Exorbitant Crypto farming returns have proven unsustainable, and coupled with the aftermath of the collapse of FTX, 3AC, Terra Luna, Celcius, and Blockfi, users are now seeking sustainable "real returns." In the past, users quickly rushed into the 20% CEX (centralized exchange) pledge rate without thinking. Now, especially in a bear market, Defi users are more skeptical of yields and how they are derived. The recent bankruptcy of institutional digital asset trading firm Genesis is another domino in the yield space. Genesis provides Gemini, one of the largest U.S.-based cryptocurrency exchanges, with earning on customer deposits in its Earn program. The Earn program allows users to deposit cryptocurrencies in exchange for up to 8% yield on certain stablecoins and other cryptocurrencies. The Genesis bankruptcy drained client funds, and in retrospect, the 8% yield on Gemini's Earn program was risky. Due to the growing trend of distributing fees to token holders, many protocols have adopted real yield strategies. In this article, I explain how GMX works and how savvy developers can leverage protocol token economics to create new DeFi primitives, yield strategies, and integrations to their benefit.

What is real rate of return?

In traditional finance, the real rate of return is the difference between the inflation rate and the interest rate. In DeFi, people refer to "real income" as the income or profit that token holders get from sharing the income of the agreement. Typically, protocol governance tokens need to be staked (using protocol-locked tokens) to claim protocol revenue.

