I will write an article about this prospect at the beginning of each month. Thank you for your attention, and I will not say too many polite words.

From my perspective, I will divide the events I am concerned about into four levels: S, A, B, and C, so as to make an ambush in advance. The article will present two sections of S-level and A-level.

S class

LSD

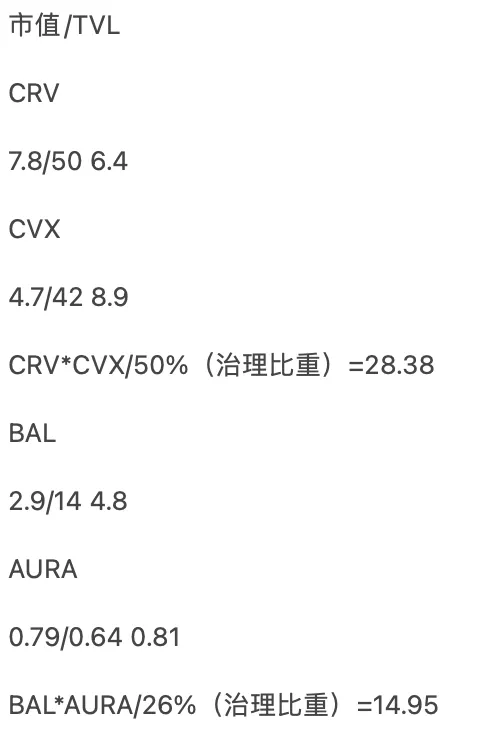

What is certain is that although the specific time for the upgrade of Ethereum Shanghai (probably April), the LSD trend should run through the subsequent development of ETH. In the article "LSD Matryoshka War Upgrade: Not only Liquidity, but also Pursuit of High Yield", I introduced three projects $YFI, $PENDLE and $AURA. To say that the most promising one should be $AURA, because $AURA will be the core of the future Balancer War. Compared with CRV/CVX, BAL/AURA is more efficient in bribery. I have explained the specific logic above. They are all considered as the third floor of the LSD building.

I did a simple calculation, $AURA. Not necessarily right.

The second layer of construction is those agreements that provide ETH pledge services, such as $Lido, $RPL, and $FXS, etc., which are equivalent to the fundamentals of pledge. I will pay attention to $SD, another project that is about to release a staking product.

The lowest-level application is $SSV, which is responsible for coordinating node operators.

I'll focus on the ones I mentioned - I won't rehash them as much has been said about LSD.

storage wind

Overall evaluation: It seems that the announcement of FEVM has pushed up the price of $FIL. I started to lay out $FIL in December last year. Facts have proved that if the car is laid out too early, it will be very bumpy. If it is not in stock, you may not be able to hold it. Fortunately I got it. $FIL will drive the arrival of the storage wind, and BNB has also launched storage-related products. Although decentralized storage is one of the important applications in the Web3 industry, at present, low adoption will limit its value discovery, and it is more driven by hot spots and hype.

FIL

The launch of FEVM was the biggest catalyst for $FIL. The introduction of FEVM will promote the plasticity of Filecoin in data storage - after all, the introduction of smart contracts. I am personally optimistic, but in essence, if you want to discover the value of $FIL, you also need the implementation of FEVM, the ecological agreement and the growth of TVL. At present, the rise of $FIL is actually a positive driver.

AR

Arweave will release version 2.6 on March 6. The new version restricts computationally intensive mining strategies, making Arweave mining more energy-efficient, and at the same time incentivizes miners to store more data, resulting in a more efficient storage market. With the arrival of the storage wind, $AR may also have room for hype.

BNB

BNB Greenfield also has nothing to say, it has released a white paper. Essentially, the reason it's mentioned here is that it's also a storage wind enabler. Therefore, many people will pay attention to projects related to BNB, such as $BLZ.

ZK

The main promoters of the Zk style are actually the market's expectations for the issuance of zk-rollup and the launch of Polygon ZkEVM. My main focus right now is the launch of the Polygon ZkEVM. Polygon ZkEVM will launch a testnet with audit next week, and the beta version mainnet will be released on March 27th. At this time, there will be two ideas. The first is to ambush Zk-related projects, such as the Zk project headed by $MINA, and $DUSK, $MUTE and so on.

The second idea is to ambush Polygon ecological projects, such as $GHST (Aavegotchi) and $QUICK. $GHST is an NFT game on Polygon, and $QUICK is the DEX with the highest TVL on Polygon. The other is NFT projects on Polygon, such as y00ts that migrated from Solana to Polygon. However, ZkEVM's catalyst for promoting NFT on Polygon is not as good as expected.

It is worth mentioning that the advantage of Aavegotchi ($GHST) is to close the bonding curve. The Aavegotchi Bonding Curve transaction closure will decouple GHST from DAI, which means that the fixed GHST supply becomes a free-floating token, and the token economics of the entire game will shift. The team also plans to do more empowerment for GHST, such as: plan to launch the Polygon PoS network licensing branch Gotchichain in 2023, and use GHST tokens as gas fees.

