As one of the strongest competitors in the history of OpenSea, the infighting between them can be described as exciting. In this issue, we review how Blur broke out of the OpenSea siege and expanded its territory.

01

overview

1. OpenSea and Blur are the top 2 NFT marketplaces

2. 3 months ago, OpenSea passed the new mandatory royalties to resist Blur's optional royalties

3. Blur tries and fails to remove itself from the blacklist

4. Later, Blur bypassed OpenSea's blacklist through OpenSea's Seaport protocol

5. All collections are now tradable on Blur

6. All creators now get full royalties from OpenSea and Blur

02

OpenSea's mandatory royalties

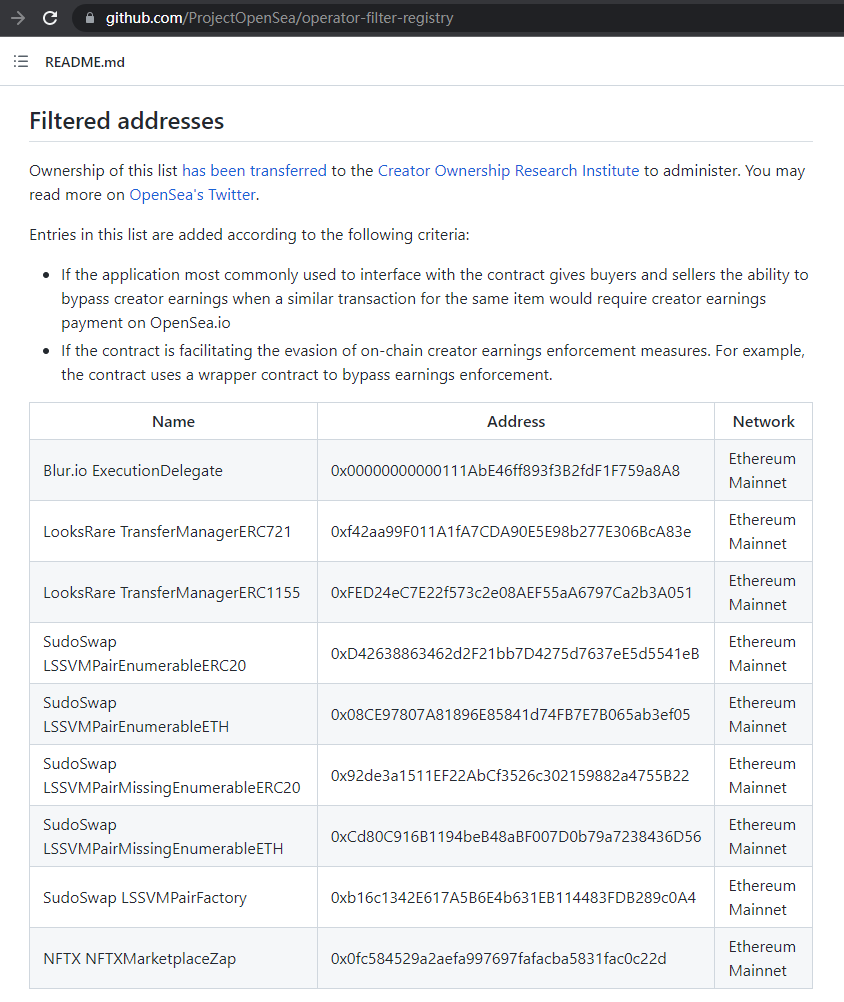

In November 2022, OpenSea implemented a new policy: If an NFT project wants to use mandatory royalties, then they must block those markets that cannot enforce royalties. Obviously, this refers to Blur, so they are on the blacklist, and all NFTs that perform royalties on OpenSea cannot be traded on Blur. (Translator's Note: Similar to the domestic 3Q war back then, forcing users to choose between Opensea and Blur is a malicious competition suspected of monopoly, which makes users disgusted.)

