Disclaimer, NFA, all that legal stuff: All the information presented on this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.

Hi folks 🙋🏻♂️,

This week in Breaking Down Businesses we’ll cover Etherscan. For many (if not all), it’s an extremely familiar name. Yet, their stories are often under-told. Which… is odd. Etherscan is akin to a gateway tool for crypto market participants when they first learn about on-chain transactions. It is the go-to place to assess on-chain movements and to understand what’s going on under the hood.

Anyway, I’m obsessed with great businesses that don’t get a lot of publication. Hopefully, this write-up will provide you with a better understanding of how one of the most utilized websites in crypto operates its business. Cheers 🍻

Share Pensive Pragmatism by Marco Manoppo

Welcome to BRB!

Welcome to BRB! — a new series where I breakdown businesses in crypto 📝

We’ll be taking a look at interesting companies or protocols, assess how they’re generating revenues, guesstimate their spending, and analyze their profile.

That’s not necessarily a bad thing — but in the current macroeconomic and funding environment, crypto businesses need to refocus their attention on one thing:

“How do we make money?” 💰

Let’s dive in 👇

Here are the quick takeaways:

Etherscan is the most popular block explorer for Ethereum.

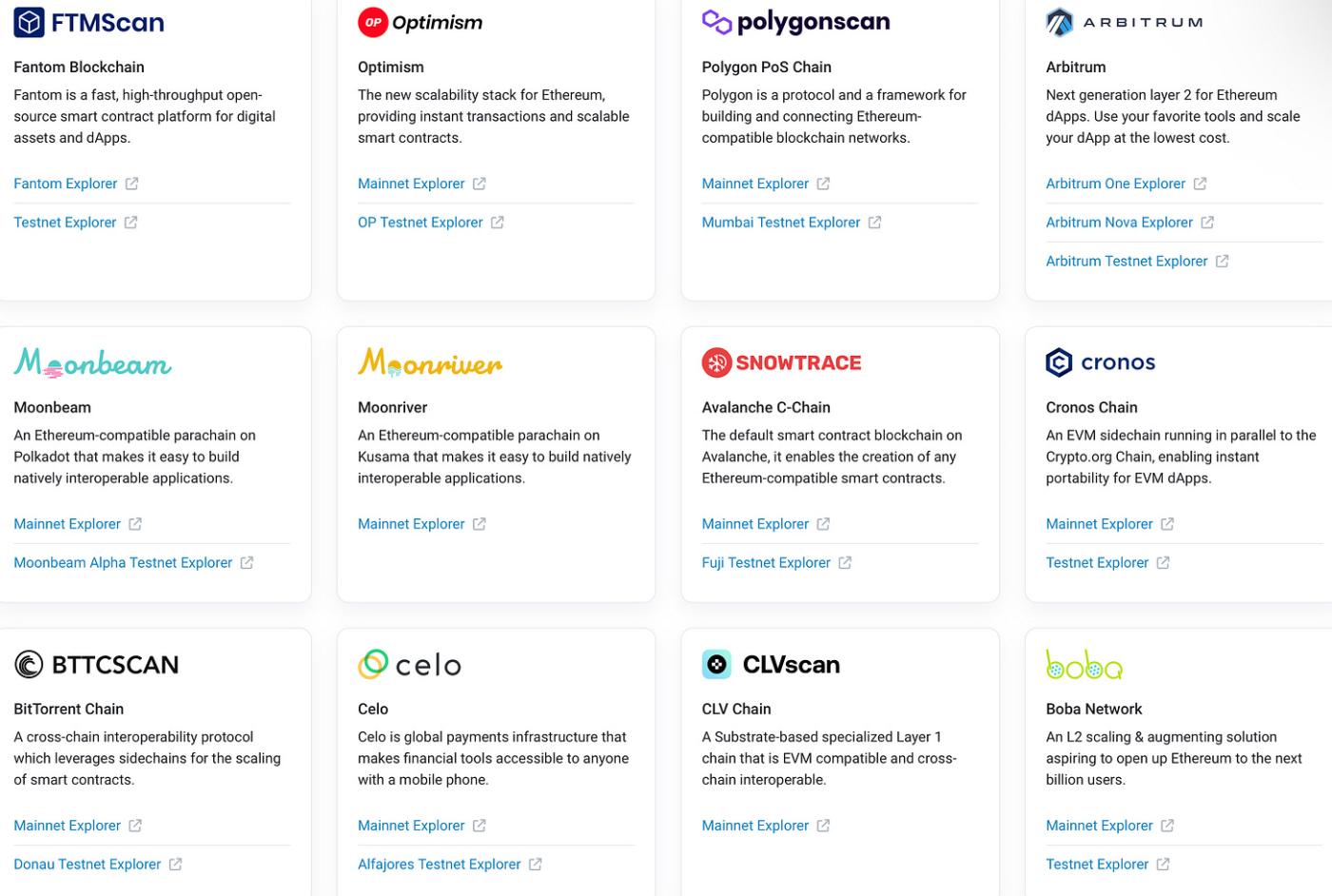

Founded in 2015, the team behind Etherscan has since expanded into other chains, creating block explorers for Fantom, Polygon, BSC, Arbitrum, and many more.

Etherscan has raised money twice, in 2016 and 2021, both were seed rounds with undisclosed sizes — the fact that they haven’t capitalized aggressively when the funding environment was hot (thanks ZIRP!) led me to believe that they’re profitable.

Etherscan makes money primarily from SaaS and advertisements. Its SaaS products include on-chain tools such as wallet-to-wallet messaging, staking, token approvals, and many more.

Etherscan employs 29 people according to LinkedIn, with a guestimated headcount burn of $1.2-2.15M annually.

If you’re enjoying this write-up, please consider subscribing. It takes 10 seconds of your time but would mean a lot to me :)

Etherscan: The Master of Block Explorers

