Note: The original author @Defi_Maestro , MarsBit compiled and compiled as follows:

The @traderjoe_xyz team has been developing during the bear market and I firmly believe they have the ability to break out in the next few weeks. This thread will dissect the main features of $JOE and why I like it so much.

introduce

@traderjoe_xyz is the largest DEX on Avalanche, next will be deployed to @arbitrum , bridged by partners @LayerZero_Labs and @StargateFinance .

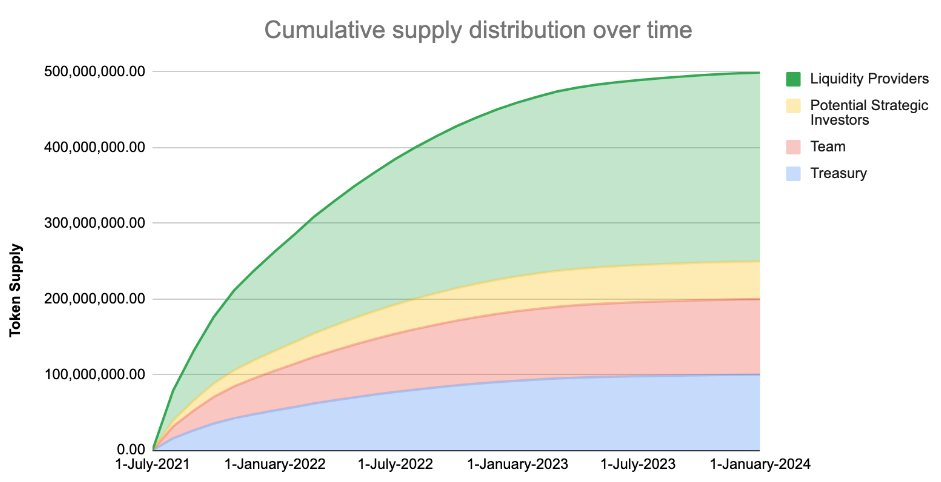

Token Economics

Market cap - $72 million

Maximum supply - 500 million

Current circulation - 464 million

Total circulation - 259,200 JOE/day

Circulation (via farming) - 14,768 JOE/day

The remaining tokens are held in the treasury for future long-term growth incentives.

Token issuance will stop in January 2024.

Liquidity Book Introduction

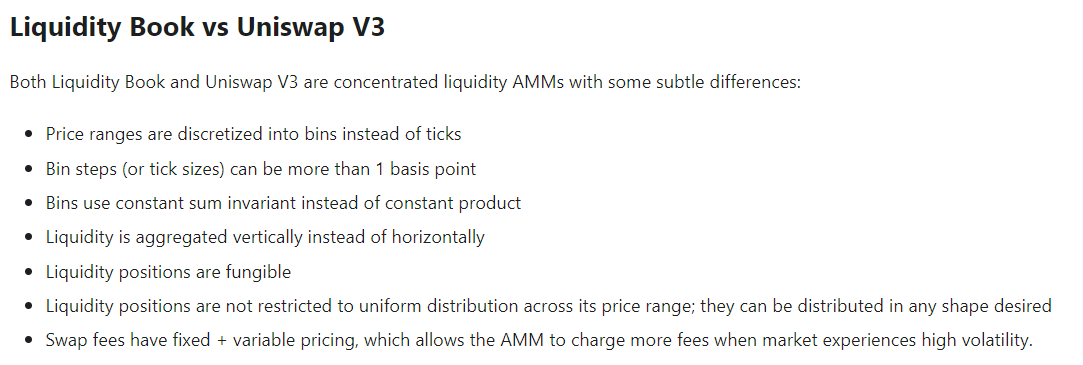

@traderjoe_xyz has launched the Liquidity Ledger (LB) model, making it a centralized liquidity AMM. Main differences between LB and UNI v3 in the attached picture.

The advantages of the liquidity book compared with UniV3:

Greater Liquidity Efficiency

Customizable Liquidity

Fungible Liquidity Positions - Allows the protocol to directly incentivize pools

Dynamic fees to capture extra value during periods of volatility

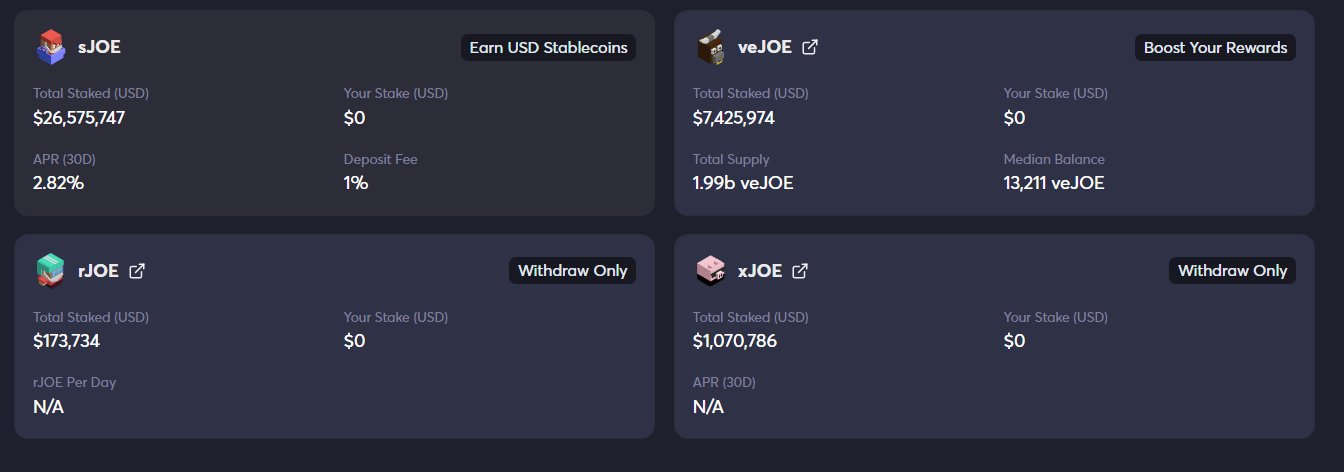

Staking Model (Token Utility)

