By NAT ELIASON

Compilation: Translation Guild Usopp

Token Economics 101 provides a high-level summary of how to value a project token. In this post, I'll dig into the supply side: How does the number of tokens and the various ways in which this number can change, naturally or artificially, affect a project's perceived health?

At first glance, this factor may seem trivial. However, knowing the token supply and how it changes over time is one of the factors within your ability that will most likely give you a good return on investing in a project. And, unless you know where and how to look, it's easy to get the wrong idea about an item's availability.

Even simple metrics like market capitalization can unexpectedly mislead or manipulate you. So let’s walk through everything you need to know when evaluating a token supply so you can be more informed before your next investment.

What do we need to pay attention to in terms of supply?

The most important thing is not the total amount of tokens. It's about how much is the current supply of tokens, how much will be the future supply of tokens, and how soon it will be reached.

Let's start with classic Bitcoin. Currently, the circulating supply of Bitcoin is 18,973,506, and there will always be only 21,000,000 of them.

Circulating Supply, Total Supply and Max Supply of Bitcoin

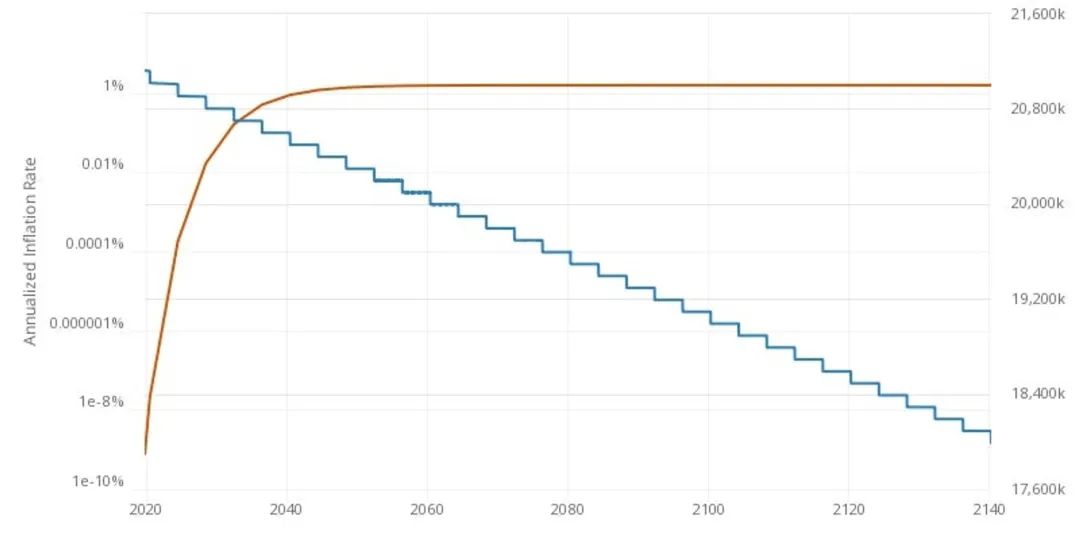

The last 9.6% of the Bitcoin supply will not be fully released until 2140, so it will take quite a while to get there. Moreover, we can see the current inflation rate of Bitcoin at any time, and the whole process will not be affected by any accidents. It is fixed.

Bitcoin Annualized Inflation Rate and Supply

Bitcoin is simple because there are no investors unlocking their assets, no team vaults, no critical conditions, no vesting periods, and no other possible variables.

However, most cryptocurrencies are not as simple as Bitcoin. Therefore, for Bitcoin, we only need to observe the circulating supply, maximum supply, and inflation table to know its current market price. It is more difficult to know the market price of most other tokens.

We need to clarify the following questions:

- What is the current supply?

- What is the future supply?

- How long will it take to reach the future supply?

- How will the future supply be achieved?

Let's look at the various factors that can affect these issues, and then analyze some cases.

Market Cap & Fully Diluted Market Cap

Market capitalization and fully diluted market capitalization (FDV) are two simple initial metrics for assessing the value of a cryptocurrency or token.

The market cap is equal to the circulating supply multiplied by the price of the token. If all tokens were in circulation, the Fully Diluted Market Value (FDV) would equal the current price multiplied by the maximum supply.

Therefore, assuming a token with a price of $10, a circulating supply of 10,000,000, and a max supply of 100,000,000, the market cap would be $100,000,000 and the fully diluted market cap (FDV) would be $1,000,000,000.

These two indicators are only useful when combined with other characteristics we will mention. Because they can let you know how the market values the project today, and how the project needs to develop in the future to achieve a price that meets the buyer's psychological expectations.