Etherscan is a tool that helps users navigate the Ethereum blockchain - more commonly known as a block explorer. With 80 million page views per month, Etherscan is one of the most popular websites and widely utilized tools in crypto.

With Etherscan, users can easily analyze blockchain transactions on the Ethereum blockchain. The platform has enabled many to uphold one of blockchain technology’s core tenets: transparency.

From on-chain sleuths investigating shady rug pulls to traders watching large funds movements, Etherscan provides the tools necessary to better understand what’s going on behind the block-scenes (*ba dum tsss*).

Etherscan doesn’t have a token. Although it’s operating at the heart of the crypto-web3 ecosystem, Etherscan is considered more as a “traditional SaaS business” that isn’t entirely on-chain native. It simply provides tools for users to better understand blockchain transactions.

Since its inception in 2015, Etherscan has become the go-to block explorer. By 2023, Etherscan has expanded into 18+ blockchains.

How Does Etherscan Make Money?

Etherscan, like many other software companies, generates revenue through the services that they provide. That said, Etherscan is primarily a B2C business, although they have some B2B products. Alas, advertisements will be a non-trivial element of Etherscan’s ability to generate revenue.

At a high level, Etherscan generates revenue from:

👨💻 SaaS: Etherscan provides primarily B2B SaaS services such as building a block explorer-as-a-service (they called it EaaS).

🤖 API Plans: Etherscan offers API plans to access their data, with prices ranging from free to $399/month, and an undisclosed enterprise rate.

📺 Advertisements: There are 5 types of advertisements on Etherscan. More on this below.

⛓️ On-Chain Services: We’ve identified that BSCscan, one of Etherscan’s products, offers delegation services. Etherscan is also developing other on-chain tools including wallet-to-wallet messaging, token approval-revoke tool, and many more.

💰 Donations: This one is straightforward. The platform allows users to donate funds to support its development and maintenance. If you want to donate, you can donate to this address: 0x71c7656ec7ab88b098defb751b7401b5f6d8976f

Revenue Guesstimation

Let’s do some revenue guesstimation.

