In most fields, the "big vs. second" battle is often fierce. Bitcoin and Ethereum, which dominate the encryption field, have also started a competition for "community consensus share".

In the past two years, with the conversion of Ethereum to PoS, the open withdrawal of pledges, and a series of upgrades such as the implementation of Layer 2, coupled with the prosperity of the ecology, all aspects have become more and more competitive, attracting many Bitcoin communities (including BCH, BSV, etc. Fork community) members joined, perhaps it is time to talk about the possibility of Ethereum’s market value surpassing Bitcoin. As a former “cottage”, Ethereum’s surpassing Bitcoin is happening, not just staying in a “dream”.

Mainstream funds have been paying attention to Bitcoin and Ethereum. Who will perform better in the next market round?

01 The main difference between Ethereum and Bitcoin

Bitcoin and Ethereum are not originally an endless antagonistic relationship of "both born and born", including the community, but the encryption community is not too large. The most important thing for Bitcoin is how to keep the "consensus share" ", while for Ethereum, it is the community that continues to "attract consensus". The comparison between the two is always talked about:

1. The overall route is different: one digital gold, one digital oil

The goal of Bitcoin is a decentralized value exchange medium and value storage, while Ethereum was born with the mission of becoming a smart contract platform to run decentralized applications, and ETH is used to pay the "gas fee" for contract execution (Gas), so BTC and ETH are also called digital gold and digital oil.

2. Different data storage models for recording transactions

Bitcoin uses the UTXO model to record transactions, which is a major advantage of Bitcoin and one of the important technical solutions adopted. This method can keep the record "database" lightweight for a long time, and Bitcoin nodes can always verify quickly and efficiently The key to long-term stable operation of transactions and systems.

Ethereum, on the other hand, uses the account model, perhaps for the purpose of recording the flexibility of the account state, but this makes Ethereum have to face the dilemma of "state explosion", which has not yet been resolved.

In short, with the passage of time in the account model, the accumulation of newly added state data becomes a burden on the consensus nodes, and the system will become more and more bloated, which will eventually limit the development of Ethereum. This may be the case in the future. resolved in the upgrade.

3. Different consensus mechanisms

After Ethereum switched to PoS, it parted ways with the PoW consensus mechanism. As for why this PoW consensus mechanism, which makes Bitcoin so powerful, was abandoned, it is a long story, which will be discussed below.

4. Other more differences

Transaction speed: Bitcoin's block interval is 10 minutes, while Ethereum's block interval is 13 seconds. Usually it takes dozens of minutes for a transaction in Bitcoin to be confirmed, while it may take a few minutes for Ethereum to complete.

Main transaction purposes: Bitcoin transactions are mainly transfers, while transactions on Ethereum can include contract execution in addition to transfers.

02 In what ways has Ethereum surpassed Bitcoin ?

Although the two routes are not the same, each has its own strengths, and the advantages in their respective fields are obvious without too much comparison, but in some important cross-cutting angles, Ethereum has indeed begun to surpass Bitcoin.

1. Ecological infrastructure

There is no need to compare the ecological prosperity of the platform-based Ethereum, but thanks to this, the ecological infrastructure of Ethereum has surpassed that of Bitcoin.

The diversification of Ethereum wallet clients, wallets including Little Fox Wallet and many hardware wallets have become the entrance of metaverse and Web3 . The foundation of the prosperity of the public chain, and the addition of competitive new public chains has increased the prosperity of EVM-related developers and related Cross-chain ecology, feeding back the Ethereum ecology.

In addition, careful friends will find that some market software will display the number of platforms on which encrypted assets are listed. The number of CEX platforms listed on Ethereum has always exceeded that of Bitcoin. If you add DEX, the future of encrypted asset exchange, Ethereum has indeed become Relatively leading.

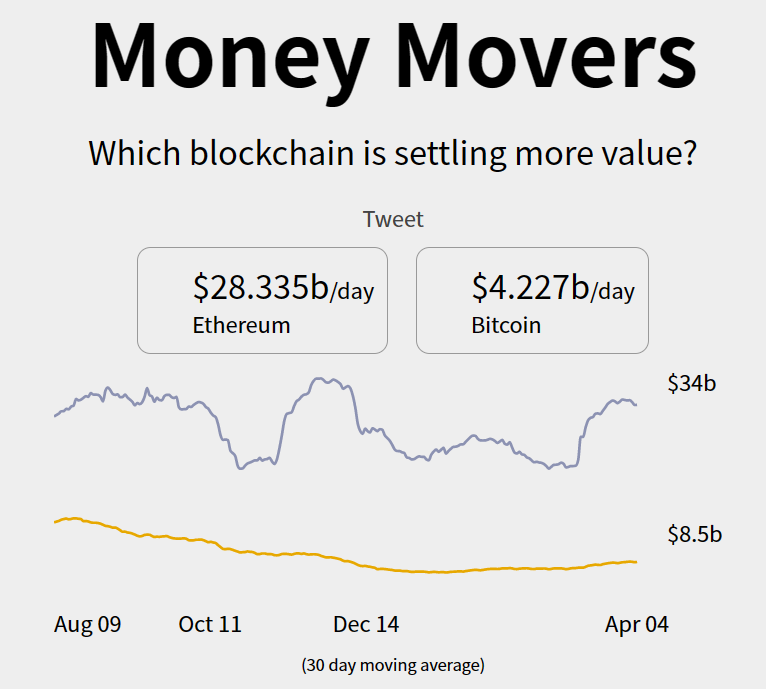

2. On-chain transfer and settlement amount

According to the data of money-movers, Ethereum currently transfers and settles nearly 30 billion US dollars of assets on the chain, while the data of Bitcoin is 4 billion+ US dollars, which is an order of magnitude worse.

