At 1:00 am on February 15th, the long-awaited Blur Token was launched, and the project opened up Care Packages (blind box) applications to qualified participants, and the third round of airdrop began, triggering market frenzy again.

Since its official release in October last year, Blur 's popularity has remained unabated and it has become a shining star in the bear market. What exactly is Blur?

Blur is an NFT marketplace and aggregator designed for professional buyers and sellers with many innovative features. The official definition of itself is "a combination of a real-time NFT market and an aggregator", which supports NFT batch buying and selling, and takes zero royalties ( OpenSea takes a 5% fee).

NFT is another heavyweight application of the blockchain. After the outbreak in 2021, investment institutions, project parties or creators, brands, artists, etc. in the traditional world have been working hard in this sector, which not only generated a lot of market value growth The multiplied NFT project has made Opensea, an NFT market with only 5 members, shine. In the first half of 2022, its valuation will reach 13 billion US dollars, monopolizing the NFT market for a long time.

Obviously this is a very lucrative track. Since then, many platforms have emerged as the times require, but none of them can shake Opensea's dominance.

In May last year, Otherdeed was released, the market FOMO, and after the bubble burst, the NFT market entered a long-term bear market just like the encryption market. The trading volume plummeted, and the daily average was only 15% of the bull market. However, Blur was in the overall downturn of the NFT market. Growth against the trend.

01 How did Blur rise to the top step by step?

In March 2022, when the NFT market was still relatively hot, Blur was still in the early stages of development. Blur announced the completion of an $11 million seed round of financing led by Paradigm , with participation from eGirl Capital, 0xMaki, and LedgerStatus.

Paradigm, as a top encryption investment institution, Blur, backed by its halo, has gained market attention as soon as it appeared. Blur's team is equally luxurious, consisting of developers from well-known institutions such as MIT, Five Rings Capital, Twitch, Blurrex, and Square.

In May, the NFT market Blur launched a test version . Blur allows users to view the sales of NFTs in the existing market in real time without manual refresh. This test version allows users to batch remove all NFTs.

In October , after a 4-month internal testing phase, the NFT market Blur was officially launched , and at the same time, users who have NFT transaction records in the past 6 months will be airdropped Token Blur.

One week after its launch, Blur’s transaction volume doubled from about US$6.6 million to US$13.8 million. After that, the market share in terms of transaction volume, unique users, and transaction volume all soared;

At the beginning of November, the daily trading volume exceeded mainstream markets such as looksrare and x2y2, ranking second;

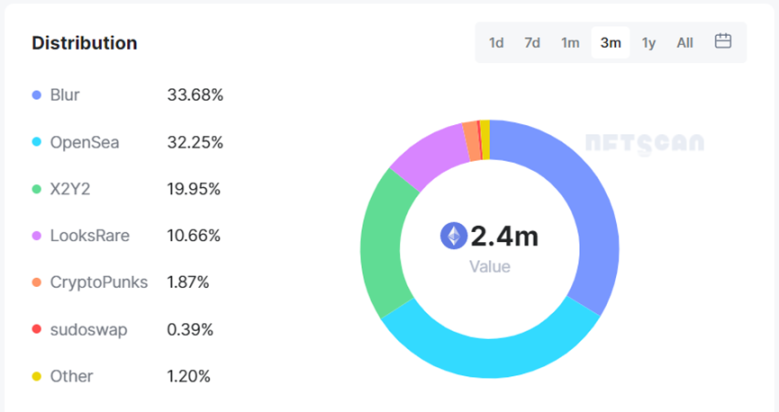

On November 27th, Blur surpassed Opensea in terms of daily trading volume, which were 5.5K ETH(Blur) and 5.3K ETH(Opensea), respectively. After a period of time, it fell. In the past three months, Blur’s total transactions denominated in ETH The volume is close to 800k ETH, which exceeds the transaction volume of Opensea 748k ETH . It is currently the second largest NFT market after Opensea.

