Against the backdrop of the brutal bear market of 2022-23, leveraging the transparency of on-chain data, and taking market investor psychology into account, we set out to simulate typical investor behavior to determine whether a cycle bottom is in place that would signal a sustainable The market recovery is about to start.

Identifying periodic changes is not an easy task, and there is currently no "single standard". In order to identify the late market direction of the Bitcoin bear market, in this article we will explore the top ten indicators that track the recovery of the bear market.

This indicator uses various technologies and information on the chain, and found that four types of basic market attributes and investor behavior patterns are basically consistent:

Technical: Reversion to the mean relative to popular technical analysis tools.

On-chain activity: On-chain activity and network utilization is positively rising.

Supply Dynamics: Saturation of money supply held by long-term holders.

Profit/Loss: Profit payout on-chain and “out of bullets” for sellers.

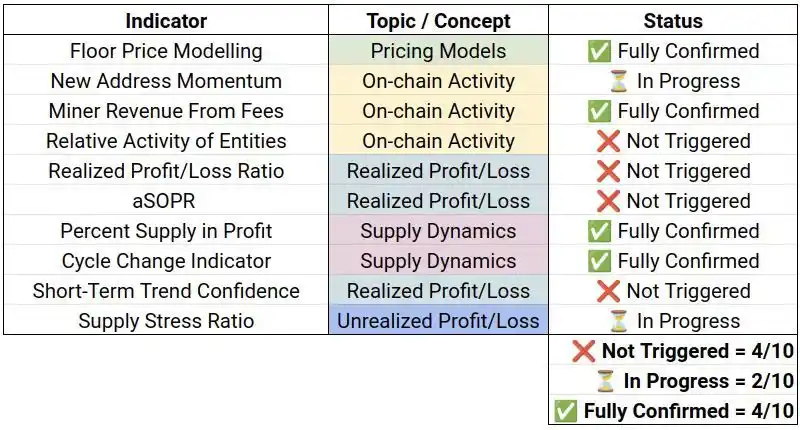

Based on the definition of each indicator, the following terms will be used to summarize current market conditions as of the time of writing:

not triggered

In progress

fully confirmed

Indicator 1: Finding the bottom price

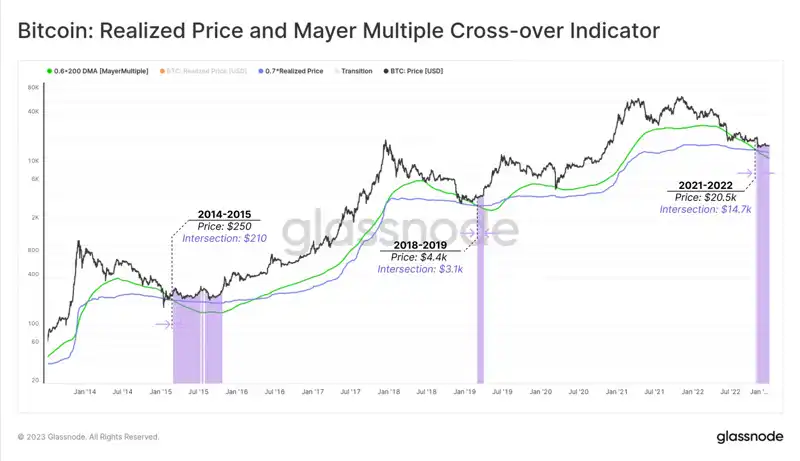

The first tool we introduce is a bottom price detection model based on the 200 D-SMA (moving average within 200 days) technical indicator and an on-chain cost basis in realized prices.