Newsletter: $120,000 - $300,000 / year

At 1 million subscribers, Etherscan can charge between $20,000-$50,000 per issue depending on the CPM. Since its newsletter isn’t a “core” business and we haven’t talked about the open ratio, let’s discount it by 50%.

Etherscan can charge $10,000-$25,000 per newsletter issue and it seems to be posting once a month. In total, they can bring home $10,000-25,000 per month from the newsletter.

Website Ads: $3.2M - $8.64M / year

There are 4 types of website ads, broken down to home page banner ads, banner ads, header text ads, and button ads.

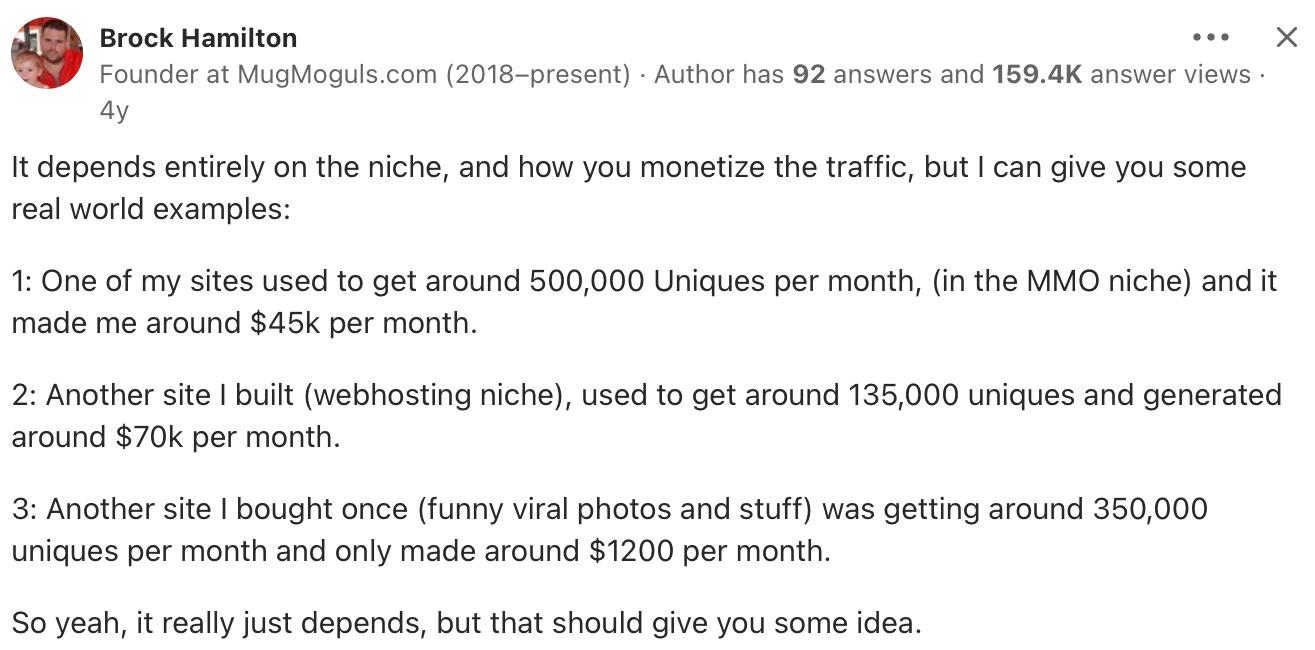

Honestly, this revenue heavily depends on how Etherscan decides to monetize it. As you can see from the example below, it depends on the niches, methods of monetization, and the state of the industry.

Guestimating ad revenue based on website traffic is extremely tricky as it varies widely according to industry, niche, and geography. For context, it can vary from $0.10 - $50 per 1,000 views.

The super general formula is: monthly traffic / 1000 * RPM.

The RPM varies from around $15 per 1000 impressions to $100 for niches such as insurance and real estate. Let’s assume that crypto has an RPM between $30-50.

