Arbitrage trading is increasing compared to other MEV types, and DeFi users should remain vigilant to prevent arbitrage bots from causing dire and poor results in the future.

Original: Catching Up On MEV

By Benny Attar

Compiled by: Peng SUN, Foresight News

Cover: MEV

Four months ago, I published " The Four Quadrants of MEV Protection ", discussing different approaches to solving the MEV dilemma. However, a lot has changed in the MEV space over the past few months. Therefore, I think it is necessary to re-examine many key events in this field and analyze some current problems and views of MEV.

If you are not familiar with Maximum Extractable Value (MEV), I suggest you read the previous report. In order to save time, this article assumes that readers are proficient in MEV and DeFi knowledge. Unless otherwise mentioned, this article assumes that the data and news mentioned are about the Ethereum network, which is the main venue for MEV arbitrage bot activity.

1. Flashbots: SUAVE

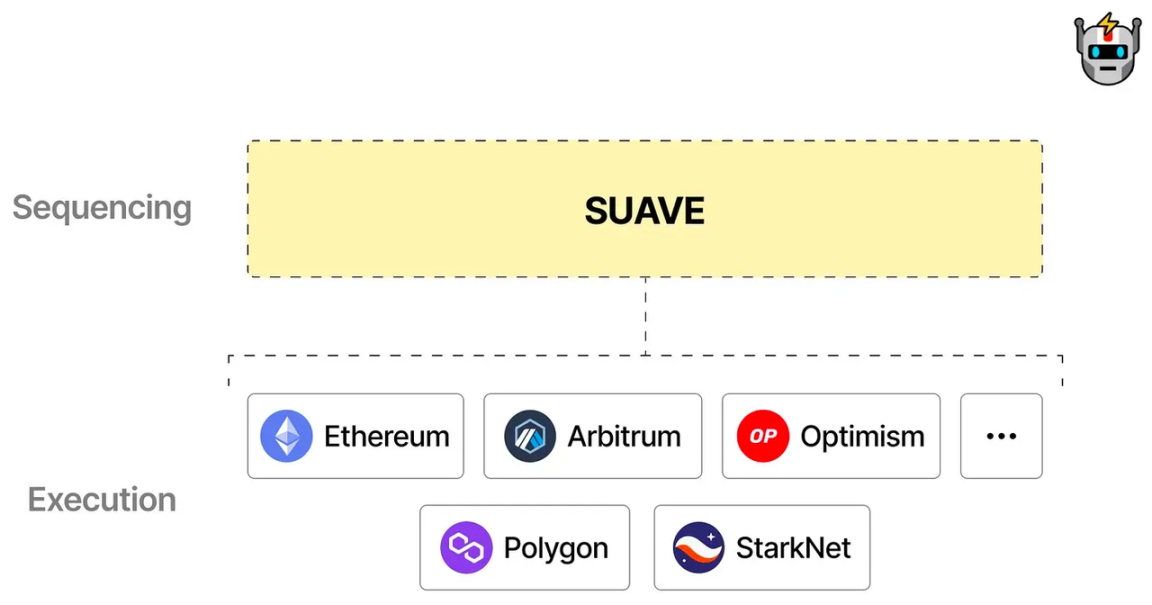

As early as October 15, 2022, Flashbots announced at Devcon in Bogota, Colombia that it has been developing a new solution called "SUAVE" for the past year, which is called "Single Unified Auction for Value Expression" (the Single Unified Auction for Value Expression). According to a presentation slide from Devcon, the software will be a fully decentralized block builder that will be open-source and EVM-compatible with support across multiple chains. Now that SUAVE has been announced, it is necessary to analyze and understand how it works, because it is likely to become the leader in the field of MEV protection.

Although Flashbots has made great achievements in MEV-Boost and MEV-Protect , there are still hidden concerns about the centralization of block construction, mainly Exclusive Orderflow (EOF) and cross-domain MEV (Cross-domain MEV). So Flashbots announced SUAVE. When Flashbots designed it, there were three main value considerations:

- Relieve pressure from exclusive order flow;

- Relieve the pressure from cross-domain MEV - which means that cross-chain block builders must integrate with each other in an open, permissionless and trustless manner;

- The combination of 1 and 2 must itself be decentralized.

