During the Spring Festival that just passed, Zhang San received millions of "lucky money" 🧧, and he was worried that he didn't know how to clean it up. Seeing friends around me investing in blockchain projects, I thought that I could also use the excuse of starting a business to "invest" the millions of lucky money in my hand into the project and turn it into a "serious" income.

Since the establishment of regulatory policies in the Web3 world is not 100% perfect, illegal behaviors such as bitcoin money laundering, trade money laundering, and aggregated payment platform money laundering have been derived. Such actions pose a direct threat to the Web3 project.

After investigation, the CertiK team found that many criminal organizations are using this scheme to convert illegal funds into seemingly legitimate Web3 start-up investments and obtain high returns. In this article, CertiK's professional investigators share their findings and experience "on the case," offering practical lessons and insights on how to maintain the financial integrity of a Web3 enterprise.

How does Web3 money laundering work?

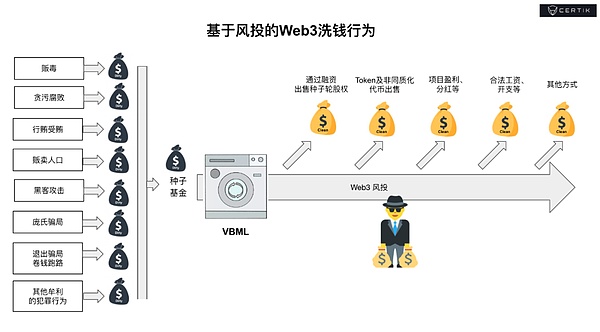

Venture-Based Money Laundering (VBML), the use of venture capital for money laundering (hereinafter we will collectively abbreviate as VBML), in Web3 is manifested as the manipulation of the seed funding ecosystem of start-up companies. Criminals turn proceeds of crime into legitimate businesses and revenue streams through early seed investments in businesses.

CertiK's expert investigative team conducted research on 272 blockchain and Web3 startups to uncover the means by which criminals use VBML to infiltrate the Web3 industry.

As in the anecdote at the beginning of this article, when individuals or organizations commit crimes and accumulate illicit profits, they need a way to "launder" their funds so that they can be used freely without arousing suspicion. VBML is one such "great" solution for criminals.

In the context of Web3, VBML involves criminals seeding a new Web3 project with "dirty" money. This initial seed funding was used to hire developers, marketers, etc. Criminals spend all their illicit funds on these investments in return for owning or co-owning a promising and lucrative Web3 project. It is also from here that they will have a public company to show them the source of funds, and the money will be "laundered" logically.

"Clean money" can be withdrawn multiple times through a variety of channels throughout the life of the project. For example, multiple channels such as subsequent financing rounds, token sales, salary payments, project dividends, and when criminals sell their project ownership.

Survey Scope and Samples

This criminological research on Web3 companies using venture capital for money laundering is based on a sample of 272 Web3 projects launched in 2022.

Researchers are particularly concerned about the risk of ill-gotten gains being injected into new Web3 ventures as initial equity. Because “founding” or seed rounds are often considered “personal investments,” they are particularly attractive to criminal operators. This, combined with less scrutiny, controls, and anti-money laundering (AML) regulations, makes it less likely to be detected by law enforcement. In addition, this round of investment has the potential to yield very attractive returns on investment.

Since subsequent funding rounds tend to come from larger and more specialized investment firms that themselves undergo more thorough due diligence, there is less potential for exposure to crime and money laundering. Therefore, this study has not yet assessed the risk of illegal proceeds being injected into subsequent financing rounds.

research method

In addition to the risk of external attacks, the Web3 industry also faces the risk of malicious fraud teams and legitimate projects being compromised by insider threats. To solve this problem, CertiK created the KYC badge program . The program is primarily about verifying and vetting the teams behind projects, with badges awarded only to project teams who agree to undergo comprehensive background checks. This differentiates the proven, transparent, and more accountable teams from other projects.

In an enhanced due diligence process, as well as a thorough review of the team and project management, CertiK's expert investigative team is able to identify projects with hidden problems with the source of seed funding, and through differential analysis, comparing risk data and known A Web3 project database with bad records to verify the safety and reliability of the project in multiple layers.

