Last week, the Silicon Valley Bank thunderstorm had a major impact on the encryption industry, affecting many large Web3 venture capital companies and the second largest Stablecoin USDC. Affected by this, the encryption market fell across the board, with the total market value falling below the trillion-dollar mark, and Bitcoin (BTC) once fell below $20,000.

Silicon Valley Bank is one of the top 20 banks in the US, providing banking services to many technology startups and venture capital firms. According to a Castle Hill report, Web3 Ventures has a total of more than $6 billion in deposits with Silicon Valley Bank, including $2.85 billion from a16z, $1.72 billion from Paradigm and $560 million from Pantera Capital.

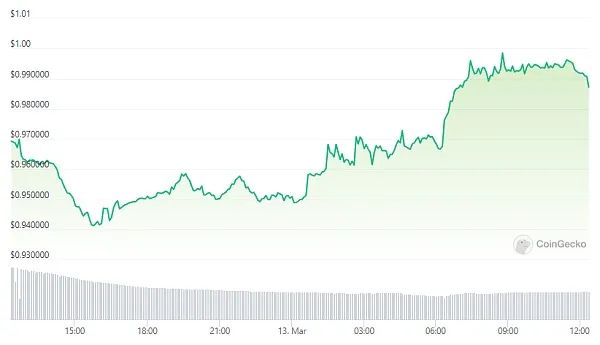

The Stablecoin USDC's issuer Circle confirmed that $3.3 billion of its $40 billion USDC reserves are stored in Silicon Valley Bank. Affected by this, USDC began to de-peg last weekend. Additionally, Circle also had an undisclosed deposit at crypto-friendly bank Silvergate, which went bankrupt at the same time. Following this, Coinbase and Binance announced the suspension of the conversion of USDC to US dollars and BUSD, which made USDC even worse and fell to a low of 0.87 US dollars.

However, the crisis appears to have been temporarily deflated as the Federal Reserve stepped in to act.

U.S. Treasury Secretary Janet Yellen, Federal Reserve Chair Jerome Powell, and Federal Deposit Insurance Corporation (FDIC) Chairman Martin Grunberg issued a joint statement:

Today, we are taking decisive action to protect the American economy by strengthening public confidence in our banking system. This step will ensure that the U.S. banking system continues to perform its vital role in protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.

After receiving advice from the FDIC and the Federal Reserve, and in consultation with the President, Treasury Secretary Yellen approved actions that would allow the FDIC to complete its resolution on SVB in a manner that adequately protects all depositors. From Monday, March 13, savers will have access to all their money. Any losses related to the SVB resolution will not be borne by taxpayers.

We also announced a similar systemic risk situation at Signature Bank of New York, which was closed today by the New York Department of Financial Services. All customers of the bank will get their deposits back. As with the SVB resolution, taxpayers will bear no losses.

Shareholders of Signature and certain unsecured obligors will not be protected. Senior managers were also removed from their posts. Any losses suffered by the deposit insurance fund to support uninsured depositors are covered by a special assessment of banks, as required by law.

Finally, the Fed announced that it will provide additional funding to eligible depository institutions to help ensure banks have the capacity to meet the needs of all depositors.

The U.S. banking system remains resilient and on solid footing, thanks in large part to reforms enacted after the financial crisis to ensure better banking security. These reforms, combined with today's actions, demonstrate our commitment to take the steps necessary to keep savers' savings safe.

1. Silicon Valley Bank depositors will have access to 'all' funds on Monday

Circle CEO Jeremy Allaire issued a statement:

We are pleased to see the U.S. government and financial regulators taking key steps to mitigate the risks posed by parts of the banking system. Deposits at Silicon Valley Bank are 100% safe and will open on Monday.

USDC reserves are also safe, and we will transfer deposits at Silicon Valley Bank to BNY Mellon. As previously mentioned, USDC Liquidity operations will resume tomorrow morning when banks open.

At the time of writing, USDC is back at $0.99, up 3.3% in the past 24 hours, almost regaining its peg.

While the broader crypto market also appeared to benefit from the news that “Silicon Valley Bank opens its doors Monday morning,” cryptocurrency prices surged across the board, with Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), Polygon (Matic) and Solana ( Assets such as SOL) are up 10.6%, 11.4%, 12.3%, 11.7% and 15.1% respectively in the past 24 hours. The total market capitalization of the crypto market is back above $1 trillion.

