By Alex Xu, Research Partner, Mint Ventures

overview

This research report mainly focuses on the current development status of the ve(3,3)Dex project, as well as the commercial advantages and challenges of this model, and further thinks about the long-term development of the Dexs track.

Dexs (decentralized trading platform) and Lending (borrowing) are the first two types of products in the Defi field to achieve PMF (product-market fit), and Dexs, as the infrastructure of the value Internet, has always been the track with the largest number of users and interaction amount , and also the bottom layer of Defi's overall ecology.

Because of this, Dexs has always been the most active field of competition and innovation, and competitors on the same track have maintained a rapid evolution rate in terms of products, economic models, and ecological combinations. The ve(3,3) model Dexs proposed by Andre Cronje in early 2022 is just one of the important practices in this field.

This research paper focuses on the topic of ve(3,3) and tries to answer the following questions:

What is the full concept of ve(3,3)? What problems is it trying to solve?

What is the actual business performance of the current representative ve(3,3) project? What improvements have they made based on the original ve(3,3) mechanism? And what is the valuation level of the project.

Will ve(3,3) become a long-term valid Dexs pattern?

The content of the following report is the author's staged views on the concept of ve(3,3) and the projects involved as of the time of publication. There may be errors and biases in data, facts and opinions, and they cannot be used as investment reasons. Pointing and correcting.

This article has a lot of content about the ve model, or requires readers to have a preliminary understanding of projects represented by Curve. About Curve, you can read:

Understand the correct posture of Curve: the business status, ecological development, moat and valuation comparison of the top Liquidity market (released in February 2023)

CRV under the attack of UNI V3: In-depth analysis of Curve's business model, competition status and current valuation (released in September 2021)

1. Definition and value of ve(3,3) mode

ve(3,3) is not a project name, but a way to build and operate Dex and Liquidity protocols, where, ve=vote escrowed (voting entrustment), comes from Curve's ve economic model, and its core advantages are Through the pledge voting mechanism, the long-term interests of the participants and the agreement are further unified.

And (3,3) comes from OlympusDAO's (3,3) game theory (derived from Nash equilibrium theory). Assets such as USDC and ETH enable the treasury to be supported by value assets, and generate OHM and distribute it to OHM pledgers through the Rebase mechanism. If more users enter the market to buy OHM tokens, the treasury will issue more OHM tokens and distribute them to the pledgers, thus creating a positive trend that the pledgers have high APR when the price of OHM tokens continues to rise. Circular effect, but the premise is that market users do not sell OHM, but choose to continue to pledge tokens, which is the so-called (Stake, Stake) — namely (3,3). That is to encourage users to continue to participate in the pledge, so as to enjoy the rights and interests of the continuous issuance of OHM tokens, and reduce the risk of token dilution.

If readers find it difficult to understand the (3,3) mechanism, we can abstract it into such a game mechanism:

A certain project has a network effect, and the larger the users and participating funds of its multilateral or bilateral scale, the stronger the barriers to competition, so it has the appeal of continuously expanding its scale to create barriers to network effects.

It introduces a mechanism that extremely encourages all token holders to act in unison to bet on re-investing tokens (or other actions that the protocol expects users to take), which will allow the scale of the protocol to continue to expand, and the network effect will become more and more The more powerful it is, until it forms a strong barrier to competition, enough to obtain the monopoly benefits of the track. As the "shareholder" of the project, as long as the user maintains his share of tokens in the entire project, the value he owns will naturally rise with the expansion of the project's scale and the improvement of monopoly, forming a "win-win" situation.

The vulnerability of this mechanism is that once some users choose to take reverse actions (such as choosing to sell and leave the market instead of staking), the overall expectations and currency prices may gradually resonate, and users begin to withdraw collectively, turning into a spiral of decline , causing the project to fail.

In the Stablecoin project represented by OHM, the network effect it pursues is that the larger the Stablecoin network, the more scenarios and users it has, and the harder it is for latecomers to catch up. In the Dex project represented by Solidly, the network effect it pursues lies in the mutual reinforcement of Dex's LP, ve token pledgers and Trader. The larger its share in the trading market, the harder it is for latecomers to catch up. Therefore, the application of the so-called (3,3) mechanism in the DeFi field is mainly aimed at helping projects expand their network effects and build barriers at a specific stage.

In addition to ve and (3,3), the Dex of ve(3,3) also superimposes new methods at the project cold start level and the composability of governance credentials. Combining the above designs, it tries to create an overall better Dex model.

