Most of the blue chips have risen to varying degrees in the past month

Since the FTX thunderstorm, the sentiment of the encryption market has continued to decline in the haze of this incident, and the NFT market is no exception. However, starting from mid-December, led by NFT leader Yuga Labs, the ApeCoin pledge in the ecology and the latest "Jimmy Monkey" plot have further promoted the development of "Ape Universe". Top blue-chip projects such as Doodles, Moonbirds, and Azuki have successively released good news. All have risen to varying degrees, and Blur’s third AirDrop is also in full swing. Coinciding with the recovery of mainstream tokens such as BTC, ETH, and SOL , the optimism of "the bull's return to speed" has begun to permeate in various NFT communities, and the entire market has ushered in a wave of "Xiaoyangchun".

There is no doubt that the good news of NFT blue chips has guided the development of the NFT market, but behind the rise, there is often the support of real money. Is the source of funds for buying orders "institutions entering the market" or "old leek recharge"? Or are we finally waiting for off-market new users to arrive with new funds?

Is it a "real recovery" or a "false bull market", after careful exploration, it may be found that there may already be crises behind it.

Blur's AirDrop campaign warms up

The third AirDrop went live

The third AirDrop of Blur airdrops is live

On December 6, the NFT market Blur issued an announcement announcing the opening of the second AirDrop of airdrops. In addition, the third AirDrop of airdrops will be launched. When users bid, they can start to earn points for Blur’s third AirDrop of airdrops. This is Blur’s last and largest AirDrop.

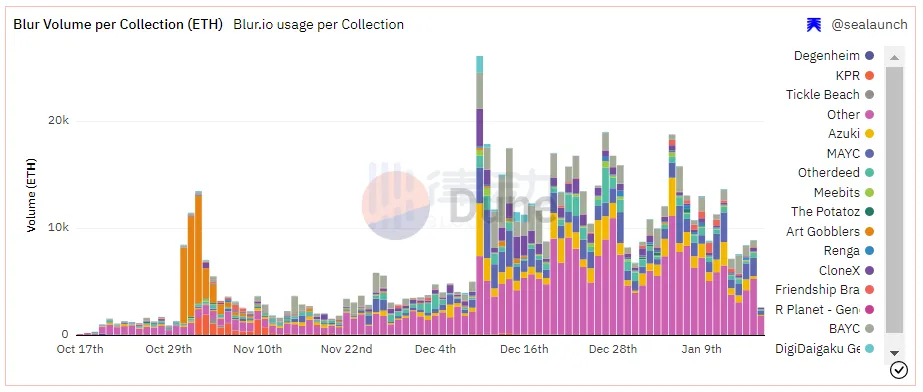

After Blur’s third AirDrop began, the NFT market’s transaction volume rose sharply (Source: Dune )

With the arrival of Blur's third AirDrop of airdrops, the transaction volume of the NFT market has risen sharply.

According to previous reports by BlockBeats, on December 11, Dune Analytics data showed that because the NFT market Blur will release the third AirDrop of airdrops, the 24-hour transaction volume of blue-chip NFTs such as BAYC and Azuki has increased significantly. in:

• The 24-hour transaction volume of BAYC series NFT reached 3365.56 ETH;

• The 24-hour transaction volume of MAYC series NFT reached 3287.25 ETH;

• The 24-hour transaction volume of Azuki series NFT reached 4670.3 ETH;

• The 24-hour transaction volume of CloneX series NFT reached 3459.68 ETH.

It can also be seen from Dune's data that the phenomenal increase in the NFT market's transaction volume this time is not a flash in the pan. Compared with the NFT bear market with almost no fluctuations in the previous few months, this Blur's AirDrop activity continues to promote the growth of the NFT market. Maintained a state of high transaction volume until now.

Why can this AirDrop activity activate the market?

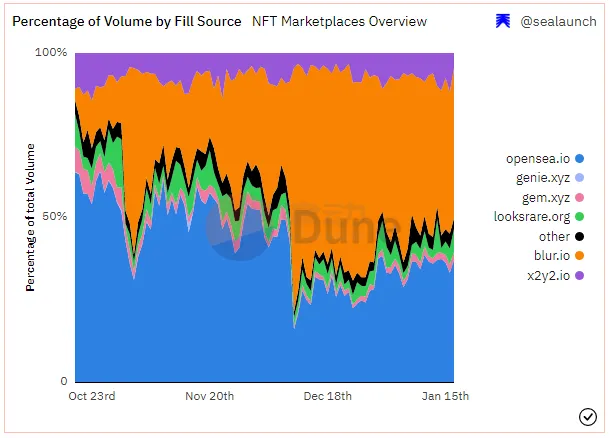

Trading volume comparison of various NFT trading platforms

From Dune Analytics data , it can be seen that before the third AirDrop of airdrops went online, the contest between Blur and OpenSea was back and forth: Blur introduced zero handling fees and optional royalties in the hope of reducing user transaction friction, and launched the "ETH In addition, Blur has the advantages of faster interaction; OpenSea maintains user stickiness by virtue of its brand effect, and also launched a "mandatory royalty tool" to force NFT project parties and trading platforms to choose sides.

However, Blur's third AirDrop gradually tilted the balance of victory: Blur's transaction volume once accounted for 74% of the entire NFT market. Although it fell back slightly, it still overwhelmed OpenSea.

The winning trick is that this "Bid to Airdrop" event will help provide higher liquidity for NFT transactions on the Blur platform.

In the third AirDrop of airdrops, Blur will give corresponding reward points to users participating in the bidding based on the 24-hour transaction volume of a certain NFT series. Among them, the bidding that is closest to the floor price (easiest to be accepted by an offer) will be judged by the system Most of the points are obtained, and the points obtained are proportional to the bidding time.

