Coinbase, Lido, and Frax's LSD are all plagued by centralization to some extent. unshETH is a protocol that uses an incentive mechanism to optimize the decentralization of LSD validators. Through validator decentralized mining (vdMining) and validator Dominate Option (VDO) provides solutions with two innovative products.

unshETH is a very important endeavor, and in this article, we will dive into the various mechanisms of unshETH.

What is unshETH?

unshETH is an early new category: LSDfi - DeFi applications built on top of Liquid Staking Derivatives (LSD).

unshETH aims to distribute capital in the LSD ecosystem in a way that prioritizes validator decentralization through incentives.

unshETH has pioneered two key innovations in the LSDfi space:

1. Verifier decentralized mining (vdMining);

2. Validator Domination Options (VDOs).

Let us understand them one by one.

Validator Decentralized Mining (vdMining)

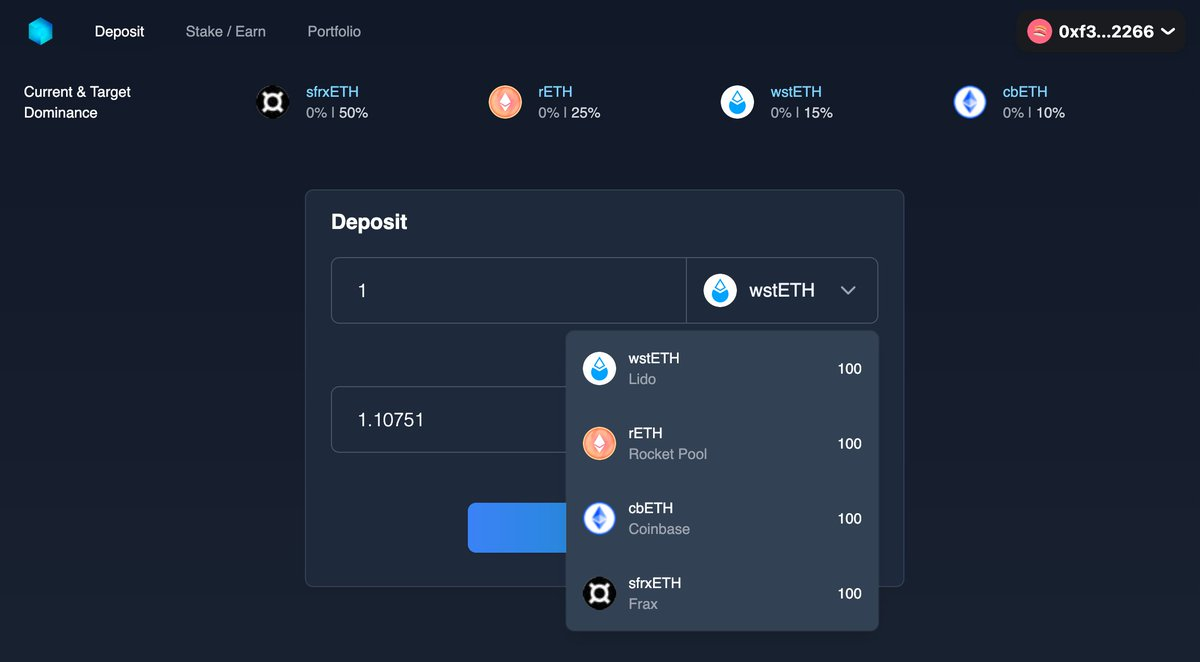

vdMining is a token distribution mechanism that rewards users for staking their LSD in a manner consistent with the optimal decentralization ratio set by the unshETH community. Currently, unshETH supports the following LSDs:

• wstETH (Lido);

• sfrxETH (Frax);

• rETH (Rocketpool);

• cbETH (Coinbase);

• ETH (native ETH).