In fact, SUAVE is a plug-and-play Mempool and decentralized block builder for all blockchains.

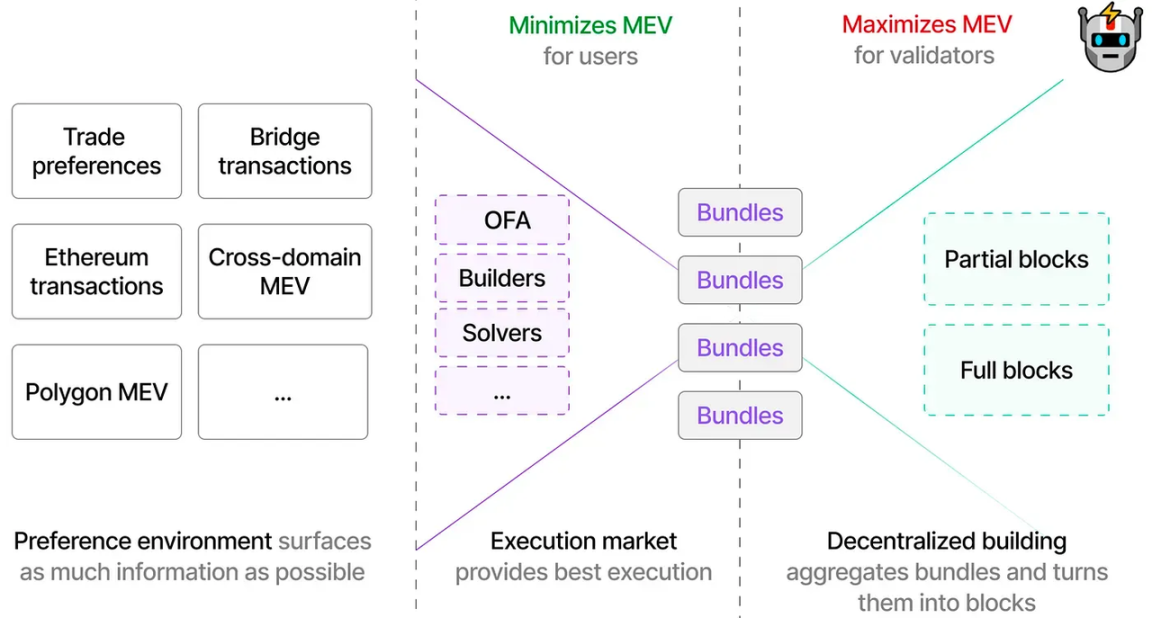

The SUAVE blockchain includes three main components: Preference Environment, Execution Market and Decentralized Block Building. SUAVE is an EVM-compatible chain that provides the infrastructure for the above components to interact in a decentralized manner. These three parts minimize the MEV problems described above:

- The preference environment solves the cross-domain MEV dilemma by exposing as much information as possible in the form of each chain and order flow, and minimizing the information gap for all builders.

- Execution marketplaces solve the exclusive order flow problem by allowing executors to compete for the best execution preferred by users. By maximizing competition, anyone can become an executor (builder, RPC service provider, solver) and return the most MEV to users.

- Finally, decentralized block construction creates a spirit of cooperation among builders by integrating the output of the preference environment and the execution market. Compared to having only one builder build blocks, this function will package the Bundle obtained from the previous step to build blocks.

For a more in-depth understanding of SUAVE, please read " IOSG Explains SUAVE: A New Decade of MEV Scale Growth ". Overall, SUAVE is very exciting as it will create a new paradigm in the MEV space. Compared with the previous centralized model, a new era of balanced competition and MEV fairness has arrived.

2. Other developments of Flashbots

In addition to SUAVE, Flashbots and its ecosystem partners have recently announced various other features and products dedicated to MEV protection. Just recently , MEV-Boost daily payments hit an all-time high with 7,691 ETH paid out to MEV-Boost proposers, nearly double the previous all-time high. Nearly 95% of the blocks that day were also MEV-Boosted blocks. Additionally, the announcement that MEV-Share, built on top of MEV-Boost, should help users and applications receive MEV created by their transactions, while bringing additional benefits and profits to searchers and block builders.