At the same time, after users deposit their ETH for bidding into the Blur platform, they can repeat bidding across NFT series, and points can also be accumulated repeatedly.

As we all know, due to the indivisible and high unit price of NFT (the unit price of blue-chip NFT starts at 10E), the quantity is small (the total amount is less than 10k, the most common), and the rarity difference (holders may subjectively think that their NFT is more unique), the floor price The offer price often does not match, and the transaction depth is insufficient, which is the main reason for the inefficiency of matching transactions in the NFT market .

This creates a bad situation:

• Traders often have to endure huge slippage losses if they want to quickly sell NFT at a fair value to close their positions

• Capital inefficiency

However, the means used by Blur in the third AirDrop of airdrops are effective (the rights and wrongs of its royalty strategy are not discussed here for the time being):

• Users can use their funds more efficiently for transactions/ AirDrop;

• This bidding rule will promote the game between buyers and sellers in the market. The bidders/buyers will try their best to get the offer price as close as possible to the floor price/fair value of this NFT series in order to obtain the AirDrop, so the seller can sell at a better price to obtain better exit liquidity, thus achieving an increase For the purpose of transaction matching efficiency between buyers and sellers, the transaction depth, liquidity, and matching efficiency of the Blur platform have all been improved.

BendDAO Spotted ApeCoin Pledge Activities

BendDAO and Yuga Labs officially launched ApeCoin staking activities on the same day

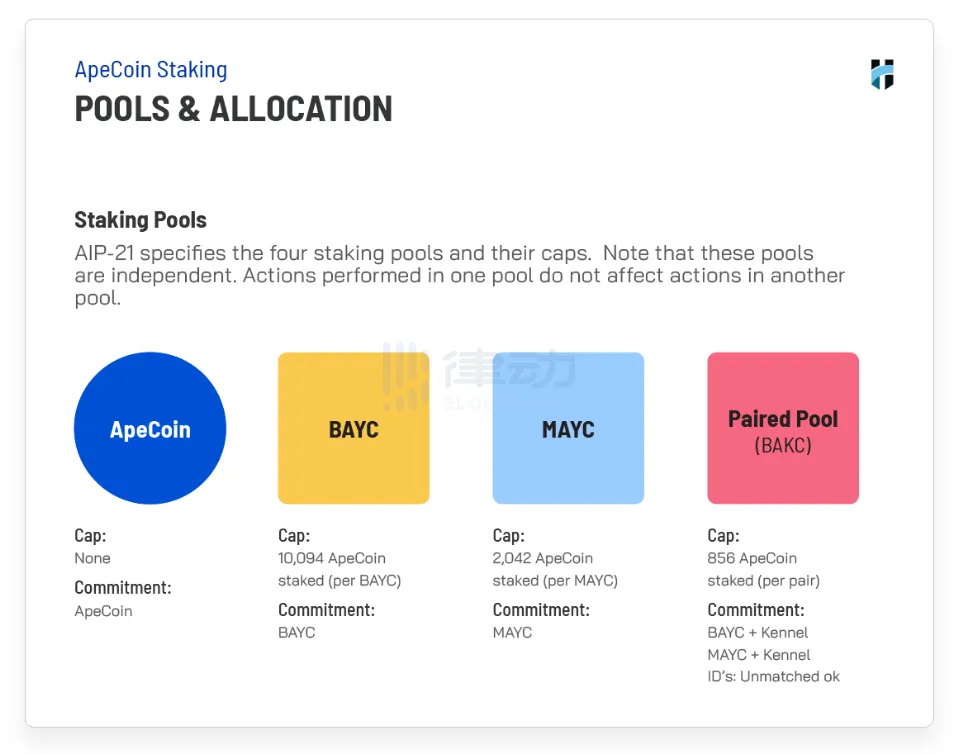

ApeCoin's "Independent Portfolio Staking Mining"

On December 6th, Horizen Labs, responsible for creating the ApeCoin DAO staking system, officially announced that ApeStake.io has officially launched and opened Ape deposits. ApeStake.io's pledge mining system divides user assets into 4 pools according to categories, namely ApeCoin pool, BAYC pool, MAYC pool, and BAKC matching pool. Users need to hold the assets required by each pool to pair themselves. Described as "independent combined staking mining".

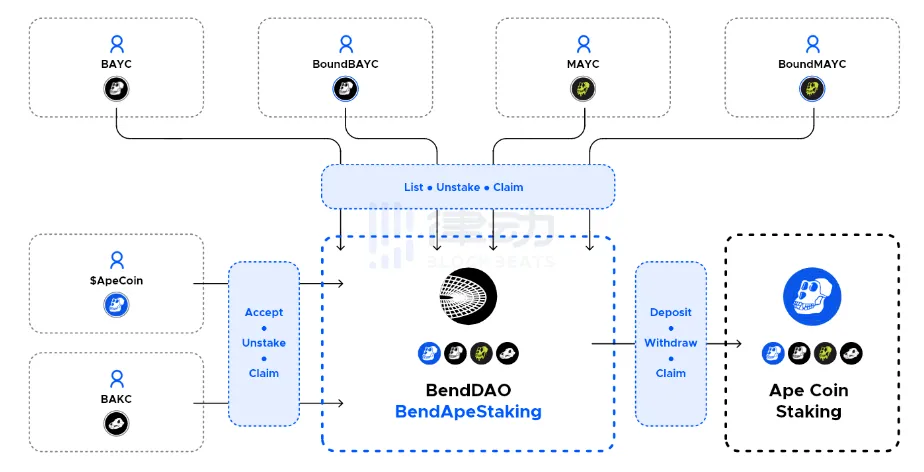

BendDAO adopts "Pair Pledge Mining" (Source: BendDAO Documentation )

Just 10 hours later, BendDAO, an NFT liquidity platform whose main business is "peer-to-pool lending", also announced the launch of the Ape pledge system. restrictions, a "pair pledge mining" scheme is adopted, users can participate in pledge mining even if they only hold part of the assets required by the mining pool, that is to say, if the user only holds ApeCoin or a certain NFT (BAYC\ MAYC\BAKC) can also be mined.

