The age of casinos is over and a new era is upon us. The choices we make today and the values we live by will shape this industry for decades to come.

Original title: " Meditations on Mayhem "

Written by: Ryan Watkins

Compile: SevenUpDAO

Everyone is looking for a scapegoat. Instead, we need to look in the mirror.

Because evil is everywhere.

In every jubilant conference hall, in every lurid YouTube video, in every smirk on the faces of insiders and their defenders, in every helpless, naïveté caught up in this madness Among the speculators, in every pump and dump of the latest casino chain, and in every hysterical tweet: Ethical influencers once cashed in on their reputations, their followers got scammed again; hardworking investing The payoff for years of intense research is the sudden, tragic bankruptcy of a trustworthy exchange; the beloved heroes of the bulls are blown into eternity by their own greed; others become frauds and wait to go to jail. It was a moment of shocking revelations and discoveries, and those weren't the worst of it.

It's never been about being afraid, it's about being prepared.

Heading into 2022, for the first time in my career, I am troubled by the state of the industry. After nearly 2 years of relentless speculation, the industry has become culturally impoverished, and as economic risks mount in the final weeks of 2021, the market's footing is increasingly tenuous. By February, I suspect it may be time to pay for this bull market excess.

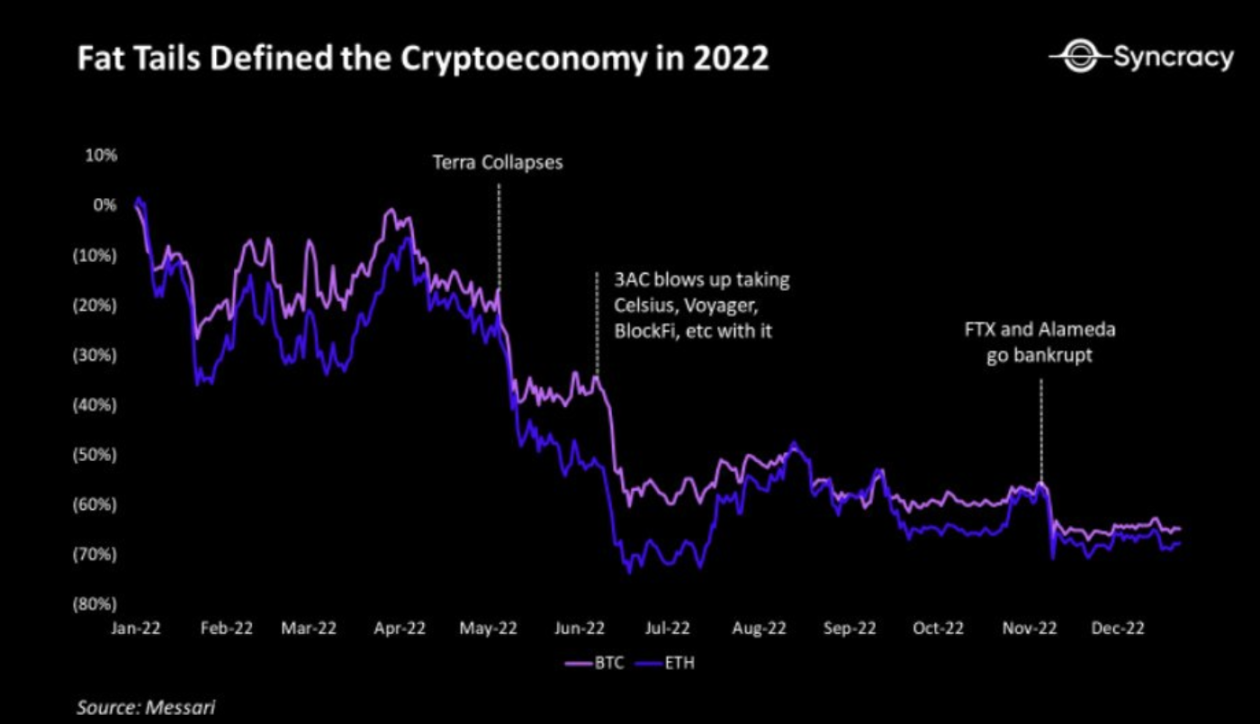

The word that defines the year is kurtosis—a measure of the "fatness" of the tails found in probability distributions. Today's environment is a first in the history of cryptocurrencies at the time of the birth of a new global market regime. A decades-long trend in global financial markets and geopolitical relationships has reached a turning point, setting the stage for a shock to the market's core engine. These shocks set off a ripple effect throughout the financial system, triggering highly unexpected, far-reaching events that dominated the cryptocurrency market.