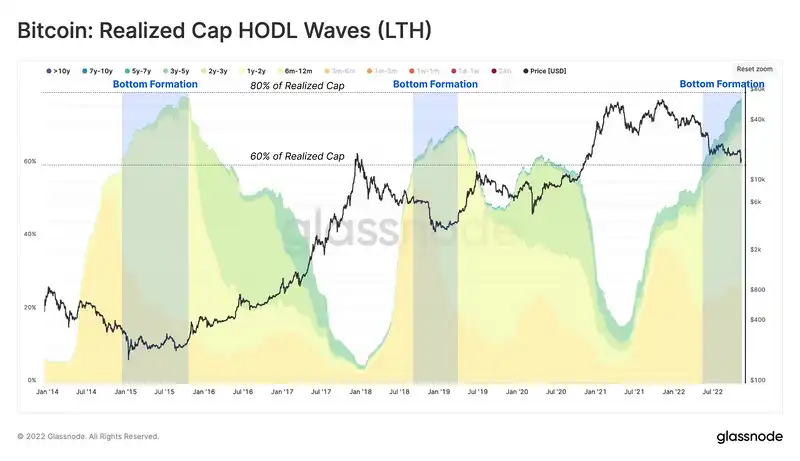

The first observation is that the group of investors who hold Bitcoin for at least 6 months typically achieve 60% - 80% of their holdings in late bear markets when the upper limit is achieved. Therefore, we will choose a multiple of 0.7 and use it as a weight for the realized price. It's a measure of the lowest valuation, and it represents investors with the "firmest grip."

Spot prices closed below this level on less than 1.6% of all trading days.

The second observation has to do with the Mayer Multiple, which tracks the deviation of spot prices from the widely observed 200 D-SMA. Bitcoin’s historical performance shows that less than 4.3% of Bitcoin’s trading days have a Meyer Multiple below 0.6, reflecting price gaps of more than 40% from the 200 D-SMA.

Metrics: Historically, the intersection between realized price * 0.7 and 200 D-SMA * 0.6 pricing models occurs during deep bear phases. This is a result of on-chain volume weighted price stabilization due to investors piling up, 200-DMA (200-day mean difference metric) while unweighted 200-DMA (200-day mean difference metric) continues due to macro price downtrend decline.

Status: fully confirmed

Indicator 2: Rising demand

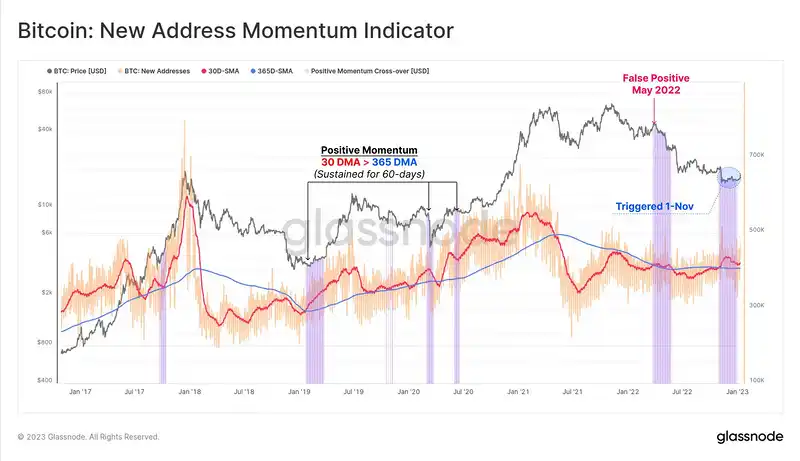

A sustainable market recovery is usually accompanied by an increase in on-chain network activity. Here, we consider the number of new addresses that appear for the first time. We compared monthly averages.

Indicator: When the 30D-SMA of a new address crosses the 365D-SMA for at least 60 days, it signals that network growth and activity is on the rise.

Status: In progress. Initial positive momentum in early November 2022. However, this has only lasted a month so far.

