An average of 23,343 developers are active in the encryption field every month.

Written by: Maria , Electric Capital

Compilation: ten articles

ElectricCapital released the 2022 Blockchain Developer Report, which analyzed 250 million pieces of code submitted by multiple ecosystems, as well as data from CoinGecko, CoinMarketCap, DappRadar, DefiLlama, Github, Gitlab, etc. The report does not cover "forked" code.

Monthly active developers up 5% year-over-year despite token price drop of over 70%

- As of December 2022, there are still 23,343 developers per month.

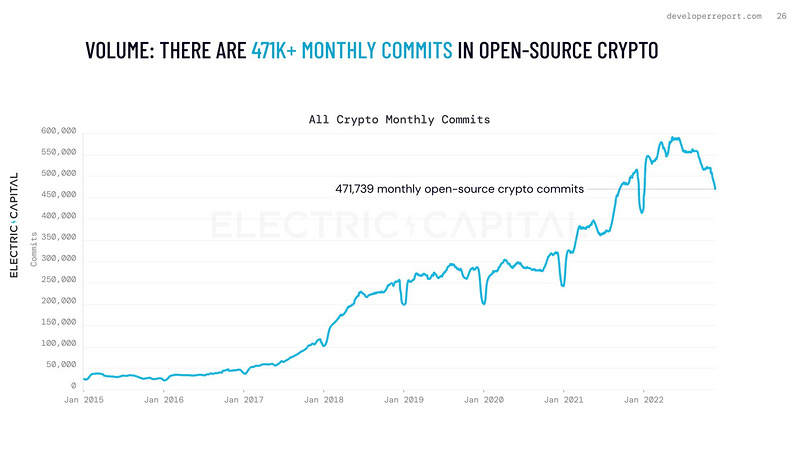

- There are more than 471,000 code commits per month for the development of open source encryption (projects).

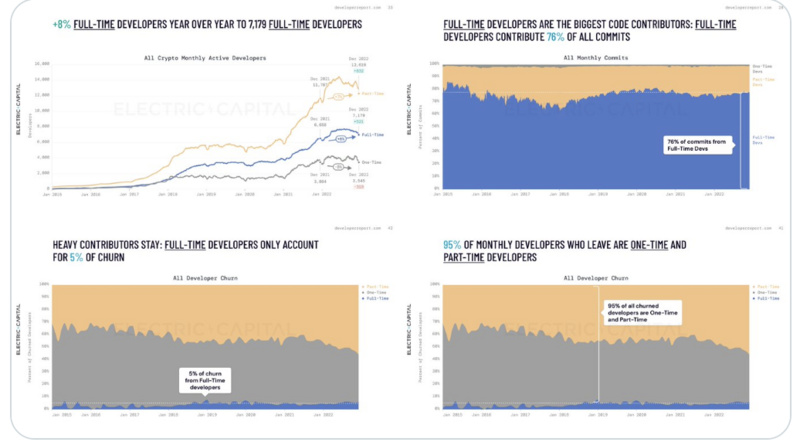

- Segment developers by monthly code commit frequency. The growth rate (+8%) was found to be highest for full-time developers, who commit 76% of the code and are the least likely to churn over time.

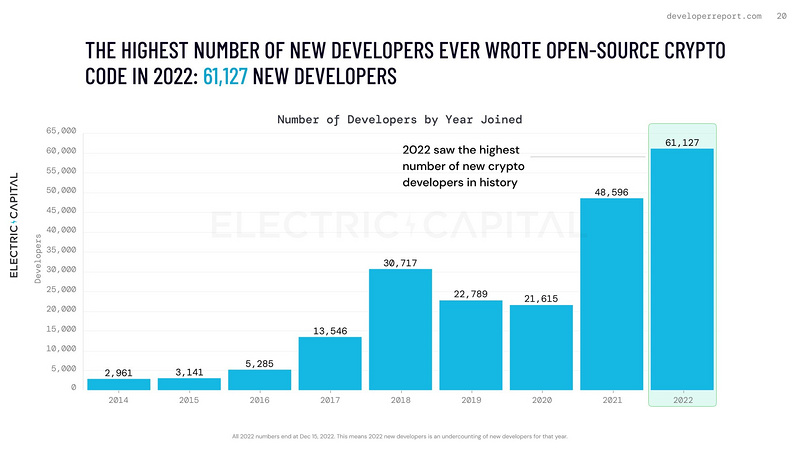

- More than 61,000 developers will contribute to the industry for the first time in 2022, an all-time high.