The kurtosis is that the market is undervaluing going into 2022. Kurtosis is ultimately the basis for Syncracy to position itself as an extremely defensive instinct throughout the year.

Fast forward to the end of the year, and the only succinct way to describe what happened is that a nuclear bomb hit the cryptoeconomy. Sweeping bankruptcies, spectacular protocol failures, sickening hacks, and appalling levels of fraud; the scale and scope of the disruption has surpassed anything experienced in previous crypto cycles. What we are left with is an industry at a crossroads, and a sense of unease that has never been greater than in the industry.

I know this sounds pessimistic, but bear with me. All I can do is keep it real. Before we can discuss the light at the end of the tunnel, we must first address our past.

The age of casinos is over and a new era is upon us. The choices we make today and the values we live by will shape this industry for decades to come.

The psychology of cryptocurrency speculators

No single idea has shattered more dreams in the past 18 months than the Supercycle. To be clear, everyone believes it, whether explicitly through their words or implicitly through their actions. The thesis is enticing. It shows that the crypto economy has reached a new paradigm where growth is unstoppable and mainstream adoption is inevitable. It promises an unprecedented "only up" rate of return that only the timid and narrow-minded dare to question.

The average speculator is defenseless against this argument. They already see their tokens as chips in a decentralized casino rather than economic ownership in a decentralized network. Valuations are arbitrary. Intrinsic value is a meme. Each token is a lottery ticket - a chance for life-changing wealth and financial freedom. This phenomenon occurs due to:

- excessive personality cult

- Lack of reliable educational resources

- Lack of a Common Valuation Framework

- Unprecedented Retail Opportunity Gain Early Opportunity

- Countless stories of self-made wealth

- For more than a decade, central banks have driven up returns that reinforce FOMO

The hypercycle argument is the rocket fuel for this lottery belief. Not only did it cause speculators to never sell and double down on every dip, but it also used a lot of leverage to boost their returns. The path to higher prices is doomed, so why not make it as long as possible? There is no risk that cannot be taken. Every financial instrument, every on-chain or off-chain strategy is designed to enhance returns. This widely shared psychology provides conditions ripe for excess. Even founders are not immune as they unleash tons of useless tokens and NFTs on the market to capitalize on the greed of speculators.

bubble burst

Bubbles typically burst due to four common factors: leverage, overly optimistic forecasts, heightened fraud and unsustainable business practices, and changing macroeconomic and interest rate conditions. The cryptocurrency bubble is a victim of all four.

Leverage — Like the broader global macro economy, the crypto economy is on a leverage frenzy fueled by easy money. This is the first real bull run in the crypto credit industry. As the bull market raged on, lenders extended credit on ever looser terms and credit quality deteriorated. At its peak in November 2021, CeFi outstanding loans reached approximately $35 billion, DeFi outstanding loans reached approximately $30 billion, futures open interest reached approximately $40 billion, and total leverage in the system was $105 billion. Today, that number has dropped by more than 75% combined, and the entire CeFi lending complex has almost disappeared.

Overly Optimistic Predictions - Check out myriad predictions of $10,000 ETH, $100,000 BTC , and mass adoption by the end of 2022. To be clear, these price estimates imply market caps of $1.2 trillion for ETH and $1.9 trillion for BTC . Considering retail and institutional holder penetration across the asset class is only 4% and 2%, this Is a huge credit - when you consider the percentage of total retail and institutional wealth stored in cryptocurrencies is in error. Not only are people storing almost no wealth in these assets. Daily usage of Bitcoin and Ethereum is inherently limited, only able to process about 2 million transactions per day. For this reason, Bitcoin and Ethereum have at best a few million daily active users.

Increased fraud and unsustainable business practices – these factors dominated the headlines throughout the year. Lax regulation, easy money, and uneducated users provide the main conditions for these practices. Once a $32 billion institutional darling, FTX ended up being the biggest fraud since Bernie Madoff. Terra, once a $70 billion ecosystem propelled to enormous heights by unsustainable mechanism design and incentives, was burned in the largest protocol collapse in the history of the industry. And these two, despite being the biggest, are just the tip of the iceberg. More fraudulent and unsustainable practices are discovered every month.

