I'm an out-and-out $GNS big guy, plus a ruthless dumper.

$GNS is within 5% of its ATH.

Even so, you should sit down and have a good cup of tea.

Let me explain to you why it is still grossly undervalued.

Let's start with the most obvious.

$GNS' product, gTrade, is gaining traction.

Lots of traction.

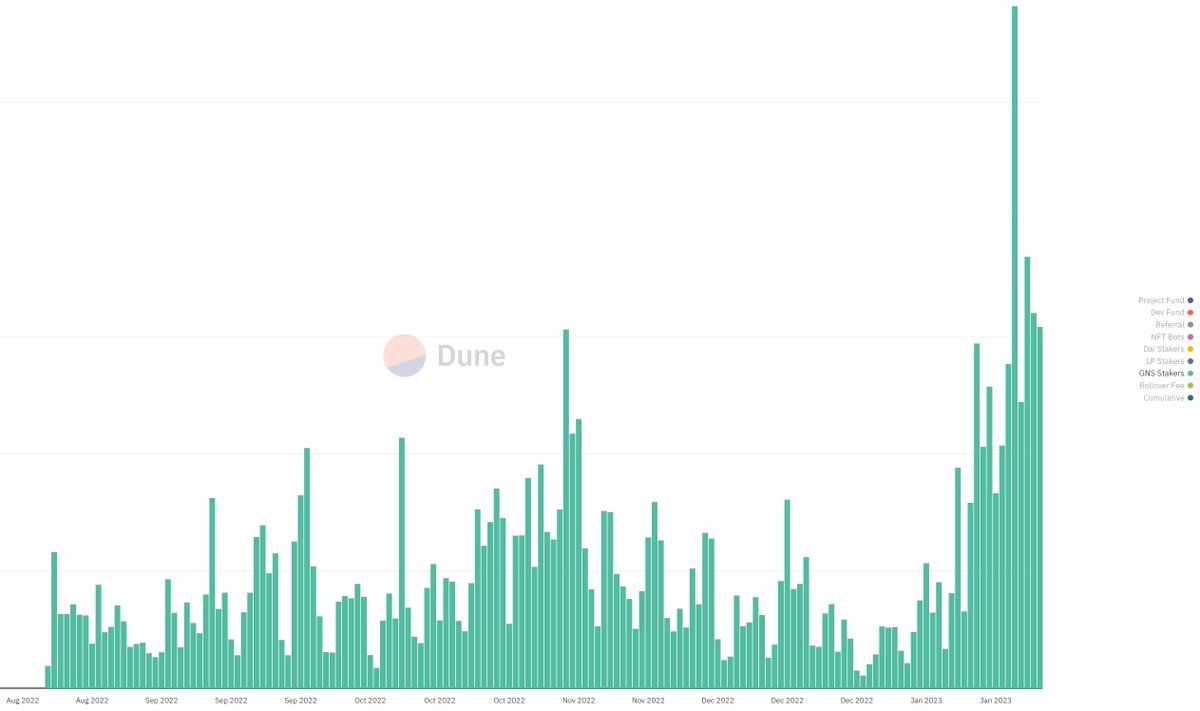

As a result, investors in $GNS have been making profits, making last week the best week since the inception of the SSS investment pool.

How good is it for stakers this week?

They made $230,581 in one week.

To put that in perspective, the previous best (the week of FTX's bankruptcy) was $116,162 or just over half.