For example, Xiao Ming only has BAYC (or MAYC\BAKC) NFT in his hand. If he participates in the official pledge mining, he needs to supplement the ApeCoin corresponding to the mining pool he wants to participate in, so as to achieve the highest expected return Rate. Now through BendDAO, in addition to the official "independent combined pledge mining", there are other ways for Xiao Ming to participate in mining with only one NFT: Xiao Ming can choose 0 ApeCoin to pledge his NFT , the system will match him with the ApeCoin pledged by other people, and they will become a joint pledger (Co-Staker). In addition, Xiao Ming can set the proportion of mining income distribution. The more the proportion of income contributed, the easier it is to be paired with ApeCoin.

In return for improving the pairing of NFT and ApeCoin holders, BendDAO will charge 4% of user pledge income as a matching service fee. This part of income is important to BendDAO, but more importantly, it has attracted more blue chips to pledge.

BendDAO took advantage of the trend to increase the mortgage ratio, staged a straw boat borrowing arrows

In addition to the above-mentioned functions, BendDAO's "Pair Pledge Mining" program also allows users to mortgage their NFTs on BendDAO for loans or pending orders during the pledge mining period . At the same time, considering the corresponding special circumstances, according to the official document , if the NFT is sold or liquidated during the pledge mining period, the matching contract can execute the uncommit operation in advance through the interceptor at an appropriate time, and all tokens in the pledge contract Tokens and rewards are withdrawn and returned to the original NFT holders and ApeCoin holders.

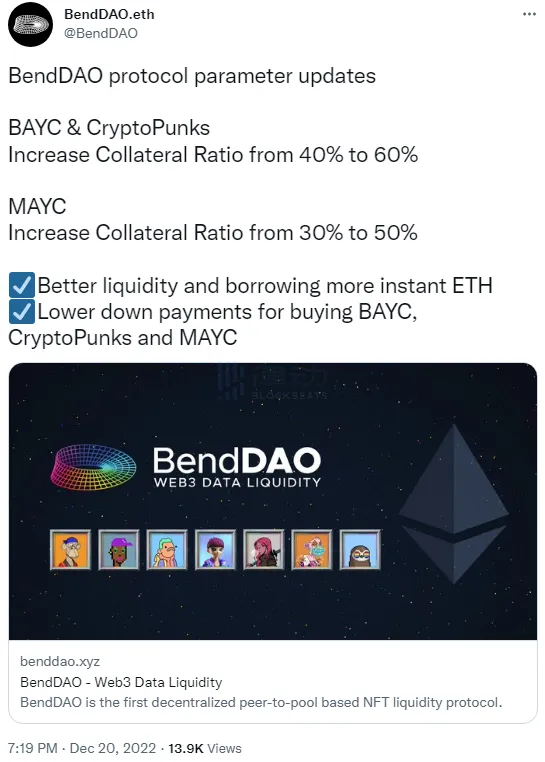

BendDAO announced that the collateralization ratio of BAYC/CryptoPunks/MAYC has increased by 20%

With the above foreshadowing, BendDAO issued an announcement on December 20, 2022, announcing that the mortgage ratio of BAYC and CryptoPunks will be increased from 40% to 60%, and the mortgage ratio of MAYC will be increased from 30% to 50%. Users will benefit from two aspects :

• Better liquidity, can borrow more ETH instantly

• Lower down payments when taking out loans to buy BAYC, CryptoPunks and MAYC

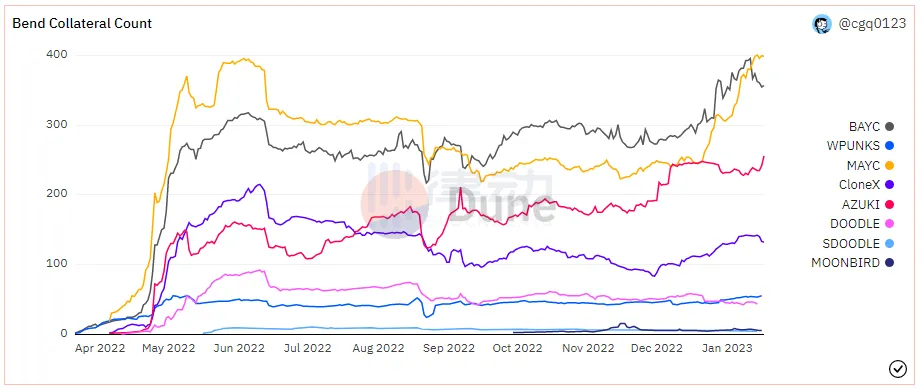

The number of mortgages for BAYC/MAYC has increased significantly since December 20 (Source: Dune )

The move paid off immediately, with BAYC and MAYC staking volumes increasing substantially from that day onwards. According to Dune data, as of the publication, the number of BAYC mortgaged on BendDAO has risen from 303 on the adjustment day to a maximum of 396, and MAYC has risen from 246 to a maximum of 401. During this period, the amount of all lending funds by staking NFT on BendDAO has also increased, reaching 28,581 ETH( source of calculation data), roughly equivalent to about 45.73 million US dollars at the latest price of 1,600 US dollars, most of which are through BAYC and MAYC lent.