Changing macroeconomic and interest rate conditions - this is the nail in the coffin. We went from trillions of dollars of fiscal and monetary stimulus and zero interest rates to the most hawkish central bank in decades. We now live in a world of aggressive quantitative tightening and 5%+ terminal rate expectations. The 40-year secular decline in interest rates that fueled economic growth and asset prices is over. A new financial reality is emerging.

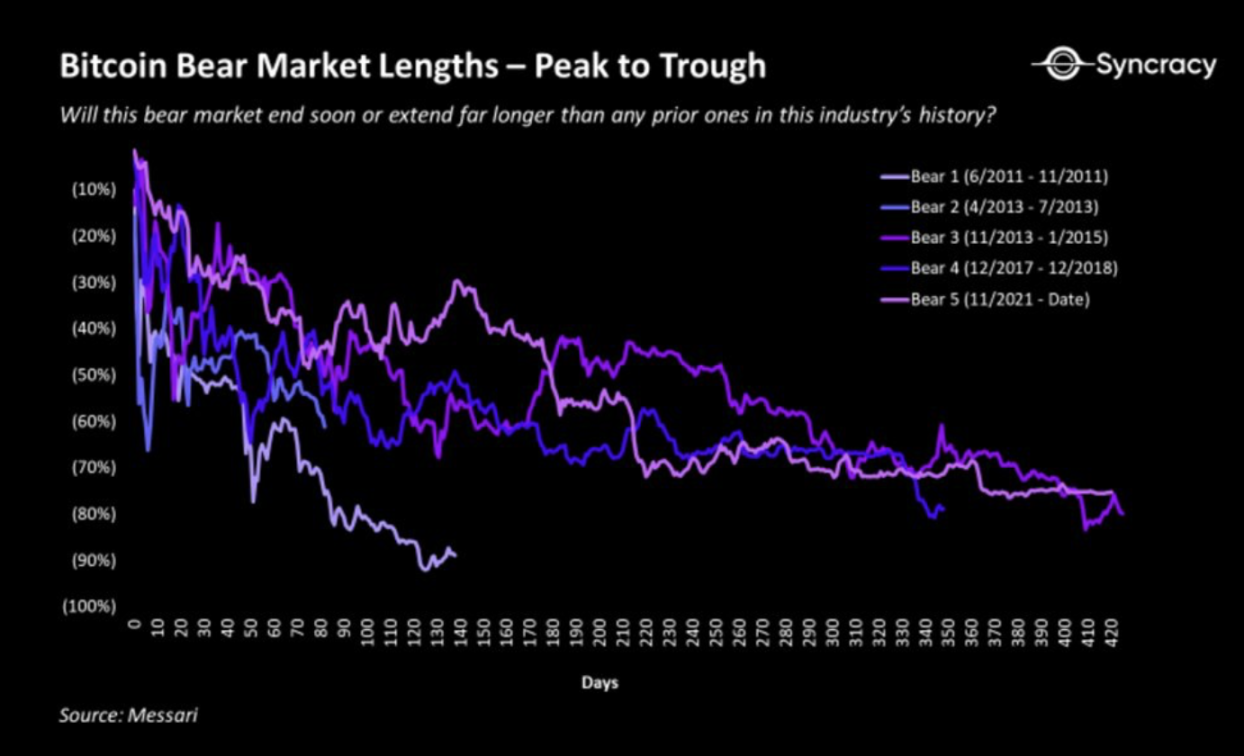

The bursting of a bubble is a process, not an event. While we're probably about 90% through the end of the first credit cycle in cryptocurrencies (not too sure it's over since there's no lender of last resort in the cryptoeconomy to prevent further contagion), we're at the edge of a potential long-term global recession Edge, and fighting the most hawkish central bank in decades. How the global economy goes in the coming quarters could determine whether this bear market ends quickly or lasts longer than any bear market in the industry's history. The smartest capital allocators I know are anxiously heading into 2023 - the worst leg of a bear market is usually the last leg of an eventual economic contraction, corporate bankruptcies, escalating liquidations and evaporating liquidity. The chances of cryptocurrencies decoupling in this environment are slim. It's still a deal.

Many would argue that after all the bankruptcies, protocol collapses, and hacks, there is very little left to break in this industry. I agree that most of the forced sell-off was done except for the distributions related to Mt Gox, Silk Road and Bitfinex totaling ~278,000 BTC(~$4.9 billion) and the possibility of further contagion from FTX. However, I also learned from previous cycles to never underestimate the apathy that follows every bubble burst - people sell when they give up.