The price at that time? $3.6

current price? $4.6

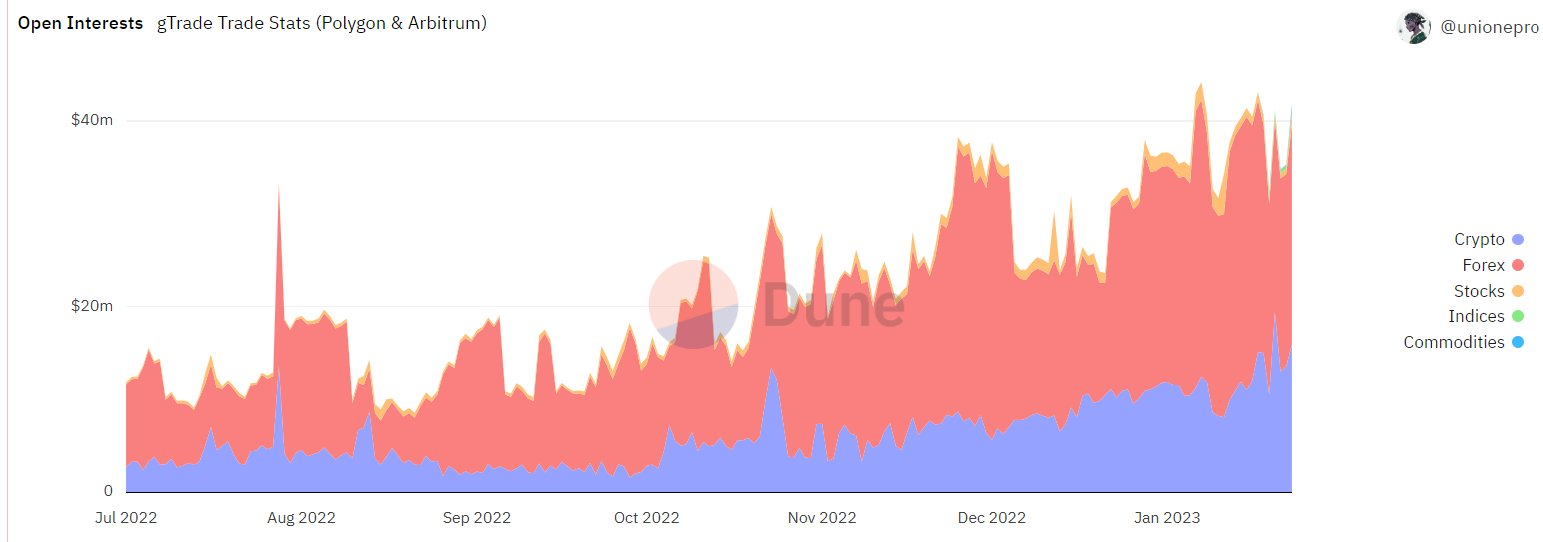

Part of the reason for this huge week was the explosion in the cryptocurrency market.