The newly added loan funds are mainly composed of the following three parts:

• New users who have just mortgaged BAYC/MAYC and borrowed at a mortgage ratio of 60%/50% respectively

• Old users, who have mortgaged BAYC/MAYC before and borrowed according to the old mortgage ratio, now that the mortgage ratio has increased, they can borrow another 20%

• New and old users of other blue-chip NFTs supported by BendDAO complete mortgage loans (compared to the above two points, the ratio is small)

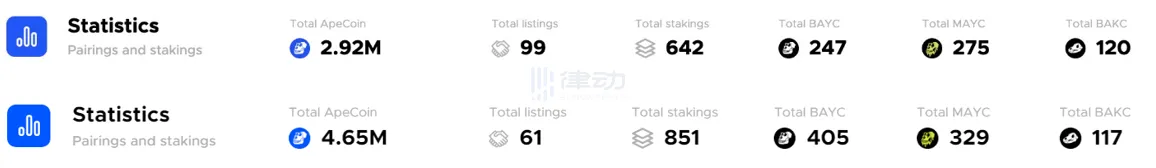

More participants in ApeCoin staking mining activities on BendDAO (Top: December 16 Bottom: Deadline for posting)

In addition, some monkey holders who were attracted by increasing the mortgage ratio participated in ApeCoin pledge mining activities. Compared with the situation before the adjustment of the mortgage ratio (December 16), the total number of pledged ApeCoins rose from 29,200 to 46,500, an increase of 59.25%; the number of pledged BAYC/MAYC rose from 247/275 to 405/329, The increase was 63.97%/19.64% respectively.

It can be seen that BendDAO has successfully converted this part of the traffic attracted by ApeCoin's pledge mining activities into customers of the platform's main business, and some of the customers participating in mortgage lending will participate in ApeCoin's pledge mining activities. Through this "grass boat borrowing arrows" good show code exchange flow, BendDAO's pledge mining, lending, trading, down payment and other businesses all benefit, and it can be said that they all win .

Good news for NFT blue chips comes one after another

Yuga Labs' "Jimmy Monkey" quotes are here

The "treasure box" that appeared in the BAYC animation video

Yuga Labs has made frequent moves in the past month: In addition to the ApeCoin pledge, BAYC announced the launch of the latest plot of " The Trial of Jimmy the Monkey " on the second day after BendDAO announced that it would increase the mortgage ratio of Yuga-based NFTs. Under the background of the story of "Treasure Box", a parkour game Dookey Dash similar to Temple Run will be launched soon. The "BAYC Sewer Pass" required to participate in this game is to hold the assets of "Ape Universe" and carry out Match to get it.

Holders of "Ape Universe" assets will receive different levels of BAYC Sewer Pass according to the assets they hold

Refer to the introduction of " BAYC New Storyline: How to Play the New Game Dookey Dash and Game Ticket BAYC Sewer Pass " article, we can see that the total number of BAYC Sewer Pass is 30,000, and BAYC and MAYC holders can receive BAYC Sewer Pass for free.

However, according to different asset holdings, the received BAYC Sewer Pass will be divided into 4 different levels:

• Holding 1 MAYC can receive Tier 1 BAYC Sewer Pass

• Holding 1 MAYC + 1 BAKC can receive Tier 2 BAYC Sewer Pass

• Holding 1 BAYC can receive Tier 3 BAYC Sewer Pass

• Holding 1 BAYC + 1 BAKC can receive Tier 4 BAYC Sewer Pass

The higher the level of BAYC Sewer Pass held by the player, the higher the score bonus can be obtained in the game, which will provide assistance for the "ranking".

The same asset collocation scheme appeared in the two activities of Yuga Labs. The demand for "out of thin air" further raised the price of the "Ape Universe" assets, and these assets will also repeatedly enter the above-mentioned BendDAO's "joint pledge- Mortgage Lending" flywheel.

Doodles 2 is coming

Doodles artist and co-founder burnt toast has posted what appears to be Doodles 2

According to reports , on December 19, 2022, Jordan Castro, the founder of the NFT series Doodles, announced in the official Discord that the announcement of the utility of the Dooplicator and the opening of the Genesis Box will take place after January 2023, and Doodles 2 will also be launched next year. closed beta. Castro said the past year has found the perfect home for Doodles 2 by exploring other blockchains and Layer 2 networks. The testnet contract is currently deployed, and a preview of Doodles 2 characters will be released this week. In addition, Castro apologized to the community for the delayed product launch, and pointed out that the main reason for the delay was "high standards for product performance", as well as some technical/architectural decisions and business considerations.

This announcement means that after almost a year of dormancy, Doodles will finally continue to deliver Doodles 2 related products after January 2023. The expectation of Doodles 2 has triggered an increase in the transaction volume of related series.

Moonbirds connects Hollywood, sparks discussion and imagination

On January 7, 2023, according to The Block, Kevin Rose, the founder of the NFT project Moonbirds , signed a contract with United Talent Agency (UTA), a large Hollywood brokerage company. UTA will manage the Web3 rights of Kevin Rose and all its subsidiaries. Since 2014, UTA has been investing through its UTA Ventures department, and has invested in Cameo, Consensys, Masterclass, Patreon, Pietra and other companies. In October last year, UTA cooperated with Investcorp to launch an investment institution UTA.VC, which will focus on investing in the creator economy and Web3 etc.

In addition, the Moonbirds second-generation Oddities series will also be promoted in 2023.