GMX

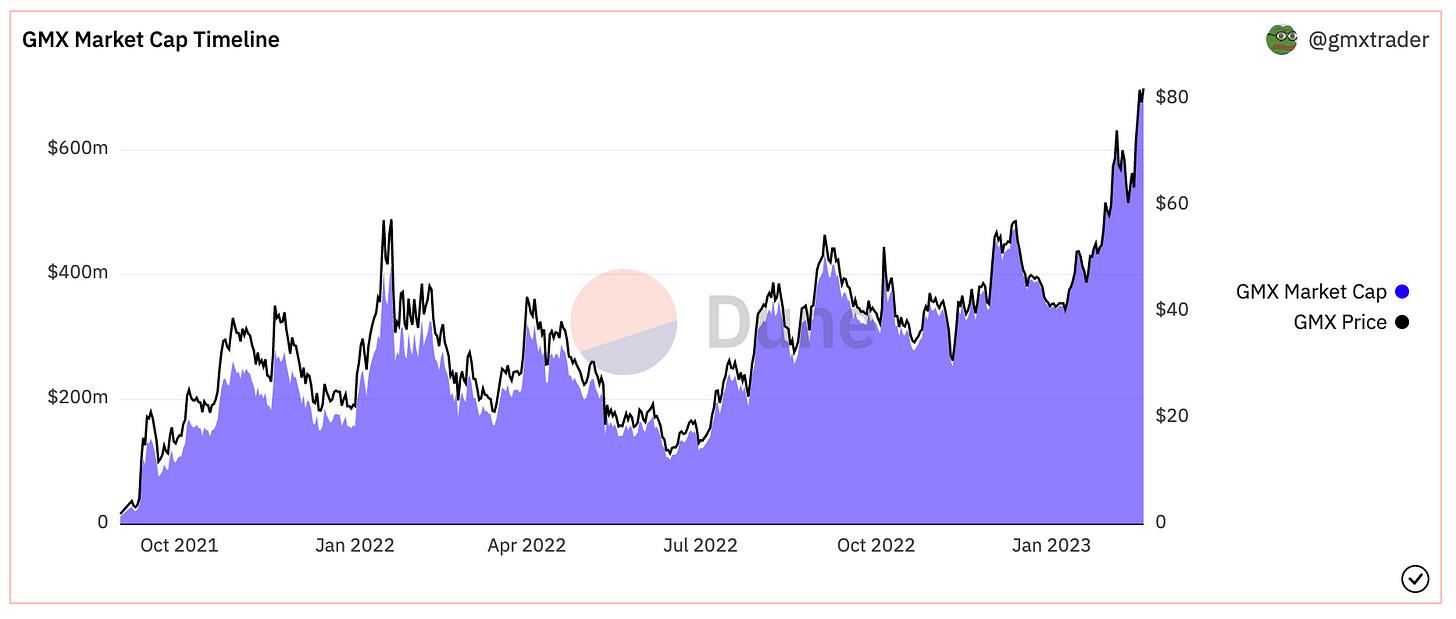

The native Arbitrum decentralized perpetual exchange, GMX, leads the way in terms of Total Value Locked (TVL) and Market Cap for Arbitrum Dapps. Perpetuals are crypto-native financial instruments similar to futures but without a settlement date. Savvy traders can keep their long or short positions open for long periods of time in exchange for paying funding rates to keep the positions open. Perpetual exchanges are ideal for directional trading of assets or hedging positions. GMX allows users to gain up to 50x leverage on trades on some supported assets, including Bitcoin and Ethereum.

GMX Token Economics

Incentives are key to DeFi and to attracting liquidity and capital to the protocol. Liquidity is hard to keep within the protocol as users move to the latest shiny thing. High APR causes funds to rotate between new Dapps and narratives. What started as airdropping and printing tokens for specific user actions has evolved into a more sustainable token incentive model. The GMX token design rewards users with protocol fees by staking tokens in the protocol to provide liquidity. GMX employs a dual token economy, $GMX and $GLP, which facilitates the value distribution of the protocol. The majority of GMX's revenue comes from the 0.01% fee charged to traders for borrowing, opening and closing positions.

$GMX

- $GMX is the governance token of the GMX protocol, which grants voting rights on new proposals. Holders of GMX can also stake (lock up a contract) their tokens in exchange for staked GMX, which will earn a claim of 30% of all fees charged to traders using the protocol. On the Arbitrum and Avalanche networks, traders can deploy transactions, and the network distributes fees in the form of $ETH on Arbitrum and $AVAX on Avalanche.