Specifically, from the perspective of abstract regression, ve(3,3) class Dex projects have the following characteristics:

The main body of the project adopts Curve's ve economic model, which means:

In addition to being Dex, the project is also a Liquidity aggregation and procurement market. The equity token of the project is the Liquidity procurement currency of this platform

Project tokens need to be pledged to have governance rights and income (handling fees + bribery) dividend rights. The premise of extracting value from the platform is to be bound to the development of the platform for a long time

The difference between the ve(3,3) project and Curve is: 1. Curve will distribute all Pool protocol transaction fees to the ve pledgers, while the ve pledgers of the ve(3,3) project will only get their own votes 2. The LP of the ve(3,3) project only gets the project token as a market-making reward, and the transaction fee is all owned by the ve pledger; 3. The bribery module of Curve is provided by the external platform (Votium or Votemarket), ve(3,3) projects have their own bribery module, and short-term procurement Liquidity will be easier

Referring to Olympus's (3,3) game mechanism, this means:

Encourage users to stake the project's equity tokens in ve, and provide equivalent token incentives for locked ve certificate holders to avoid dilution of the token ratio of token holders, so as to encourage users active pledge

Through the increase of the pledge rate, the selling pressure of the token is reduced, and the price of the token is promoted. The rise of the token price leads to an increase in the market-making APR, which further attracts more Liquidity accumulation and creates a better transaction depth, attracting more transaction volume, forming a self-reinforcing business flywheel

During the cold start, the initial ve certificates are often AirDrop to projects with high business and influence in the ecology (often referring to the public chain where the project is located) to recruit the first batch of "B-end customers" for its Liquidity procurement market. The logic is similar to that Internet products issue "free experience coupons" to customers, and the experience here is the project's "Liquidity procurement service"

The pledge certificate of equity tokens has changed from veToken to veNFT. veToken is non-transferable, but veNFT is. This means that users can resell or re-mortgage their ve certificates to further improve capital efficiency.

Generally speaking, ve(3,3) projects are an upgrade of the Curve model, and we hope to focus on the following three points:

1. Increase the willingness of users to pledge ve, and further improve the consistency of interests and actions between currency holders and the protocol

2. More "transaction fee" incentive-oriented, because the pool's handling fee is only distributed to those who vote for the pool, which in turn incentivizes transaction volume (better Liquidity can attract more transactions to create more handling fees)

3. More "TOB" orientation, which not only provides a better Liquidity procurement experience for token issuing project parties, but also higher initial incentives, and actively binds B-end customers

Therefore, the author will also focus on the performance of the ve(3,3) project in the above three points.

2. ve(3,3) represents project analysis

In the selection of the specific ve(3,3) project, the author comprehensively considered the competitiveness ranking of the chain where the project is located, the transaction volume, the amount of bribes and other indicators, and selected the following projects with better business performance for comparison and analysis: Velodrome (Optimism) , Thena (BNBchain), Euqalizer (Fantom), and Chronos, which has just launched Arbitrum recently.

2.1 Velodrome: the first batch of practitioners of ve(3,3), OP chain head Dex

Velodrome is the most representative project in the Solidly fork project, and the author will spend more space on the introduction.

2.1.1 Project introduction and difference mechanism

a. Mechanism design

Velodrome is currently only deployed on the L2 network OP of Ethereum. Its product mechanism design is derived from Solidly, the originator of ve(3,3), but some adjustments have been made, specifically:

The liquidity bribe reward for Pool can only be claimed in the next cycle

The Pool for the incentive issuance of Velo tokens adopts a whitelists mechanism. The whitelists is currently an open application system and does not go through the on-chain governance process. Solidly’s emission application is unlicensed, which means that as long as you have the right to vote, you can Direct token incentives to pools that generate no transaction fees at all. In addition, Velodrome has a committee that can suspend discharges to any pool at any time.

The reward ratio for additional issuance of ve token holders has been reduced. Compared with Solidly’s guarantee that the proportion of ve token holders’ tokens will not be diluted, under Solidly’s mechanism design, the emission rewards of ve tokens are: (Total amount of pledge ÷ total amount of TOKEN) × 0.5 × total incentive emission, and the calculation method of Velo’s additional issuance reward ratio for ve certificates is: (total amount of pledge of veVELO ÷ total amount of VELO) ³ × 0.5 × total incentive emission. Assuming that the current Velo pledge rate is 50%, then under the traditional ve(3,3) model, veVELO users will get 50% of the total emissions; while under the Velo adjusted model, veVELO users will only get 50%³ =12.5% of the total emissions, only 1/4 of the traditional model. This improvement has actually greatly weakened the (3,3) part of the ve(3,3) mechanism.