Always at the forefront of MEV protection, Flashbots' focus is critical to understanding the industry's key issues and directions, and they are key players in nearly every type of MEV protection project .

3. What else happened at the consensus layer?

In addition to Flashbots, there have been various other unexpected developments in the consensus layer. Therefore, this section aims to give a quick overview of some recent innovations and discussions.

(1) Block construction

First of all, the most interesting discussion for every MEV enthusiast is what to do next in Ethereum block building. Block building refers to the way of building blocks externally through MEV-Boost, which separates block builders from validators. While initially (just after the merger) almost entirely dominated by Flashbots, block building has gradually become decentralized and Flashbots now only account for around 20% of the block building market.

The question that remains is what is the future of block building? A recent report from Frontier Research came up with several really cool ideas for block builders to bundle other products, or even start offering services. By bundling other products, innovations can be made in terms of gas friction, transaction execution, and even runtime monitoring to ensure transactions with expected outcomes are included in blocks. By starting to provide services as an abstractor, there will be integration and internal products with cross-chain future, block customization, and various MEV smoothing solutions.

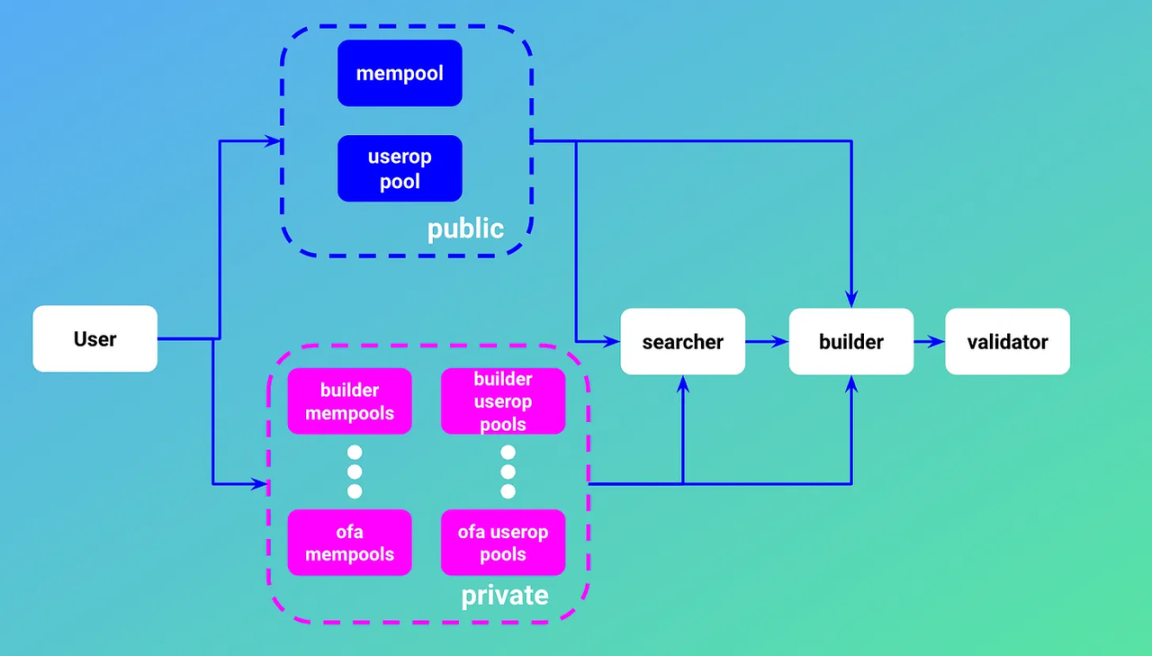

(2) Memory pool

There is also a discussion about how we think about memory pools, and how to make them more efficient. Mempools are often the root of all MEV conflicts and have been a sensitive and complex topic for most of the blockchain community. While encrypted mempools appear at first glance to be a potential approach to MEV smoothing, there are actually many other issues to be addressed. Jon Charonneau does a great job explaining encrypted mempools in this post . For a simpler explanation, you can read this tweet .