If you're wondering what might be breaking during this cycle, I encourage you to look in the mirror a lot.

Consequences - sobriety

One of my favorite blockchain concepts is the single source of truth system. At its core, the blockchain is the public digital infrastructure that maintains a consistent and truthful view of the state of the economy, finance, and society—the information of social memory that forms the basis of nearly all of our institutions. The important idea is that by managing this state, and the conditions under which this state may change, blockchains can underpin a new world governed by transparent, impartial, autonomous code. The code can manage various activities around:

- property

- contract

- identity and reputation

- source

- vote

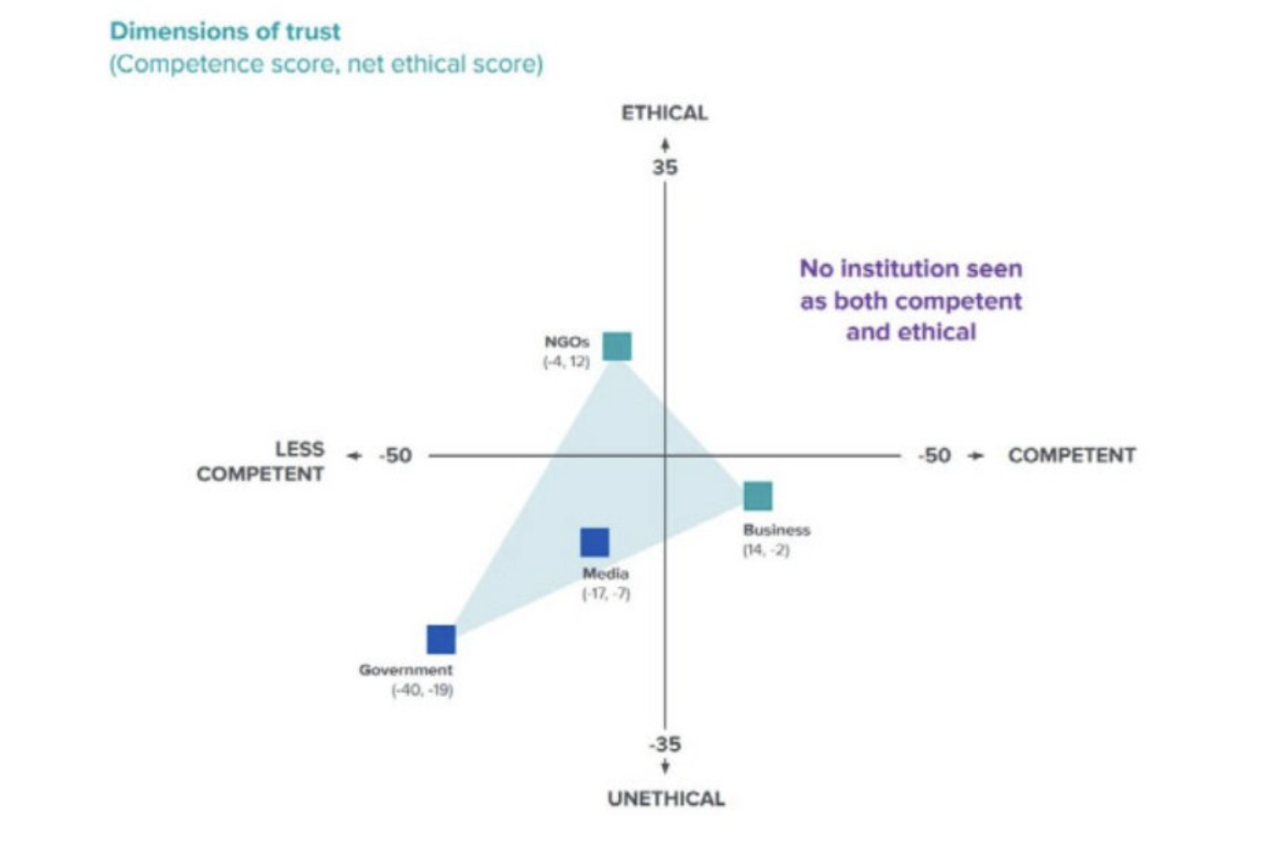

As global trust in institutions continues to decline, the rise of transparent, unbiased, autonomous code in these mission-critical domains is important. Stability After decades of rising inequality and several major systemic shocks, including the 2008 financial crisis, the 2016 political election cycle and the 2020 Covid pandemic, the economy that is the backbone of economic growth is in jeopardy middle. The fragility of core institutions—money, finance, technology, and government—is threatening rising costs of global coordination. Blockchains may introduce a new paradigm of algorithmic authority, enforced by tens of thousands of independent, open-source, user-run nodes around the world, potentially counteracting these forces. Blockchain can provide more trustworthy digital native institutions for every smartphone user in the world.