$GLP

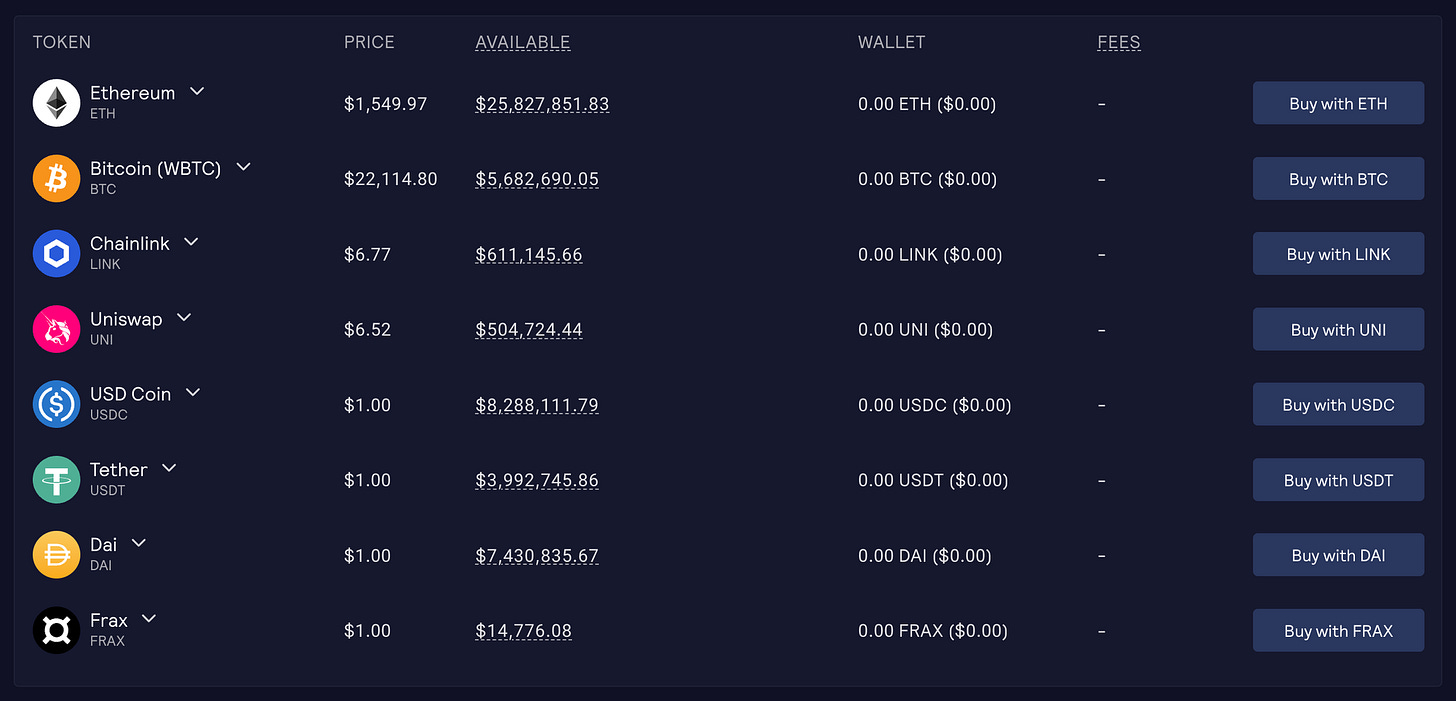

- The $GLP Liquidity Token is an index of assets including $ETH, $WBTC, $LINK, $UNI, $USDC, $USDT, and $DAI that is a source of funding for profitable trades. Arguably more importantly, $GLP is the liquidity token of the GMX protocol. In order to mint GLP and earn rewards, traders can deposit collateralized index assets to earn protocol rewards. Rewards are distributed in AVAX or ETH depending on the network used to mint GLP. Those holding $GLP will receive 70% of protocol fees from the chain generating GLP.