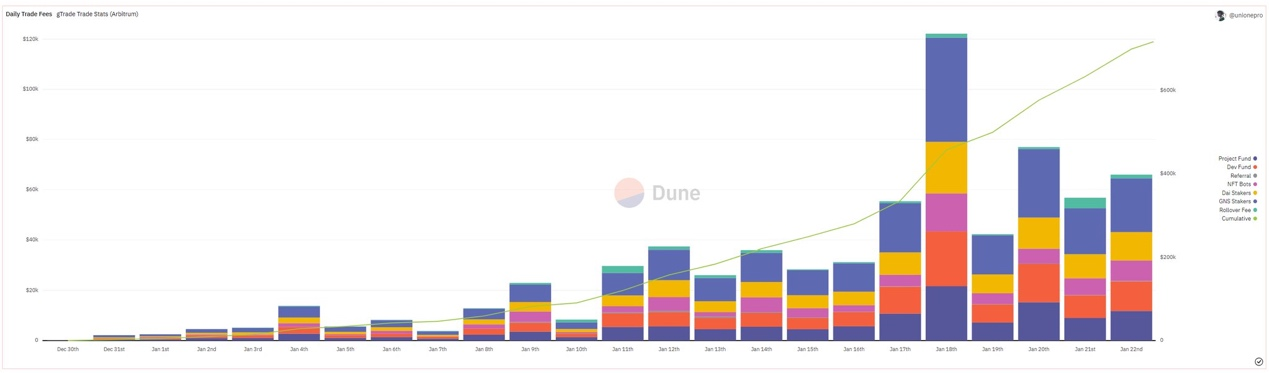

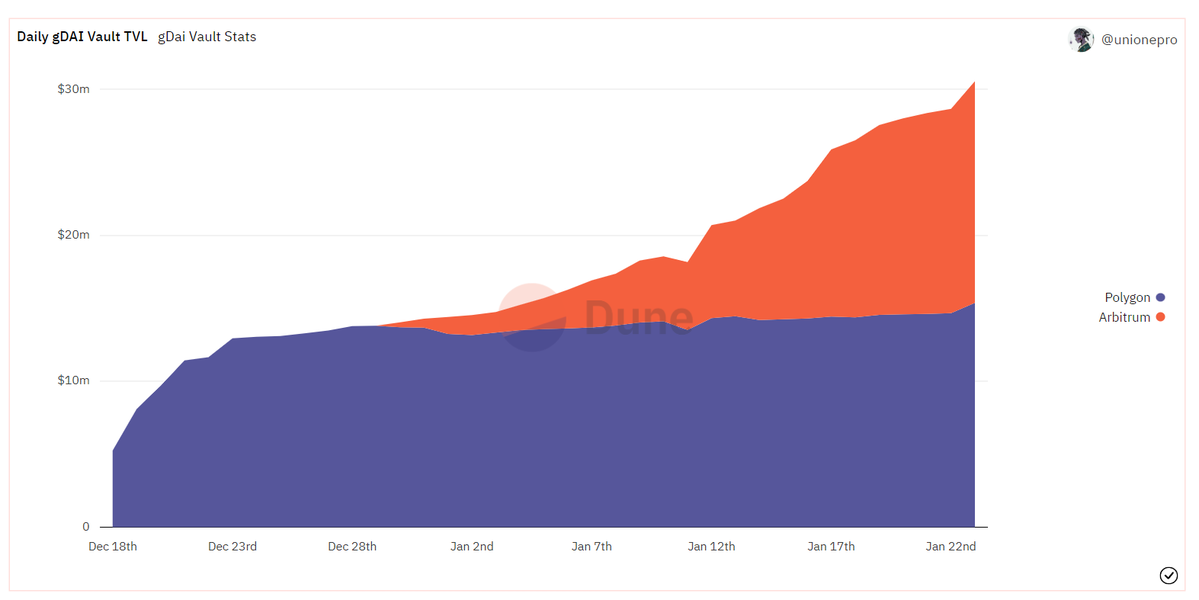

But there's another, bigger reason, a recent new launch on @arbitrum.

Since its launch on New Years Eve, the growth of $GNS has been relentless.