Nor is growing distrust of institutions more than an abstract social megatrend. This “counterparty” risk has very visible implications for individuals, businesses, and governments around the world, with political and economic implications. This year, the Bank of Canada froze the accounts of people protesting vaccine mandates, while Russia's central bank reserves were seized after Western governments invaded Ukraine. Over the past few years, Facebook has infamously cut ties with Zynga due to conflicting interests and Twitter shut down API access to third-party developers to gain greater control over the user experience and Twitter's ability to monetize. The list goes on. The rule of law and property rights in the digital realm are unreliable with powerful centralized intermediaries at the helm, with serious political and economic consequences.

Initially I thought all the crashes, bankruptcies, hacks and scams would set the industry back years. It is undeniable that industry confidence has been hit hard, and there is now a greater risk of severe regulatory counterattacks. However, the more I think about it, the more I feel like I'm only focusing on the bad.

In fact, now that the greedy, reckless, and fraudulent are out of business, it's easier for the industry to move forward with confidence. It's also a good thing that governments are finally desperate to figure out how to regulate the industry. There are tons of people and institutions waiting on the sidelines for the green light to enter the cryptoeconomy. Regulatory clarity will hasten their arrival.

But perhaps more important than any of these developments, all of these events may have provided users, businesses, and governments with perhaps the greatest catalyst ever to embrace an on-chain economy — an economy that itself is built on this new based on trust.

The crux of the matter is that all of the cryptoeconomic chaos in 2022 will be nuanced. Off-chain economies are riddled with principal-agent problems. Centralized intermediaries misappropriate assets, act recklessly, and commit fraud. In contrast, on-chain economies are largely protected by transparent, fair, self-governing codes. Intermediaries based on smart contracts protect the rights of users. Off-chain commitments enforced by the government are broken. On-chain commitments enforced by smart contracts are maintained. In short, protocols are more reliable counterparties. The difference between an off-chain economy and an on-chain economy was, and still is: companies make commitments. The agreement guarantees.

Going forward, I believe it is inevitable that decentralized protocols will eat away at market share from centralized protocols in the cryptoeconomy as users place greater value on trust and transparency. If you're already dealing with blockchain-based assets, why rely on a government-based legal system to protect your rights when the protocol can protect them with greater assurance? That's what it's all about, right? "Not your keys, not your coins."