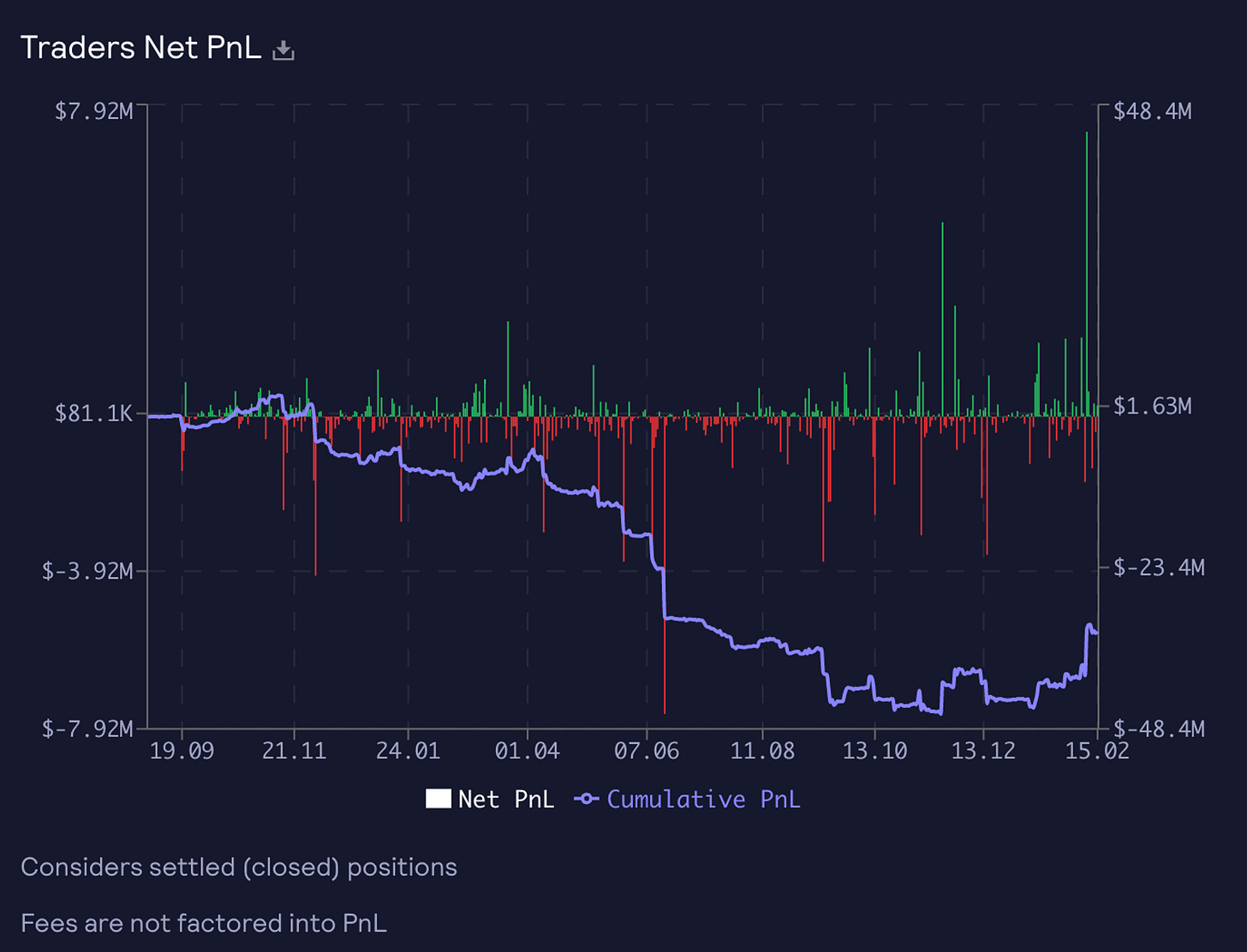

When a trader wins a trade on GMX, the GLP pool is responsible for paying out bonuses, while $GLP holders on the chain that minted GLP will receive 70% of transaction fees and liquidations. GLP holders essentially act as "houses" and provide funds for traders, since most traders lose money on trades. Since the launch of the GMX protocol, traders have lost over $30 million (profit + loss) trading on the platform. GLP token economics create positive incentives for both parties to a transaction. Liquidity providers expect traders to exchange losses for stable gains, and traders have the liquidity to conduct large-scale transactions.

GMX composability

Other Dapps can take advantage of GMX's yielding assets and trading protocol since it is a permissionless platform. More than 35+ protocols are utilizing GMX in some form, likely due to the ability to build on top of GMX, known as "Defi Composability" or "Defi Lego". Composability is critical to rapid innovation in the crypto space, as one protocol can replicate or extend the services of other protocols without building the entire infrastructure from scratch.

