Note: This article is from @defi_mochi Twitter, and MarsBit organizes it as follows:

As the Ethereum Shanghai upgrade is about to open withdrawals, up to 185,205,463,000 USD worth $ETH will be pledged to LSD providers.

In this thread, I analyze the undervalued LSD suppliers that are poised to grow 10x to 100x on this event!

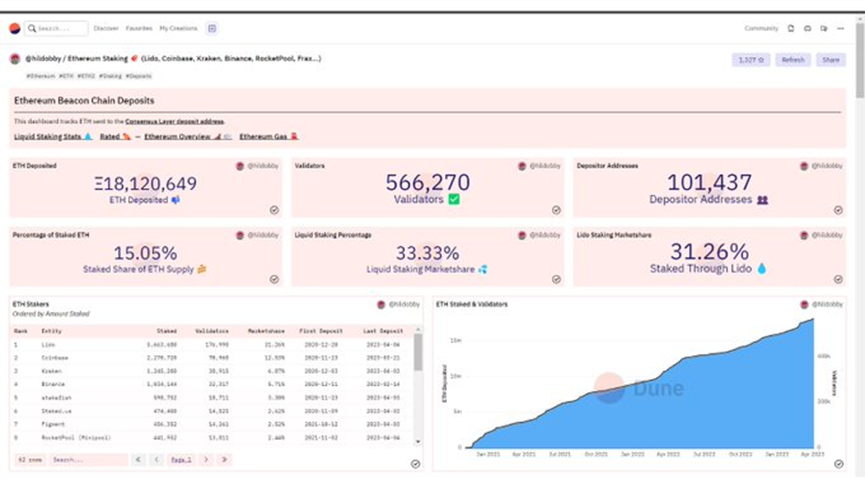

First let's look at some stats from Dune. at present:

- Only 15.5% of $ETH is staked

- 1/3 of staking is through LSD providers

- Lido has an overwhelming 31% market share of all $ETH staking

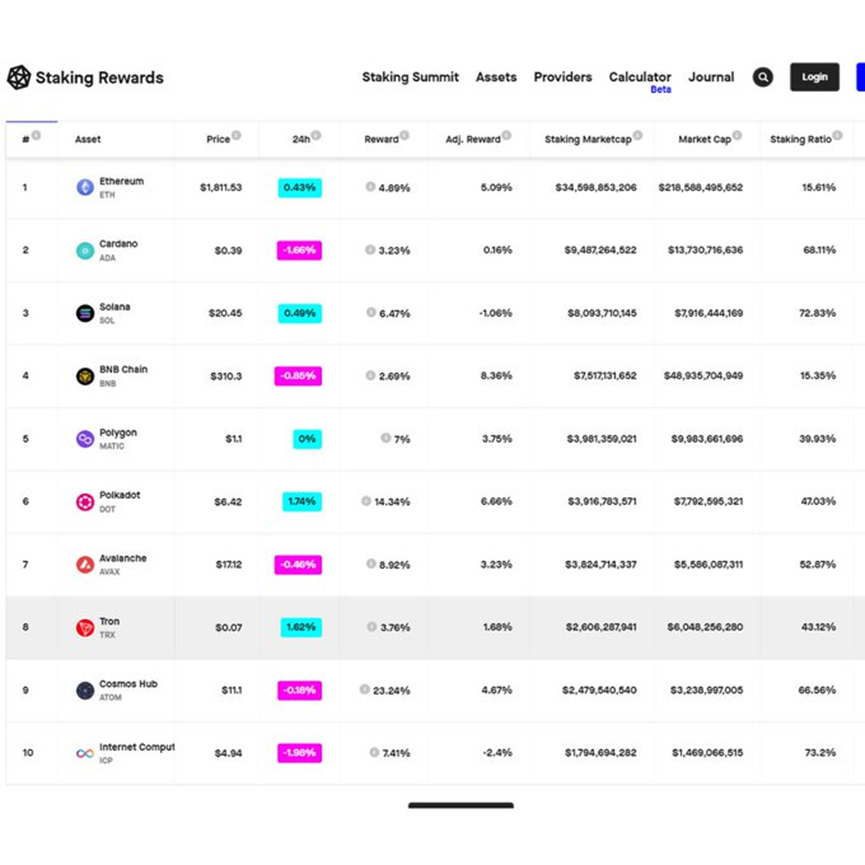

This is in stark contrast to the higher pledge ratios we have seen from other L1s such as:

Solana: 72.83%

Polygon: 39.93%

Polkadot: 47.03%

Cosmos: 66.56%

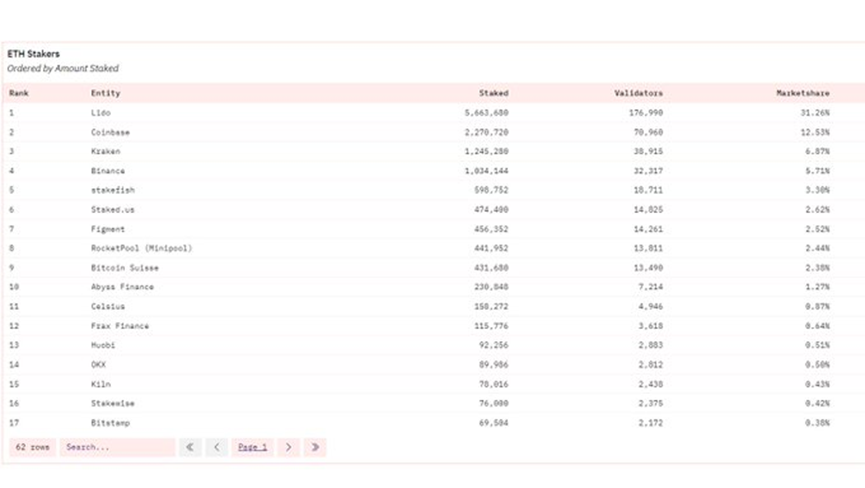

Check @hildobby_ 's Dashboard: Top LSD Suppliers by Market Share:

$LDO: 31.26%

$RPL: 2.44%

$FXS: 0.64%

$SWISE: 0.42%

$ANKR: 0.31%

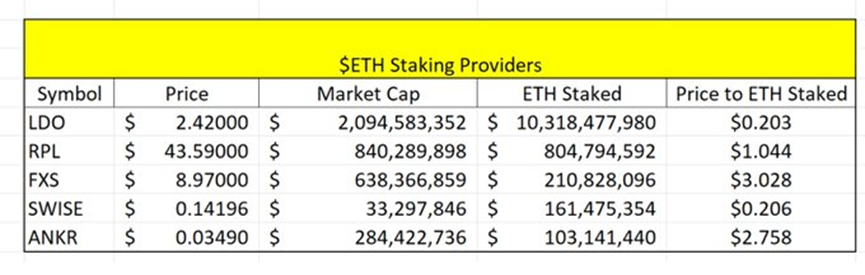

Considering the market capitalization, mochi calculated the following figures. It's clear who Mochi thinks is underrated. They are in order of $ETH staked.

Blue Chip Position: $LDO

Seriously Underrated: $SWISE

However, of the five:

$LDO Token: Governance

$RPL Tokens: Used as Collateral for Default Penalties

$FXS: 8% commission from $frxETH staking (FIP-122)

$ANKR: Mainly used for RPC use cases

$SWISE: Governance

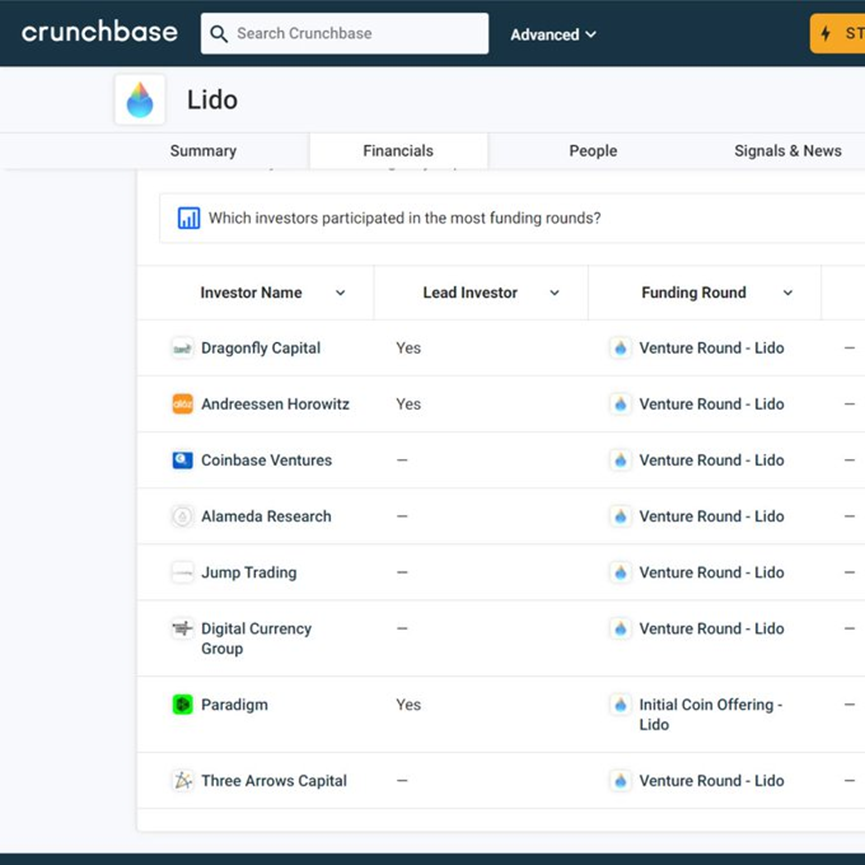

Mochi's bet is $SWISE, but lead investors have been selling heavily, suppressing price gains, you already know how many big VC firms such as: Paradigm, Dragonfly, a16z hold $LDO. However, as @DegenSpartan said, this is a way for funds to gain $ETH collateral exposure.

Check out @hildobby_'s dashboard: https://dune.com/hildobby/eth2-staking