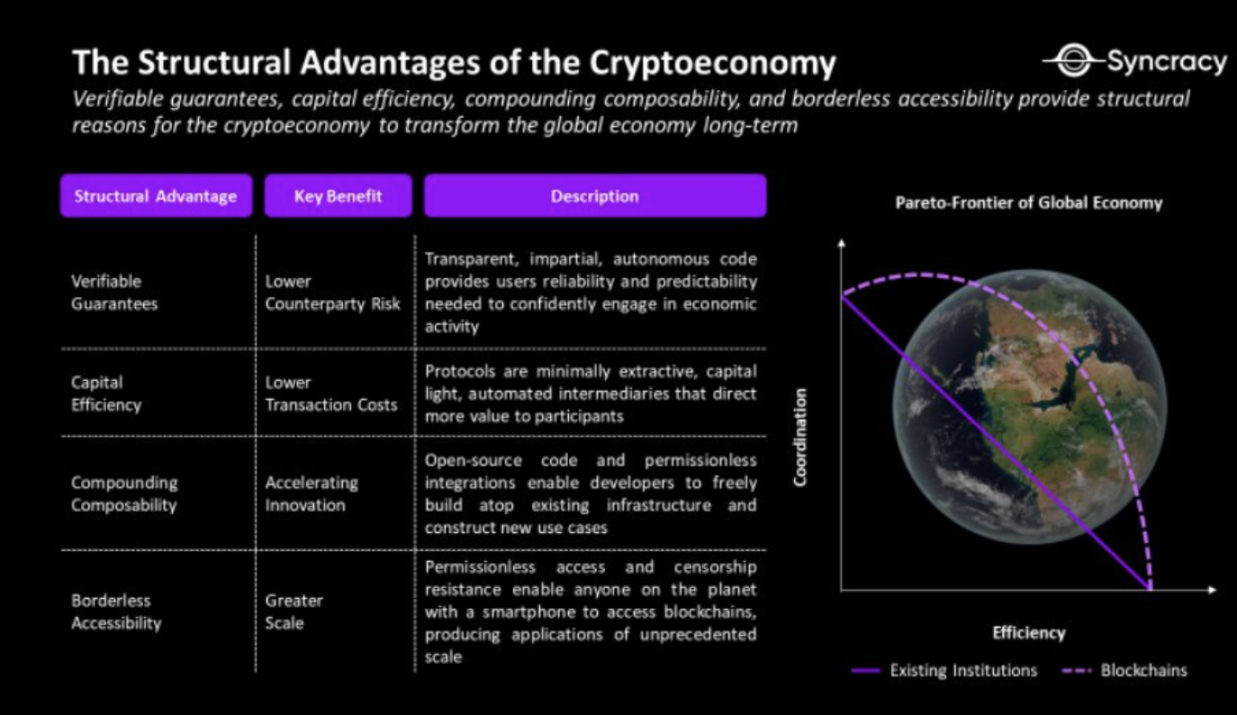

When combined with capital efficiency (lower transaction costs), compound composability (accelerated innovation), and borderless accessibility (greater scale), it will become increasingly difficult for users and developers to ignore these assurances and guarantees. The structural reasons for the cryptoeconomy's win have never been clearer. Over time, the cryptoeconomy will eventually expand the Pareto frontiers of the global economy and enable coordination on an unprecedented scale and efficiency.

Of course, these applications are still in their early stages. Not only are many decentralized applications slow, cumbersome, and difficult to use, but many are also vulnerable to hacking and unsustainably built. The latter property is heavily discounted in bull markets where deploying unaudited code and increasing usage through unsustainable incentives are popular. At some point during that time, the industry's original design goal of building a reliable decentralized economic infrastructure became an afterthought as bullish protocol architects looked for returns.

As the industry wakes up after the Terra debacle and similar unsustainable design protocols, I expect sustainable protocol design to command a premium again. The environment in the coming years will be much more forgiving than in the past, and protocols that organically channel demand and thoughtfully engineer critical infrastructure will win moving forward. Bet boring.

The Future - Scalability, Availability, Commercialization

Blockchains sell block space - space on the blockchain that can be used to store information and run code. This space guarantees that information stored in it will not be corrupted, and that code written into it will function as designed. All economic activities on the blockchain are based on the block space. Today, however, secure block space is scarce and expensive, limiting the ability of the cryptoeconomy to scale.

Over the next 6 to 18 months, the state of blockchain scalability will change dramatically as leading blockchains roll out core protocol upgrades, scalability improvements, and interoperability solutions. I expect the introduction of sufficiently secure, connected, and plentiful block spaces to be the industry's broadband moment powering the next generation of applications.

As the secure block space expands, I expect the usability of blockchain applications to increase significantly. Tech giants like Meta are embedding blockchain into their core products and are investing more than $25 billion into Metaverse every year. Wallet infrastructure is evolving rapidly, especially in the mobile space, and key features such as multi-party computation, social key recovery, and direct fiat on-ramp will soon become standard. Account abstraction - an upcoming Ethereum protocol-level upgrade - will be a key accelerator of this trend by making user-owned accounts programmable and providing wallets with enhanced functionality and customizability. Traditional fintech companies have also seized on this opportunity, with some starting to offer in-app access to on-chain protocols. Protocols like Superfluid and Sablier make it easier to get paid from smart contracts, providing the infrastructure to support on-chain work. Payment protocols make it easier for merchants to transact with stablecoins. Data providers are illuminating the rich data of the crypto economy, enabling stakeholders to make better decisions. The list goes on. As retail and institutional infrastructure rapidly matures, the usability of blockchain will increase by orders of magnitude.

With faster, more scalable blockchains and a smoother, more secure user experience, the wave of new talent and capital that has flooded the industry over the past two years will finally be able to develop blockchains ready for mass adoption chain application. Today, we are already seeing the germs of the mainstream applications of the future, which are achieving impressive results relative to centralized applications. We are also seeing early signs of scalability, with Ethereum L2 processing more transactions than the Ethereum main chain. We continue to see cryptocurrency adoption on the fringes of developing economies that lack reliable monetary and financial infrastructure. Despite user experience hurdles, non-sovereign digital currencies and stablecoins are already functioning in these markets.