GMX Composability Use Cases

Abracadabra

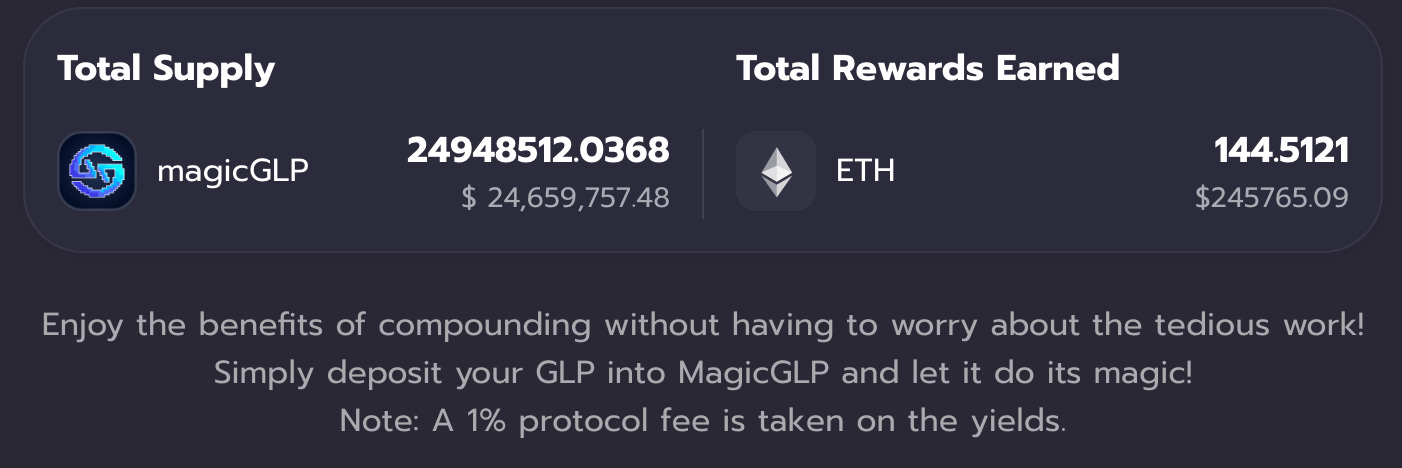

For example, Abracadabra Money is a leveraged and yield farming protocol with a GLP vault. On Abracadabra, users can deposit $GLP into their automated compounding vault, which automatically takes the earnings earned and puts them back into the protocol. Abracadabra charges a 1% fee to provide this service and has become one of the largest holders of staked GLP.

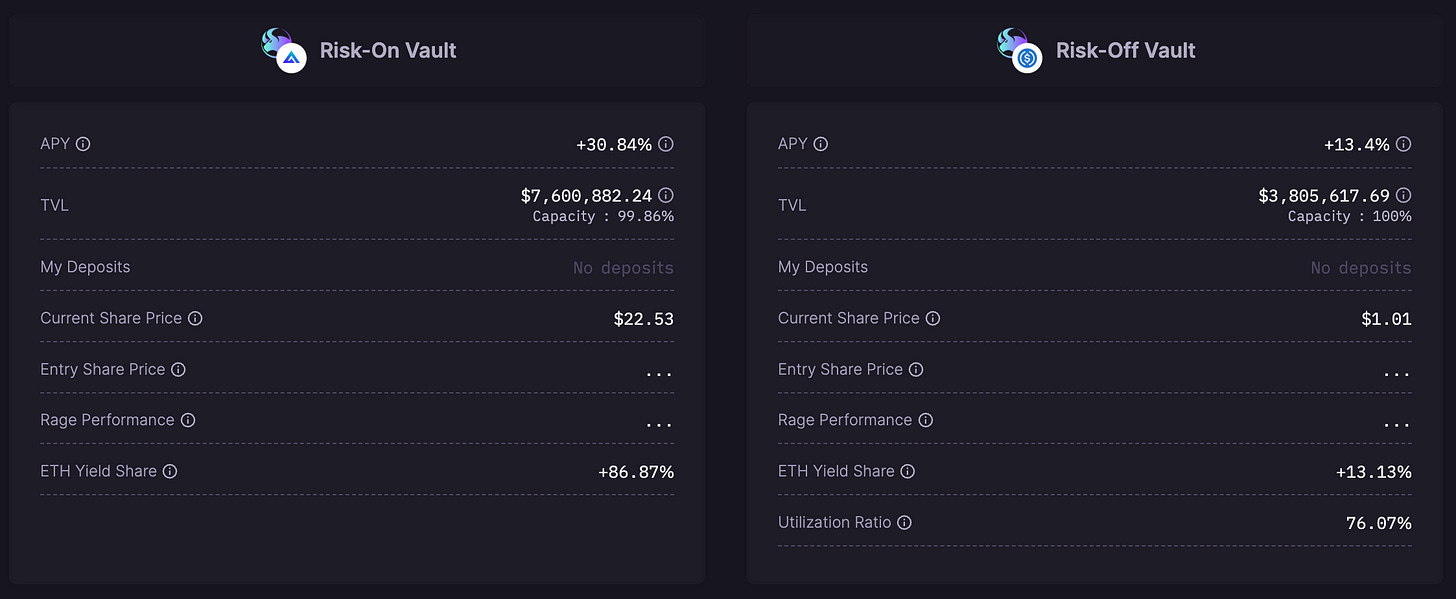

Rage Trade

Rage Trade offers a delta neutral vault for $GLP, allowing users to earn ETH while maintaining a delta neutral position. Rage Trade executed this strategy by shorting Aave and Uniswap, curbing price exposure to ETH and BTC. The combination of short positions and $GLP hedges the underlying assets in the $GLP index, so that users will not suffer impermanent losses on $GLP. Impermanent loss is a risk when participating in a Defi liquidity pool, and the profits obtained in the pool are lower than those obtained by directly holding assets. The Rage Trade key innovation essentially removes this risk in exchange for slightly lower yields.