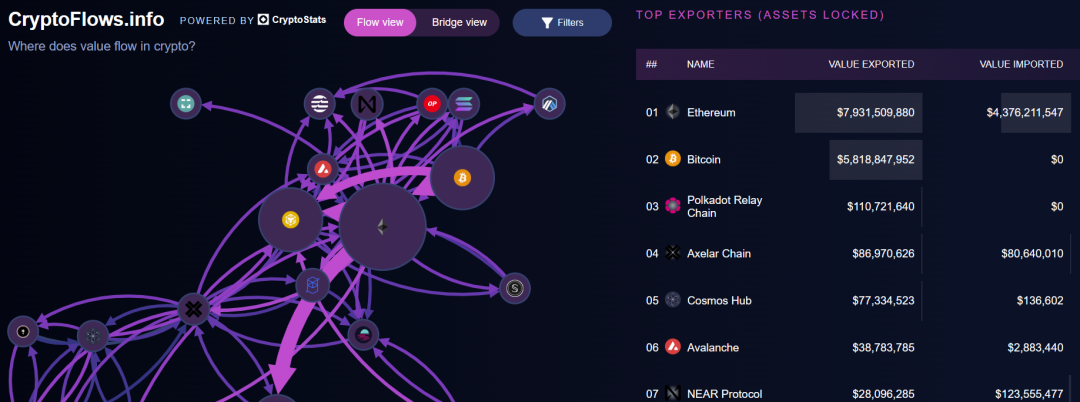

If Cross-chain is the future, then Cross-chain liquidity data is also very important. As can be seen from the CryptoFlows data chart, the total amount of funds entering and leaving the Cross-chain of Ethereum exceeds 10 billion U.S. dollars, and the amount of funds entering and exiting Bitcoin Cross-chain is 60 About 100 million US dollars.

In general, in terms of on-chain fund transfer and settlement, and Cross-chain fund inflow and outflow data, Ethereum has already "topped the dust" among all public chain ecosystems.

3. Token Supply

Many people believe that a large part of Bitcoin's high value is due to Bitcoin's supply rules, which are constant and halved every four years. However, Ethereum has entered the normalization of deflation, which gives Ethereum a positive and rigid capital against Bitcoin, the "digital gold" that is mainly based on scarcity.

Screenshot from: Ultra sound money

Many people believe that the current Ethereum has become an "ultra-stable currency" for the following reasons:

a. Ethereum implemented the EIP-1559 upgrade in August 2021 to reduce the Circulating Supply of ETH by burning a part of the base fee of each transaction.

b. Ethereum completed the merger from proof-of-work(PoW) to Proof-of-stake(PoS) in December 2021. The pledge reward (floating) under the POS mechanism is greatly reduced compared with the fixed block reward under the PoW mechanism.

d. With the continuous prosperity of the ecology, the advancement of DeFi, NFT, Metaverse, Web3.0, and Layer 2, the usage and demand of Ethereum continue to increase, which increases the demand for ETH as payment fees and collateral, and then Pushing up the transaction volume on Ethereum and the burn volume of EIP-1559 .

A few days ago, the annualized deflation rate of Ethereum on the 7th was about 1%, which means that 1.2 million ETH were reduced every year.

To sum up, the claim that Ethereum is an ultra-stable currency is based on its ever-decreasing supply and increasing demand, which makes Ethereum highly scarce and valuable, and also makes it deflationary and anti-inflationary.

4. Degree of decentralization (controversial)

After switching to PoS, the total number of verifiers in Ethereum has exceeded 560,000, and it continues to grow. In the past, the Ethereum community "boasted" that:

-Ethereum 2.0 adopts the Proof-of-stake(PoS) consensus mechanism, which can reduce the dependence on computing resources and energy, reduce the centralization and monopoly of mining pools, and improve the security and sustainability of the system.

- The node distribution of Ethereum 2.0 is more extensive and decentralized than that of Bitcoin.

- The future sharding scheme of Ethereum 2.0 will improve the scalability and throughput of the system, while also reducing the burden and cost of a single validator node.

In summary, the Ethereum community believes that the upgrade of Ethereum makes the system more decentralized, with higher security, scalability and innovation.

03 Bitcoin is not a "vegetarian"

It is said that each has its own advantages and disadvantages. Although Bitcoin is not as radical as Ethereum, it does not mean that the Bitcoin community lies flat and does nothing:

1. Bitcoin’s hedging properties play a huge role

The recent banking crisis has caused more people to re-examine the safe-haven properties of Bitcoin. In the case of thunderstorms in the traditional financial system, Bitcoin has begun to replace or even partially replace the function of gold, and it may go further in the future.