All in all, the setup for onboarding new users into the crypto economy has never been stronger.

The road ahead - controlling aggression

Going into 2022, I'm disgusted with the state of the crypto economy. I am no longer disgusted today and believe risk reward favors controlling accumulation over the next few quarters. However, while the days of selling everything are long gone, this market remains one of patience over bravery. Regime change can be brutal as global markets rapidly re-price every asset class for new financial realities. Being agile and adaptable in this environment remains a top priority. The last thing you want is to make a fatal mistake before the next big dance. Now is the time to start long-term, careful thinking.

2023 could offer a very favorable environment for long-term buyers. Syncracy's forecast is for volatile markets over the next 6-12 months, with a directional bias still tilted to the downside. After all the major bankruptcies, idiosyncratic risks in the crypto economy have dropped significantly, creating an opportunity for this bear market to begin its indifferent phase. With clarity looming, we may finally have what it takes for a firm bottom. The contagion risk for FTX remains, but unless DCG, Tether or Binance crash, more dominoes may just be footnotes.

As publicly disclosed, DCG is at the highest risk of bankruptcy Tether and Binance seem to be doing fine for now after the FTX debacle. I'm not betting on any serious problems with Tether or Binance, but I do expect both to come under pressure in 2023. Tether is known to have actively managed its reserves throughout its history, and with TradFi’s rising yields and lower willingness to hold stablecoins with lower yields. If ever their aggressive reserve management practices got them into trouble, it was during the climax of a broader global economic bear market. I am least concerned about Binance's solvency issues, although their transparency is questionable. However, Binance is notorious for being a rebellious offshore exchange, and I expect the government to take a more aggressive stance on it after FTX,

However, idiosyncratic risks in the crypto economy are no longer a major concern for the direction of the market. Broader financial markets will provide significant support as global recession risks rise and the world accepts structurally higher interest rates and tighter liquidity. This unresolved situation is largely driven by monetary policy shifts and will continue to put pressure on cryptocurrency valuations that have not yet been fully rationalized - the inertia percentage decline from ATH and relative valuation analysis is not enough to justify our 2021 is far from reality. There are still more than 50 deals with projects valued at over $1 billion, a figure that doesn't even include the private market. I am as long-term optimistic about this industry as anyone, but I personally find it hard to believe that the crypto economy has produced so many unicorns. After all, the industry is still struggling to provide tangible, widely discernible evidence of its value. Remember, this is all one trade, and if the worst remains to come for the wider financial markets, cryptocurrencies will not be immune.

That said, the beauty of this environment is that it provides a lot of time to build conviction and build quality assets. As mentioned earlier, the structural advantages of blockchain-based applications have never been clearer. With valuations already down to such low levels, there is little need to assume unnecessary illiquidity or contrarianism when the safest, category-leading protocols are publicly traded at low prices. This is the generational environment for fundamentals-oriented asset pickers. The next generation of globally dominant platforms is expanding.

Looking at it another way, after Bitcoin bottomed at $3,156 during the previous cycle in December 2018, investors had 111 days to buy below $4,000. This comes after 355 consecutive days of no-return buying the dip, as Bitcoin trended lower each month — and this was in a significantly more favorable macro regime. Remember, the goal is to get to the next big dance, not to be a hero. The most profitable thing is to grasp the essence of the trend, not to buy the bottom or sell the top. Rhythm is essential.