Azuki Anniversary and Token Launch Expectations

On January 12 last year, Azuki was sold in a Dutch auction. The innovative ideas emanating from the Gas-saving ERC721A protocol and the style of painting that integrates Eastern and Western aesthetics have all contributed to the NFT world.

After a year of ups and downs of development, Azuki has always remained in the top blue-chip echelon. According to the timeline of Blur, BendDAO, and Yuga Labs above, Azuki will celebrate its anniversary on January 12, 2023.

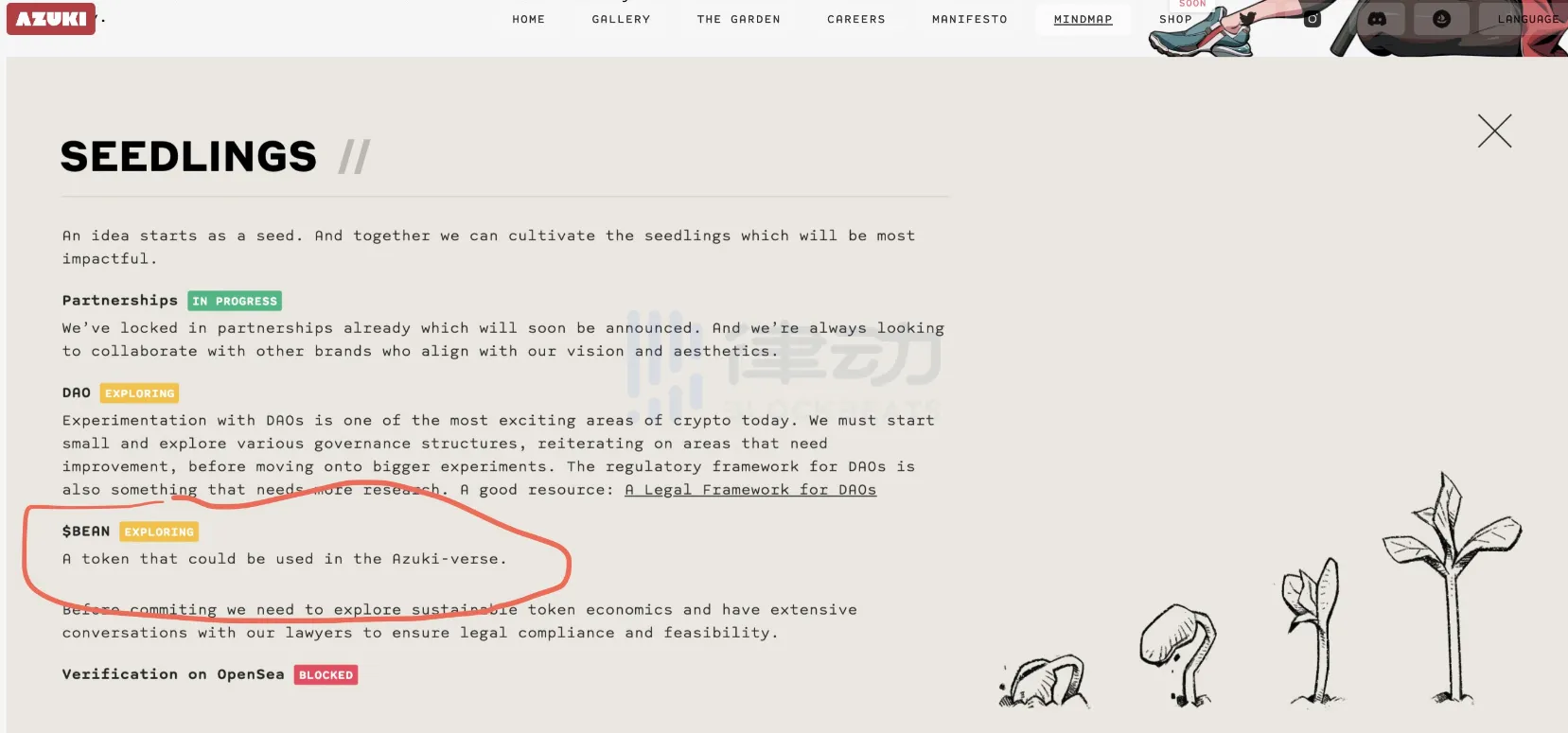

The content of $BEAN Token was actually written in the MindMap of Azuki's official website very early

There is no doubt that the anniversary is an excellent marketing node for every NFT project. Standing at this point in time, review the major events that happened in the past year, summarize the content delivered by the project, and at the same time look forward to the future with the community and Holders.

For Azuki, "token issuance" is always a good theme when looking to the future. So since December, $BEAN has been continuously mentioned by various communities. People saw the screenshots about $BEAN as if they were treasures, and thought for a while that "the "coin issuance" will happen on the anniversary" This incident has passed this "evidence" Be confirmed. However, in fact, the content about it has appeared in the MindMap of Azuki's official website in early 2022, and it is not new content.

Azuki's virtual city Hilumia

Azuki did deliver something new for its anniversary, though.

Following "Streets" and "Ruins", Azuki ushered in the third chapter of his world view - the virtual city Hilumia . Azuki NFT holders or community participants can now participate in the exploration, which includes Slowpoke's Toy Haven, a high-quality toy store, Ember Square, a design platform, Golden Skate Park, a community of skateboarders, and Garden Express, a "collection box" for opinions. Hilumia has yet to release an official roadmap, but the community believes the project could be an immersive version of Azuki Mindmap.

