The $ARB airdrop might be one of the hottest airdrops of the year. But how will it change in price compared to previous large airdrops?

In this article, I compared $ARB with $UNI, $OP, and $1INCH and got some interesting results!

01Total Token Allocation

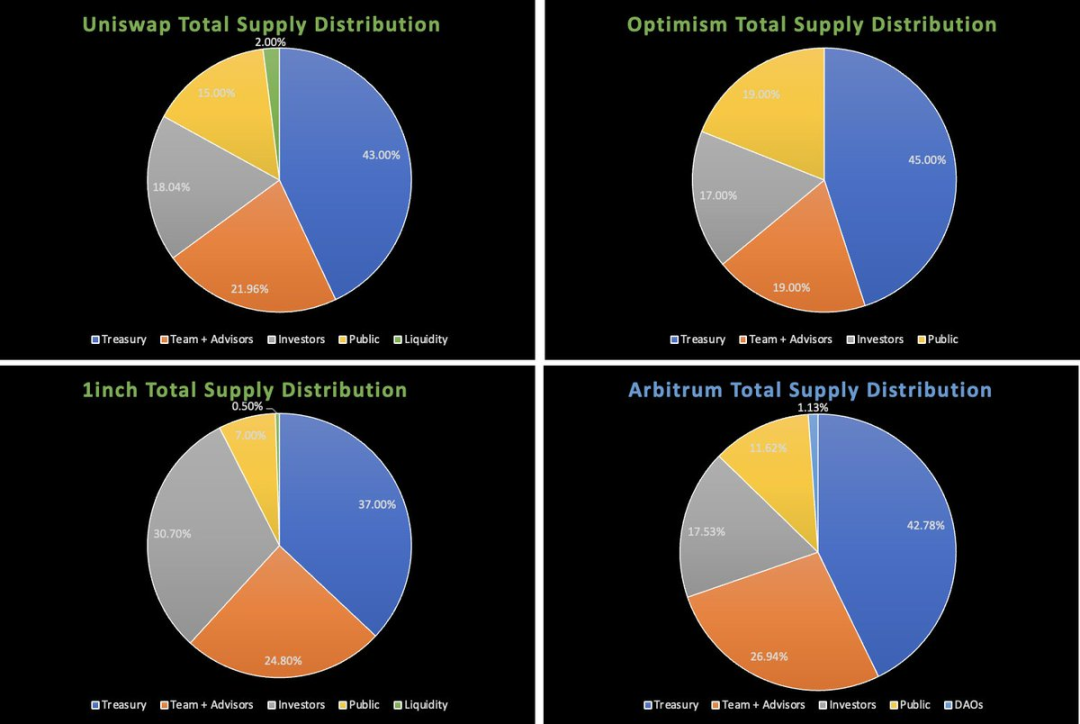

Let’s start with a comparison of total token distribution, here I have combined some categories for a fairer like-for-like comparison.

We can draw several observations from this:

- The $ARB airdrop percentage is slightly higher. (Note that $OP has only distributed about 1/3 of its airdrop allocation so far)

- Team + investor distribution ratio $UNI and $OP higher, but lower than $1INCH

- Allocation of treasury on par with peers

Full form:

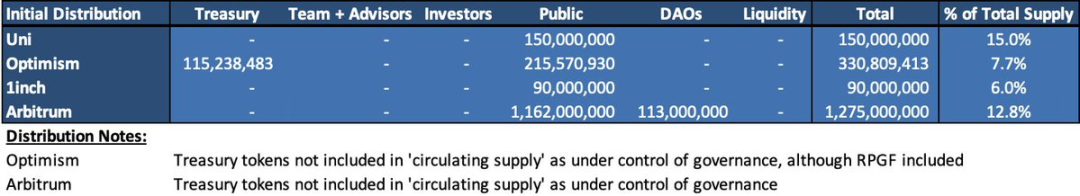

02Initial token distribution

In addition to the total token distribution, a comparison of the initial supply distribution also helps gauge initial sell pressure. The initial supply of $ARB is at a high level, similar to $UNI.