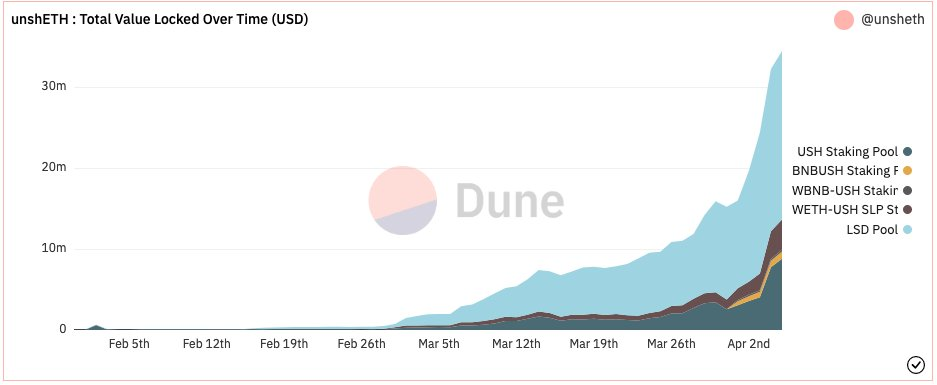

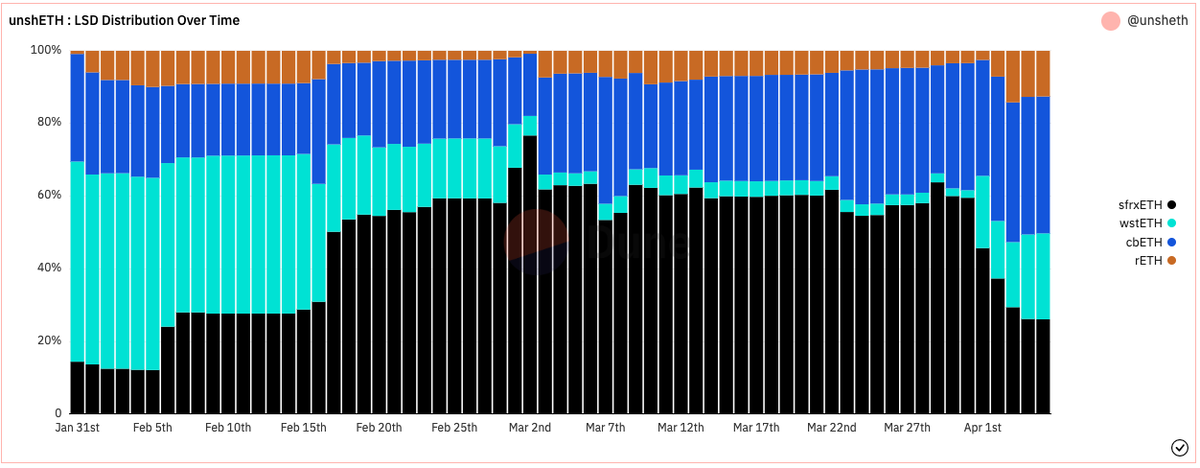

The graph below shows the TVL share over time for different LSDs.

Through the unshETH protocol, users can deposit their ETH / ETH LSD in exchange for unshETH tokens. Users can further stake their unshETH tokens to obtain $USH tokens. Staking unshETH enables users to earn high returns on locked LSD if they stake with certain conditions.

This is where Unsheth innovates - they encourage good staking behavior through economic incentives (i.e. additional staking rewards).

But how does unshETH reward users for staking their LSD optimally? This is where the reward multiplier comes into play.

For a better understanding, let us first understand what is Optimal Decentralization Ratio (ODR) and Current Ratio (CR).

- Current Ratio (CR): CR is the ratio of staked LSD to total staked LSD in the vdMining pool.

- Optimal Decentralization Ratio (ODR): ODR is determined by the unshETH community through a governance proposal, the ratio between the predetermined optimal amount of pledged LSD and the total number of pledged LSD.

The idea is to have an optimal ratio of LSD staked to maximize decentralization among validators. ODR votes on governance proposals every 21 days.

Now that we understand ODR and CR, it's time to understand the three reward multipliers:

• Coordination Multiplier (CM) : The closer the CR is to the ODR, the higher the CM, resulting in a higher rate of return for all users in the pool and encouraging users to stake in a more decentralized manner. It is worth noting that all users collectively get the same CM.

• Timelock Multiplier : Reward multiplier for extending LSD staking time.

• Base Multiplier : Reward multiplier for participating in governance to set a new ODR (and then implement it).

Rewards and penalties collectively apply to all users in the pool, incentivizing coordination among users to increase their collective payoff.