Celebrate the "Xiaoyangchun" in the NFT market, and use the timeline to sort out the coincidences

The main participants in the NFT market "Xiaoyangchun" project progress timeline

Combing the timeline, we can find the drivers of this NFT market recovery at various stages:

1. First of all, Blur’s AirDrop have warmed up the NFT market. The three rounds of AirDrop since October are more like cultivating users’ habit of continuing to use Blur for transactions, especially the third AirDrop of airdrops has made Blur’s platform transactions The depth, liquidity, and matching efficiency have all been improved;

2. Then the ApeCoin pledge activity was launched, and BendDAO followed the official steps to launch, and at the same time adjusted the mortgage ratio of the related NFT, which not only allowed the various businesses in its ecosystem to attract each other, but also allowed the NFT market to print "new money". Improved capital utilization;

3. Finally, various NFT blue-chip projects simultaneously released good news in the short term, which boosted market confidence and created demand to drive up both prices and transaction volume.

Be wary of the crisis of "over-leveraging"

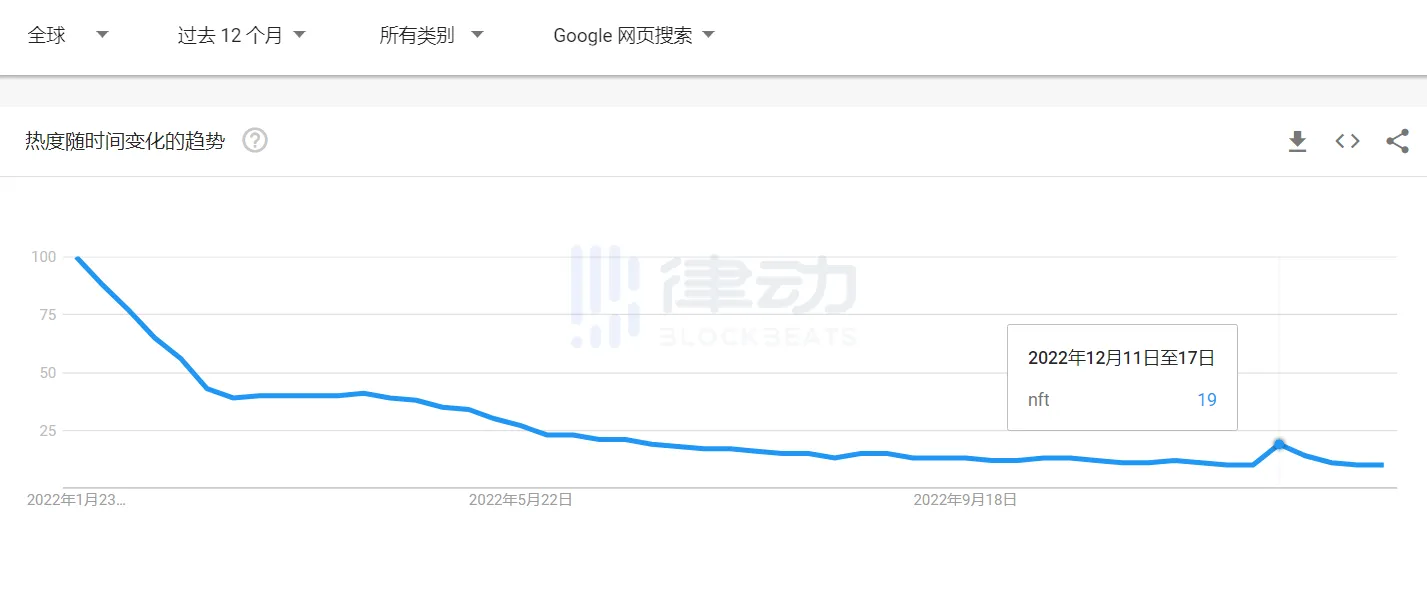

Google's global search index for NFTs continues to decline

According to the Google Global Search Index , the popularity of NFT has continued to decline in the past year, and the only rebound occurred in the middle of 2022. It is speculated that Trump’s NFT sale at that time attracted attention, and the popularity continued to decline afterwards.

This can be confirmed from the side that the recovery of the NFT market this time is not caused by new traffic and new funds from the outside world. This "false bull market" needs to be vigilant.

Increase leverage, how big is the "bubble"?