Crypto market value back to January 2018 levels, but monthly active developers up 297% since 2018

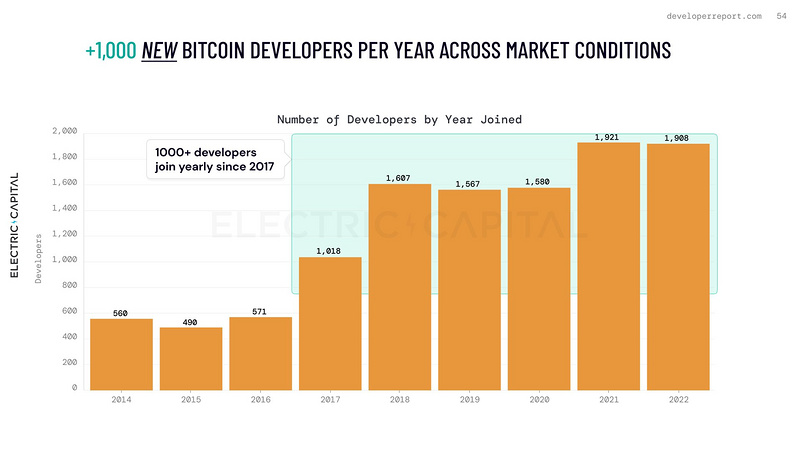

- Compare to previous crypto winters: Bitcoin monthly active developers tripled from 372 to 946. Bitcoin full-time developers are down 4%, but part-time developers are up 9%, and one-time developers are down 32%. Since 2017, and across market cycles, more than 1,000 new developers have contributed to the Bitcoin network each year.

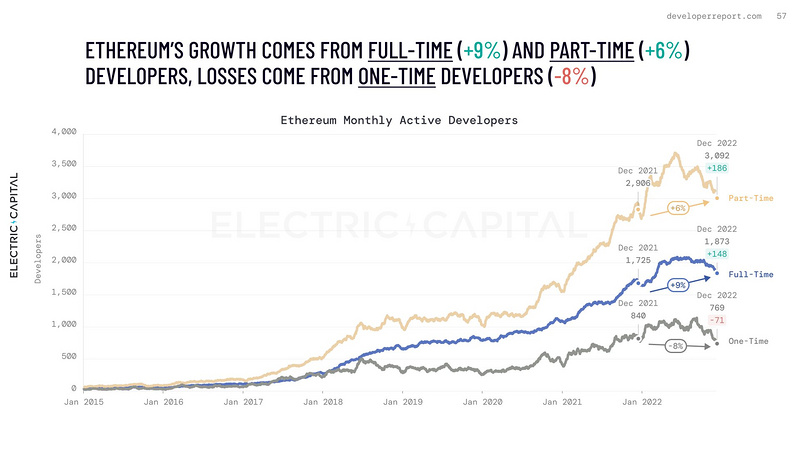

- Ethereum, the largest crypto ecosystem, saw a 5x increase in monthly active developers from 1,084 to 5,819. Full-time developers increased by 9%, part-time developers increased by 6%, and 16% of new developers committed code on Ethereum.

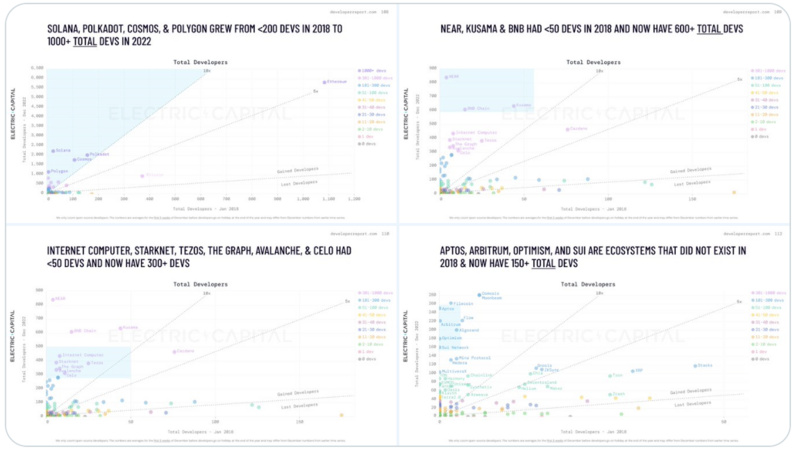

- The rest of the ecosystem was virtually non-existent in 2018, but is now sizable, with Solana, Near, and Polygon seeing over 40% year-over-year developer growth and over 500 total monthly developers. Developers for Sui, Aptos, Starknet, MINA, Osmosis, Hedera, Optimism, and Arbitrum grew 50% year over year.

Growth in other figures is also impressive

- 28% of developers are working on both BTC and ETH development.

