The Shanghai upgrade will unlock over $27 billion worth of ETH, which means the battle for the LSD market has begun, and they will revolve around offering the highest APR.

The question is, who will be the winner? It may come from the following 9 LSD protocols: 🧵 👇

Before officially starting, we need to understand the Ethereum Shanghai upgrade.

This is the first major upgrade of Ethereum after switching to PoS. It will launch the pledged ETH unlock function to help verify and secure the Ethereum network.

Ethereum validators have been staking their ETH since 2020 with nothing in return...until the Shanghai upgrade.

So where did the LSD platform come from? To become an Ethereum validator, you need up to 32 ETH. The LSD platform allows any amount of ETH to be pledged (for a fee, of course).

As a result, the incentive for everyday ETH holders to participate in staking will surge as rewards finally activate. The gold rush of the LSD platform is on, and the platform that can consistently provide the highest APR will win. Let's find out who might be 👇

Pendle

Pendle is probably my favorite LSD player.

Why? Pendle's TVL is almost double its market cap, with a massive inflow of assets after its V2 launch.

Pendle has created a unique tokenized yield strategy: Principal Token (PT) and Yield Token (YT). (Click here to learn more)

On the bright side, Pendle is now also available on Arbitrum thanks to @CamelotDEX.

They have strategic partnerships with other niche cities like @AuraFinance. This gives me confidence in:

• Team legitimacy

• Desire to provide an authentic, competitive product

stader

Stader will support Ethereum network staking and release ETHx , which will reduce the requirements for ETH nodes by 8 times (only 4 ETH is required). Importantly, they also require 0.4 ETH in Stader. That means tight supply and a great opportunity.

As @NagatoDharma pointed out, SD tokens are still 60% below their public sale price.

With a solid cap-to-TVL ratio, it's promising to see SD above $5.

Read Nagato's post for a comprehensive look at token economics/revenue.

Hord

Hord is completing an audit of hETH with the help of Zokyo as part of Dcentralab

They claim to achieve higher APR through several routes:

• ETH pledge

• MEV rewards

• Additional HORD awards

The price of hETH is not pegged to ETH due to additional rewards.

The Hord team has ambitious plans, but their location at Dcentralab means they have a strong development capability.

HORD has seen substantial growth, but its FDV is still below $20 million and its circulating market cap is $6 million.

Can they attract ETH holders?

Frax Finance

Frax Finance needs no introduction, with its LSD variant frxETH boasting a $170M TVL .

frxETH's TVL has grown 100x since last November, largely driven by its impressively high yield.

Bifrost

My interest in Bifrost was sparked by @Crypt0_Andrew and the ratio of TVL/MC (ETH Value Staked / Project Market Cap).

Now Bifrost's FDV is $7 million, 18,000 ETH is pledged , and the TVL/MC ratio is 4!

Bifrost is operated by the OG team from the Polkadot ecosystem, and the potential of BNC is worth looking forward to.

Shared Stake

SharedStake is the riskiest option I have from @CryptoShlug

where to learn about the project

16,000 ETH are pledged in SharedStake, but its market value is only $1 million. They optimize revenue (generating over 100ETH) by combining Ethereum staking with their own MEV bot.

StakeWise

StakeWise is another "safer" protocol that plans to enable v3 before the Shanghai upgrade. On paper, the protocol is undervalued, with a TVL of $140 million and a market cap of $40 million.

However, given SWISE's monthly inflation rate of 2% and FDV of $180m, its outlook is not so rosy.

Liquid Staking Derivatives

Liquid Staking Derivatives is an LSD aggregator, @iearnfinance competitor. They devised a clever flywheel for veLSD/LSD, I'd love to see it run, will it attract enough ETH ?

Liquid Staking Derivatives has a market cap of $2 million, and its earning potential is obvious to me, but proceed with caution.

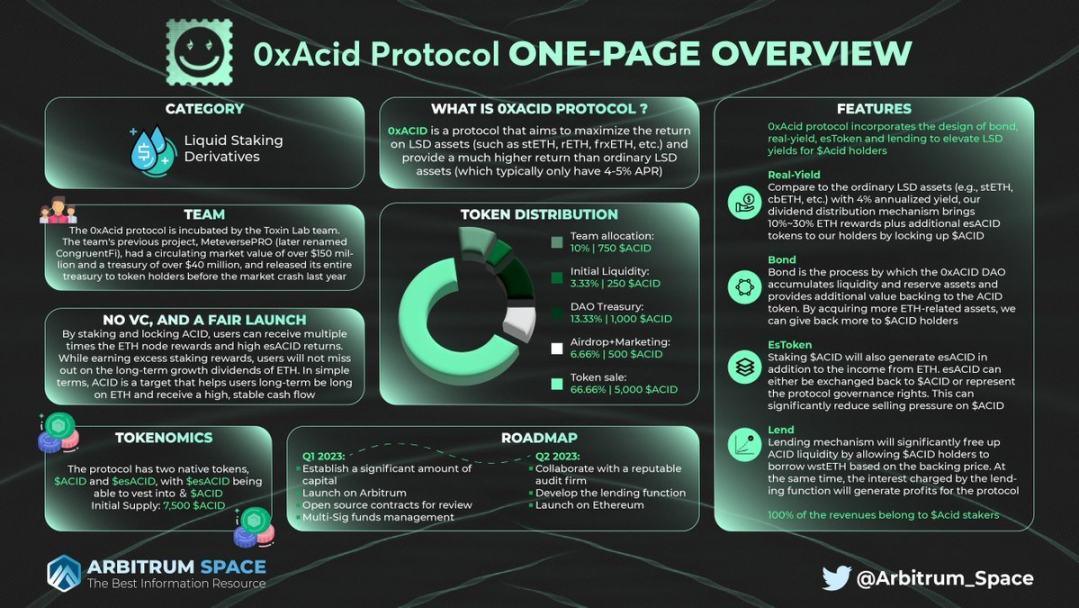

0xAcid Protocol

The last project is 0xAcid Protocol, an ambitious LSD protocol looking to raise 4,000 ETH, which I doubt.

0xAcid Protocol claims to maximize the return on LSD assets, which is the same as the aforementioned frxETH and stETH.

Finally, there are many protocols that I could not include but still have potential vying for LSD market share:

- $AURA

- $ YFI

- $FIS

- $RPL

- $DVT

- ...

Remember: anyone can label "build LSD protocol", be careful.

Who am I missing? 👇

For obvious reasons, I didn't mention Lido. It completely dominates the LSD market now, but I expect that to change as competition intensifies.