After talking about ETH2.0, POS pledge and Lido last time, many friends asked me to talk about SSV ( ssv.network ), SSV is indeed more difficult to understand than Lido, after all, it is not directly oriented to C-end users, So it seems not intuitive enough, I try to analyze for you what this project does, as well as its significance and value.

First of all, give a definition, SSV and Lido do not belong to a competitive relationship, but a complementary relationship.

If you haven’t read the previous article, you should first make up the “ Talking about Ethereum 2.0, POS pledge and Lido with a TVL of 5.9 billion US dollars ”, otherwise this article is more difficult to understand.

As I said before, Lido’s problem is the centralization of downstream operators. Because the upstream enters 30% of the POS deposit and then feeds it to downstream operators, it has a very strong control over operators, and the selection and exit of operators are also difficult. Lido decided it himself. This problem is like an elephant in the room. Everyone has seen it, but because there is no problem yet, everyone chooses to ignore it for the time being. Lido still sits firmly on the top spot of POS pledge.

In addition, I also said before that stSaaS is equivalent to the logic of agent operation. After you apply for a POS verifier, you will give the key of the node to the operator, and the operator will take your key to help you complete the work of the verification node, but once Regardless of whether the operator is stable or intentionally doing evil, the verifier who actually paid the money will be punished, so the verifier's selection of a reliable operator is all based on luck, or entirely on Lido's auditing ability.

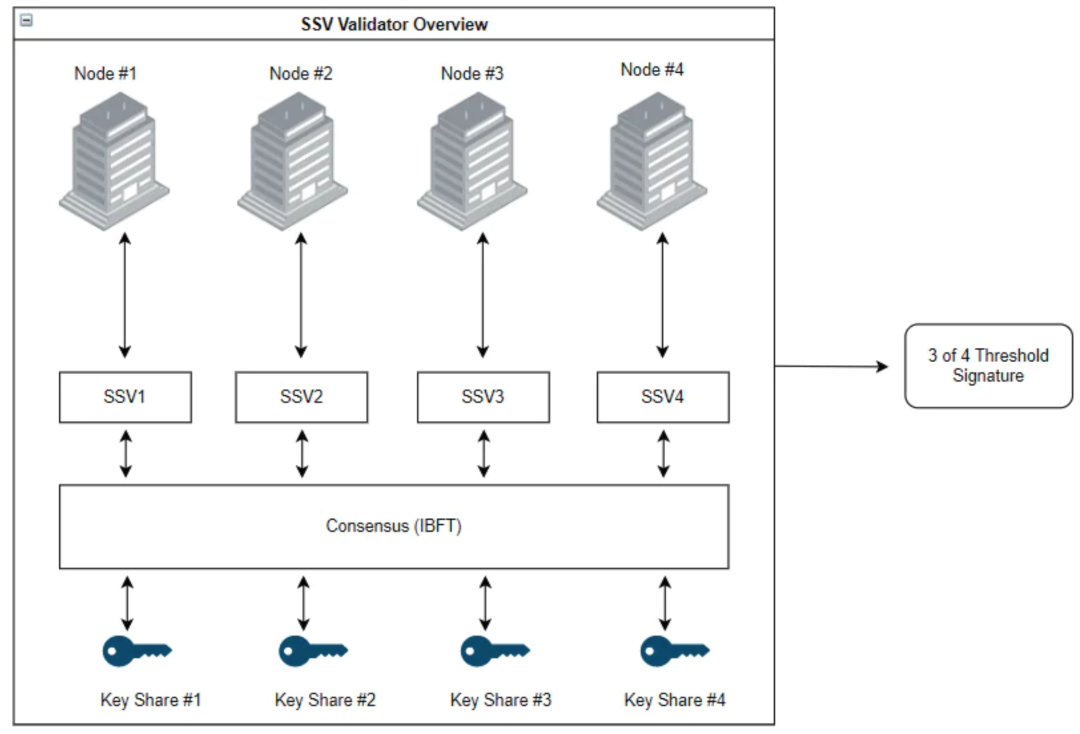

Then the solution currently proposed is DVT decentralized verifier technology, which allows multiple node operators to jointly operate verifiers. The previous verifier and operator have a 1-to-1 relationship, and DVT is a 1-to-N relationship, so that The reduction of single point of failure will not directly affect the corresponding verifier after the operator hangs up. If one operator hangs up, other operators can take over.

So what is the relationship between SSV and DVT? SSV stands for Secret Shared Validator. It is a concept proposed by two Ethereum developers @CarlBeek and @adiasg in an article discussing the failure of ETH2.0 validators. The original link is as follows:

https://notes.ethereum.org/@adiasg/preventing-eth2-validator-failure#Proposals-for-SSV-protocols

The core concept of SSV is to fragment the private key of the verifier and give it to multiple operators, which is equivalent to the logic of multi-signature. The follow-up SSV has been upgraded to DVT through continuous discussion and development, so SSV is the predecessor of DVT. SSV It is also a technical term, and the ssv.network we are talking about today is a practitioner of the SSV concept, so it directly named itself SSV, which is such a relationship.