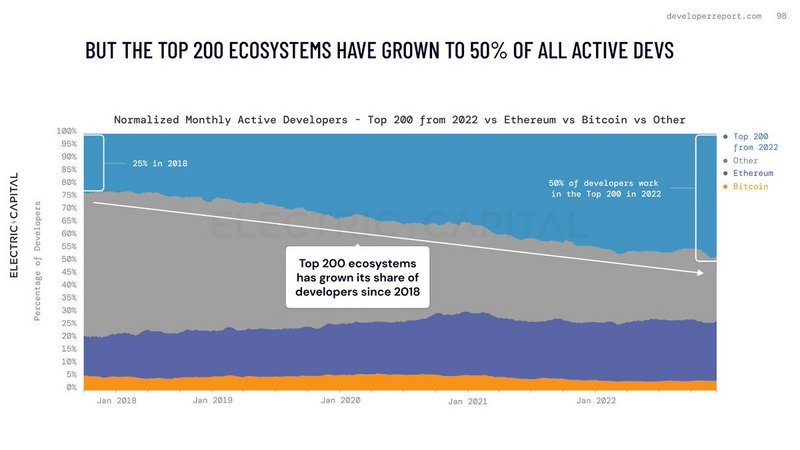

- 50% of developers work on top 200 projects by network value.

- 22% of developers work on projects with a network value of more than 200.

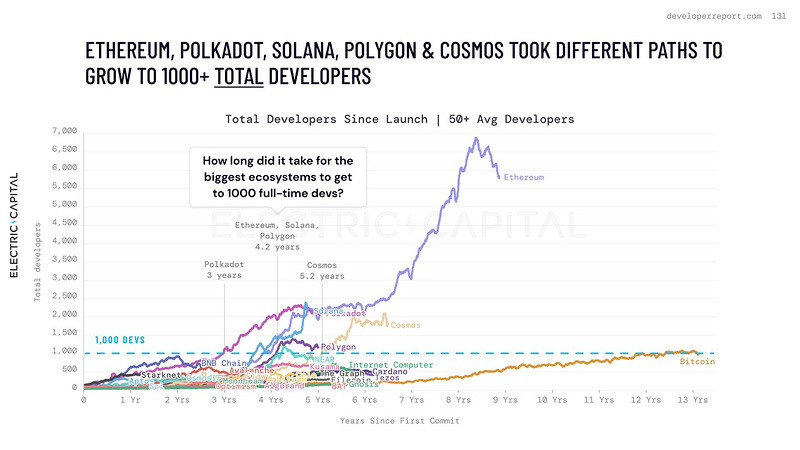

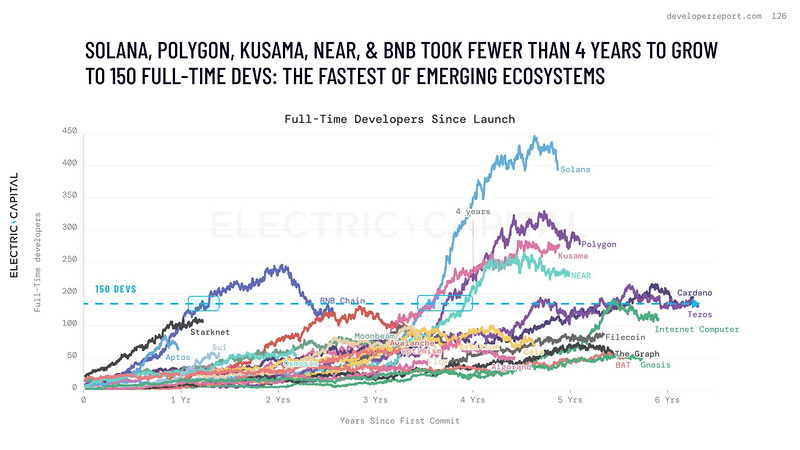

It takes years for a development community to reach a certain size and grow

- Polkadot, ETH, Solana, Polygon took years to grow to over 1000 developers.

- Polygon, Solana, Near, kusama, and BNB Chain have trained 150 full-time developers in less than 4 years, making them the fastest growing emerging ecosystems.