02 Where Blur shines

Excellent products, fast buying and selling, in line with market demand

In the downturn of the NFT market throughout the second half of 2022 , "shit" combination projects such as ill poop it NFT and ShitBeast became popular, and the meme wind blew into the nft circle. The situation of bad money driving out good money in the market intensified, reflecting the user's enthusiasm for the market at that time. The ridicule and despair, and then the endless NFT projects began to break and return to zero frequently. In this market context, users have an urgent need for fast transactions, and aggregators began to quickly occupy the market.

"shit" combination

Blur is based on the aggregator as its broad traffic entry, and the product is finely crafted. The official claims that the speed of buying and selling NFT on the Blur platform is 10 times faster than that of head aggregators such as Gem . Slow transaction response problem.

Blur official website

As shown in Blur's buying and selling interface , Blur is a very practical product for users who have some experience in NFT buying and selling . The interface clearly lists the key information that users care about, and it has complete functions and strong professionalism.

Users can individually select the rarity and price range to filter, and quickly find the NFT they want to buy and buy in batches. All NFT series have an in-depth analysis of the floor price, intuitively understand the historical price and pending orders, and help users buy and sell NFT Provides a very convenient integration tool.

Custom royalties, 0 handling fees

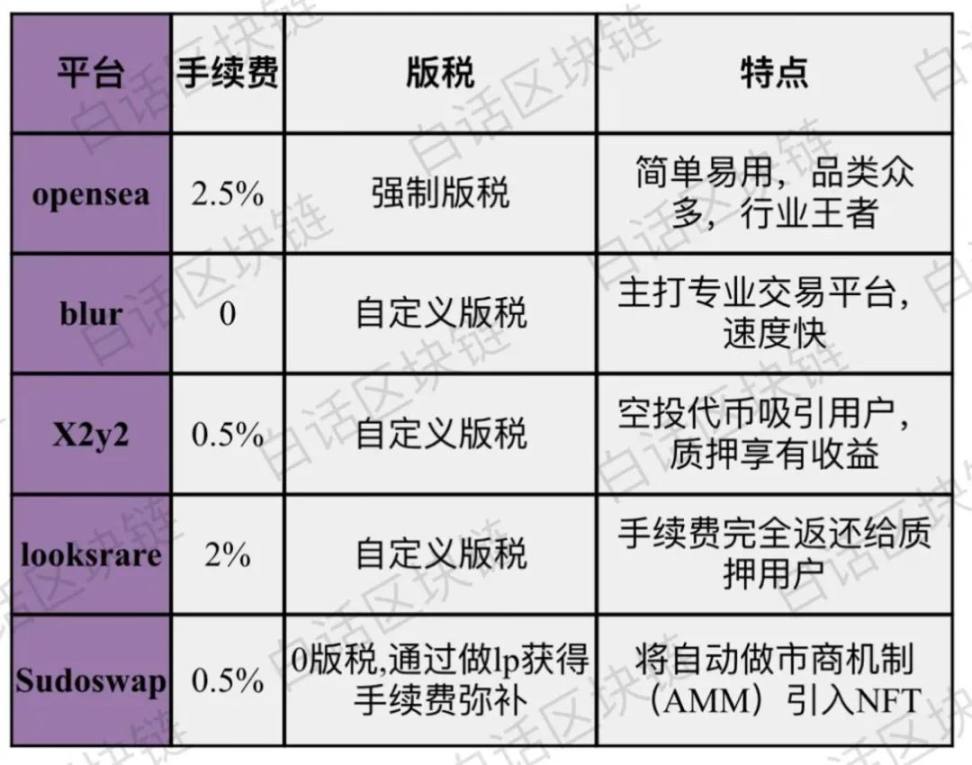

Royalties and handling fees are two important costs for users, especially in the case of poor profit-making effects in a bear market , users are even more unwilling to bear them. Therefore, other major emerging trading platforms have also made a lot of effort in this regard.

In terms of royalties, Blur adopts a custom royalty method to give users more choices. At the same time, in order to encourage users to pay royalties, it rewards users who pay high tax rates with airdrop . The final results show that this behavior partially increases Blur’s overall royalty rate. .