Just on March 1st, Aavegotchi officially issued a document announcing that with the successful passage of AGIP64 and AGIP65 (note: these two votes were pre-official off-chain votes on Snapshot), a discussion on shutting down will be launched on Aragon Official on-chain voting for GHST Bonding Curve and distribution of its internal DAI reserves. Voting is on March 8th.

Grade A

ATOM

Cosmos is about to undergo a Lambda upgrade on March 15th. This upgrade aims to activate the Cosmos Interchain Security (ICS) function, which is equivalent to giving more empowerment to $ATOM. Other application chains only need to pay fees (probably their native Token) and inflation rewards to Cosmos Hub validators, and $ATOM will undertake the verification (security) work of the corresponding chains for them. This is equivalent to the security of other application chains will be jointly maintained by $ATOM stakers.

For more interpretations of Cosmos 2.0, please read my article on September 27 last year: https://mp.weixin.qq.com/s/MbyVa27p_BC8HjCWpqeXwQ

People who know me will know that I liked Cosmos very much before, but judging from the current development situation, the competition Cosmos is facing is very fierce. This will limit the development of Cosmos - because the future value capture of $ATOM is based on the thriving Cosmos ecology. The addition of more and more application chains will greatly promote the value capture ability of $ATOM. However, fierce competition will reduce the target customers of Cosmos, which will weaken the value capture ability of $ATOM.

It should be noted that Paradigm unlocked a batch of $ATOM, which was unlocked on February 22, about 6 million.

Another thing worthy of attention is that dYdX is expected to launch the v4 version of the personal testnet at the end of March, which is to build the dYdX application chain on Cosmos. However, the security of the dYdX application chain should be guaranteed by $DYDX.

SNX

Synthetix has completed the v3 upgrade on February 23rd. The essence of v3 is to increase the amount of sUSD (such as staking other assets to mint sUSD-$SNX alone cannot effectively promote the growth of sUSD). As I mentioned before, the advantage of Synthetix is that giant whales can exchange large amounts of tokens (atomic swaps) in a nearly slip-free manner. The mechanism of this approach is to use sUSD as an intermediary. Increasing the number of sUSD can increase the transaction depth of Synthetix—that is to say, Synthetix is continuing to seize the DeFi market in this way. I still have the previous opinion, optimistic about $SNX.

For details, please read this article: https://foresightnews.pro/article/h5Detail/25820

STG

Two things in $STG that need your attention: the token swap on March 15th and the introduction of a new market maker, GSR. I'll keep an eye on it.

OKX brand building

OKX has done a good job in crisis public relations in the $Blur incident and $CELT incident recently. It is willing to give users enough compensation to gain popularity (build brand). Combined with the upcoming launch of OKBChain in Q1 and OKXChain’s adjustment of token economics (lower total supply of $OKT), I would focus on $OKB, $OKT and $CHE.

OP

Regarding $OP, my previous opinion is that although I like the governance structure of $OP, the FDV of $OP is too high, too many unlocks, and the OP ecology has been suppressed by Arbitrum, which led to my wrong judgment on $OP last year . In addition, this year is a great year for unlocking, which has also promoted the trend of many Token unlocking and rising shipments. Therefore, from a short-to-medium-term perspective and this trend, and $OP’s good catalyst and product promotion speed, it seems that it can have a good performance this year. I will add $OP to my watchlist for this year.

Next, I will list three catalysts that $OP deserves attention:

1. Coinbase announced the launch of Layer 2 based on OP Stack. This is something that has happened for a while, but it also shows that OP Stack technology is no longer a tool in the PUA market, but is about to land. I also expect more enterprises to start building on the OP Stack.

2. The Bedrock upgrade on March 15th.

3. The release of Ethereum EIP-4844 will have the opportunity to reduce the Layer2 Gas fee by 100 times, greatly optimize the Layer2 experience, and $OP will benefit from it (of course Arb will also, but it does not have Token). For specific information, please see: https://foresightnews.pro/article/detail/21638

But you also need to pay attention to some of the risks, for example, a giant whale is shorting $OP.

AI style

Crypto AI is a very metaphysical thing, mainly depends on the promotion of external events. Crypto AI has no fundamentals, and it mainly depends on hot events and narrative promotion. I would look at $AGIX and $FET.

game style

PRIME

Parallel ($PRIME) is a card game led by Paradigm and already launched on Coinbase, which includes the mechanism of Play2Earn. According to Paradigm's valuation of US$500 million and investment of US$50 million, the cost of holding coins for institutions should be around 4.5u, let's wait and see. I am going to play a specific game to see.

ILV

Illuvium is launching a new game called Beyond on March 7. In order to play the game, players need to purchase D1sk NFT: Standard D1sk and Mega D1sk. NFTs can also be used as Avatars in the player's Illuvium world (in Illuvium, Avatars are called Illuvtars). The game will be released on IMX.

GHST has been mentioned before, so I won’t repeat it.

And some old GamaFi, such as Xingshark and Raca, are offering relatively false benefits. I personally view it cautiously and will not participate.

Finally, the 312th anniversary is coming soon, so pay attention to market risks. I will try to reduce trading in the first half of March, and I am also reducing my position now.