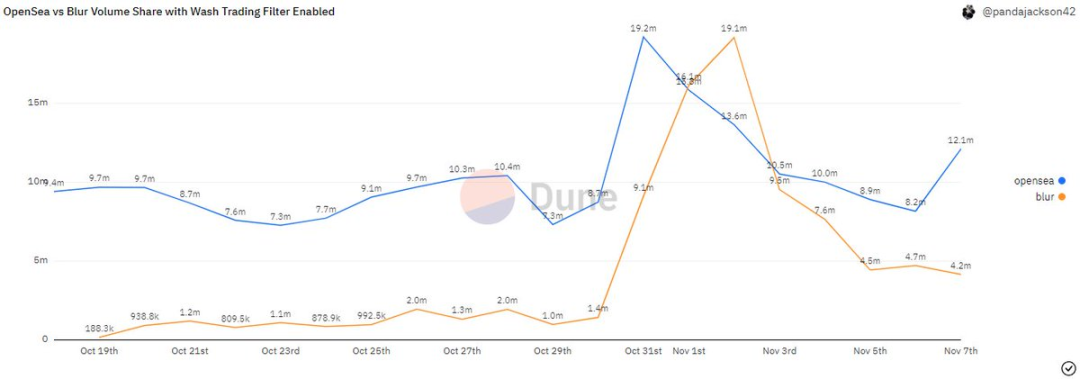

After Blur went online in October 2022, its transaction volume has shown an upward trend, and even surpassed OpenSea's daily transaction volume for a period of time, posing a threat to OpenSea's dominance. And OpenSea's new regulations on mandatory royalties have effectively defended its market dominance.