Relevant data shows that the average tax rate is about 0.65%, which is higher than X2Y2 and looksrare, but far lower than Opensea6%. Lower royalties are user-friendly.

Since Blur was launched, users have not been charged fees. Users can enjoy Blur's high-quality services for free, which is also the reason for the high user loyalty.

successful marketing strategy

Compared with Opensea's hesitation in issuing Token and less interaction with community users, Blur has firmly grasped the hearts of Web3 community users since its launch. In the testnet stage, a large number of fans were attracted in a short period of time by recommending the waiting list, and users need to invite 5 people to participate in order to gain access;

After the project is officially launched, it is planned to carry out three airdrops for different types of users , and the scale of each airdrop will be larger than the last one, which will satisfy the appetite of users. The details of the three airdrops are as follows:

First airdrop :

Launched in October, users need to list an NFT on the Blur platform within 14 days, as long as they have a record of buying and selling NFT within 6 months, they can participate.

The second round of airdrop :

Started on December 5th and ended on January 3rd, the scale is ten times larger than the first one;

The second round of airdrop distributes airdrop packages to all participants who actively participate in pending orders and transactions on its platform.

The third airdrop :

Launched on February 14th, Eastern Time, Blur officially stated that the third airdrop will be Blur's last and largest airdrop .

Every time Blur superimposes the scale of airdrop , it raises the user's expectations.

It is also in the past three months that Blur's transaction volume and user numbers have grown rapidly.

03 In the battle between Blur and Opensea, does Blur have a chance of winning?

blacklist event

In November 2022, Opensea resisted Blur by requiring the new NFT collection project to blacklist Blur and enforce royalties. Most creators chose Opensea because of the royalty income. As a result, NFT collectibles that enforce royalties on Opensea cannot be bought and sold on Blur.

Afterwards, Blur attempted to settle with Opensea to lift the blacklist restrictions, but was rejected.

On February 1, 2023, Blur created a new NFT trading system by utilizing Opensea's Seaport, bypassing Opensea's blacklist controls. Since Seaport was not on Opensea's blacklist, the NFT items that blocked Blur can now be traded through the new system, and Blur finally cleverly bypassed Opensea's blacklist control, which had a profound impact on all parties involved, including Blur , creators, buyers and sellers , and Opensea.

Opensea and Blur have taken very different approaches to the royalty issue, and the business overlap is high and competition is heating up. Recently, although Blur has surpassed Opensea in terms of daily transaction volume for many times, there is still a big gap between the number of users and Opensea. Also based on the data of the past three months, the number of users of Opensea is 636k, while that of Blur is only 187k.

In addition, the transaction volume of Blur in the past three months was obtained under the circumstances of continuous airdrop incentives, abandonment of fee income and burden of copyright tax disputes. When airdrop lands, whether the subsequent transaction volume can maintain growth again is the key to measuring user loyalty and products.

In terms of profitability , since Blur does not charge handling fees and has no other source of profit, the progress of the project depends entirely on the funds of investors . Therefore, it is necessary to determine a stable profit model in order to ensure the sustainable development of the project. Otherwise, the issued Token will have It may become a cash machine for project parties and investment institutions;

In terms of products, Opensea acquired Gem last year and was the largest aggregator before Blur. Under the pressure of Blur, Opensea is also working hard to optimize user experience . With more loyal users and several years of market testing, Blur needs to continue to maintain its core of differentiation. In addition, in terms of security, as a newly established NFT market, Blur has not yet experienced market experience.

Generally speaking, there is still a certain distance for Blur to truly surpass Opensea, and there are still many challenges in many aspects. But the current Blur’s pressure on Opensea is indeed unprecedented. With the support of star capital and team, Blur may also create new brilliance

Compared with other major platforms

In addition, compared with the top six NFT trading platforms in the past three months, Blur ranks first in terms of the proportion of transactions . Compared with platforms other than OpenSea, other platforms currently pose relatively little threat.

Whether it is from the perspective of royalties or handling fees, there is no advantage over Blur for the time being.