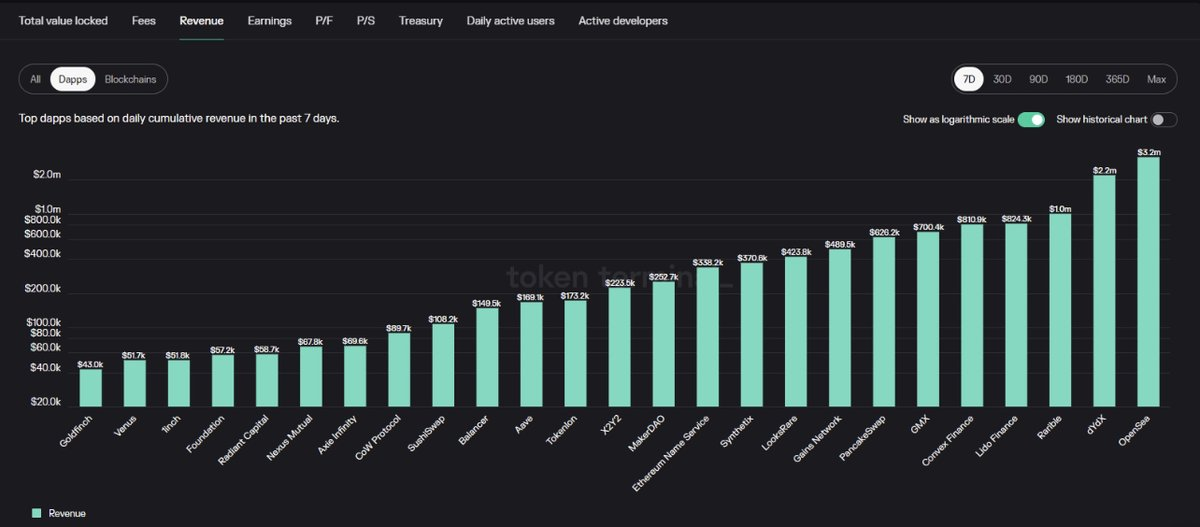

The numbers pulled by this protocol are larger than those of @synthetix_io and almost as close as those of a similar @GMX_IO protocol, both with a market cap of $GNS 4-5x.

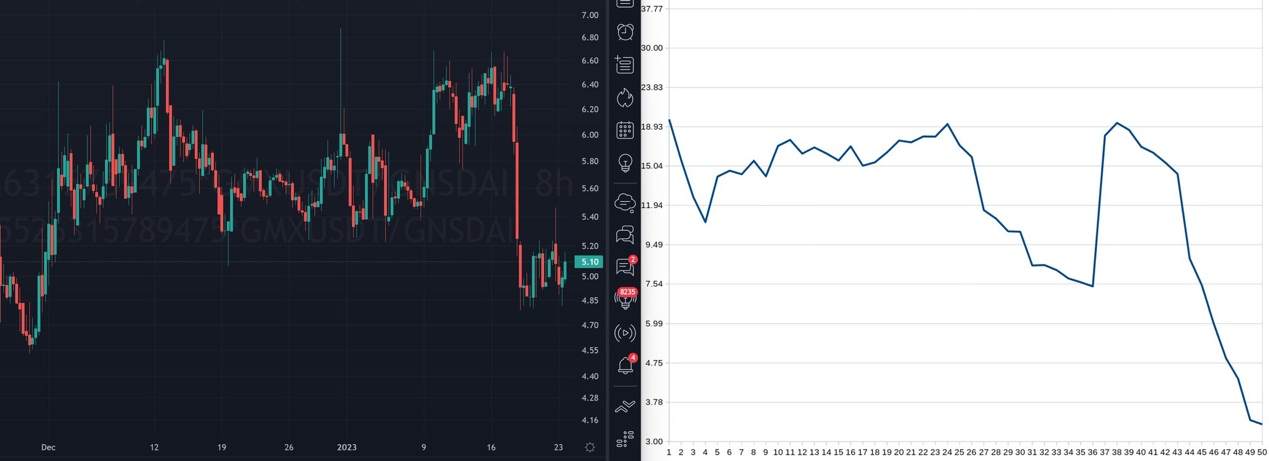

In fact, if we plot the return on stake for $GMX and $GNS we get the graph on the right depicting the past 50 days.

When we plot the fully diluted MC for both over the same period, we get the graph on the left.

That's right, $GMX stakers earn roughly 10 to 20 times as much as $GNS stakers.

But it's different now, today their revenue is about 3-3.5 times.

However, while the charge ratio is skewed 3-4 times towards $GNS companies, the market capitalization ratio barely changes by 10%.

There are many reasons why $GNS has traded at multiples of $GMX in the past on a market cap/fee basis.

Higher growth potential ($GMX capacity question), launch of @arbitrum already priced in, and $GNS is secularly deflationary due to traders' PnL providing a second revenue stream for the token.

There is little reason for the market to price a $GMX market cap to expense ratio at a multiple of $GNS and yet it is doing so now.

