Today I will introduce @NibiruChain, a project born with a "golden spoon" , a sovereign Layer 1 in the Cosmos ecosystem that focuses on Derivatives transactions.

Nibiru previously completed a seed round of financing of US$7.5 million, with a valuation of US$100 million. Lianchuang’s background includes Tribe Capital partners and Binance market makers. The strength of the team should not be underestimated.

Let’s look forward to whether it can become the biggest competitor of dYdX Chain in the future.

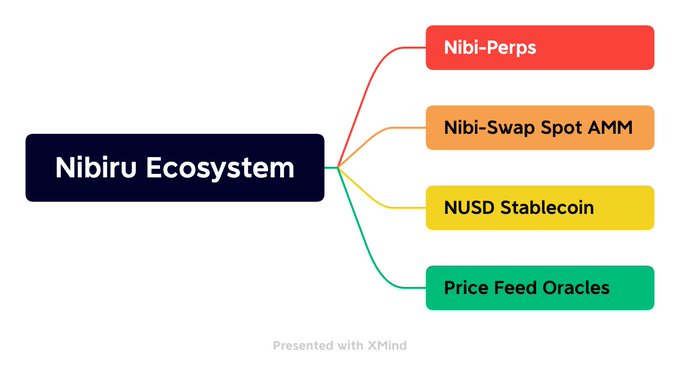

The Nibiru ecosystem consists of 4 core components:

Perpetual contract trading, AMM spot trading, $NUSD Stablecoin and oracles.

And Nibiru integrates CosmWasm, which supports the deployment of smart contracts in Go/Rust language. At the same time, it has been connected to IBC, and has realized inter-chain communication with 40+ Cosmos ecological sub-chains.

Nibi-Perps

At present, the vast majority of centralized contract exchanges are implemented based on off-chain Order-book, and Nibi-Perps provides fully decentralized on-chain contract transactions. A few features:

1) Both cross-margin (future) and isolated margin are supported;

2) $NIBI stakers have Perps governance rights (parameter changes/reward mechanism, etc.);

3) VIP service. Stakers of $NIBI can enjoy transaction fee discounts.

Early warning mechanism for black swan events

For contract transactions, extreme price fluctuations can have disastrous consequences for the agreement. Nibiru handles black swan events through the Ecosystem Fund (EF) and Treasury (Treasury).

Among them, the treasury is the last layer of guarantee mechanism to maintain the normal operation of the agreement. Initially, it is managed by multi-signatures of the core members of the team, and finally transitioned to be completely managed by the community.

EF

The initial supply of Ecosystem Fund EF comes from the allocation of tokens from the Genesis community. The later growth of EF reserves comes from 3 parts:

1) The transaction fee of the perpetual contract;

2) liquidation fees;

3) Capital investment income.

EF reserves are mainly used to balance the positions of long and short parties, and to compensate for bad debts that have not been liquidated in a timely manner.

Nibi-Swap

Nibiru's spot trading DEX, Nibi-Swap is one of the four core components independent of contract trading.

The Nibiru V1 architecture supports 2 different LP pool types: StableSwap pool and constant product pool. Nibiru's StableSwap is based on Curve and supports Stablecoin swap.

NUSD Stablecoin

Nibiru launched its own fully-collateralized Stablecoin$NUSD . The first collateral it supports is the Stablecoin $USDC .

Users mint NUSD by providing $NIBI and collateral (such as USDC), and the specific ratio of the two is determined by the collateral ratio (CR).

If CR= 70%, it means minting 100NUSD, the user needs to provide collateral equivalent to 70NUSD and NIBI equivalent to 30NUSD.

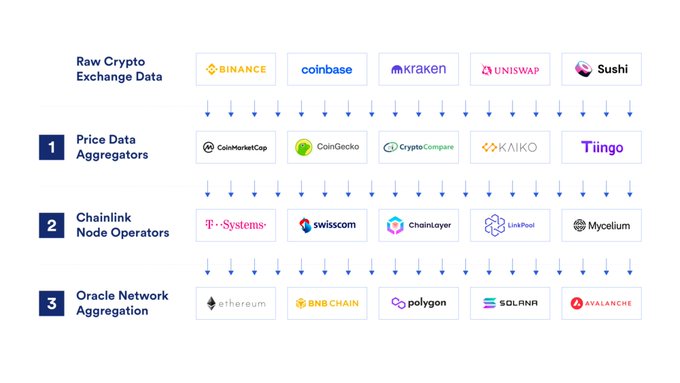

Oracle

Most blockchain networks use third-party oracle machines (such as Chainlink, Pyth, etc.) to feed asset prices. Nibiru has taken a different approach and developed its own decentralized oracle machine.

In the Nibiru network, the verifier node plays the role of the oracle.

The verifier (oracle machine) gives the price of the whitelists trading pair within a given voting period, and after the voting period ends, the weighted median of all prices within a certain range becomes the final price (exchange rate).

