Recently, crypto researcher Thor Hartvigsen summarized the activity of some well-known venture capital funds, large investors, and traders in the cryptocurrency market in the past 30 days. These activities involved a variety of digital assets, including $GNS, $DYDX, $GMX, $RDNT, $DPX, $ARB, $LDO, $ ETH , $ BTC , $MATIC, and $AAVE, etc. (For details , please refer to "Analysis of the Link between Giant Whale and VC Chain Dynamics and Token Price Fluctuations" compiled by Deep Tide TechFlow)

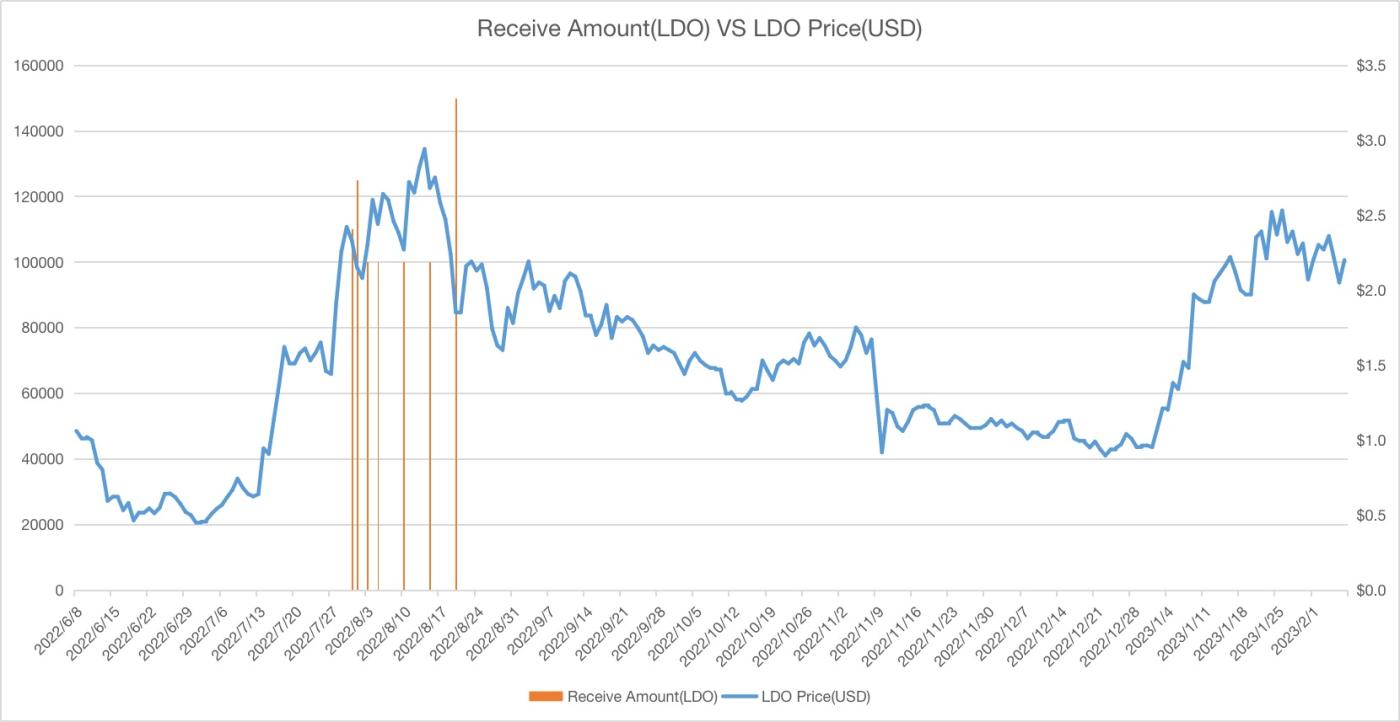

It is mentioned that Arthur Hayes, a BitMEX joint venture and trading enthusiast, purchased 758,000 $LDO (the original token of Lido Finance) at an average price of $2.53 during 2022, but in March this year, he bought $LDO at an average price of $2.42. Sell it all at a loss.