A hot topic right now about mempools is ERC-4337 . While primarily abstracted around accounts , the main feature of ERC-4337 is that users are now able to interact on an alternate mempool of "user actions". Further reading on next steps for MEV supply chains using ERC-4337 can be found in this post .

(3) Sei divides MEVs with different externalities

In simple terms, some blockchains try to be specialized and functional blockchains. One of them is Sei, a Layer1 blockchain dedicated to transactions. Although specific function chains won't be discussed until later, Sei has a pretty good approach to MEV. As we've discussed many times, MEV is both good and bad. Frontrunning and verifier-level MEV are clearly not beneficial to the blockchain, while arbitrage and liquidation MEV can bring meaningful results from another aspect. Sei is aware of this, so instead of eliminating MEV entirely, they approach the problem in two different ways. To get the most out of good MEV, Sei is using an "off-chain Flashbots-like auction". While that's funny in its own right, the way Sei handles bad MEV is pretty good. Sei uses a frequent batch auction format with an advanced, fully native order matching engine (OME) that aggregates every market order after block packaging, and then executes all orders at the same unified settlement price. This means everyone in the block (about 450 milliseconds) gets the same price regardless of transaction order. Sei's approach is to divide different forms of MEV and deal with them separately, hoping that other blockchains and applications can also try this method.

(4) Skip Protocol

One of my favorite defensive MEVs is Skip Protocol , the infrastructure builder for the Cosmos Ecological Sovereign Blockchain. The project has quite a few products, including Skip Select (a blockchain auction system that allows searchers to capture MEV), Skip Secure (a private RPC endpoint that allows private transactions from anyone who adds it to their wallet). Recently, Skip Protocol launched ProtoRev , an on-chain module on Osmosis that immediately rollbacks transactions upon execution, thereby capturing this MEV and sharing it with users.

However, Skip Protocol recently announced that it is working on Protocol-Owned Builders (POB), which is its counter to Ethereum's Proposer-Builder Separation (PBS) plan. By implementing POB, it will prevent builder centralization by minimizing private order flow, and will remove complete reliance on off-chain builders. All MEV recapture will be done within the protocol and will allow for fully customizable mempools and preferences on the blockchain.

(5) Two applications of MEV protection

The article " The Four Quadrants of MEV Protection " discusses two forms of MEV protection: offensive on-chain protection and defensive on-chain protection. Since then, two applications have caught my attention.