Therefore, Lido is also aware of its centralization problem, and it is also exploring the effect of integrating DVT solutions to allow operators who have passed Lido's audit and have not been verified by Lido to perform mixed verification, thereby reducing the risk of Lido operator centralization. Last year In October, Lido also announced the first test with ssv.network . This is why I mentioned that Lido and SSV are not competing with each other even though they are both POS concept coins.

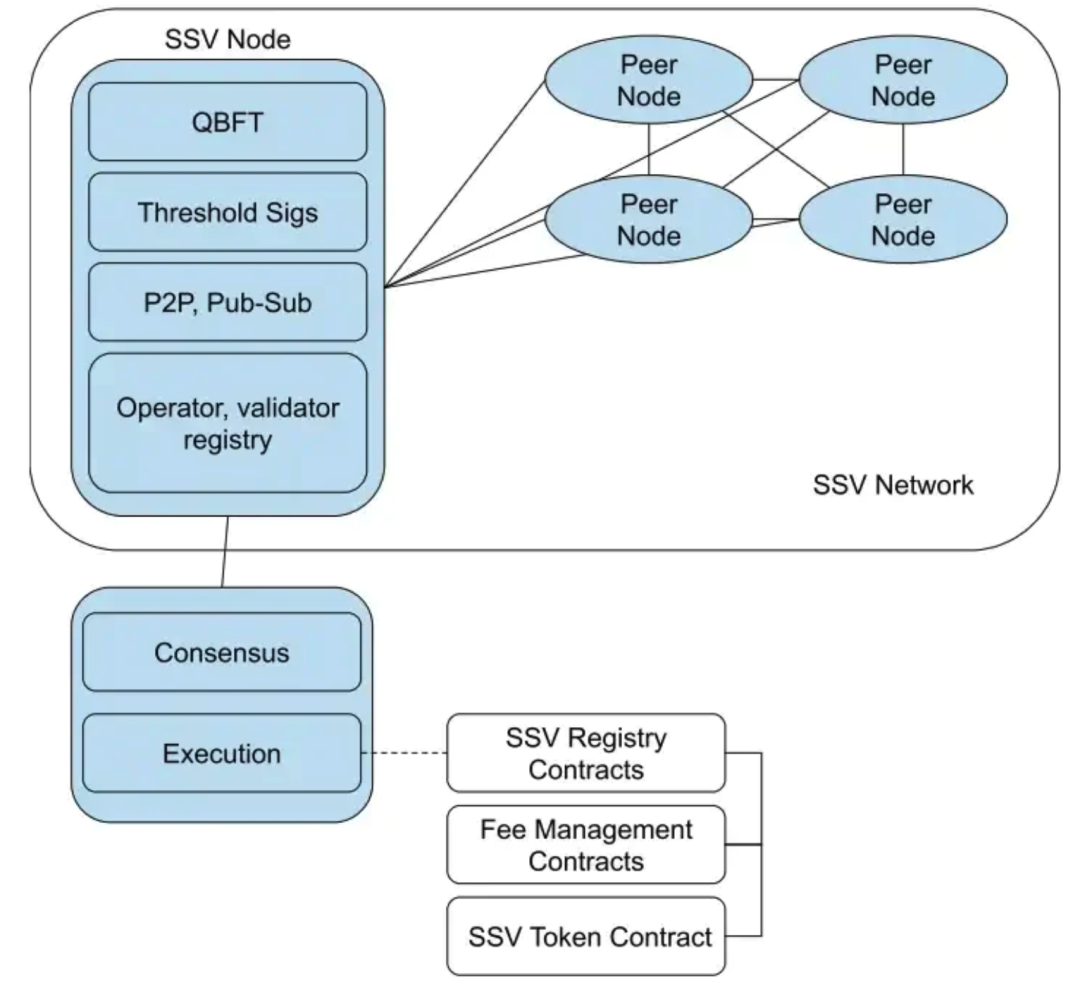

Let's go back to DVT. You can understand it as a large-scale multi-signature scheme for the verification layer on Ethereum. It has 4 key components: distributed key generation DGK, private key sharing of BLS signature, multi-party secure computing MPC and IBFT Consensus layer, is it difficult to understand? Don't be afraid that I will introduce them one by one, please keep reading

Distributed key generation DKG is a cryptographic process that allows multiple machines (multiple operators) to use the same verifier private key. As I said before, there are four steps to become a POS verification node: apply for authentication, pledge ETH, and obtain a private key. key, and run the machine. Therefore, to implement DVT, we must first solve how to allow multiple machines to share a private key. DKG allows each participant to own a part of the private key, thereby preventing one party from directly accessing and controlling the entire private key.

The private key sharing of BLS signature is a mechanism that realizes multi-party aggregate signature, that is, it can combine all the signatures in the block into a single signature. The signatures of many people are aggregated into one signature, just like a key is split into 4 parts and kept separately. When the door needs to be opened, the 4 pieces are glued together and then inserted into the lock hole.