If you see a large difference between the market cap and the fully diluted market cap (FDV), it means that there are many coins locked up and waiting to enter the market. If you think current prices are in line with expectations, then you should investigate how they got into the market (3 & 4).

If the market cap is 10% of the fully diluted market cap (FDV), and all tokens are released within the next year, then the project needs to grow 10x, or 1000%, in 1 year to maintain the current price.

However, if the market cap is 25% of the fully diluted market cap (FDV), and all tokens are released over 4 years, then the project only needs to grow 4x over 4 years, or about 40% per year.

So the market vs Fully Diluted Value (FDV) ratio is one of the first things you check to get some clues about supply. And, once you do, you'll be eager to dig into what circulating supply and max supply really mean.

Circulating Supply & Maximum Supply

Circulating supply and maximum supply can answer questions 1 (what is the current supply) & 2 (what is the future supply). And, they also help us understand market capitalization and fully diluted market capitalization (FDV).

Maximum supply is fairly readily available data. What is the maximum potential supply of this token? For Bitcoin, it's 21,000,000. Ethereum does not have a maximum supply. For Crypto Raiders, we set it to 100,000,000. Yearn is 36,666 coins.

Acquisition of the circulating supply can be trickier. How many given tokens are in circulation? For Bitcoin, it is very simple, just subtract the unreleased amount from the maximum supply, and you can get your amount. Other low-level blockchains (L1s), like Ethereum and Solana, will provide self-reporting, or be monitored by application programming interfaces (APIs).

Acquisition of this data can quickly become complicated when researching project tokens. Here is a simple example. For Crypto Raiders, we have released approximately 16,000,000 coins out of a total supply of 100,000,000 coins. However, if you look at Coingecko, it says our circulating supply is only 6,723,611 coins. Where is the rest?

Coingecko and other application programming interfaces (APIs) will attempt to subtract "inactive" tokens from the circulating supply, even if those tokens have previously been released into the market. In our example, people locked up 9.5 million tokens in our staking contract for 3-12 months. So, Coingecko subtracts them from the supply:

Crypto Raiders project interface in Coingecko

I find this absurd. It's people choosing to lock up 9.5 million tokens, it's not that we haven't released them. But from a technical point of view, they are tokens that are not in circulation.

This shows how important it is to delve into the circulating supply. At first glance, it appears that only 6% of our tokens have been released, which means that the project needs to grow ~20x in order to maintain its current price. But in reality, 16% of the tokens are already unlocked, so it needs to grow by 6.25 times.

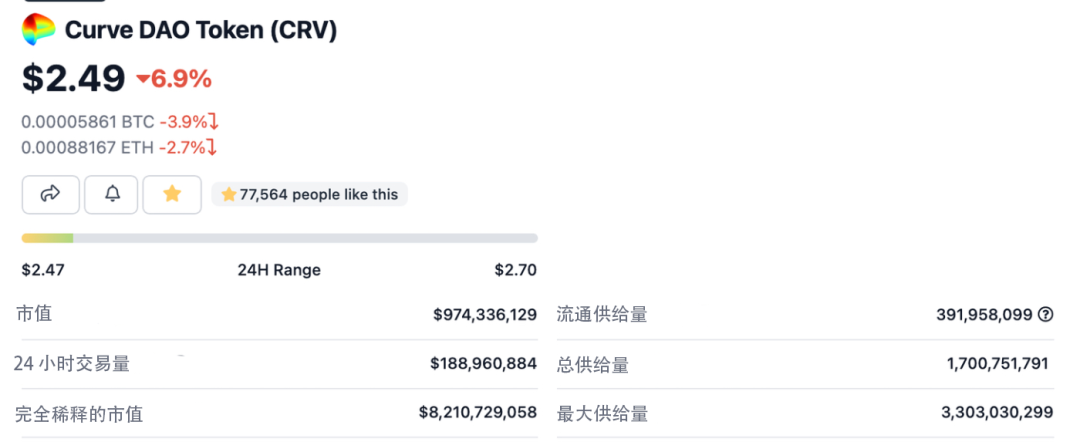

Curve is another good example.

Curve project interface in Coingecko

Their fully diluted market value (FDV) is about 9 times their market capitalization. Also, it looks like only 11% of their tokens are in circulation. However, they have given you a clue here: the total supply. When we drill down into the circulating supply, we can see that there is a large amount of tokens locked up in various contracts:

Curve project contract lock-up details interface in Coingecko

Strikingly the "founder" appears to own 572m tokens, and only 440m vote-locked CRV (reported in the Curve Wars article). A large number of tokens are owned by the founders!