2. Signature Bank is closed

In the United States, there are only three crypto-friendly (undertake crypto business) banks, Silvergate, Signature, and Metropolitan.

As the only cryptocurrency bank with a 24/7 fiat currency and cryptocurrency exchange network (SEN), Silvergate suffered a bank run last week due to the thunder of FTX, one of the largest customers, the cryptocurrency exchange platform, and poor risk management. were not spared from the crisis.

In January of this year, Metropolitan Bank announced its withdrawal from the crypto industry due to regulatory pressure from Operation Chokepoint 2.0. (The original "Operation Chokepoint" campaign was a joint crackdown on companies deemed high-risk by U.S. regulators. By putting pressure on the banking industry to stop doing business with companies in specific industries, it completely marginalized the company. 2.0 is the crypto community A term coined to refer to all the financial regulators in the U.S. that have been attacking crypto businesses over the past few months and don’t seem to be interested in policing cryptocurrencies, but in shutting them down.)

That left Signature as the only viable option for most crypto firms last week, with many of Silvergate's top clients switching to the bank.

As we said in our article deconstructing the reasons for Silvergate's bankruptcy a few days ago, if Silvergate officially collapses, regulators and politicians will have the excuse of "crypto-threatening banking" to crack down on Signature and other remaining crypto-friendly banks.

The New York Department of Financial Services shut down Signature yesterday, citing “systemic risk” and “protecting depositors.” The FDIC was appointed receiver of the bank, guaranteeing full refunds of customers' deposits.

Coinbase tweeted that it had about $240 million in cash at Signature as of March 10, while noting that it expected to fully recover the funds.

Paxos, the issuer of the Stablecoin BUSD, said it currently has $250 million in cash at Signature Bank .

Circle has been processing USDC minting and redemption through Signature's SigNet network before. After the latter is closed, Circle will temporarily "rely on the settlement of Bank of New York Mellon" and reach a cooperation with Cross River Bank to provide USDC automatic minting and redemption Function.

Circle CEO Jeremy Allaire:

With the closure of Signature Bank announced tonight, we will not be able to process minting and redemption through SigNet and we will be relying on BNY Mellon for settlement. Additionally, we will soon be introducing a new transaction banking partner with automated minting and redemption capabilities. We are committed to building robust and automated USDC settlement and reserve operations with the highest quality and transparency.

(Tweeted at time of writing) Circle's USDC business will be open for business on Monday morning, including new automated settlements through our new partnership with Cross River Bank.

The "crisis" facing the encryption industry has not been resolved

In the previous article, we analyzed that it is not the optimal solution for encryption companies to abandon "Silvergate" and switch to "Signature".

First of all, for USDC and other crypto companies, there is no guarantee that other crypto-friendly banks can operate for a long time without being scrutinized and cracked down by regulators. Signature is a profound example. What's more, at the beginning of this year, many regulatory agencies such as the Federal Reserve have issued warnings to the banking industry about "cryptocurrency risks". This may cause the banking industry to lose "confidence" in the crypto industry, and may also have a knock-on effect on other financial institutions.

Second, a 24/7 fiat-to-crypto exchange network like SEN is necessary for the proper functioning of the crypto market, playing a vital role in facilitating the transfer of funds between large investors and crypto trading platforms. Without it, it is very difficult for institutions to enter and exit the crypto industry. What's more, without it, the flow of funds to banks is limited by business hours, which would be a disaster for the 24/7 crypto market.

Signature's SigNet network was one of the alternatives to SEN, but it went offline with Signature's shutdown. Last week, the CEO of cryptocurrency payments provider BCB Group announced that the company is researching an alternative to SEN and hopes to have it up and running by the second quarter of this year. It is expected to become the new major entry and exit channel between large investors and cryptocurrencies.

Taking advantage of the thrilling Silicon Valley Bank crisis, Circle CEO Allaire reiterated his Stablecoin"vision":

We have long advocated for full-reserve digital currency banking, insulating the base layer of our "internet money" and payment systems from the risks of fractional-reserve banking.

In fact, the Stablecoin Act remains a very active pursuit in Congress, and it would enshrine in law a system under which Stablecoin funds would be held as cash at the Federal Reserve and in short-term Treasury bills. We need this law now more than ever if we want a truly safe financial system.