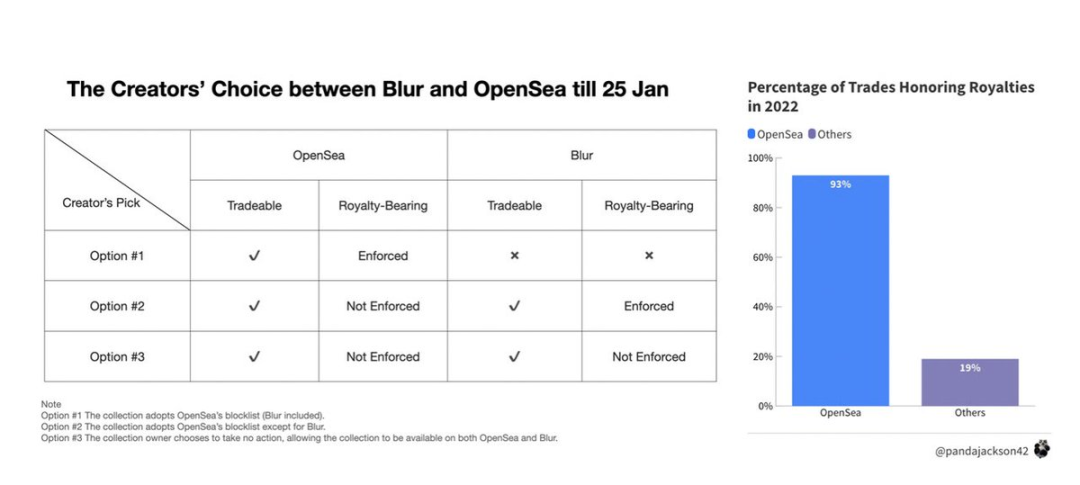

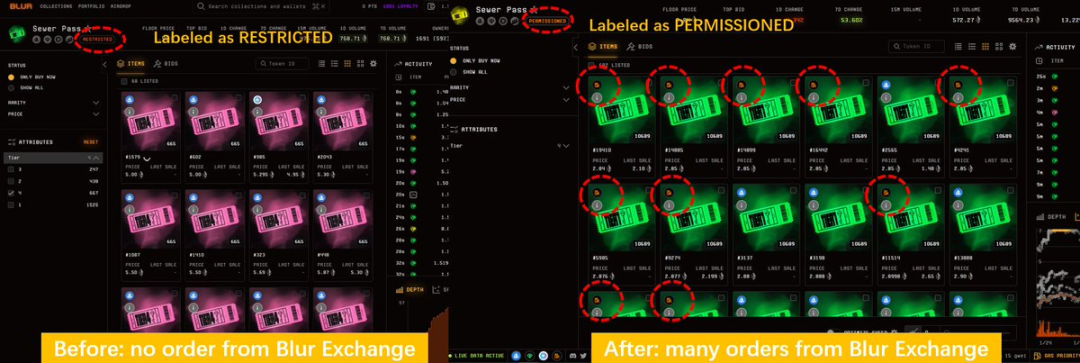

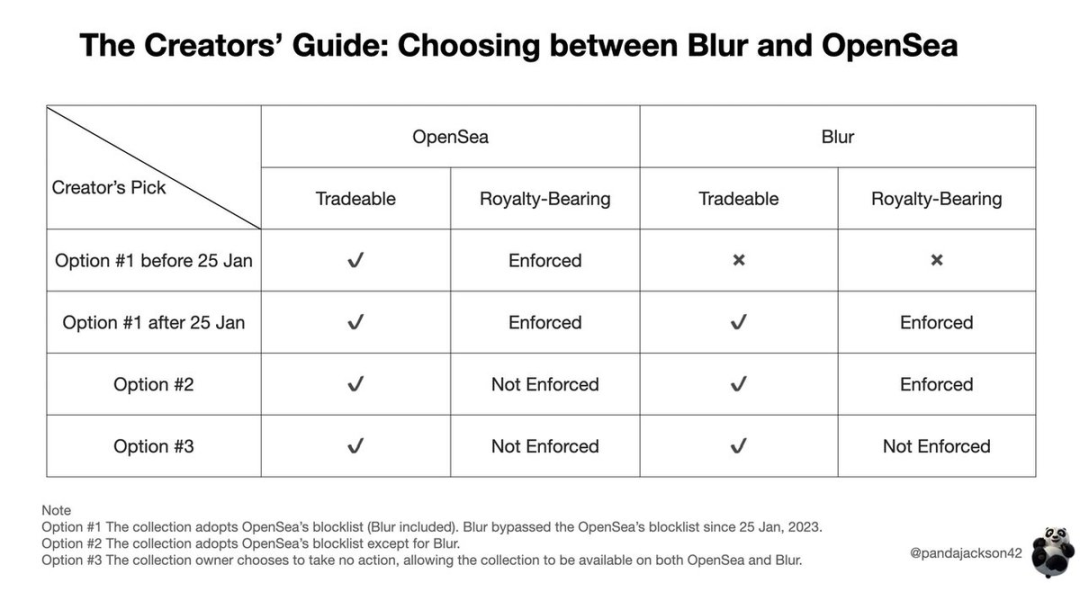

In the short term, OpenSea's new regulations have proven effective, as new NFT lines like Yuga's Sewer Pass have chosen to ally with OpenSea and block Blur. Blur has no choice but to promise to implement compulsory royalties for the new series of NFTs, and claims that he is now in compliance with the regulations. He hopes that OpenSea can give him a chance to remove himself from the blacklist. In the face of Blur's compromise, OpenSea was unmoved, and instead replied that their regulations require mandatory taxation of all NFTs, not just those that block you. So sorry, I can only continue to block you. Therefore, in the first round of the duel, OpenSea won, and Blur was still lying on OpenSea's blacklist. As the saying goes, gods fight, and mortals suffer. NFT creators are caught in a dilemma of choice at this moment:

- NFTs cannot be traded on Blur if they choose OpenSea

- Mandatory royalties cannot be enforced on OpenSea if they choose Blur

Most people choose OpenSea because 92% of transactions on OpenSea are charged royalties, but only 19% on other platforms.