However, regarding the average price he bought $LDO, some people said it was $2.26 or $2.35, which may be a small profit.

The Shapella upgrade (Shanghai upgrade + Capella upgrade) is coming. After that, the pledged $ETH can be redeemed, and the increased willingness of users to participate in the pledge will also promote the rise of the pledge rate. It is foreseeable that the Ethereum LSD (liquidity Pledge derivatives) track scale will continue to expand.

Arthur Hayes has expressed his optimism for the merger of Ethereum, the LSD track, and the leading project Lido many times before, so why sell $LDO which he has held for half a year?

Today, he gave the answer in a blog post, compiled by Bai Ze Research Institute:

Last December, I launched my crypto family office fund, the Maelstrom Fund. I hired Akshat Vaidya, former Head of Corporate Development at BitMEX, to scour the world for crypto projects worth investing in. Our goal is to invest in early stage projects that will generate excess returns over just holding $BTC and $ETH.

Next, Akshat will provide readers with thoughts on the encryption track that he is very excited about every once in a while. Obviously, we are paying out of pocket, but we also want to try to make the market understand why the problems these projects are trying to solve are important to the goal of further decentralization. Ultimately, we hope to help these teams bring down the rotten TradFi financial system for good - aha! I mean, offer an alternative.

The following article talks about the movement toward decentralization of validators on the Ethereum network. This space is very exciting and I have expressed a bullish view on Ethereum consolidation in the past by adding $ETH and $LDO in my portfolio . In the back of my mind, though, I've been worried that Lido isn't decentralized enough and that once the market starts paying attention to this, the token will plummet . After Akshat invested in Obol and ether.fi and explained his rationale for doing so, I knew it was time to sell my $LDO.

Akshat's Crypto Paper: The Coming Restructuring of the $ETH Staking Track

"Not your keys, not your crypto" has been the motto of the industry since I entered the crypto industry. But traders, investors, and even founders and high-profile fund managers screwed up time and time again, too many repeating the same mistake over and over again, losing control of their private keys—leading to dozens of billions of dollars in funds lost or stolen (from Mt. Gox to FTX , and everything in between).

Before DeFi Summer (circa 2020), investors typically lost money on mismanaged or fraudulent CeFi exchanges .

But in 2021-2022, the problem resurfaces in a new way — with many so-called “decentralized” (but ultimately custodial) cross-chain bridges being compromised by hackers, with losses totaling over $2.5 billion.

Given the inherent properties of the blockchain, our loss of control of our private keys — whether in CeFi or a “decentralized” entity — is not a compromise any of us should make. However, we are already in 2023, and in our desire for simple $ETH staking rewards, dangerous flames have resurfaced.

Post-DeFi Summer, we've come to expect yield on our cryptocurrencies - especially our $ETH, even more so now given the recent Fed rate hike.

However, as setting up validators is still difficult, investors find themselves forced to choose between using dangerous escrow services or simply sitting idle with their $ETH.

Worryingly, many have chosen the former, entrusting their private keys to:

1) Fully centralized services such as Coinbase , Kraken and Binance;

2) Early decentralized ETH LSD protocols, such as Lido Finance.

To be fair, these escrow services or protocols are important stepping stones to a trustless, decentralized $ETH future of staking. However, they also prioritize speed to market, at the cost of exposing stakeholders to potential node operator risk, regulatory risk, and security risk.

Fortunately, this option is coming to an end. The Shanghai upgrade (Shapella upgrade) will be implemented within the next 24 hours, which will allow stakers to withdraw staked $ETH for the first time (0.4% of total staked ETH per day). More than 18 million $ETH (approximately 15% of circulating supply, worth tens of billions of dollars) is about to be freed from the aforementioned high-risk custody business model.

In terms of existing $ETH staking services market share, these service providers or protocols have the most to lose and will likely benefit the least from the tens of millions $ETH that will be staked in the next few years.

Of these, Lido — the largest and first decentralized LSD protocol — may be the biggest ticking time bomb of all.