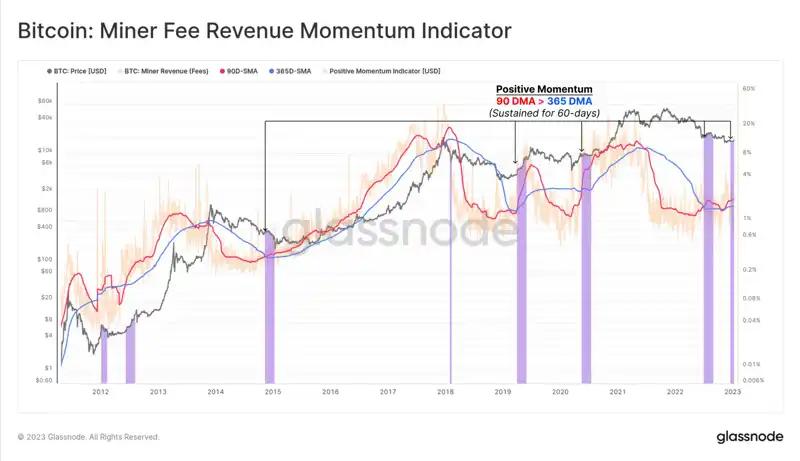

Indicator 3: Competitive fee market

Another sign of growing demand on the network is the healthy increase in revenue fees from miners. This is a result of blocks becoming congested and fees rising.

The following indicators use a momentum indicator, compared to quarterly averages. These momentum indicators are powerful when applied to on-chain activity indicators, as they help capture institutional changes in network utilization and demand.

Indicator: between 90D-SMA (90-day moving average)

When the income of 90D-SMA miners exceeds 365D-SMA, it indicates that the block space is more congested and the pressure on fees is increasing.

Status: fully confirmed

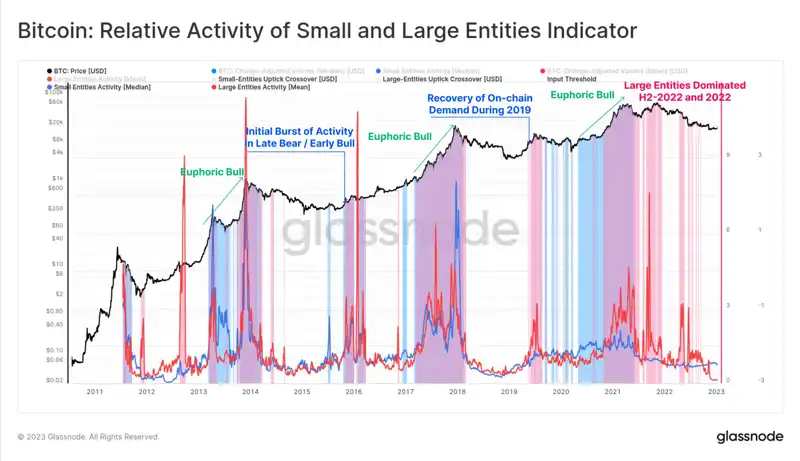

Indicator 4: Full recovery of economic activity

To demonstrate how the frequency of small transactions is significantly higher than that of large transactions, we develop a framework for evaluating the relative transaction behavior of two small transactions.

The volatility indicator below is formed in such a way that higher values indicate that more trading activity is taking place, while lower values mean that there is less trading activity of the target group.

Metrics: Bear markets tend to lead to significant drops in on-chain activity for entities of all sizes. Values above 1.2 tend to define thresholds for initial recovery and elevated levels of on-chain demand. As a result, recoveries for both small and large entities exceeded 1.2, suggesting that network demand is recovering across the board.

Status: not triggered. Both entities are still relatively inactive on-chain, but the smaller entity is gradually increasing its activity.