03

Blur's counterattack

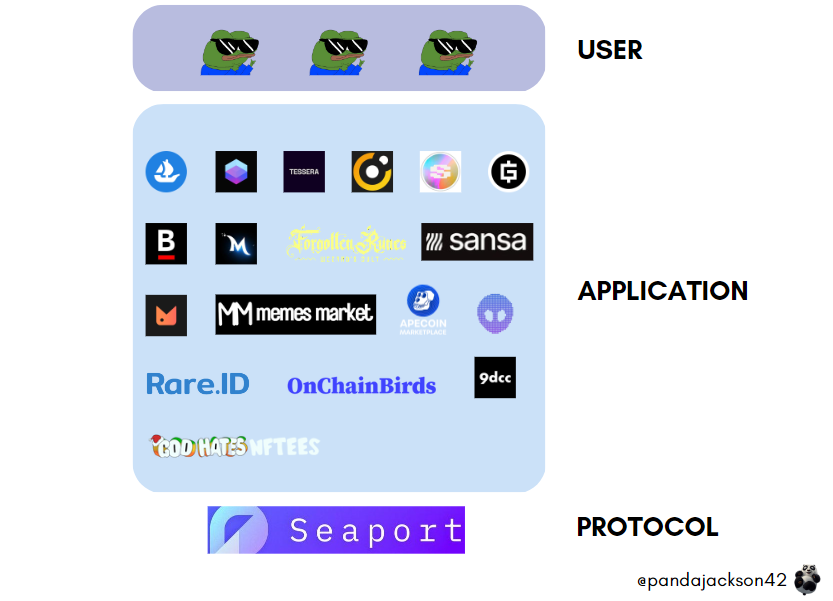

Before we get into the 2nd round of the showdown, let's understand what a Seaport is. Seaport, developed by OpenSea, is a decentralized Web3 marketplace protocol that is open and permissionless. Anyone can use it for free. More than 20 teams, including OpenSea, have used it to build marketplaces.

But Blur found a loophole and created a new trading system using OpenSea's Seaport. Since the Seaport protocol is not in OpenSea's blacklist, it is its own protocol after all, but they cannot prevent Blur from using the protocol. Since OpenSea is also built on top of Seaport, if OpenSea blocks Blur, it blocks itself. So the result is that Blur has two trading systems. The old system continues to be used to trade those NFTs that have not blocked Blur, and the new system is used to trade those new NFTs that have blocked Blur due to mandatory royalties, and these NFTs are now Taxes can also be enforced on Blur.

OpenSea's blacklist operation is similar to France's Maginot Line, a series of defense projects used by France to protect itself from potential attacks from the East during World War II. But when Germany chose to invade Belgium first, thereby bypassing the Maginot Line, no matter how exquisite and strong the defense line was, it would not help at this time. OpenSea's blacklist is like the French Maginot Line. Although it seems extremely powerful, it seems to be a decoration in front of Blur and can be easily bypassed.

So in the 2nd round of the duel, Blur won.

04

Influence

- This subtle counterattack by Blur has had a profound impact on all stakeholders, including Blur, creators, traders, and OpenSea. For Blur: Blur Bypasses OpenSea Restrictions And Restarts Trading Restricted NFTs

- Without any announcement, 10% of the trading volume of those previously restricted NFTs has moved to Blur

- With the launch of Blur's new system and the stimulation of AirDrop, the trading market will continue to grow steadily

For creators: Creators now get full royalties from OpenSea and Blur

- New series of NFTs can do this by blacklisting Blur in their contracts

- Existing NFTs can achieve this by updating the contract and then blocking Blur

For traders: traders can now trade all ERC721 NFTs on Blur. Blur has zero platform fees, so transaction friction becomes lower. Note that restricted NFTs can only be listed on the Blur front end at present, but cannot be used for bidding. For OpenSea:

- As the initiator and largest stakeholder of the Seaport protocol, OpenSea clearly benefits from greater adoption of Seaport. Being adopted by a leading market like Blur is a win-win for both Seaport and OpenSea;

- Although Blur bypasses OpenSea's restrictions, OpenSea's protection of creators' royalties is still commendable;

- Mandatory royalties will increase the income of creators, so that more creators will join Web3, and OpenSea will definitely benefit from it.