According to on-chain data, the net worth of Ethereum unstaking has surpassed $1 billion in value in the past 24 hours.

ETH withdrawals are increasing

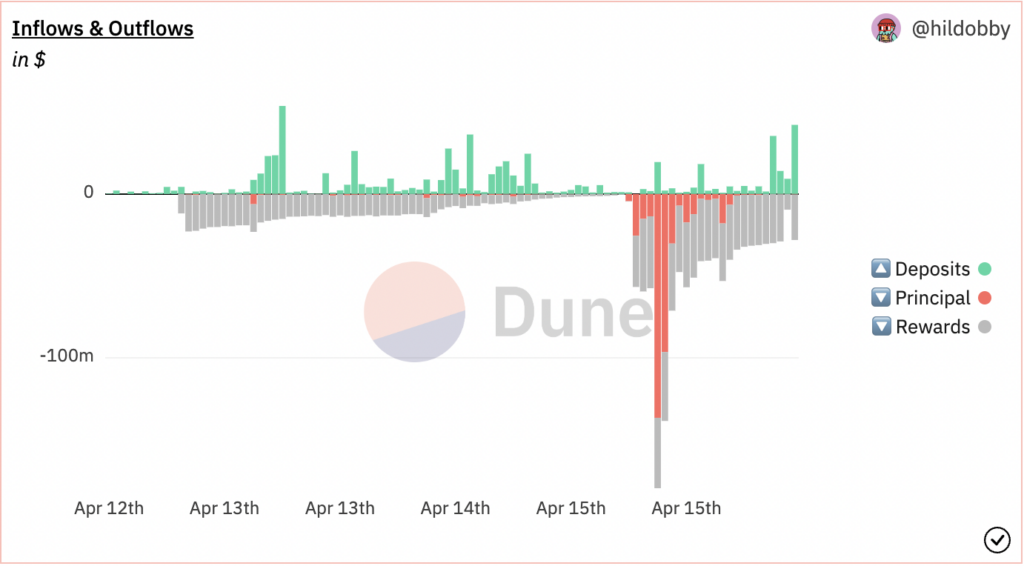

A total of $1.7 billion has been withdrawn since the Shanghai and Capella upgrades went live. However, when the withdrawal Monday starts, the value of Ethereum withdrawn increases. Round 1 took 4.14 days to complete once validators in the queue were processed.

18,442,455 ETH is currently staking, with a value of $38.5 billion as of press time. Therefore,

Staking ETH accounts for 15.32% of the total supply, with 33% staking with Lido.

With withdrawals now open, investors have withdrawn their initial capital and earned rewards. Staking Ethereum earns interest over time, and when validators earn more than 32 ETH through rewards, the excess will not add to their principal. Instead, it is automatically withdrawn as a reward payment every few days.

The chart below shows the big difference between deposit and withdrawal (bonus and principal) since the upgrade.

Staking rewards

Staking rewards start at around 15% and are set on a predefined downward curve against validator participants until Consolidation occurs. The current validator reward is 4.33%, which includes consensus rewards and transaction fees. These rewards spiked to around 5.2% in the days leading up to the upgrade but have since returned to a downward trajectory. Total staking rewards have decreased by 1.4% since Consolidation last September.

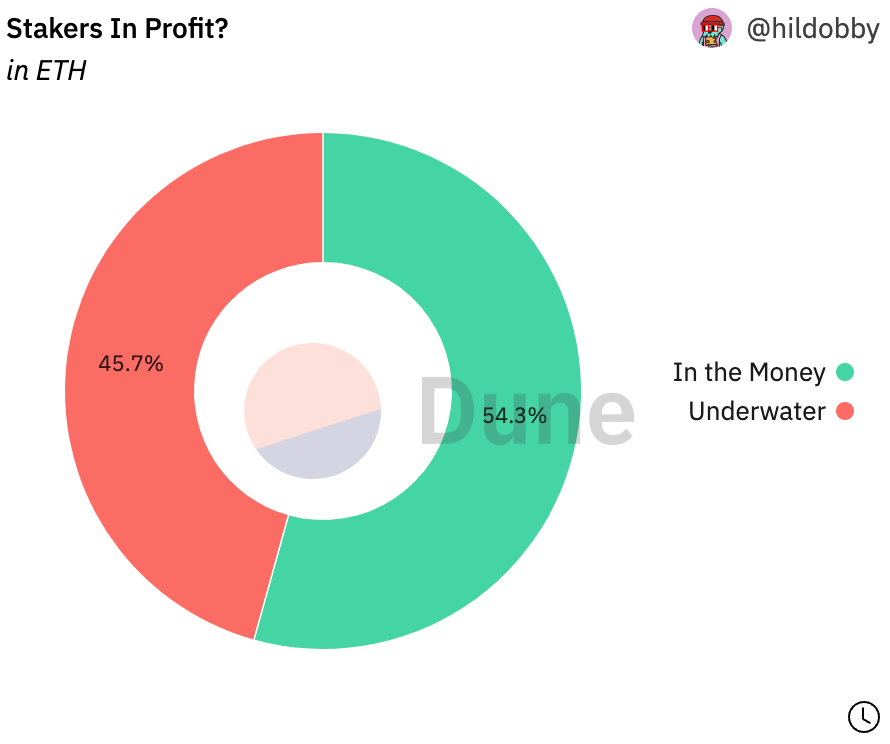

In addition to the change in deposits, withdrawals, and rewards, the average value of Ethereum staking with validators has decreased since the opening of withdrawals. As a result, 54.3% of stakingers are currently profitable.