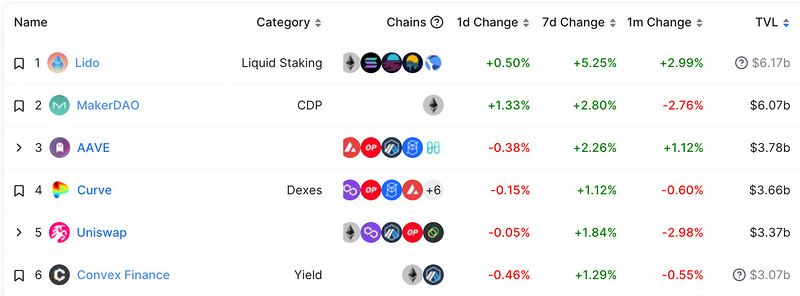

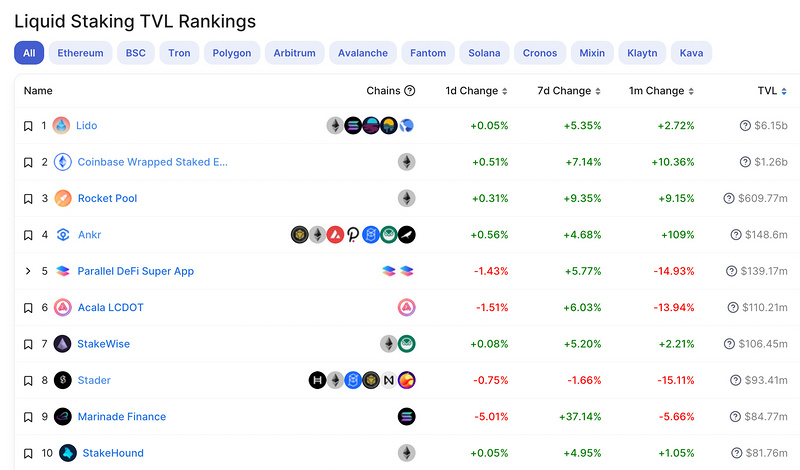

At the beginning of 23 years, the liquidity staking narrative resumed. The price of $LDO soared by 40% in just a few days, and Lido's TVL also ranked first again. I have participated in the operation of the Lido Chinese community for some time, and I am writing this article to answer the following core questions with detailed data and cases:

What is Lido?

What's the value?

Where is the project moat?

What's the future?

How does the liquid staking game represent other projects?

Is there any thunder to avoid?

1. What is Lido

Lido provides liquidity staking solutions, and the core problem it solves is the problem of no liquidity in pledged lockups, as detailed in the tweet below.

Therefore, for staking projects with a longer lock-up period, liquidity staking is more important.

2. Lido business model

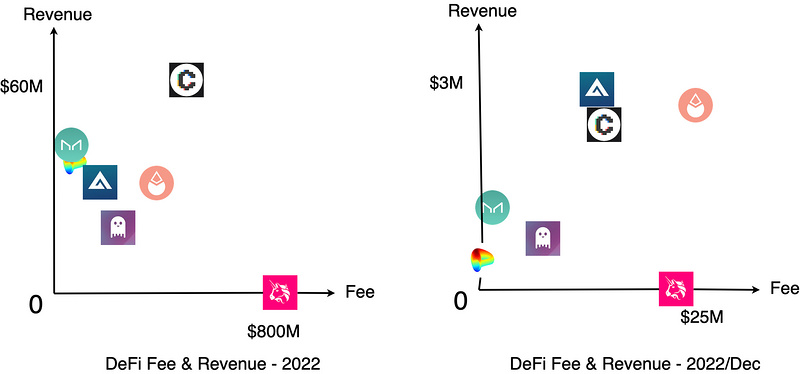

Lido's business model is to draw 10% of the staking proceeds as agreement revenue, 5% of which is owned by the staking node operator, and the other 5% goes to the Lido treasury, which is governed by $LDO. Staking income is less affected by market fluctuations, so its currency-based income is hardly affected by the bear market. In December, the agreement income was only slightly less than GMX, and the total agreement fee exceeded Uniswap. At present, LDO is only used for community governance, and its token empowerment is similar to AAVE/Maker, which is relatively general but stronger than Uniswap, which has no protocol income.