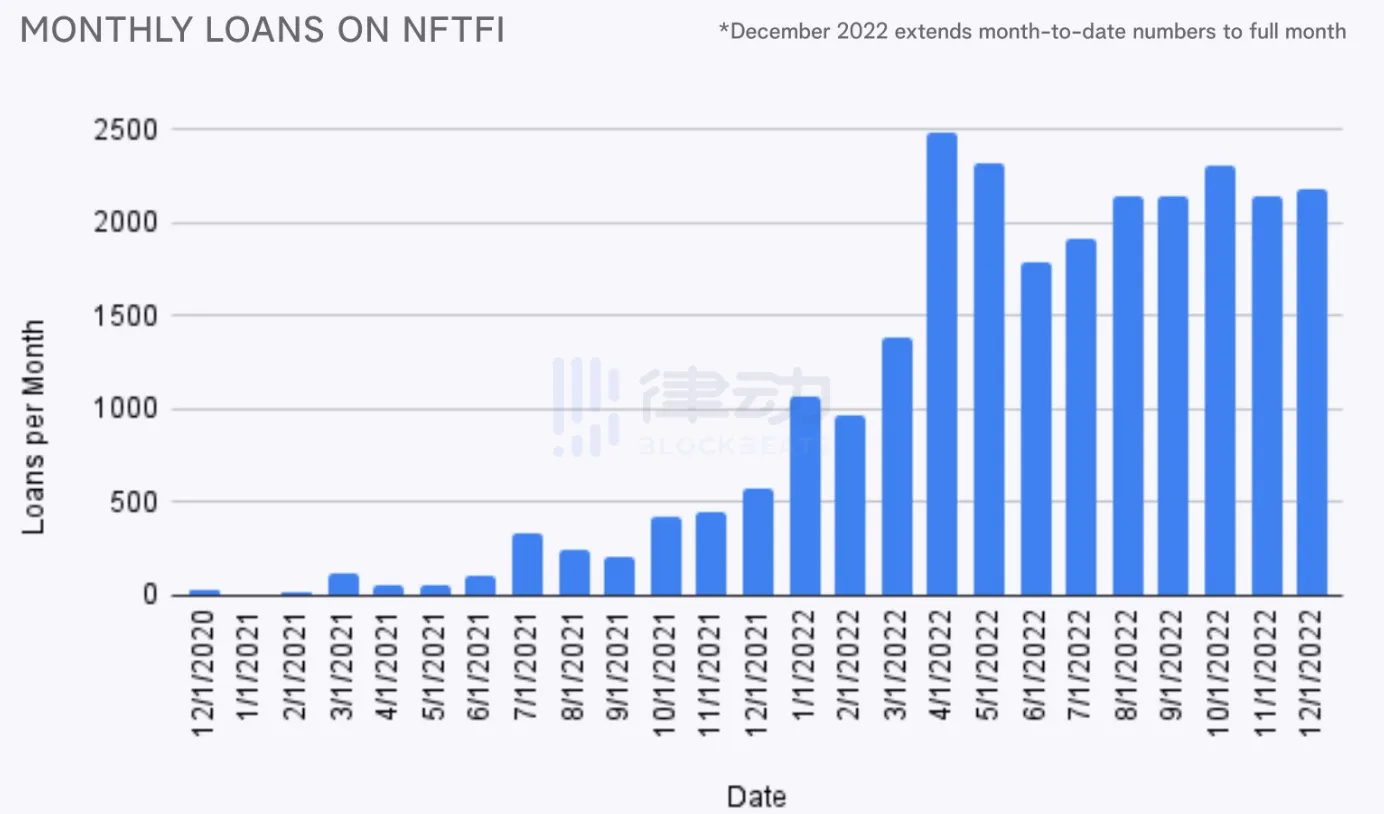

NFTFi monthly loans

According to the latest report data released by PROOF analyst WarDaddyCapital , although the NFT transaction volume in the bear market is low, the number of NFT-related loans currently issued is close to the April 2022 high. The total amount of loans for NFTs on the NFTFi platform is near an all-time high.

Number of Borrowers in NFTFi

More lenders are entering the market and the total number of borrowers peaked in March and April, but lenders are hitting new highs now. As a result, the APR on lending has dropped dramatically over time.

At the same time, the mortgage ratios of various NFT lending platforms are not the same. BendDAO, which is a bit-to-pool instant lending business introduced above, has increased the mortgage ratio of some top blue chips, and even platforms such as Rollbit can set the mortgage ratio to as high as 80%. The ever-increasing leverage blows the bubble bigger and bigger.

Unsustainably high APY

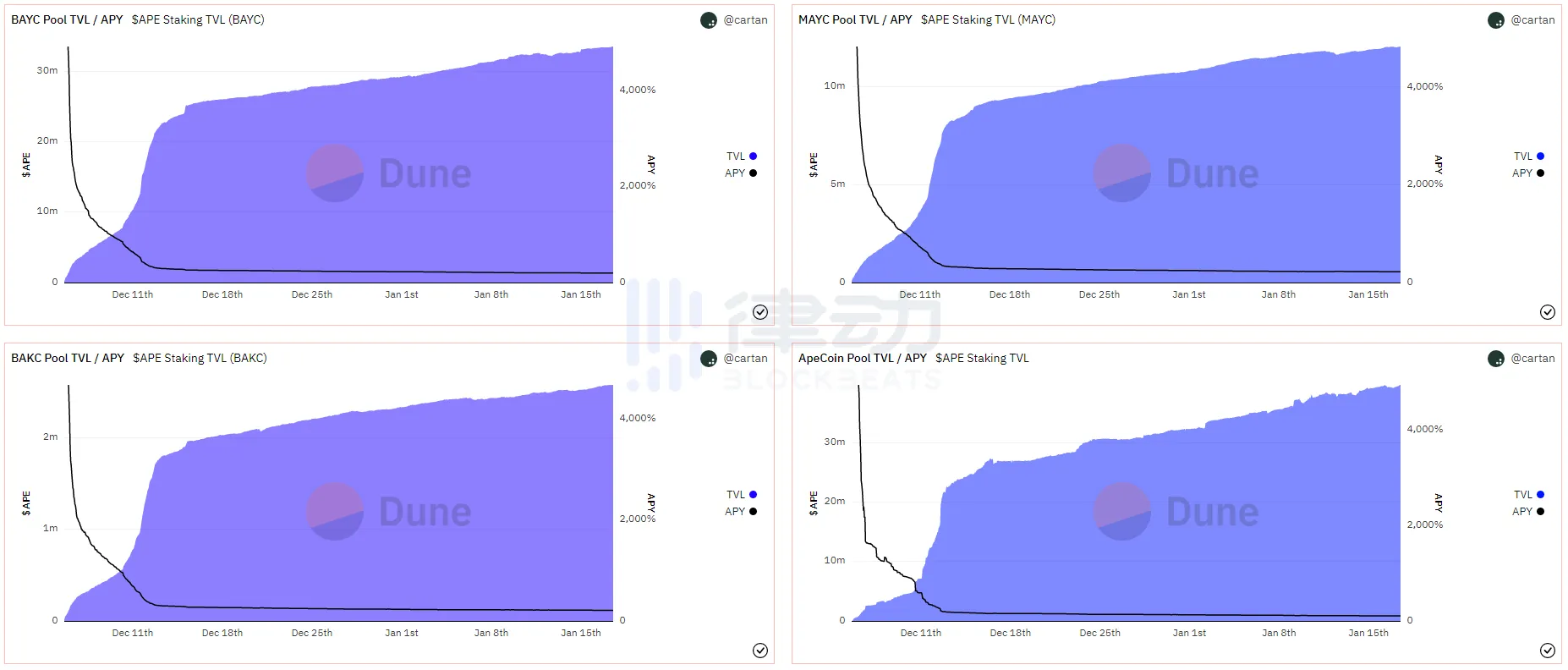

ApeCoin staking mining APY changes in the four official pools of ApeStake.io (Source: Dune )