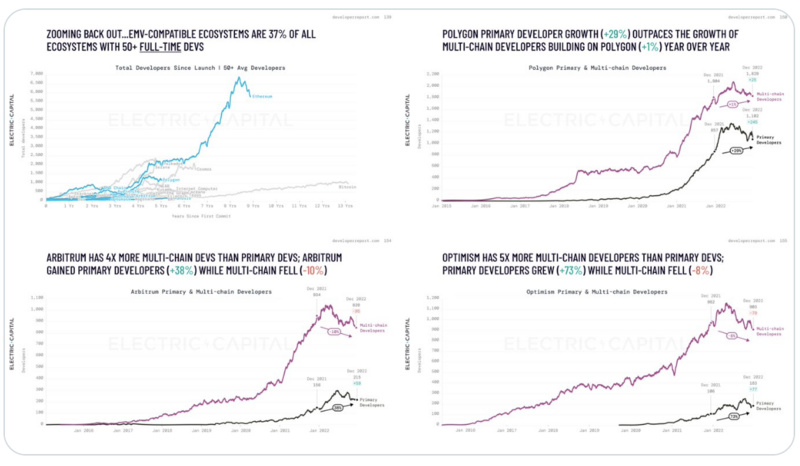

Multi-chain developers are growing

- 37% of ecosystems have more than 50 full-time developers compatible with EVM.

- More and more developers are deploying on more than one chain.

- Polkadot, Avalanche, BNB Chain, Celo, Arbitrum, Optimism have more multi-chain developers.

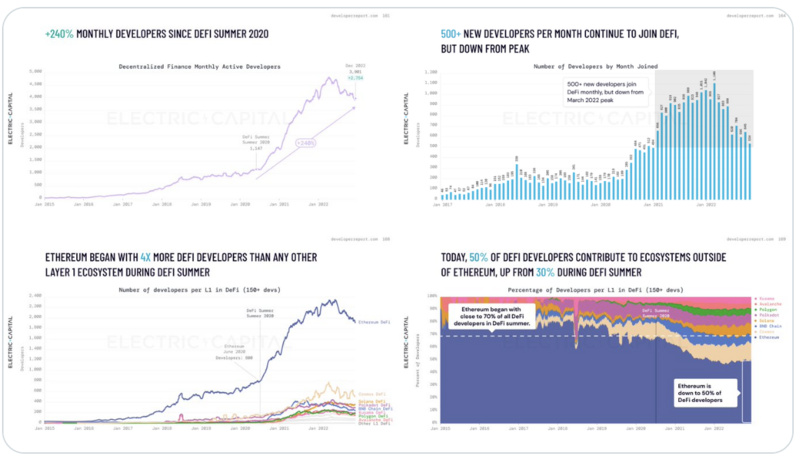

Defi and NFT are the largest gas usage use cases in cryptocurrency, how are their developers doing?

- DeFi developers have increased by 240% since DeFi Summer.

- 500 new developers join DeFi every month.

- 50% of DeFi developers work outside of Ethereum.

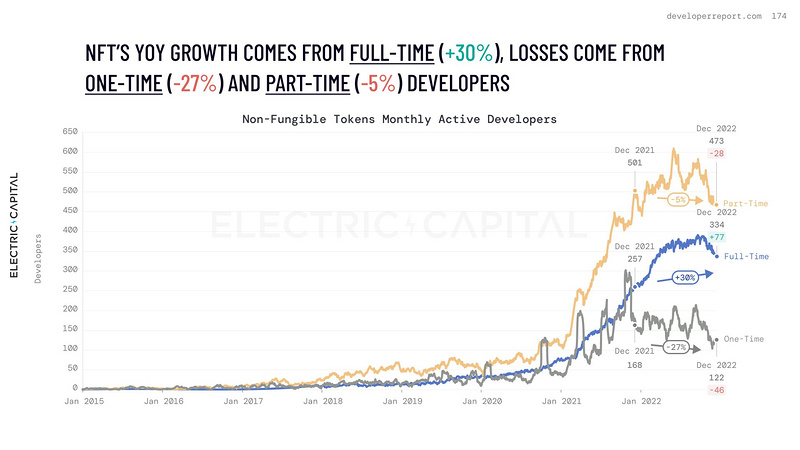

How big is the NFT developer community?

- More than 900 developers work on open-source NFT projects every month.

- 299% increase in monthly developers since 2021.

- NFT full-time developers increased by 30%, part-time personnel decreased by 5%, and one-time contributors decreased by 27%.

- But many NFT projects are closed source and most NFT projects don't require a lot of on-chain code.

- The first transaction of more and more new wallets is to buy and sell NFT, for example, the first transaction of 80% of wallets in 2022 is related to NFT.

Simply counting developers in different fields may not be the right way to analyze NFT, GameFi and DAO

In NFT, GameFi, and DAO, relatively few developers can build reusable components, and the amount of smart contract code written will be small relative to community participation. For example, a tiny amount of code written by only one developer could drive a large PFP NFT community. Or in the case of GameFi, most of the code may be off-chain and closed-source. Therefore, it is difficult to infer from the chain and open source data. But we think community engagement signals are an important and complementary leading indicator for the NFT, GameFi, and DAO markets. We are investigating several novel methods of collecting community data and signals and will share our results when available.