In addition, CertiK investigators have previous experience investigating large-scale money laundering cases. By speaking directly with high-risk applicants, investigators can further evaluate and identify these issues.

In some cases, real project founders and owners use deception to hide behind front teams and have direct links to criminal activities such as various scams and even international drug trafficking.

The following will introduce the research results of CertiK.

The ubiquity of VBML in the Web3 industry

In an anonymous sample of 272 projects, CertiK estimates that between 3.68% and 7.72% of Web3 projects are at risk of VBML. This suggests that 3% or even as much as 7% of new Web3 projects may be started with “dark money” provided by criminals.

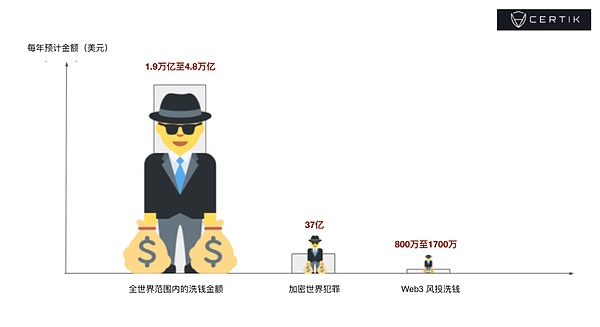

If we extrapolate this ratio to the 1,500 most well-funded Web3 projects in 2022, and estimate that a Web3 venture needs at least $150,000 in seed funding for initial R&D and marketing, then VBML risk-related funding would amount to $8 million to $17 million.

It’s worth noting that this forecast is for seed funding and doesn’t include other funding rounds. Additionally, this forecast does not include other known money laundering methods.

Comparison with global money laundering scale

The scale of global money laundering is directly proportional to the amount of cash generated by crime around the world, so it makes sense to know that number. The United Nations Office on Drugs and Crime (UNODC) estimates that the total amount of money laundered globally is equivalent to 2% to 5% of global GDP each year, suggesting that criminals are currently laundering between $1.9 trillion and $4.8 trillion in criminal proceeds annually.

In comparison, Web3 criminal proceeds are estimated at $3.7 billion per year (approximately 0.15% of global criminal proceeds), and the Web3 VC money laundering studied in this paper is expected to launder approximately $8 million to $17 million per year.

Web3 VC money laundering offers criminals a very efficient, profitable and low-risk avenue. However, the small size of initial seed funding per company and the limited number of such venture capital opportunities make this approach and scale insufficient to meet the needs of global money laundering.

Development of cat and mouse game

Money laundering (ML) and anti-money laundering (AML) are criminological concepts that evolved over the course of the 20th century. Initially, money laundering was not considered a stand-alone crime, but rather as a strategy to disrupt criminal activities such as drug trafficking, bank robbery and corruption. Targeting criminals' wealth to disrupt crime is more effective than prosecuting them for their original criminal activities.

Because money laundering is a crime in itself, this strategy has naturally caused many negative effects after being adopted. In the short term, it may have some positive impacts, such as bringing much-needed capital to businesses, cities, and the country; but in the long run, it has serious and irreversible negative impacts on the country and the economy: Controlled, money laundering increases corruption and organized crime, reduces business reputation, productivity and competitiveness, undermines trust in laws and institutions, and threatens social stability.

Regulatory Deployment of Anti-Money Laundering Measures

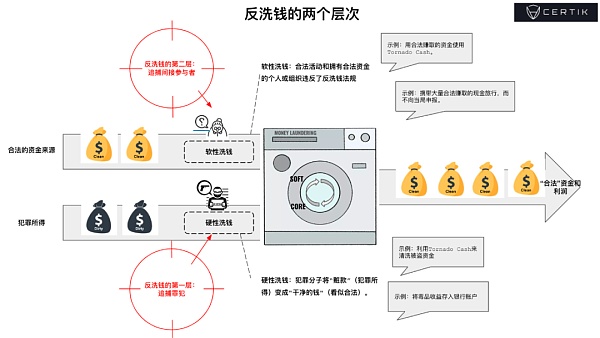

Regulators try to reduce crime and corruption through systematic anti-money laundering measures. In addition to targeting criminals who launder money, there is now a second layer of anti-money laundering measures targeting anyone (including non-criminals) involved in helping criminals launder their money as well as within the system. This additional layer of AML regulations means that when criminals are apprehended, they can be charged and convicted not only for their original offense but also for non-compliance with AML regulations, facilitating criminal prosecution .