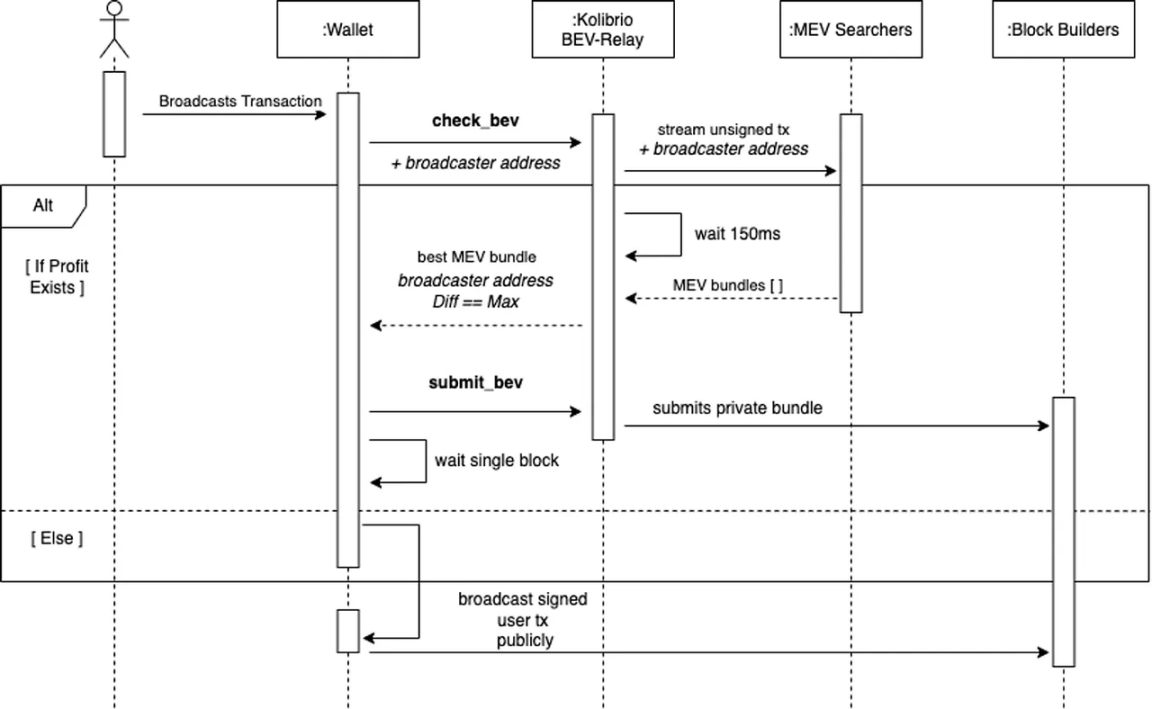

The first app that caught my attention was Kolibrio , the first BEV (Broadcaster Extractable Value) relay. By allowing transaction broadcasters (node providers, wallets, cross-chain bridges, and even future Dapp and protocols) to own the order flow they create themselves, and earn revenue from it. Without going into too much detail, the Kolibrio BEV relay checks every transaction for potential MEV profit before it appears in the public mempool. If there is MEV profit, then the transaction will be delayed by a block or so, while the transaction will be privately mined as a MEV bundle.

My hope is that this new type of relay can redistribute MEV profits and further the democratization trend of MEV. If you want to learn more about Kolibrio BEV relay, you can read this document .

Another useful application is PropellerHeads . While there is very little public information about how the project's StabilityKeepers work, its deployment on zkSync is certainly notable. Additionally, there has been no opportunity to invest in MEV robots in the blockchain space, or frankly in any alternative asset space. I think this is unique (not financial advice) and hopefully PropellerHeads will publish more information about how Keeper works soon.

4. Other MEV events

Recently, an article in the Flashbots community " Decentralized Cryptocurrency Needs You: Be a Geographic Decentralization Maximalist " believes that both technical decentralization and geographical decentralization are important, and the latter can prevent the A region or its regulation creates bias and creates a truly global system. While this is not so applicable in MEV discussions, the " MEV on Ethereum: A Policy Analysis " paper mentions geographic decentralization. Mikolaj Barczentewicz believes that if states eventually start outlawing or enacting unfriendly policies for MEV searchers and verifiers, they will choose more permissive jurisdictions, and geographical decentralization will be difficult to achieve. In any case, the first step is to understand what are legal and illegal MEVs (because some are even beneficial to users).