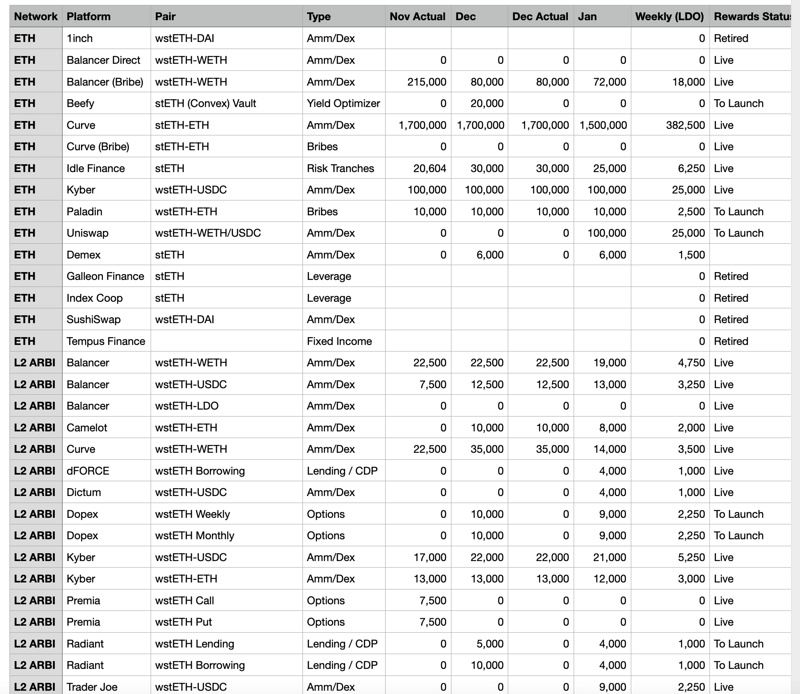

The growth of Lido relies heavily on DeFi Lego. So far, there are 140+ cooperation agreements. The established budget committee analyzes data and makes decisions to motivate budget allocation. For example, DEX, mortgage lending, stable currency, options, etc. are all involved. It looks complicated, but if you look at it as a whole, you will find that the core is actually "replacement of native ETH with stETH".

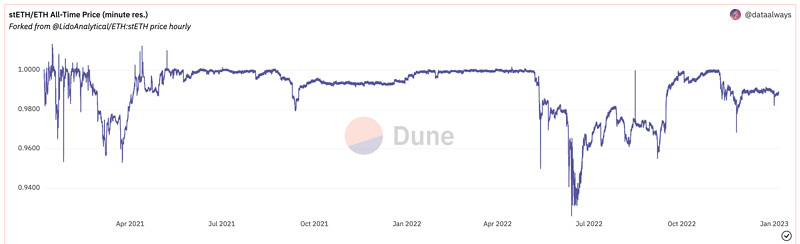

Before the upgrade in Shanghai, the development of stETH was always limited because the inability to unstake would lead to frequent depegs. After the upgrade in Shanghai, according to the experience of stSOL/stMATIC that has been able to unstake, the frequency and amplitude of de-pegs will be very small, so Naturally, it will further open the ceiling and fully replace the imagination of native ETH.

On the other hand, Shanghai’s upgrade is also a challenge. Due to the inability to unstake, large funds can only choose Lido at present, and the strong can rely on the scale effect. After the Shanghai upgrade, the unstake will significantly weaken the scale advantage while benefiting the overall track. So does Lido have any moats to deal with this competition?

3. Lido’s moat

Moat: Many people think that liquid staking is a fee rate, and may not make much money in the end, but Lido does have a certain moat. It is mainly brought about by its scale advantages. On the one hand, it has a strong rate capability for node operators, and on the other hand, it is the terms and conditions obtained in DeFi Lego. Of course, when the quantitative change produces a qualitative change, stETH will naturally become the de facto standard asset like USDT, counting money lying down.

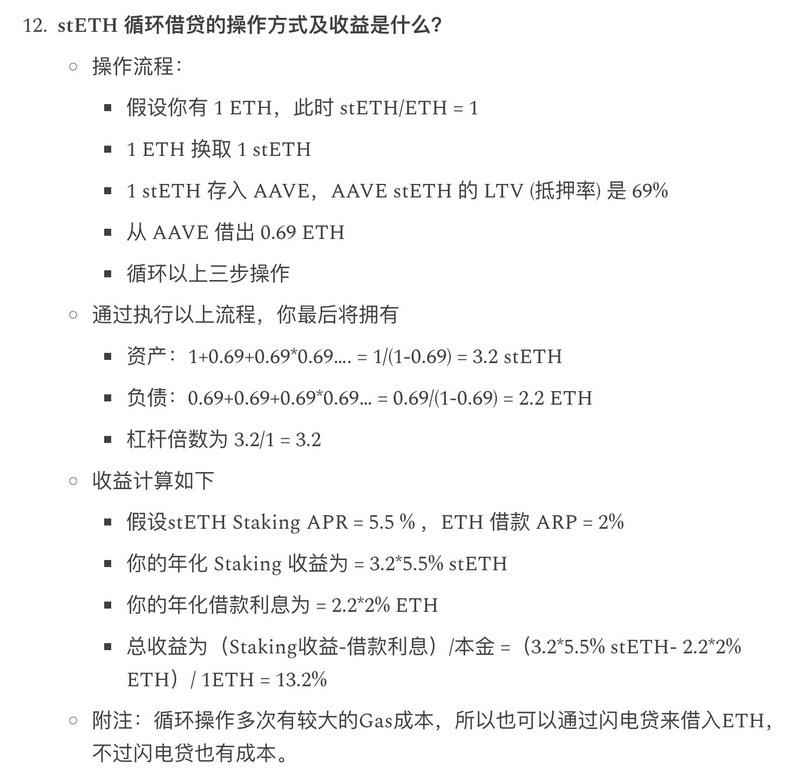

For example, AAVE is one of Lido's important application scenarios. Users mortgage stETH to lend ETH and then exchange it for stETH, and cycle to obtain high returns. With the current 72% LTV, a leverage factor of = 1/0.28 = 3.57 times can be achieved. See the figure below for details:

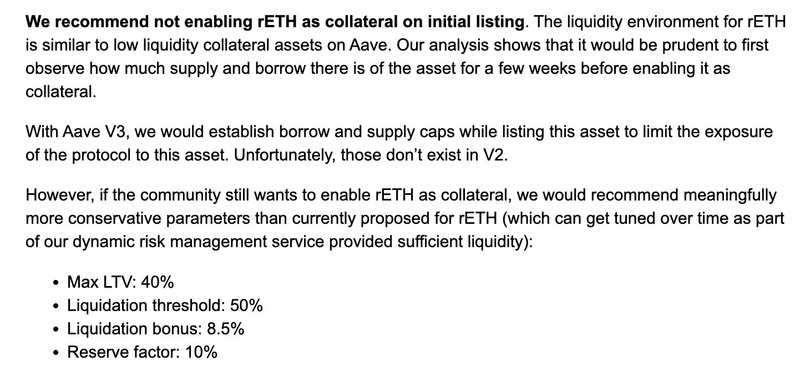

For other protocols, due to their scale and liquidity issues, it is impossible to obtain the same conditions as Lido. For example, Rocket pool once promoted the listing of rETH on AAVE, and the AAVE risk management manager Gauntlet concluded that it is not recommended to go online, and said that if it is questioned, it is only willing to give 40% of the LTV, so the maximum leverage is 1/0.6 = 1.67 times , far inferior to stETH.

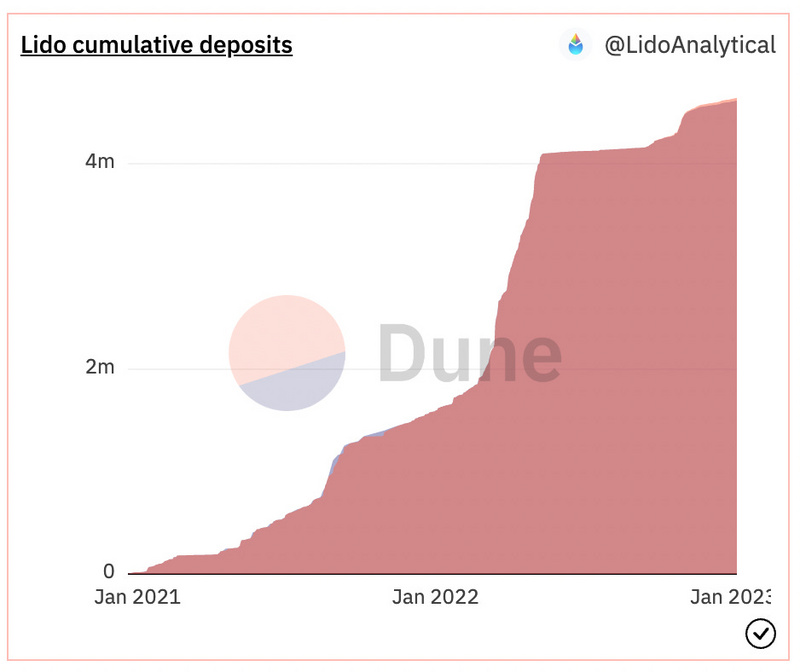

Leveraged staking is a magic weapon for the growth of liquid staking. At present, only 20% of stETH is located, while for stSOL, which can be unstaked, leveraged staking accounted for more than half. By extension, it can be seen that the snowball advantage brought by Lido's scale effect is difficult for other latecomers to match.

4. For the future, Lido currently solves two core problems:

2. Develop DVT so that everyone can be a node operator

There are many projects in the liquid staking track. Among them, rocket pool is allowed to freely become a node operator, and cbETH is centralized custody. Other projects are similar to Lido, and the business model is also a staking proceeds. No more words.

5. Pay attention to lightning protection on the liquid staking track

For example, Ankr once had a self-stealing incident. Although it paid back most of the money, in the end, Sao Operation only paid back half of the money it stole from its rival stader/pstake LP.

To put it simply, if you are optimistic about these fringe projects, you can buy the project’s currency. It is not recommended to deposit the currency and do yield farming. Maybe it has a back door like Ankr. If you want interest, others want your principal.

As for how to staking liquidity and get more income through DeFi, the lido FAQ below should be the only one. You can also join the Lido Chinese community https://t.me/lidocn to exchange questions, welcome to follow the Lido Chinese community Twitter @lidocn and mod @NintendoDoomed (me)

appendix:

Lido Chinese data collection and FAQ