Let's take a look at how the Shapella upgrade will break Lido's $ETH staking market dominance:

Lido accounts for about 75% of all $ETH locked in the LSD protocol, and about 30% of the total $ETH staked, which is basically based on validators' belief in the trustworthiness of node operators above:

Validators deposit $ETH, but node operators don't contribute (unlike Rocketpool's model, where node operators contribute 16 of the 32 ETH per validator);

Node operators generate keys (including BLS private keys and validator keys), not stakers, and execute the stake$ETH redemption process on a voluntary basis;

This means that validators have no direct claim to their $ETH or staking rewards, only a hypothetical pool of assets generated by the protocol itself (similar to the business model of cross-chain bridge Wormhole, which was hacked last year)

To be clear - Lido works because node operators choose to cooperate.

If the node operator is for some reason unwilling or unable to withdraw their validators (in order to redeem $ETH and staking rewards for you), then you are in trouble. Of course, Lido has taken some meaningful steps to reduce the risk of a major event - such as hackers compromising validator keys, or regulatory/enforcement actions preventing node operators from redeeming - 20232023202320232023-19 - causing market panic. The entire redemption process for Lido will only be tested on a large scale for the first time after the April 12th Shapella upgrade, so it's been a one-way street so far. But anyway, ultimately the node operator can simply refuse to exit, effectively making "your" staked $ETH illiquid and inaccessible for a period of time, with limited downside risk the node operator needs to take .

In short: Lido's model (and its node operator's revenue model) depends on you not only giving up your private keys, but taking most of the risk. All for... 4 - 6% yield on your valuable assets. Sound familiar?

Fortunately, none of us need to take that risk anymore.

Lido's architecture is arguably good enough in its early stages - withdrawal credentials at the execution layer are not enough to make the LSD protocol non-custodial. We now know that it is not possible to simply create a smart contract controlled redemption mechanism as a workaround. So, how would we design an Ethereum staking service that is both non-custodial and scalable?

We launched Maelstrom, BitMEX co-founder Arthur Hayes' family office fund, in December 2022 amidst the ashes of the collapse of many custody business models, to invest in projects aimed at fixing things.

Therefore, we invest in ETH staking infrastructure projects that:

1) Compete directly with the above two riskier custody business models (full centralization and early decentralization);

2) Projects that complement existing services to help them decentralize further.

Maelstrom's first investment is in the second category, a project that neither competes with Lido nor Coinbases, but uses them to eliminate single points of failure. Obol Labs, an investment we closed in January of this year, is helping to further decentralize existing services as well as "decentralized" protocols. Obol's Distributed Validator Technology ("DVT") middleware allows validator keys to be "split" among multiple node operators, effectively creating a "multi-signature" validation that can run concurrently on multiple machines device. These multi-validators still act as a "talk" to the beacon chain, avoiding penalties or slashing, while improving the security and decentralization of the $ETH staking track.

On the other hand, ether.fi is our first investment in the second category, a project designed to evolve gradually from the legacy custody models of Lido and Coinbase. ether.fi is building the first true non-custodial staking protocols for Ethereum (and other PoS networks in the future). In the post-Shapella era, stakers are free to jump among multiple staking services in order to chase the highest yield and highest APY, but ether.fi chooses to compete with other protocols in other aspects. With ether.fi, stakers generate and control their own keys throughout the staking process from creation to redemption, and can exit validators at any time to reclaim their $ETH, preventing node operator malfeasance. Well done to "Your keys, Your crypto." ether.fi reduces risk for all parties, including node operators who no longer need to keep wallets connected or rely on trusted intermediaries for coordination.

Giving up control of your private keys is not a compromise you need to make in order to participate in any decentralized ecosystem. Existing services and protocols in $ETH staking — both centralized and early decentralized — prioritize speed to market. But dark clouds hang over these players, as there are now a growing number of new projects being built and aiming to provide trustless, truly non-custodial $ETH staking solutions. With today's Shappela upgrade, the shackles are finally off.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.