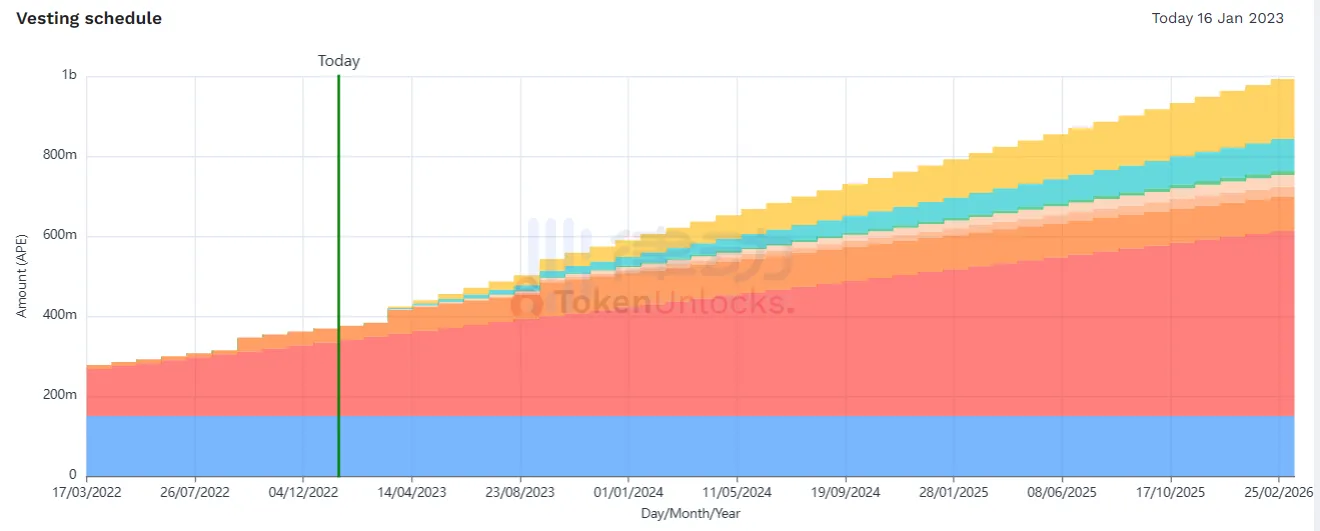

ApeCoin’s unlocking curve (source: TokenUnlocks )

According to Dune data, after the four official pools of ApeStake.io started staking mining, the APY dropped from nearly 5,000% at the beginning to about 200% at present within a month, all in the form of an inverse proportional function.

The unlocking of ApeCoin's Token will inevitably increase the supply of ApeCoin in the market. Almost the entire token economics follows the old-fashioned Ponzi model. High APY is unsustainable. How to ensure that investors who enter the market at all stages can exit safely? is a problem. Similarly, there are also doubts about the unsustainability of BendDAO 's Token economic model.

End of Blur AirDrop could start a chain reaction

As mentioned above, Blur’s AirDrop activity has warmed up the NFT market, especially the third AirDrop of airdrop activity has improved the Blur platform’s transaction depth, liquidity, and matching efficiency. However, cause and effect follow, when the Blur AirDrop activity ends, unprofitability may cause a large number of bidding orders to be canceled, and the advantages in transaction depth, liquidity, matching efficiency, etc. will be sharply weakened in a short period of time, and then lost It provides a cushion against the large fluctuations in the NFT market.

If the situation is worse and it happens to usher in the decline of the NFT market, it will trigger a chain reaction:

• In order to obtain AirDrop, users may have used the same funds to participate in repeated bidding for multiple NFT series after depositing their ETH for bidding into the Blur platform in order to obtain airdrops. As a result, the bidding of this fund in other NFT series disappeared, which also means that the transaction depth and liquidity disappeared;

• Some NFT lending platforms currently maintain a high mortgage ratio, which will make liquidation more likely to be triggered when the NFT market falls. When combined with the sudden drop in liquidity in the Blur market, runs and bad debts may be more likely to occur.

epilogue

Looking back on this short month, it seems that the various participants in the NFT market have already colluded: Blur is the "appetizer", laying the foundation for liquidity and warming up the market; , released the liquidity of the top blue chips, and this is where the "new money" comes from; NFT blue chips acted as "desserts after dinner", the money was already in place, and good news was released to boost the market, dealers and retail investors joined forces to pull the market.

The symbolism in this is that this is almost a small bull market driven by NFTFi, and BendDAO picked a good time to "pull the trigger". However, the financialization of the NFT market is always a double-edged sword: on the one hand, we hope that NFTFi and NFT financialization will bring more liquidity to the entire market and improve capital utilization; The horrific event of over-leverage triggering thunderstorms lingers.

May wish to prepare for the worst, at least not when the building collapses, from the leader to the scapegoat.