Aurora, a researcher at leading crypto venture capital capital, recently analyzed on Twitter the crypto market maker Wintermute’s market-making strategy for OP and Ape tokens. Forecasting the future price trend, it is believed that Blur will break through new highs again after a low price consolidation.

Let’s review the market-making strategy of $BLUR, which was popular a while ago. Everyone knows that the market-maker of $BLUR is @wintermute_t , and he is also the market-maker of $ OP and $ Ape , so in theory, as long as research Through the previous trend of $ OP and $ Ape , the currency price of $BLUR is predictable #Blur #Optimism #ApeCoin #Layer2 #Crypto

— Aurora (@AuroraWantMoney) March 8, 2023

Wintermute Market Making Strategy Analysis: Ape

First, observe the past transaction records of Ape (boring ape ecological token). The transaction date of Ape was 3/17 last year, and the project earlier than 3/4 Ape facilitated the transfer of 1.75 million Ape to Wintermute’s multi-signature wallet , and conduct the same transaction again on 3/18.

On 3/16, the day before Ape went live, the Ape of the Wintermute multi-signature wallet was transferred to the address marked as Wintermute 1 , and then sent to multiple centralized exchanges (KuCoin, Binance, Coinbase, etc.) through the address 0x0000f079e .

Aurora speculated that Wintermute’s behavior was to sell at a high price at the opening of the exchange, and then receive the sold chips and token AirDrop at a relatively low price on Uniswap to stabilize the price in the market.

In the next period of time, Wintermute bought low and sold high for market-making behavior among exchanges. While maintaining a certain amount of Ape in hand, it also accumulated a large amount of income through market-making and selling at the opening.

It can be clearly seen from the token balance of the Wintermute 1 address that most of the Ape were sold at the opening of the market, and only maintained a quantity of about 100,000. Before the Ape broke a new high at the end of April, Wintermute began to accumulate more Put up chips until the price breaks through and sell in large quantities.

Since then, Wintermute has gradually reduced its holdings of tokens until June, when it completely withdrew from the Ape market with a lot of profits.

Wintermute Market Making Strategy Analysis: OP

Then turn your attention to OP (L2 expansion plan Optimism token), which was launched on June 1 last year. Although the Wintermute team had technical problems, the 20 million OP sent by the Optimism project party was obtained by hackers and caused panic sexual selling.

However, Wintermute obtained an emergency additional 20 million coins before the OP was launched, and sent them to multiple centralized exchanges through the address 0x51d3a , so that they had time to sell at a high price after the market opened.

(Related article: Optimism AirDrop package stolen, use 20 million OP to learn smart contract instructions )

After the OP price fell, after a period of emotional silence, and Wintermute also absorbed chips in the market, the OP price broke through a new high in early August last year. The difference is that in this case, Aurora found that Wintermute did not make a selling action, and there are hundreds of thousands of OP in multiple addresses controlled by Wintermute ( 0x43c5b1 , 0xc8373c , 0xf491dz ).

After OP broke new highs last year, although the price gradually fell and went through a long period of consolidation, but in the case of Wintermute not selling (currently still holding hundreds of thousands of OP), it can be seen that OP is experiencing the third wave of rising .

For the above two trends, Aurora divides the Wintermute market-making technique into 4 stages, which are summarized as follows:

- Sell at opening high

- Get back the chips at a low price

- new high again

- Sell or continue to hold, if you continue to hold, there may be another wave of upsurge

What will be the trend of BLUR?

Based on the above case, we can predict whether the price of BLUR is expected to reach a new high.