However, when we dig into its contracts, it shows that it has multiple people involved, so it doesn't just have one founder. And if you look up the actual contract, you'll see that the vesting period is 4 years. So these tokens take a while to unlock.

The reason it’s worth knowing these details is that it helps you gauge how many tokens are actually being released into the market. For me, I think the CRV locked up by voting should be counted as part of the market cap, which makes the market cap closer to 2120 million instead of 974 million. That puts it very close to fully diluted market value (FDV) and shows that it doesn't need to grow to meet the market's preferred price.

However, circulation vs maximum supply is only part of what we know about supply. If the supply of tokens quadrupled in 4 months or 4 years, you would feel very differently. That's why we also need to look at the release schedule.

release schedule

Remember the main question we're trying to figure out:

- What is the current supply?

- What is the future supply?

- How long will it take to reach the future supply?

- How will the future supply be released?

Circulating supply vs maximum supply answers questions 1 & 2. The release schedule answers questions 3 & 4: how and when supply will be reached.

Often when we need to dig into a project's documentation, we look at the release schedule. This isn't available at Coingecko, so you'll have to do some research to find out.

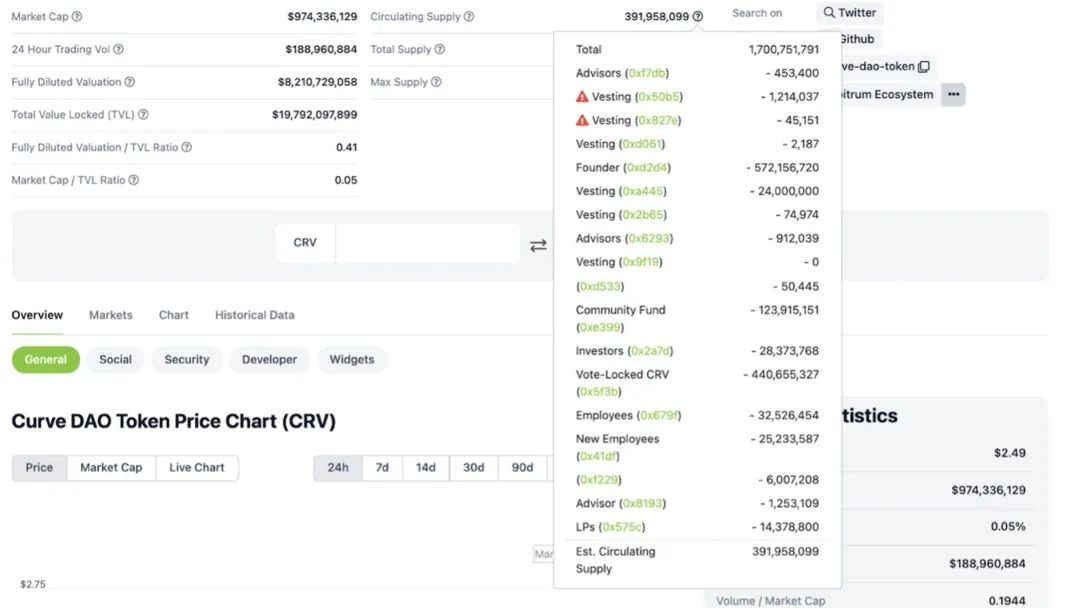

In my recent JonesDAO article, I put together a chart showing their token release over time:

Jones release schedule

First of all it should be noted that they have a slow growing initial release period and then there will be an accelerated release period from April 30, 2022 to October 30, 2022. That's the unlock period for private investors, linearly unlocked over 6 months.

Approximately 3 % of the JONES supply will be released each month during that 6 month period. But between now and April 30th, only 1.36% of the supply of JONES will be released each month.

So, during this 6-month period, the inflation rate will more than double. And new tokens entering the market will go solely to those who entered the market at a heavily discounted price, giving them a greater economic incentive to sell tokens even if the price has not changed in the interim.

It's not that investors are malicious, or that they do it on purpose, just that they are free to do so. Before buying such tokens, you should anticipate such changes affecting future supply.

You might see another release based on platform performance. Convex is a good example, most of the CVX token releases are based on the amount of CRV tokens their pool earns:

Minting volume of CVX per unit of CRV profit - the process of decreasing the proportion of CVX minting over time

This gives you an idea that the inflation rate of CVX has been decreasing as the minting ratio of CVX changes: CRV minting is decreasing until it reaches 100m CVX in circulation.

How Initial Mobility Affects Release Rate

One more thing to look at on the release schedule is the impact of the percentage change. Even with a 4 year gradual release schedule, if tokens are unlocked starting from a very small percentage, this will do a disservice to early buyers.