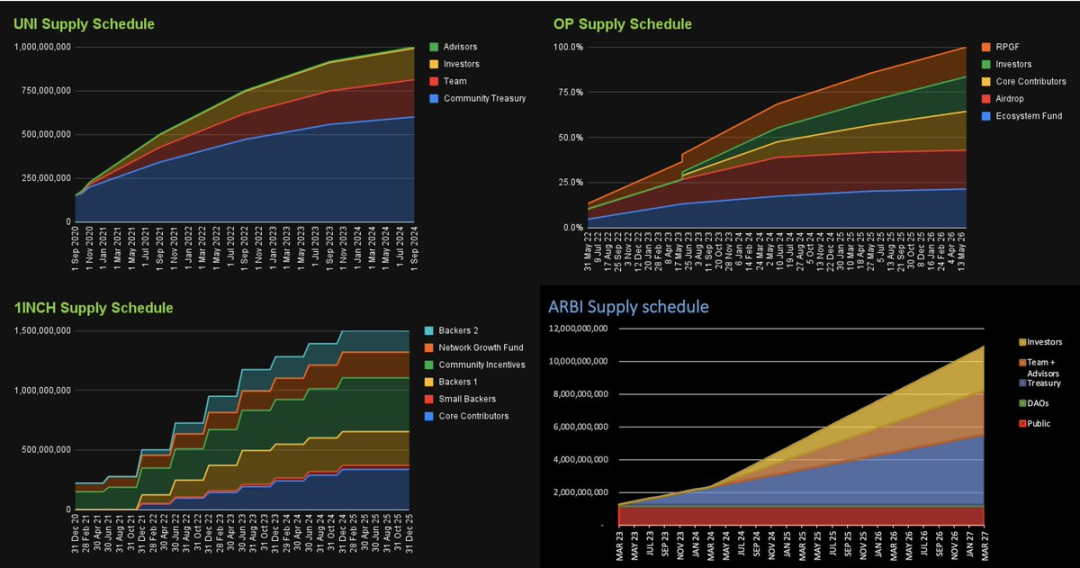

03 token unlock

The initial distribution and total distribution of tokens are only part of the data, while the unlocking schedule of tokens helps to understand the relative distribution rate of tokens and where they come from.

Note that the unlocks for $UNI, $OP, and $1INCH are all from @coingecko's data.

Compared to its peers, $ARB’s token unlocking schedule looks relatively smooth, especially in its first year.

Please note that here I assume that the treasury of $ARB is linearly unlocked (this assumption is similar to CG and TokenTerminal, these institutions usually use linear unlocking methods to calculate the issuance of tokens), if there is no such linear unlocking way, then there will not be any $ARB tokens issued in the first year.

(Translator's Note: If there is no linear unlocking, the tokens will be locked for a period of time and cannot be released. In this case, the issuance of tokens will be postponed until after the start of the token unlocking period. And if the linear unlocking method is adopted , the issuance of tokens will be evenly distributed during the unlocking period, so that the circulation of tokens will gradually increase.)

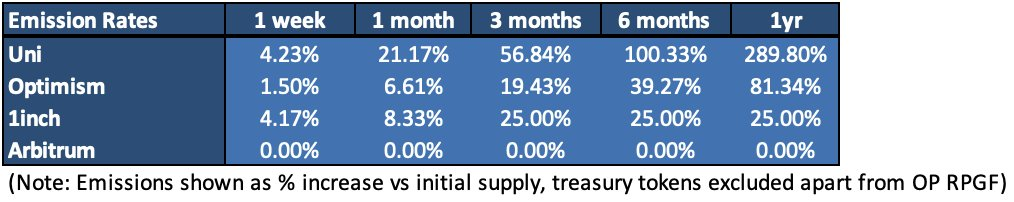

04 Distribution rate

Below is a comparison of short-term distribution rates (excluding treasuries controlled by DAOs), which clearly shows the huge difference in distribution rates between different projects. This has major implications for how users should participate in airdrops, which I'll get to later.

05Initial price fluctuations

The last part is the initial airdrop price fluctuation. Let's take a look at the price trend of UNI, OP and 1INCH as the control group after the airdrop is issued. (Graph courtesy of @coingecko)

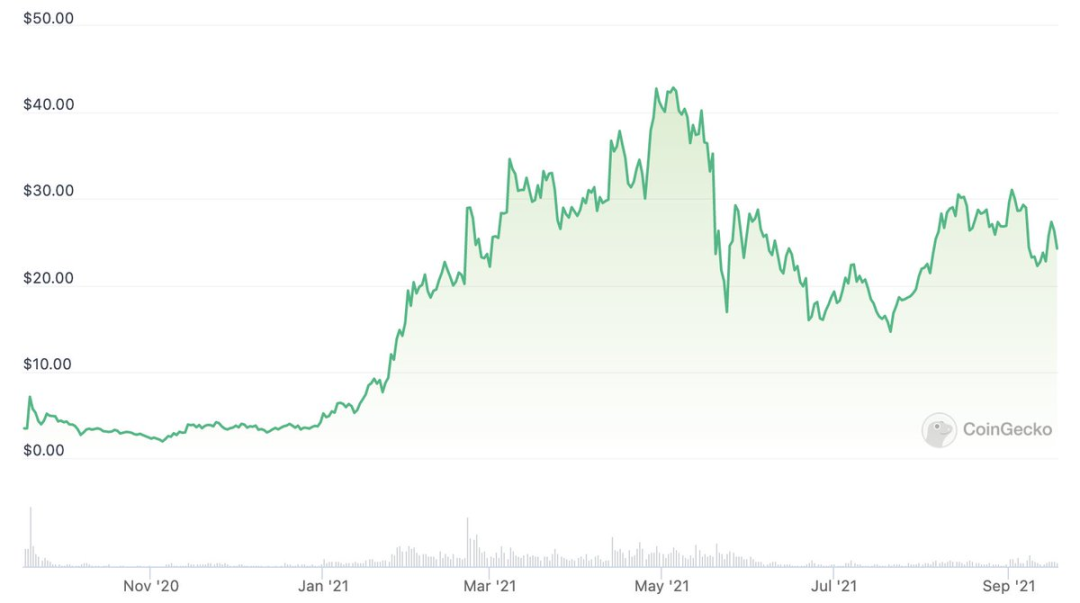

$UNI

Because of the high initial supply and no team/investor token cliff period, UNI's initial distribution rate is the highest among these few projects. This resulted in some initial selling pressure, but then the price rose more than 10x, and of course perfect market timing also helped.