STFX

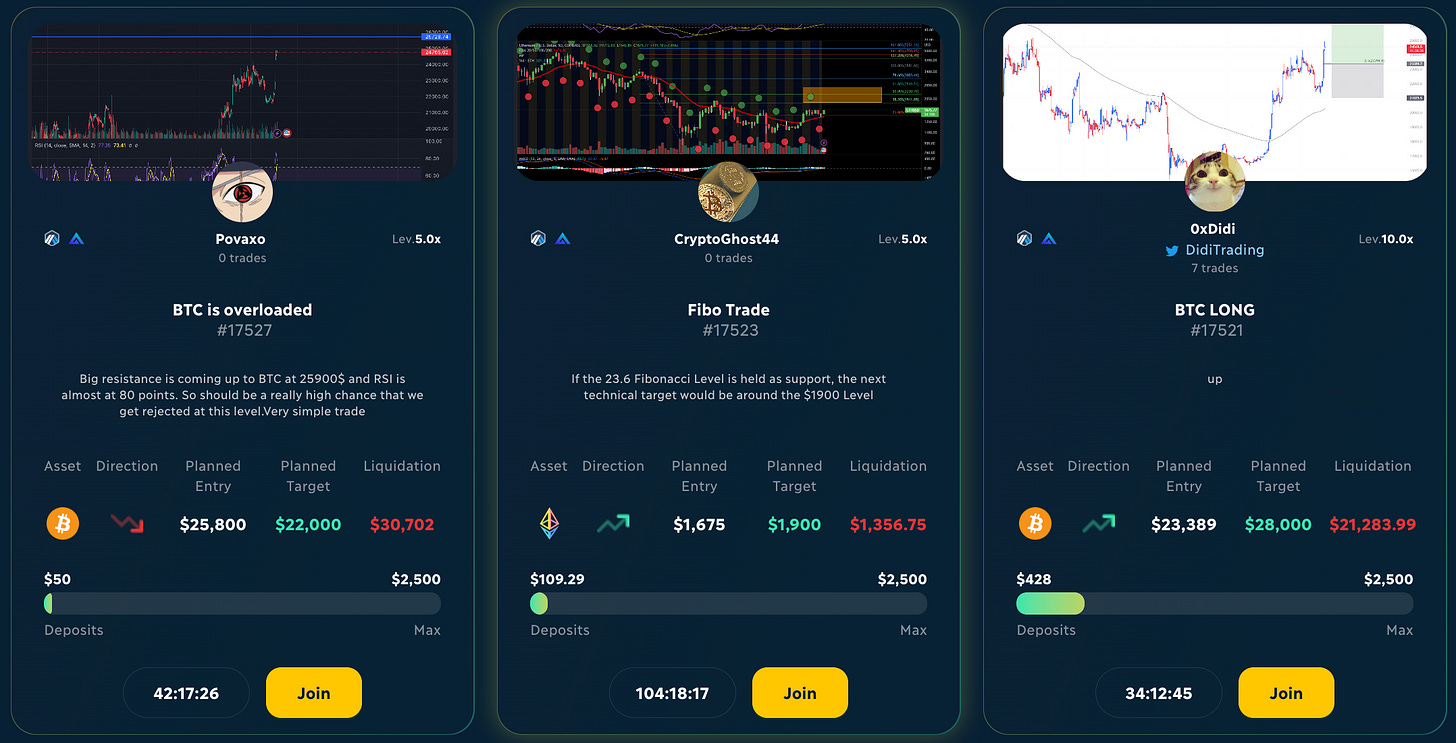

STFX provides users with copy trading services and is built on top of GMX. Users can join a peer-managed trading vault by depositing USDC, and the vault owner will open a crowdfunding position for the trading strategy. Treasury managers earn fees from successful trades, and the entire trading functionality is built entirely on GMX. Although the treasury manager uses the STFX interface, the trades are routed to GMX.