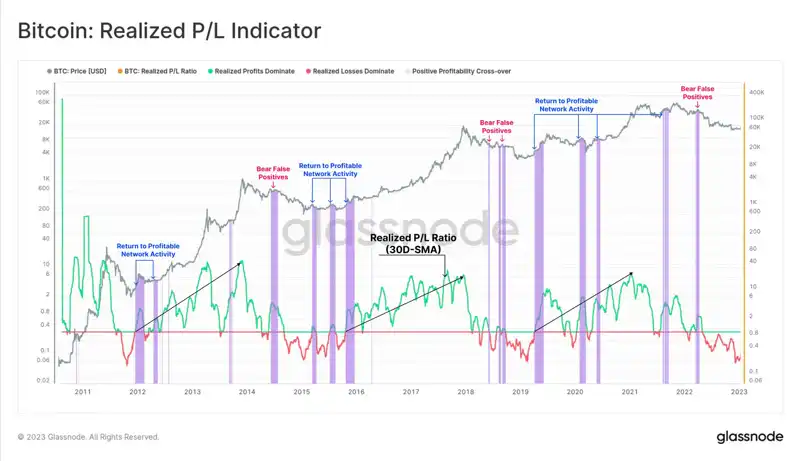

Indicator 5: A New Wave of Capital

One of the most powerful tools in on-chain analytics is the assessment of realized profit and loss, calculated as the difference between the value of a token at the time of dominance and the time of buyback. The Realized Profit/Loss Ratio provides a volatility indicator that tracks whether total realized profits exceed realized losses.

Here, we use the ratio's long-term 30D-SMA (30-day moving average) to get clarity and better identify large-scale macro changes in network profitability. False positives do occur due to market volatility, but can be explained by considering larger scale indicator trends.

Indicators: The 30D-SMA of the Realized Profit Ratio (P/L) returned above 1.0, suggesting that investors holding unrealized losses are softening and a new wave of demand is able to absorb the profits gained.

Status: not triggered

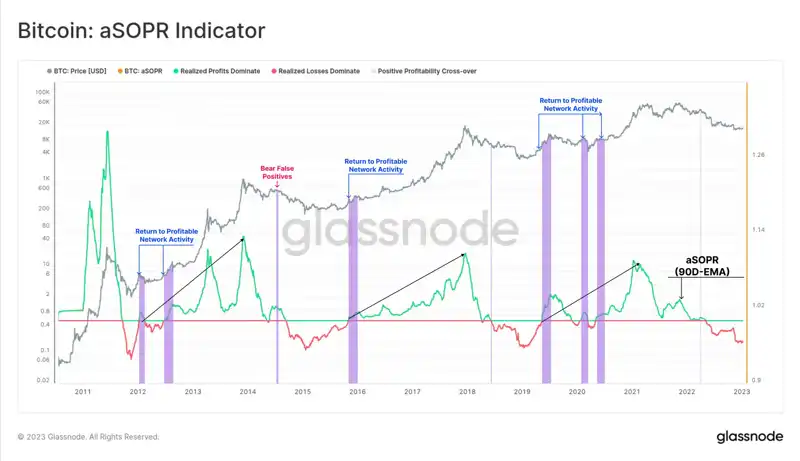

Indicator 6: Taking Loss

A similar network profitability model is aSOPR (Output Spent Profit Ratio), which monitors profitability on a per unit spend basis. aSOPR is a popular short-term market analysis tool that is often very sensitive to macro changes in market sentiment because it reflects small retail investors and whales on an equal footing.

Here, we apply a longer-term 90D-EMA (90-day exponentially weighted moving average) to better identify macro trend changes across the market.

Indicator: aSOPR’s 90D-SMA reverted back above 1.0, indicating a macro trend shift back to profitable on-chain spending. This suggests that a significant portion of on-chain market activity is profitable.