At present, the market value of global gold is more than 8 trillion US dollars, while the market value of Bitcoin is currently only more than 500 billion US dollars. That is to say, whether it is a partial replacement or the possibility of surpassing gold in the future, it is still "broad sea and sky".

2. Ecological explosion

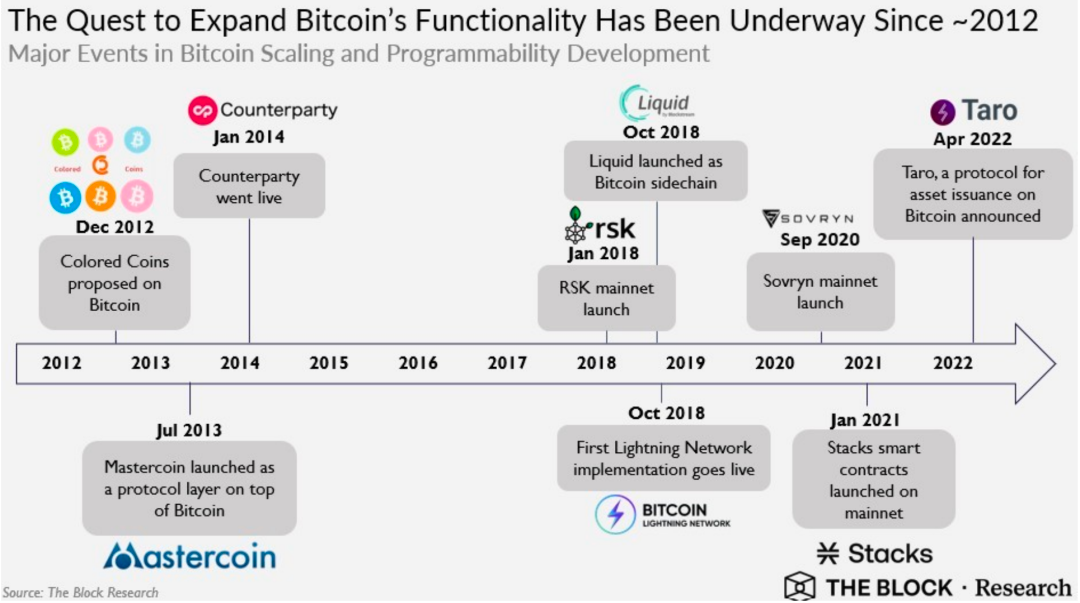

Ethereum has its own ecology, and the ecological development of Bitcoin has not stagnated. The upper-layer smart contract application ecology based on Bitcoin, including Stacks, RIF, etc., BitcoinFi and BitcoinNFT are also quietly growing.

The recently popular BRC20 has also attracted a lot of attention. Compared with the ERC20 of the Ethereum ecology, although there is still a certain threshold for BRC20, it is early enough, and the "Bitcoin ecology" alone has enough gimmicks and unique distribution The method with stronger decentralized attributes also brings a different new narrative.

Of course, we should also pay attention to the risk of short-term loss of heat, directly engraving BRC20 Token on the Bitcoin mainnet is essentially old wine in new bottles. The scalability, functions, performance, user habits, infrastructure, etc. of BRC20 are far inferior to ERC20. The industry has been exploring innovative "capacity expansion" in the opposite direction. If there is no sustainable direction, BRC20 will not go far.

An at-a-glance map of the exploration of Bitcoin’s capabilities since 2012. Source: The Block Research

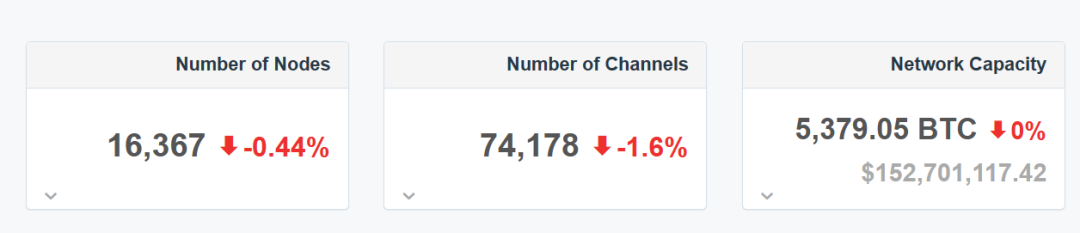

In terms of payment, the lightning network is steady and steady. 1ML data shows that the lightning network capacity exceeds 5,000 BTC, the current number of nodes is 16,367, and the number of channels is 74,178. At the same time, several leading platforms have begun to support the deposit and withdrawal of Lightning Network.

Image credit: 1ML

04 Summary

Ethereum surpassing Bitcoin, from the impossible dream to gradually stepping into reality, this seems like an inspirational story . Bitcoin is as stable as Mount Tai, and Ethereum is actively innovating. Perhaps the battle between Bitcoin and Ethereum will continue for a long time, but they all have a bright future. Regardless of success or failure, they only compete for the top.