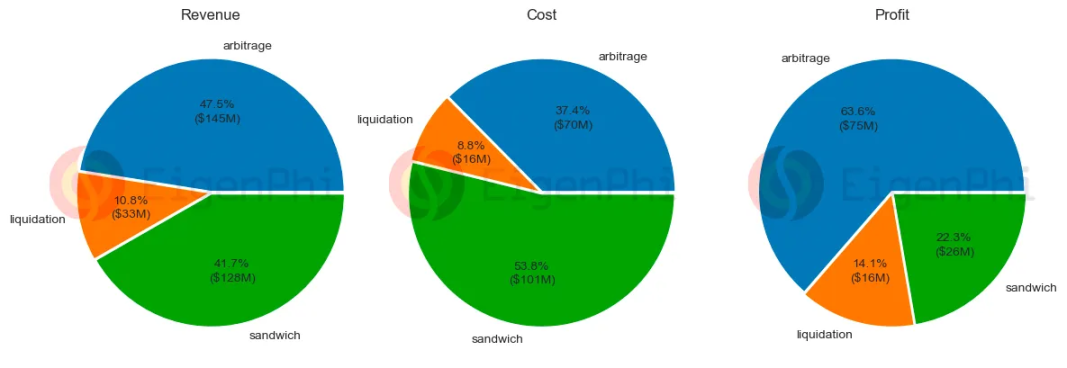

Another interesting trend in the MEV space is the highest number of arbitrage transactions compared to other MEV types. A recent report by EigenPhi states that nearly half (47.5%) of all MEV trades are arbitrage trades, while also being the most frequent (63.8%) opportunity. Of course, arbitrage will remain the dominant form of MEV, and rightly so, as many DeFi protocols rely on it to function. However, arbitrage does create some centralization issues, especially on Ethereum. The top ten arbitrage robots on Ethereum account for 51.3% of MEV's profit share, while BNB Chain's environment is more friendly and its penetration rate is low, so the top ten robots only account for 25% of MEV's profit share. As BNB Chain continues to advance and develop the DeFi ecosystem, MEV competition will grow significantly.

MEV is the mecca for transactions

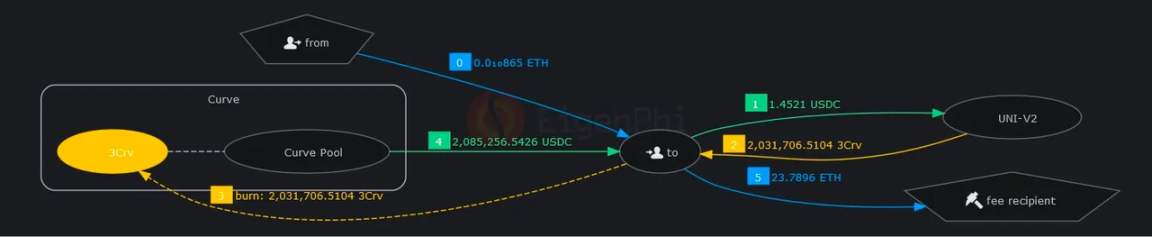

There have been some recent MEV attacks that are also worth noting to understand how professional bots play and how they can best protect themselves. The slight decoupling of USDC during the collapse of Silicon Valley Bank created fear throughout the DeFi community. When users turned to other stablecoins for safety, an unfortunate user suffered a huge loss during the exchange process. He mistakenly sold Curve LP token 3Crv worth $2 million through KyberSwap, and only got 0.05 USDT, which is very scary . In this case, the lucky MEV robot paid $45 in gas fees and $39,000 in MEV bribes, for a net profit of $2.045 million.

Several lessons can be drawn from this. First, the user needs to be vigilant about transactions. Obviously, the user did not set the slippage, and did not know that 3CRV tokens can be directly converted into USDT, and the slippage is only 6%. Second, there is a deprecated Uniswap V2 pool on the Kyber Network aggregator, which is a clear red flag. Third, why aren't more MEV bots attacking it! Sometimes the efficiency (or inefficiency in this case) of markets is astounding.

Another interesting MEV attack is an ARB robot sandwiching 56 transactions in a block! I don't know exactly what this is, but it's important to understand and analyze it anyway. In the end, this is the most profitable MEV attack in modern history , and it is fascinating to see it in simple MEV transactions.

V. Conclusion

As we’ve seen, there’s been incredible innovation in the MEV space almost every week, and hopefully this post has given you some of the trends, discussions, and news to watch that’s happening. I have been paying attention to some open questions, such as how the function of the block builder will be further developed, the evolution of the mempool, and what different MEVs will be produced with the new changes in DeFi, professional chains and their Derivatives. Finally, the trend toward eliminating, smoothing, or democratizing MEVs is as strong as ever, and I expect it will only grow as industry interest in it grows.

My goal is to make DeFi users aware of these external factors and make sure the community is aware of some of the strategies, tools, and protocols that are taking shape to prevent arbitrage bots from having dire and worse outcomes in the future.

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the authors and guests, and have nothing to do with Web3Caff's position. The information in the article is for reference only, and does not constitute any investment advice or offer, and please abide by the relevant laws and regulations of the country or region where you are located.