Status: not triggered

Indicator 7: Strong Bear Market Bottoms

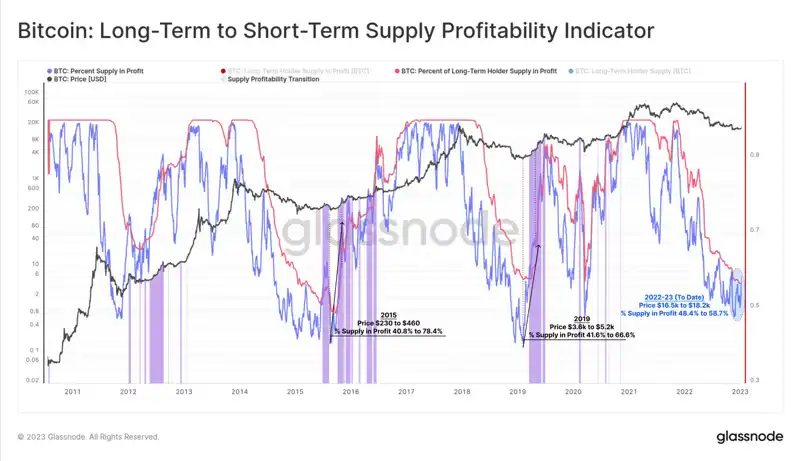

In order to establish a strong bear market bottom, a lot of supply usually needs to change hands at lower prices. This reflects both the capitulation of sellers and an equal and opposite inflow of new cumulative demand. The result is to reset the average market cost basis to more favorable and lower prices.

An early sign of a macro trend reversal on this basis is often a sharp spike in profits as a percentage of total supply. This usually happens with relatively small price increases. Even more interesting is that when the overall market outperforms the long-term holder group, it usually only happens after cycle top buyers have flooded in.

Indicators: Due to the massive supply reallocation at bear market lows, the percentage of supply held by new buyers tends to be very price sensitive compared to long-term holders. Therefore, when supply exceeds long-term holders as a percentage of profits, it usually means that a large-scale supply reallocation has occurred in recent months.

Status: fully confirmed

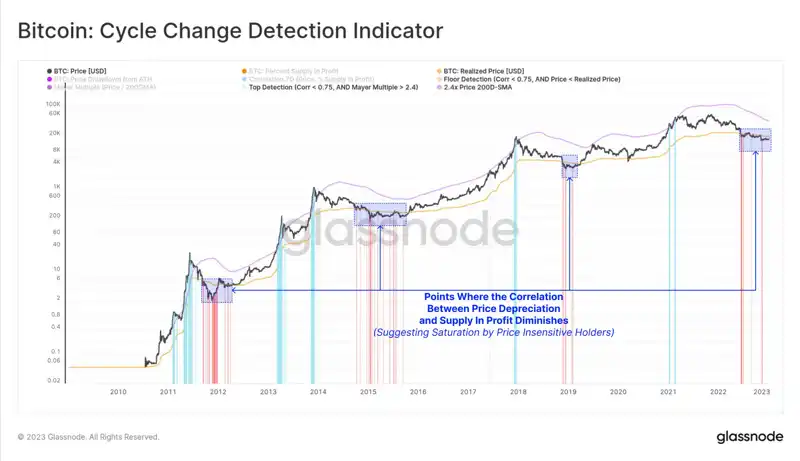

Indicator 8: Bottom

In a recent article, we developed a framework to assess investors' "resilience" to price volatility, and how it affects the proportion of supply in profits. This allows us to model situations where sellers may “run out of bullets” and where the effect of price drops in motivating additional seller activity wears off.

Indicator: A deviation of the correlation between price and profit supply percentage below 0.75 indicates that the relatively price-insensitive holder base is saturated.