To put it simply, it means rewarding validators who provide "correct" prices, punishing validators who provide "wrong" prices, and ensuring the effectiveness of asset price feeds through the underlying economic incentive mechanism.

token economy

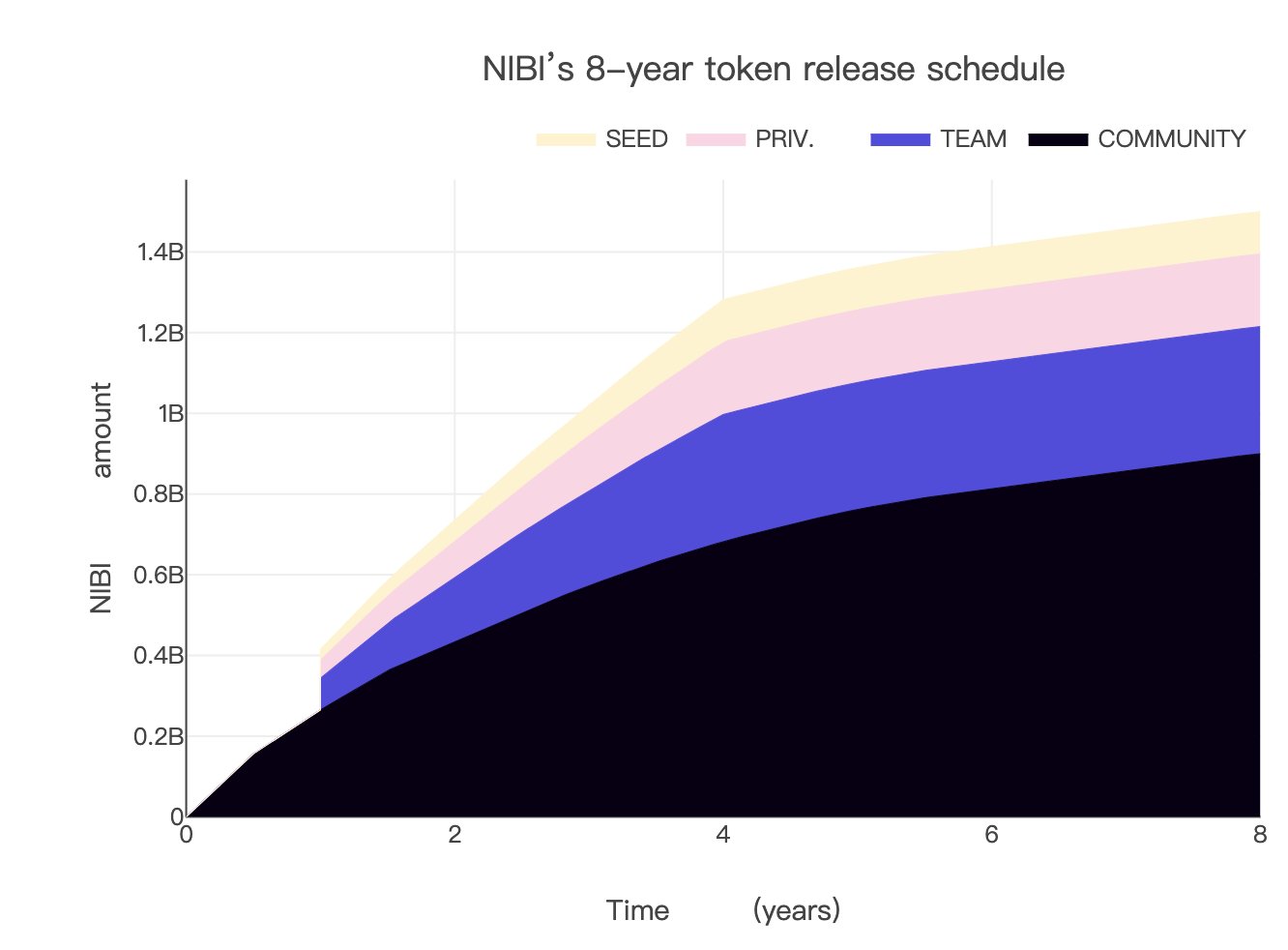

Nibiru will issue the native token$NIBI , with a total of 1.5 billion (Hard Cap), and the token supply will be released linearly in 8 years.

The final token distribution ratio is: community (60%), team (21%), private placement (10.5%), seed round (8.5%).

Incentivized Testnet

According to the official roadmap, Nibiru has launched multiple rounds of testnets (private testnet and 2 public testnets) as early as last year. Currently in the incentive testnet stage, the incentive testnet will last for 3 months from March to June.

To encourage participation in the testnet, please refer to @EthExploring 's tutorial:

Run the node:

https://mirror.xyz/exploring.eth/a3Ie1mQ5lbNz3VJCh9dd1CmXbhgxXF9hgLlwYbzHiOI… _ _

non-node:

https://mirror.xyz/exploring.eth/Z-K9MVYHJWzvsmLeYvguSMO7JysLpRnE4M_TvZ0-5ak… _ _