For example, let's look at a new project that just released a token: JPEG'd. They sold 30% of the tokens in a public auction and used a portion of the raised funds to increase the liquidity of the tokens.

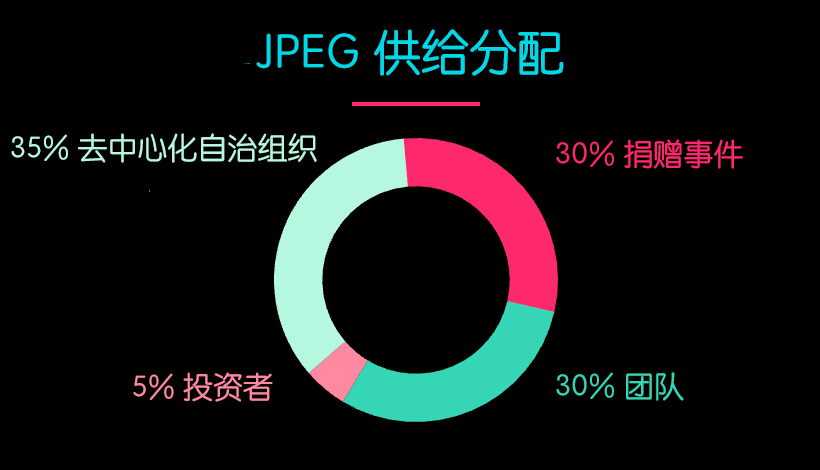

Their overall assignment is clear at a glance:

Supply Allocation Scheme for JPEG

35% of the tokens are allocated to the team and advisors with a vesting period of 2 years and an initial critical period of 6 months. So, 30% of the tokens are unlocked first. After 6 months, 35% of the tokens are released to the market over a period of 18 months. So about 2% of the supply continues to enter the market every month during this period, after which inflation stops.

2% entering the market is a relatively small increase when 30%+ are already in circulation. The token supply will double in 15 months, but this is enough time for the valuation of the project to catch up with the token price.

In comparison, if only 10% of the tokens were released initially. Then the token supply will double in 5 months instead of 15 months! Early buyers are more affected by the unlock and the token price will struggle to keep up with the new inflation.

OK, we've covered most of the important considerations. Only the last few factors remain to be considered.

Initial Distribution & Mining

Most protocols release a significant portion of tokens to liquidity pool (LP) rewards. If you provide liquidity for the protocol, you can pledge the liquidity and earn a steady amount of tokens.

Superficially very community-oriented, as anyone can buy tokens, create liquidity, and stake it to earn more tokens. But depending on how the process works, the initial team or insiders may be able to exploit this loophole and significantly increase their token share.

A good recent example is LooksRare. As Cobie explains in his article on the subject, half of the mining rewards go to investors who staked their stake early. So while retail investors may feel like they earn most of the platform’s fees, those fees actually go to early investors.

Another manifestation of this case is that a large part of the team or investor’s tokens are suddenly unlocked, because they can use these tokens for liquidity mining. And what you imagine is that the team and investors have a lock-up period of at least 3 to 6 months, after which the tokens can be slowly withdrawn in linear time.

unlock

The last thing to watch out for is the timing that will unlock a large number of tokens. Some protocols like Convex have a lock-up mechanism. If users want to get token rewards through lock-up, they must participate in this agreement.

When Convex first released this feature, a large number of CVX holders locked up their tokens for the first week. This means that after 17 weeks, all these tokens will be unlocked. The mechanism was introduced in early September and the tokens began to be unlocked in early January. Did you notice something?

Convex Finance (CVX) price chart

There were other market moves at the same time, but it was hard to ignore the impact of locking and unlocking tokens. So, if you're buying a staking token like veCRV style, or any other staking mechanism for that matter, it's good to be aware that there will be a large amount of circulating supply unlocking the opportunity.

review

When you dig into a project’s token, fully understanding the supply and how it changes over time will give you a better idea of whether now is a good time to invest.

You can get a lot of information from public dashboards like Coingecko, but digging into the details in the project documentation can help you unearth subtle details like how release schedules change over time, token flows, And what tokens may be unlocked in the future.

However, supply is clearly only one piece of the token economics puzzle. Therefore, in future entries in this series, we will also dig deeper into demand, game theory, return on investment (ROI), and other good token economics worth knowing before investing in or launching your own project.

PS If you want to design token economics for your project, please get in touch on Twitter. Especially if it's a game.

By NAT ELIASON

Translation: Usopp

Proofreading: jomosis1997

Typesetting: Bo

Reviewer: Suannai