veJOE - Featured mining pool to boost JOE rewards + governance

sJOE - share all platform revenue generated

rJOE - distribution token for access to Rocket Joe Launches

Catalyst - Real Yield

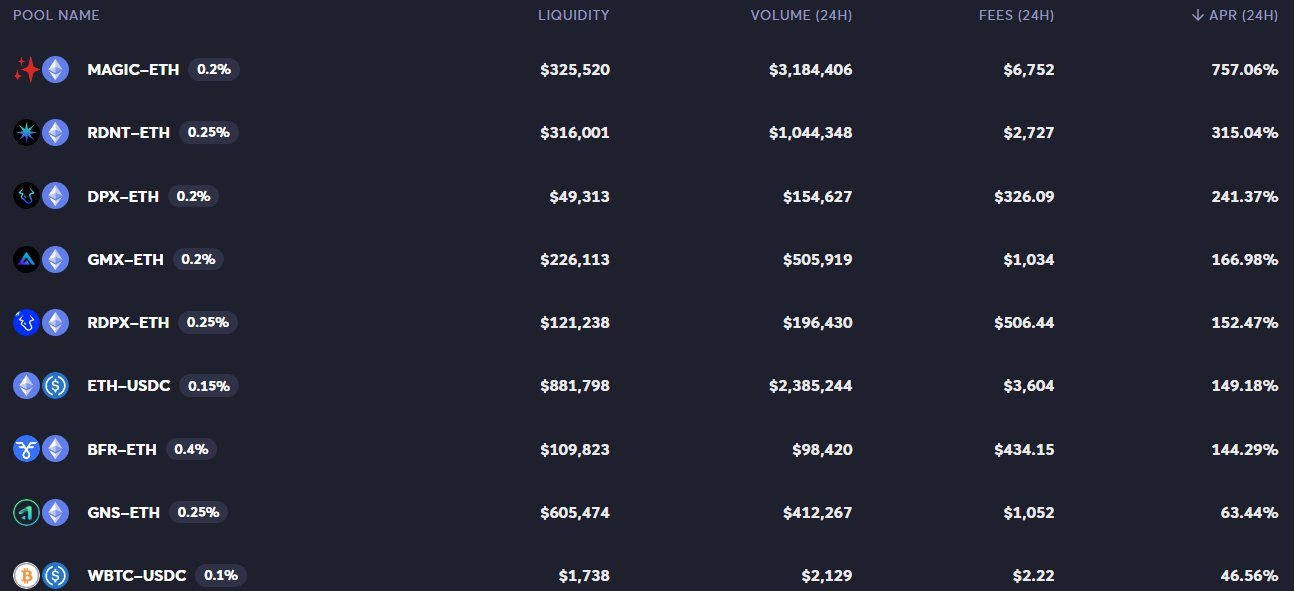

Currently @traderjoe_xyz LP is generating a lot of fees using the LB model.

The fee switch for sJOE will be open soon, and a portion of all Dex fees will go to $JOE stakers .

This means $JOE will start the real earnings narrative.

Catalyst - Multichain

sJOE stakes will be isolated by their respective chains.

+$JOE LP has $8.2M in liquidity, while sjoe has $26M in collateral and vejoe has $7.3M in collateral.

2 sJOE launch on both chains ( @arbitrum & @BNBCHAIN ) will see JOE liquidity reduced from $JOE LPs.

Catalyst - Market Making Program

ETA + veJOE within 1 month will be integrated into the MM plan to increase rewards.

LPs will be rewarded based on fees.

Protocols will be allowed to further incentivize their own LP pools and native tokens.

Catalyst - Market Making Program (2)

Users will be incentivized to become LPs within a narrow range to generate maximum MM rewards.

Protocols that offer additional incentives will gain access to deeper liquidity, protecting them from large slippage swaps.

LP and agreement win-win.

Catalyst - Governance Model

VeJOE is also used by governance aggregators such as @yieldyak_ and @vector_fi .

The governance aggregator permanently locks $JOE to increase the veJOE allocation.

veJOE's Perma lock ensures that governance capital is sticky and not mercenary.

Catalyst - Governance Model (2)

The upcoming MM program may see veJOE rise in importance.

Increased $JOE locked in veJOE = Decreased market supply + Decreased supply + Increased token demand = Supply volatility imminent?

Catalyst - Licenseless pool

The current LP pool is carefully curated to ensure the reliability of participating assets.

Licenseless deployment is in progress.

No permission pool = Altcoins can be deployed = Degen Central = Dex volume up.

Speculation - $JOE Pool Incentives

With $JOE multichain and upcoming MM plans, I expect $JOE pools to be incentivized to bootstrap liquidity.

IMHO, $JOE LP spurs @arbitrum and the BNB chain .

sum up ideas

$JOE sets the perfect flywheel for next month

low emissions

Staking Model Limits $JOE Supply

Efficient Liquidity Model

An effective way for the protocol to incentivize liquidity

All signs point to tighter supply.

With the flywheel in place, I expect $JOE to explode once MM incentives are turned on .

Deep Liquidity + LB Model = Fee Black Hole

In addition to MM incentives, LB's market exposure to the masses will help drive long-term growth.