This is a case of market irrationality.

You might be thinking that the $GNS fee surge was a fluke.

But I don't think so.

Right now, $GNS has a better product.

One-click trading is fast, smooth, better than CEX, and addictive.

You know it's true when $GMX stakers start admitting it.

Every indicator shouts major adoption in your face.

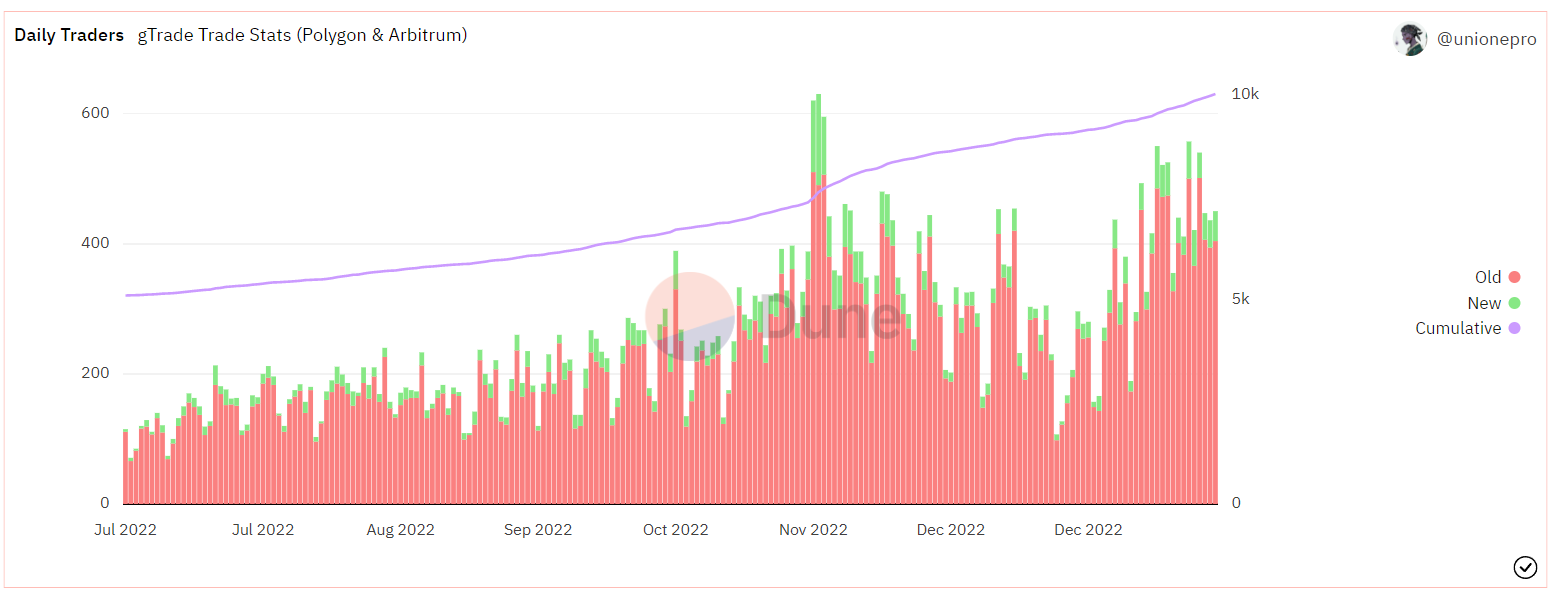

Today, the number of traders has exceeded 10 thousand.

There are 500 traders per day, compared to just over 200 before FTX.

Trader: up

Open Interest: Up

Volume: Up

Fees: rising

Leverage Ratio: Up

Tradable Assets: Up

chain: rising

Then, last but not least…

Take a look at the liquidity profile for some pairings...

They start to look very much like this.

All are bids, no asks.

Can't wait to see the deal competition!