Using an extremely high-level estimation, I’m forecasting that; Etherscan’s ability to monetize, the fact that there are 4 different ad placements, and crypto’s higher RPM rate will net Etherscan between:

🔸 80 million page views per month. According to Playwire, a 10 million page view should net a minimum of $25,000 per month. At this rate, Etherscan should net $200,000 per month.

🔸 8 million unique visitors per month. According to the Quora source above, 500,000 unique views on a gaming niche net $45,000 per month. At this rate, Etherscan should net $720,000 per month (assuming that crypto has at a minimum equal RPM with a gaming niche).

API plans, on-chain services, SaaS: $2.91M - $12.55M / year

We have absolutely no public data on these numbers.

If we assume that Etherscan converts the following percentage of its unique visitors (8M) into buyers at the lowest rate ($199/month):

0.1% → 8,000 clients paying $199/month → $1.91M / year

0.5% → 40,000 clients paying $199/month → $9.55M / year

As for Etherscan’s Explorer-as-a-Service (EaaS), it is more of a one-time deal (perhaps with some sort of retainer fee). Most of the on-chain services listed on its website, token approvals, and blockscan chat are still in beta.

Thus, we’re guesstimating that this falls somewhere in the low 7 figure annually ($1-3M).

Headcount & Burn

Etherscan has 29 employees according to LinkedIn. LinkedIn classifies the top 5 “departments” as follows:

Engineering - 12 people

Business Development - 8 people

Operations - 4 people

Community and Social Services - 3 people

Information Technology - 2 people

Let’s create a scenario to guestimate how much Etherscan needs to spend on the 5 departments listed above:

Engineering: At a $100k - $200k range, Etherscan needs to pay $1.2M - $2.4M per year.

Business Development: At an $80k - $120k range, Etherscan needs $640k - $960k per year.

Operations: At a $70k - $100k, Aave needs to pay $280k - $400k per year.

Community and Social Services: At a $60k - $90k range, Etherscan needs to pay $180k - $270k per year.

Information Technology: At a $100k - $150k range, Etherscan needs to pay $200k - $300k per year.

In total, for the 5 departments listed above, Etherscan needs to spend between $2.5M - $4.33M annually.

However, it’s important to note Etherscan operates out of Malaysia. This will substantially reduce salary expenditures. A more realistic assumption would put the annual headcount burn at around 50% of the rate stated above - bringing the tally to $1.25M- $2.15M annually.

As always, this number is just the headcount burn assessment. It doesn’t include other operational costs such as third-party vendors, office spaces, and many more.

Earnings

Our high-level estimation leads to the following:

Etherscan makes: $6.23M - $21.49M / year

Newsletter → $120,000 - $300,000 / year

Website Ads → $3.2M - $8.64M / year

API plans, on-chain services, B2B SaaS → $2.91M - $12.55M / year

Etherscan burns: $1.25M - $4.33M / year

Our back-of-the-napkin math leads to:

A gross profit of as low as $1.9M ($6.23M - $4.33M)

A gross profit of as high as $20.24M ($21.49M - $1.25M)

*We hope that this exercise provides you with an understanding of how businesses like Etherscan, which is super critical for the crypto environment, make money at a high level. We welcome any feedback regarding our estimation and case scenarios.

What’s Next

It makes perfect sense for Etherscan to get into the insights business.

They have all of the blockchain data they need to launch something similar to Dune’s dashboard or Nansen’s wallet tagging. This seems to be a relatively easy vertical for Etherscan to expand on without spending too many resources.

The fact that Etherscan is not capitalizing on this trend led me to believe that they’re already extremely profitable in the domicile that they conquer (raw blockchain data) and branding (website traffic/advertisement dollar).

Etherscan is in a good place. They're outside of the US and they haven't launched any tokens yet. As the blockchain ecosystem matures, it would be interesting to see how the undisputed king of block explorers decides to enter the market.

Until next time,

Until next time,

Marco M.

If you enjoy this piece, please consider sharing :)