The improvement of magic high money laundering strategy

Despite the annual global cost of AML being approximately $274 billion and the current severe restrictions imposed on honest retail users and legitimate organizations, criminal organizations continue to adapt to the new AML policies and are constantly innovating money laundering strategies.

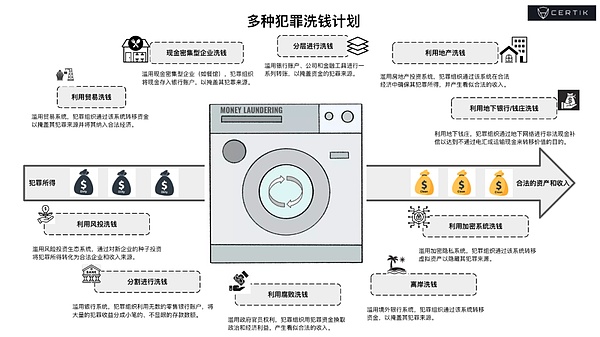

Criminals are still able to launder some $1.9 trillion to $4.8 trillion in proceeds of crime each year, and trade-based money laundering is one of the most frequently used money laundering methods, after all it can easily be hidden in the $28.5 trillion per year In the huge global trade market. And using the real estate industry for money laundering is also attractive to criminals because it is legal, safe, profitable, and by far the largest store of wealth industry, with a total market size estimated at $326 trillion.

The graphic below shows the various money laundering channels used by criminals.

Protecting Web3 Financial Integrity

Compared to other types of money laundering, the proportion of money laundering utilizing venture capital in Web3 may seem relatively small, but it is still a serious threat to Web3 enterprises. Due to the use of venture capital to launder money in the Web3 industry, projects affected by black money face operational, reputation and legal risks. An economic system that turns a blind eye to the proceeds of crime may benefit in the short run, but have serious negative consequences in the long run.

Beyond compliance with the law, the economic health of the Web3 industry depends on its efforts at financial integrity. CertiK research confirms that surreptitiously seeding Web3 projects with illegally obtained funds is the riskiest project for its users and investors, and leads to a correspondingly higher rate of project failure, fraud, and scams high.

Three important revelations

The following are three revelations from the investigation perspective of CertiK’s expert team on money laundering in Web3:

1. Never play side-by-side, even if it is soft money laundering. Transferring legally earned money without complying with anti-money laundering regulations is also a serious compliance issue.

Dangerous criminals, such as drug traffickers, thieves, and corrupt officials, have no difficulty laundering large amounts of criminal proceeds, while lifelong honest people or small businesses who are targeted for involvement in the transfer of funds will not pay off.

It is worth noting that the proceeds of crime related to Web3 ($3.7 billion in 2022) account for only a tiny fraction (0.15%) of global money laundering (estimated at $1.9-4.8 trillion per year), while international trade and real estate remain The most favorable tool for money laundering.

Second, the blockchain is not a problem, but a solution. Blockchain is often accused of facilitating crime and money laundering, but blockchain technology offers transparency and traceability that can help economic and political systems establish their integrity. When the technology is widely adopted, it can help detect and investigate money laundering and fraud, as well as directly prevent and combat core criminal activities.

3. Due diligence is critical to Web3 financial integrity. Since the industry is relatively new, there are fewer standards and guidelines compared to other industries, causing some projects to underestimate the importance of due diligence, which in turn compromises the safety and integrity of projects.

In order to reduce the risk of using venture capital money laundering in Web3 enterprises, CertiK experts recommend conducting due diligence on the main investors, core team members and owners of new Web3 projects, so as to reduce the risk of project initial funds being used by criminals to launder money. Criminal operators often hide behind intermediaries, so thorough background checks are required.

Due diligence assessments using third-party security audits can greatly enhance the security and integrity of Web3 projects. Security professionals with special training and experience in criminal and background checks are better at spotting fraud and effectively assessing criminal risk.