(Translator's Note: The token cliff period means that during this period, the team and investors cannot immediately sell or trade their allocated shares or tokens. After this period, the shares or tokens will be gradually released, and holders can Make a transaction. Designed to incentivize teams and investors to participate in the project for the long term and prevent them from immediately selling their stake or tokens.)

$OP

While OP has a low initial supply, this is offset by its relatively high issuance and bear market listings, so prices are not ideal to begin with.

Still, it recovered relatively quickly from the initial dip before falling during the crypto winter before hitting new all-time highs.

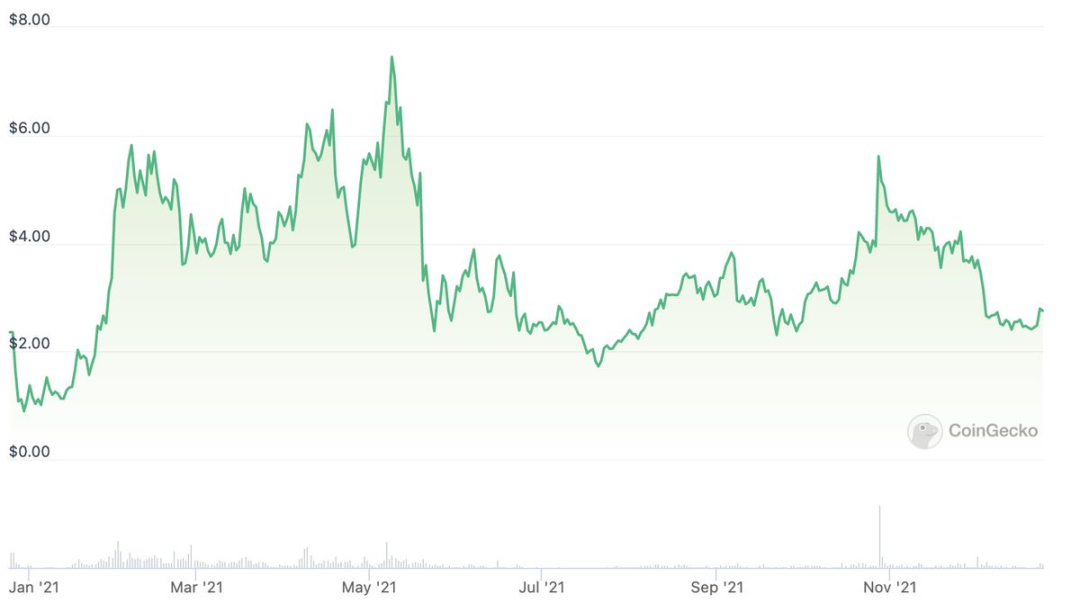

$1INCH

1INCH has the lowest percentage of initial supply and relatively low issuance. Therefore, after the initial decline, 1INCH quickly recovered and started a sharp rise. Also, market timing is important here.

06 Fundamentals

In terms of Arbitrum's fundamentals, Arbitrum One has attracted considerable locked value and transaction volume, becoming a specialized field of financial application chains (similar to $GMX, $GNS and $RDNT).

It is one of the few profitable chains (data source: @tokenterminal) and is still in its early stages.

07 Conclusion

From the above analysis, it can be seen that buying these airdrop tokens when their prices fall is profitable. However, timing the bottom is not easy.

For $ARB, there are three additional considerations:

- relatively high initial circulation

- But in subsequent year token releases, emissions are lower

- The cycle of the market

Considering the above factors, especially the good fundamentals of $ARB, I intend to continue to hold my $ARB airdrop. In addition, if the token price drops after the airdrop is released, then I will buy it in batches. Because according to the above analysis, I predict that $ARB will quickly recover the price and achieve multiple returns.

After the initial sell-off, there really aren't any significant sources of selling pressure, at least for the first year, so I feel comfortable with this strategy.

Of course, it all depends on the initial pricing of $ARB, but I expect market forces to play a role here.

Don’t overlook the impact of strong price action at initial launch on tokens across the ecosystem , the impact may spread over time, and I expect this effect to help drive the ecosystem as a whole.

What do you think the initial price of $ARB will be? Welcome to add the little assistant WeChat Biteye01 to join the community and discuss with us.