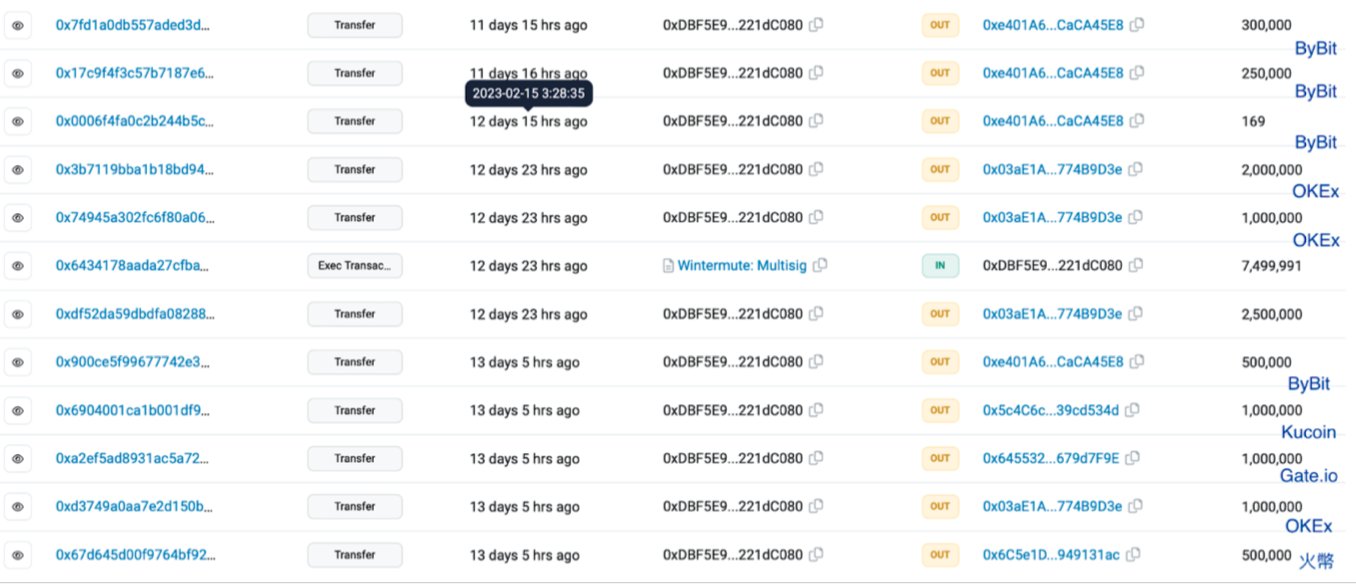

The transaction launch date of BLUR was 2/15 last year, which is the same as Ape and OP . Wintermute received tokens from the Blur project party the day before and transferred them to address 0xDBF5E9c .

Through this address, Wintermute then transfers BLUR to multiple centralized exchanges. Aurora said that this period also belongs to phase 1, and Wintermute sells when the buying price is high.

After a few days, Wintermute received low-priced BLUR from multiple centralized exchanges and transferred it back to the original address (0xDBF5E9c). Aurora believes that this belongs to stage 2, which is the low-priced fundraising Behavior.

From the number of tokens held at this address, we can observe the relevant behavior more clearly. After the initial sell-off, the number of tokens held dropped significantly. Wintermute continued to increase its holdings of chips through the profits earned from the sell-off, and maintained it at 10 million above quantity.

Regarding Wintermute's choice to continue to hold rather than sell, Aurora believes that judging from Wintermute's past operating methods, Blur is expected to break through a new high after a low price consolidation, which is stage 3.

Note: The number of BLUR holdings at address 0xDBF5E9c dropped sharply on 3/9, and most of them were transferred to address 0x988aCE (the multi-signature address of the Blur project party) . This address has accumulatively held about 290 million BLUR since BLUR went online, and there is no record of any sale. Currently, the possibility of a large number of sell-offs is ruled out.

However, although BLUR is expected to break through to new highs in the future, BLUR is still in a downward trend, and it is uncertain how long the low-price consolidation will last. Funding risks must be controlled. In addition, the token properties and application scenarios of Ape and BLUR are different. In addition to market makers, other factors that will affect price fluctuations need to be considered.