Summarize

At first glance, GMX is a perpetual transaction protocol, but in essence, the protocol provides developers with tools for creating new Defi primitives and external transaction service liquidity. Protocol services can be optimized and specified for specific users, eg how Abaracdabra, Rage Trade and STFX utilize GMX differently. GMX's ecosystem of supporting Dapps proves the value of DeFi composability and continues to expand.

GMX-based protocol

- Abracadabra : Algo Stablecoin Protocol with Auto-Compound$GLP Strategy

- Jones DAO : Option Yield and Strategy Library Using $GMX and $GLP

- Plutus DAO : Governance Token Blackhole, Exploit$GLP Vault

- GMD protocol : Smart Vault and Yield based on GMX

- MugenFinance : Real Yield Aggregator on LayerZero Leveraging $GLP

- RageTrade : Yield vault strategy protocol utilizing $GMX and $GLP

- Dopex : Options exchange on Arbitrum with GMX integration

- Umami finance : Delta Neutral vault strategy utilizing $GLP

- STFX : A social trading platform built on GMX

- Lyra : Optimism's native options trading protocol integrated with GMX on Arbitrum

- Buffer Finance : Exotic options trading platform, a pledge mechanism forked from GMX

- Tender financing : loan agreement with $GLP and $GMX collateral

- Rodeo Finance : Leveraged Yield Farming Strategies Using $GLP Vaults

- Perpy Finance : GMX-based social trading platform

- Vovo Finance : Earning Vault with $GLP strategy

- Beefy Finance : Multi-chain yield optimizer with $GLP vaults

- Stability Protocol : Stable Coin Stability Protocol Using $GLP Pool

- Vesta Finance : Stablecoin Protocol on Arbitrum with $GMX and $GLP Vaults

- Nitro Cartel, Arbitrove : Yield Index and Strategy Vault Using $GLP Vault

- Moremoney : Lending protocol on Avalanche with $GLP Vaults

- Demex : Cosmos Defi all-in-one DEX with automatic compounding $GLP Vault

- Steadefi : Optimizing Yield Strategies, 3x Leverage Long - 20232023202320232023-24- Vaults

- Sentiment : Lending and trading platform with $GLP treasury

- Neutra Finance : $GLP Delta neutral strategy

- Olive : Use the $GLP Real Earnings Strategy for the Vault

- Handlefi : Forex trading and lending protocol with ETH and BTC routed to GMX

- KostrenFinance : Yield Aggregator and Smart Vaults with $GMX and $GLP strategies

- Stardust : Yield aggregator based on GMX and $GLP

- Dsquared finance : Options-based Defi vault, integrated with GMX

- Edited, Pirex : Using the $GMX and $GLP Vault Auto Compound Return Strategy

- Puppet Finance : GMX-based social trading platform (coming soon)

- DappsOS : Defi Accessibility Mobile App with GMX Exchange Integration

- MUX : leveraged trading platform with GMX trading integration

- Yeti Finance : Avalanche Lending Protocol with $GLP Vault

- Yield Yak : Avalanche Defi Tool with Enhanced $GLP Farms

- Delta prime : Lending platform integrated with $GLP

reference source

https://stats.gmx.io/

https://docs.stfx.io/

https://cryptofees.info/

https://docs.rage.trade/

https://gmxio.gitbook.io/gmx/

https://defillama.com/chain/Arbitrum

https://dune.com/saulius/gmx-analytics

https://abracadabramoney.gitbook.io/learn

https://dune.com/shogun/gmx-analytics-arbitrum

https://dune.com/defimochi/definitive-glp-vaults-tracker

S/o @Helkem0 for the cool GMX logo used in the header banner

Editor in charge: Lynn