Validator Domination Options (VDOs)

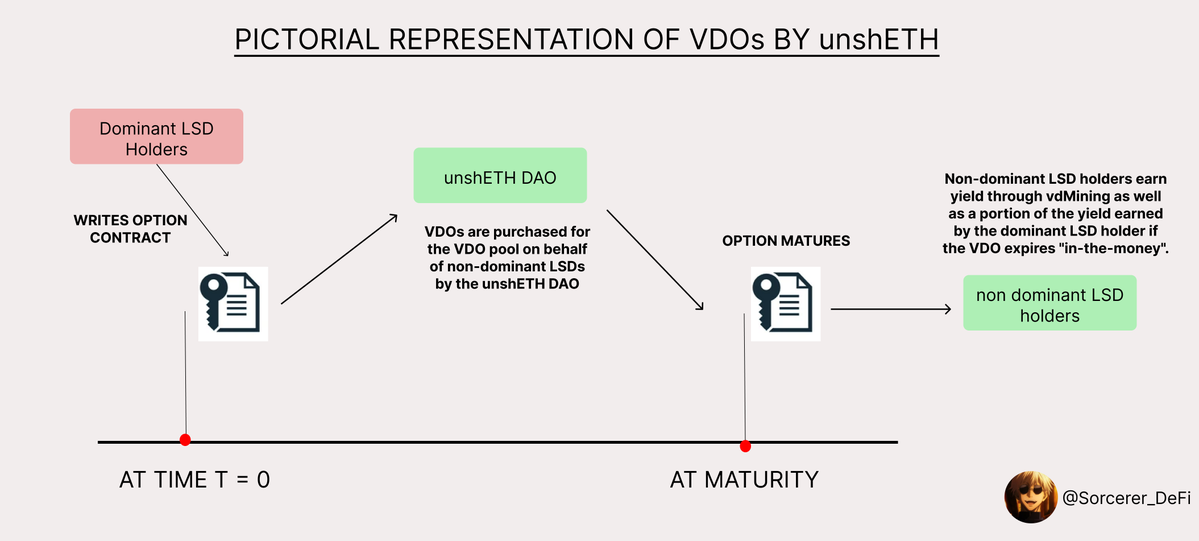

VDOs are an LSDfi term that allow dominant LSD holders to write options on their own validators. This allows non-dominant LSD holders to reap the benefits, while also providing dominant holders with a way to earn additional income from their already established dominance.

So, how does it work ?

Dominant LSD holders write VDOs against their own LSD (no other collateral allowed). In this case, the strike price corresponds to their validator dominance (%) at expiration. The typical contract period for a VDO is a few days.

Representatives of non-dominant LSDs purchase VDOs through the unshETH DAO, which pre-pays the option cost. In exchange, unshETH DAO has a liquidity preference for yield when VDO pays. If the option expires with no value, the DAO writes off the cost.

Non-dominant LSD holders earn through vdMining and a share of the dominant LSD holder's proceeds, which can be earned if the VDO expires in a "earning" situation. The riskier the VDOs written by dominant LSD holders, the greater the premium they earn, but also the greater the potential loss.

route map

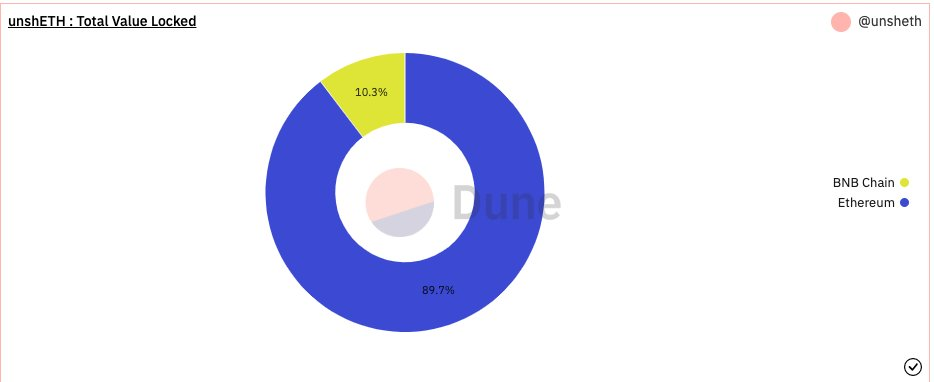

Currently, unshETH runs on the ETH and BNB chains. They use LayerZero as the underlying cross-chain bridge.