Status: fully confirmed

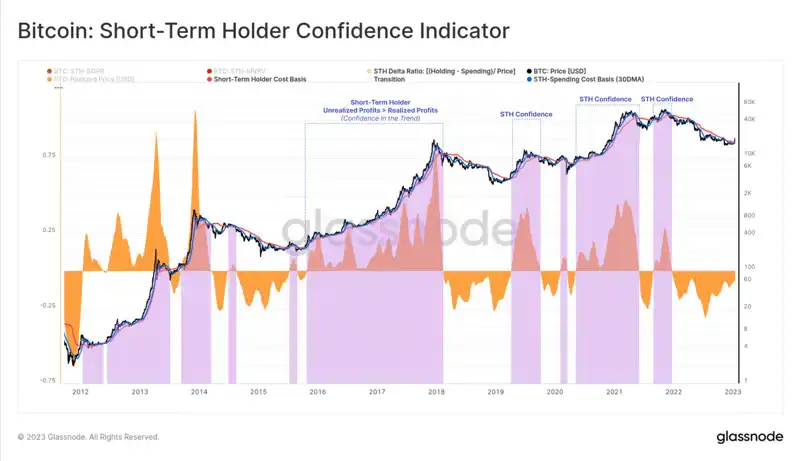

Indicator 9: Confidence in the trend

Helps identify reversals in macro bearish trends when new investor confidence improves. This often shows up in their spending patterns. A practical way to measure this is to compare the size of unrealized profits in newly acquired (and held) tokens to the size of realized profits in spent tokens.

The indicator below is the difference between the cost basis for short-term holder payouts.

Indicators: When the cost basis of the spending entity is higher than that of the holding entity, we can conclude that most new investors tend to hold and therefore have more confidence in continued upside.

Status: Not triggered, but it is approaching a positive breakout.

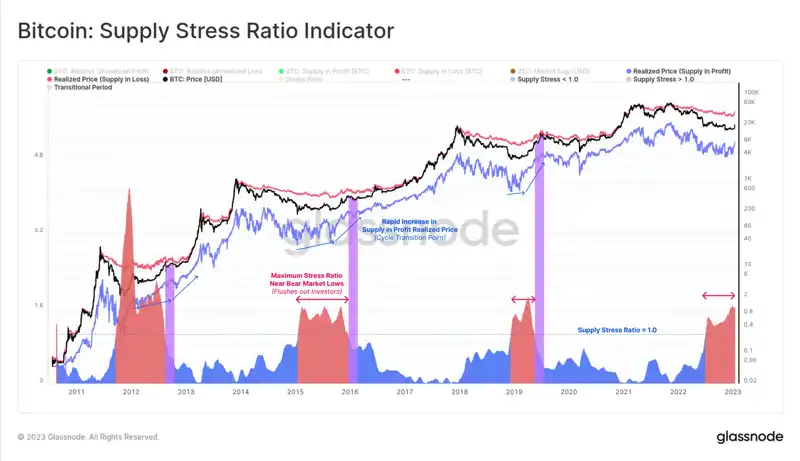

Indicator 10: Measuring the Bottom Line of Stress

The cost basis for a group of market-specific investors is equal to the total dollar value of their holdings divided by the number of tokens owned by that group. From this, the diagram below shows the cost basis for the two supply groups:

Cost Basis for Lost Supply

supply cost basis in profit

After reaching a cycle high (ATH), the market enters a phase of deteriorating demand, increasing net wealth held in unrealized losses. We can measure economic pressure across the market through the Supply Pressure Ratio.

Indicators: During a deep bear, the ratio can reach levels well above 1.5, reflecting the level of economic "pain" that has eluded investors in the past. These spikes are usually followed by a sharp drop back below 1.0.

Status: In progress. That ratio is now in the peak range of market stress, which is historically enough to put most investors out.

Summarize

Identifying cyclical changes is not easy, and there is no single indicator. However, due to the transparency of the blockchain, we can observe periodic patterns of behavior on-chain and then "visualize" them as indicators.

In this article we describe ten such indicators covering a wide range of fundamental market properties and investor behavior patterns. This set of indicators helps to find periods consistent with a sustainable recovery from a bear market. By seeking a fusion between multiple models, we can reduce our reliance on any one indicator or concept and create a more reliable gauge of market sentiment.

Below is a summary table of these 10 metrics as of the publication of this article. The Bitcoin market has yet to trigger most of these indicators, but we can use these 10 indicators to track the development of new trends.