Multi-party secure computing MPC was proposed by Yao Qizhi, the founder of the famous Tsinghua Yao Class in 1982. It means that participants can use private data to participate in confidential computing and jointly complete a certain computing task without disclosing their private data. The concept of MPC wallet should be recognized by everyone. It is familiar to everyone, so MPC technology is also needed to allow each private key fragment holder to complete the reconstruction of private key generation together without leaking their own data

The Istanbul Byzantine Consensus IBFT should be familiar to everyone. A node of DVT is arbitrarily selected as the leader, responsible for block proposals and other work. If the majority of verifiers believe that the block is valid, it will be added to the block. in the block chain. If the leader selected during the consensus process goes offline, IBFT will perform a fast leader change and select another DVT node to assume the role.

We understand DVT technology. ssv.network is a decentralized validator DVT infrastructure based on this. It belongs to the 0-layer solution, thus becoming the decentralized infrastructure of the Ethereum POS layer. It enables verification Ability to be run by multiple operators, rather than just 1 which is the current industry standard, on which developers choose to build their dapps and protocols

So we see that SSV is building its own ecology, and has given a large amount of grant to the outside world. Its official website has disclosed 73 ecological members: https://ssv.network/ecosystem/ .

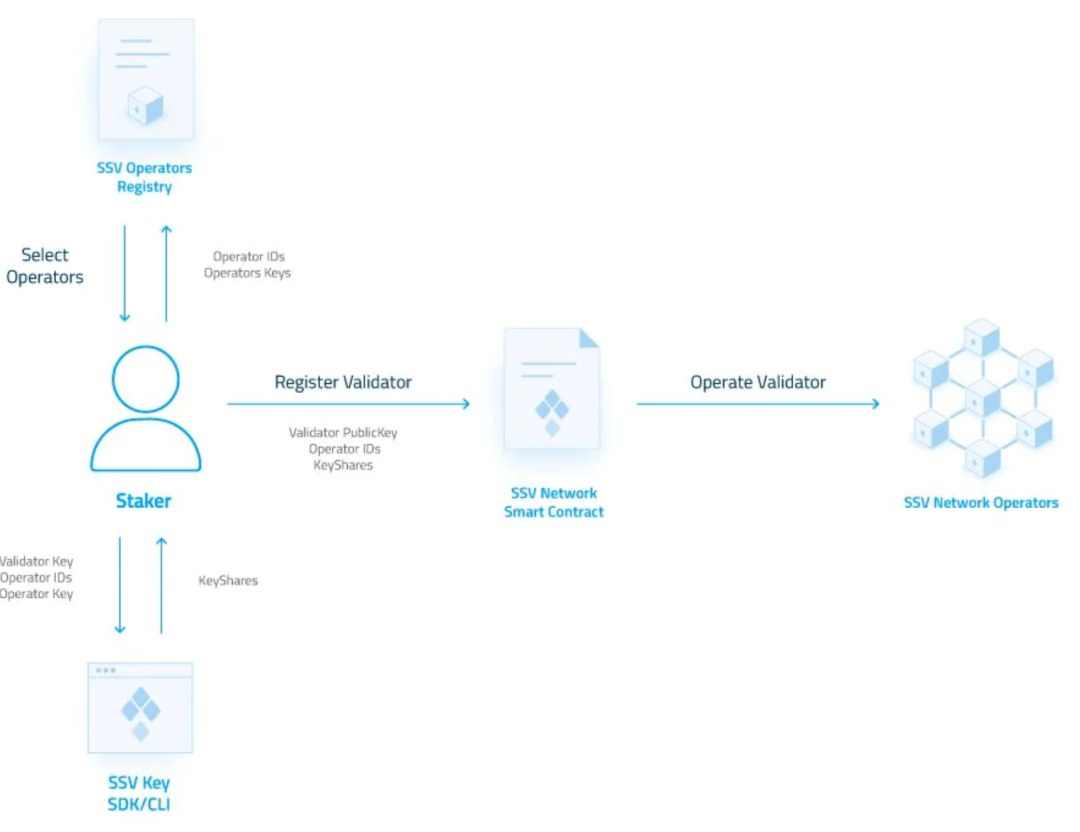

Because SSV is a very low-level infrastructure for decentralized verification node solutions, it is far away from C-end users. After opening its official website, you can’t see the pledge entrance like Lido. It combines the complete completion of pledge The process is as follows, mainly divided into 3 steps. The pledger must first select a group of 4 operators as my escrow, and then send my private key as the verifier to KeyShares to carry out the DKG process just mentioned, and finally submit to me A selected group of operators sends out a broadcast to register them in the network, and their economic model is also integrated here, and pledgers can pay SSV tokens as management and operation fees.

Operators also save a lot of trouble. They only need to provide hardware infrastructure and run the SSV protocol to simply become a decentralized verification node. Operators can determine the service fees they want to charge stakeholders.

Finally, at the market level, although Lido has become the leader of the track with a very low pledge threshold, centralization in web3 is the original sin. Lido must solve this problem. SSV is the head project of the decentralized node verification protocol. I think that as Lido and other projects start to decentralize and transform, they will be released with a high probability, and they may still be underestimated at present. If Lido is the breaker of the POS track narrative, then SSV is the next stage of narrative. successor.