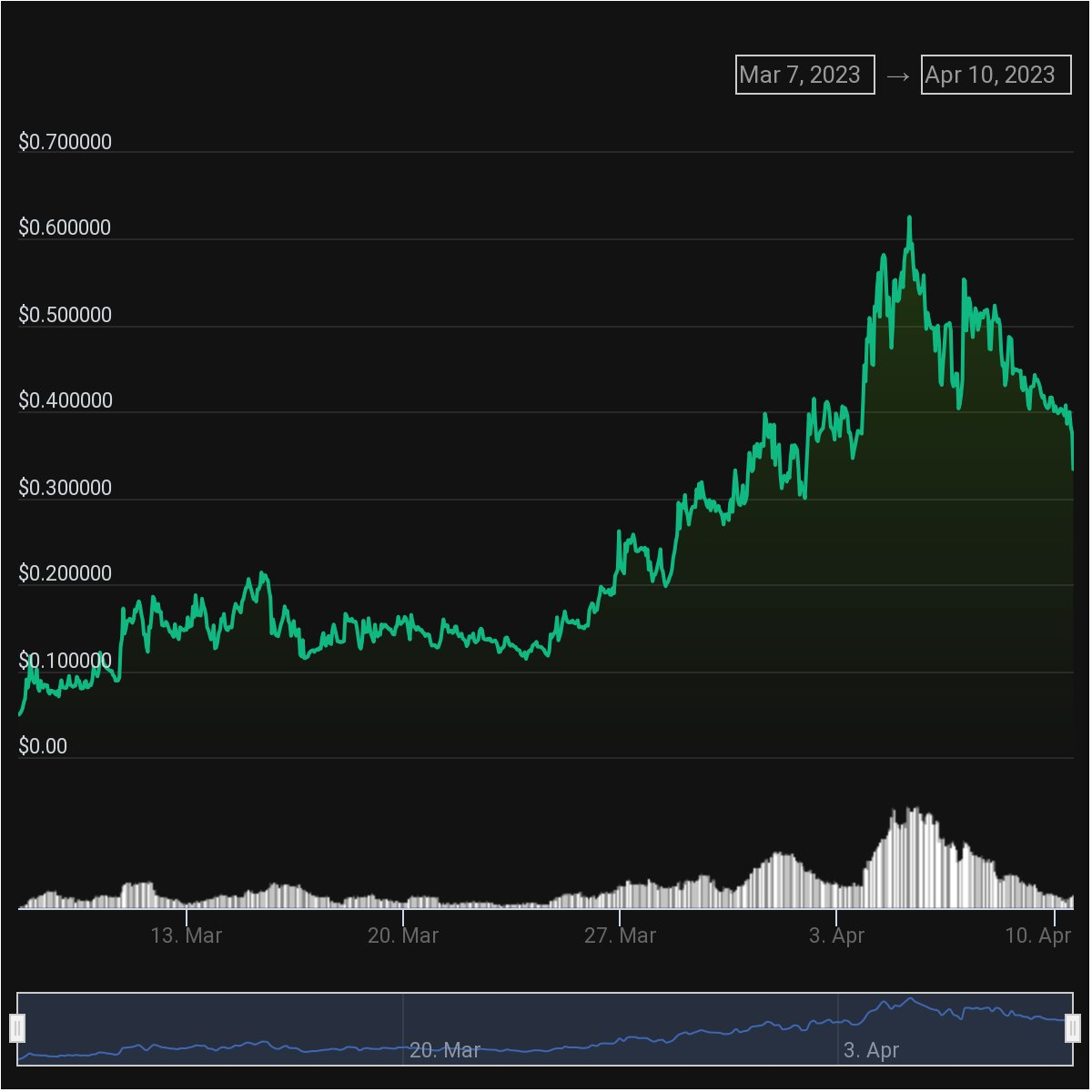

token price

The token price is still undervalued in my opinion, even though it rose almost 6x in a month before falling back again. However, most of the token's liquidity is on the recently hacked Sushiswap - so I advise users to proceed with caution here!

In summary, I think unshETH does make some fascinating incentivized innovations aimed at solving problems of great importance to the ETH community. Even Vitalik has been vouching for protocols that use well-designed incentives to improve blockchain security.