Prices and crisis - the light at the end of the tunnel

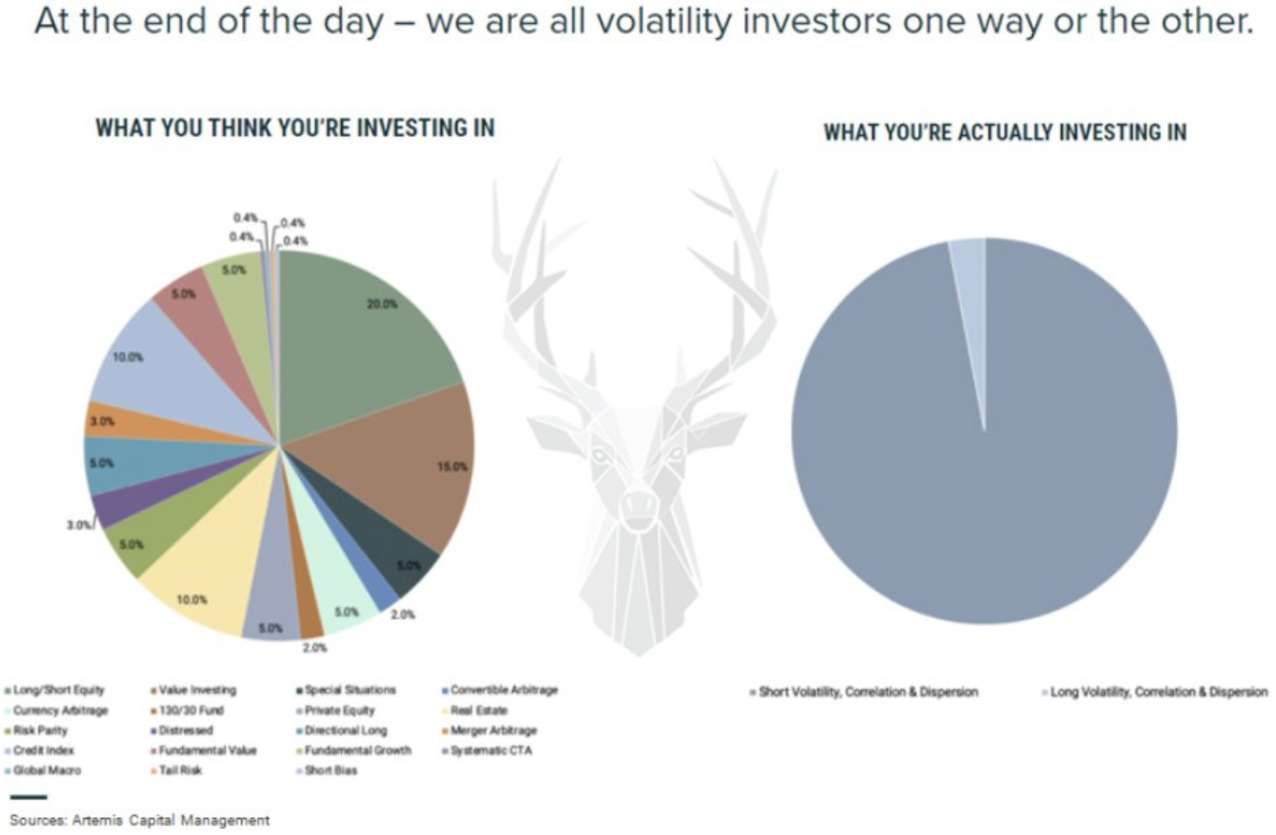

Financial markets are a peculiar thing. On the surface, they often look like a sideshow — a zero-sum game that masks the real economy. After all, traders don't build anything, builders do. In practice, however, the idea that financial markets are a zero-sum game could not be further from the truth.

In essence, finance structures uncertainty and forms an open system of promises we make to each other about the future. These relationships do not mediate other things on the "real" side of the economy; they are constitutive relationships of the economic system. Financial markets don’t matter to the crypto economy because they can make you rich or poor, they matter because they reflect confidence in the commitments made between their stakeholders.

In 2021, the financial market will provide a lot of new attention, users, capital and talents to the encryption economy. However, confidence eventually outstrips reality and ends up sowing the seeds of fraud, fraud and opportunism. In 2022, that confidence peaked, with a sharp reversal in financial markets, catalyzing a nasty reset of all cryptoeconomic businesses and infrastructure that failed to deliver on their lofty promises. With confidence collapsing, the industry has been rocked by a much-needed reminder. In 2023, the financial market is likely to continue to be the shadow of the industry, resulting in the drying up of attention, users, capital and believers. But unanswered questions may also provide the conditions ripe for the ecosystem to refocus itself and drive real adoption—a path to restoring that confidence again. It should be clear then that financial markets are not just a sideshow, they are an intrinsic part of the game we all play.

If you survived all the bankruptcies, closures, hacks and scams this year, you deserve all the glory on the other side. I firmly believe that one day we will see this period as the end of the beginning - a defining moment when the industry makes a choice whether to die in the cradle as a niche technology, or to grow and reach the masses. The path to mainstream adoption won't be smooth, and certainly isn't guaranteed, but I believe there are enough smart and determined people in the industry to make it happen. Despite the growing pains, the vision for the crypto economy has never been clearer.

Stay happy, healthy and engaged as we head into winter. The hardest part of the next 6 to 12 months will be keeping a cool head as we move through this challenging time. I hope you are all ready for what comes next. I know Syncracy is. Bear markets are where legends are created.