3% of Velo's emissions will be transferred to the team's multi-signature wallet as operating expenses to provide a budget for the long-term operation of the project

Canceled the LP Boost mechanism (a mechanism inherited from Curve based on the number of ve tokens that can accelerate LP mining)

b. Team situation

Velodrome Finance was incubated by the team behind the veDAO of the original Fantom ecosystem. And veDAO was incubated by Information Token, an anonymous blockchain research organization. Its initial task is to obtain the governance rights of the Solidy ecosystem proposed by Andre Cronje. At the beginning of 22, Andre Cronje launched Solidly on Fantom, and said that Solidly's initial governance rights (veNFT) will be allocated to the top 20 projects on Fantom according to the ratio of TVL. veDAO was launched along with the trend and attracted nearly 2.6 billion US dollars in TVL during the peak period.

However, Andre Cronje announced his resignation shortly after. In addition, after the launch of Solidly, the problems continued to be "overwhelmed". Since then, the Fantom ecosystem has also continued to decline in the bear market, and it is no longer active as it was when AC was located. Since then, the veDAO team has turned to the Optimism ecosystem and developed Velodrome.

c. Milestones and Roadmap

The major events of the project are as follows:

2022.4 veDAO stated that it will launch Velodrome on Optimism using Solidly as a template, and announced that it will conduct token AirDrop .

2022.5 Announced that Optimism will become its official launch partner, and Optimism will officially obtain veNFT representing about 5% of the initial voting rights.

2022.6 The product was officially launched and received an AirDrop of 4 million OP tokens provided by the OP .

2022.7 TVL surpassed Uniswap ( OP chain).

In August 2022, the team wallet was stolen, and operating funds worth 350,000 US dollars were lost. It was later confirmed that the thief was a former team member.

2022.11 Launch the incentive plan "Tour de OP " with a total budget of 4 million OP , which is used to motivate Liquidity and veVELO lock users, especially providing high rewards for cooperative agreement projects.

2022.12 Released the function plan of Velo2.0, which includes the proxy and income optimization functions of ve rights, as well as the basic functions of centralized Liquidity, custom Pool, veNFT segmentation and trading, etc. At that time, it was estimated that V2 would be released in 2023. Available quarterly.

2023.2 The VELO FED concept was released, indicating that subsequent veVELO users will be able to adjust Velo's emission rate through governance, and also announced that it will provide Pool's optional fee level (fee level) function.

2023.2 A new version of the OP incentive plan "Tour de OP" was released, and the incentive ratio for Liquidity and veVELO lockup was adjusted.

The next most important milestone for Velodrome is the launch of Velo2.0, which was originally planned to be released in the first quarter of 2023, but it has not yet been launched as of now (early May 23). The author also inquired about the launch time of Velo2.0 in the official community. The community ambassador replied that the audit has been completed and it should be launched in May.

Velo2.0 contains a lot of content, which is mainly divided into 5 major parts:

Velodrome "Night Ride" UI upgrade: rich data dashboard, improved interaction friendliness, visual optimization

Velodrome Relay: functions such as bribery revenue optimization around ve pledge entrustment

New functions: LP customization (basic function of centralized Liquidity), Pool customization (editable Pool function similar to balancer), fee level, voting module upgrade (like Votium), veNFT transactions, fragmentation, etc.

Technology upgrade: code base streamlining, auditing, risk control, etc.

Governance upgrade: veVELO can control VELO emissions

However, considering that 2.0 contains a lot of content, the author believes that it is more difficult to launch the functions promised above at the same time, and the possibility of launching them in batches is higher. In addition, functions such as the Lauchpad function, LP automatic reinvestment, complete centralized Liquidity function, combination pool (similar to Curve's metapool), and veNFT lending have also been arranged by the team as key tasks for 23 years.

2.1.2 Business Situation

In terms of business evaluation, the author will evaluate Velodrome and other projects from four aspects, namely: Liquidity(TVL) and corresponding Liquidity procurement expenses, transaction volume, bribe amount and number of bribe projects, and Velo’s pledge ratio .

As a ve(3,3) model spot Dex+ Liquidity procurement market, Velodrome's business model can be summed up in one sentence, that is: purchase and gather Liquidity through the platform equity token (Velo), and then use the Liquidity for : 1. Satisfy traders (for exchange fees); 2. Sell to project parties (provide Liquidity for their tokens).

Therefore, through the Liquidity(TVL) and the corresponding Liquidity procurement expenses, transaction volume and handling fees, bribery amount and the number of bribery projects, we can comprehensively grasp the income, customers and cost of the project, while the pledge rate of Velo is used (3,3) Mechanism Effects for Evaluating Projects.

a. Liquidity(TVL) and corresponding Liquidity purchase expenses

According to Defillama data, Velodrome's current TVL is 289 million US dollars (as of May 4, 23), and the TVL has fluctuated between 270-320 million US dollars for most of the past two months.

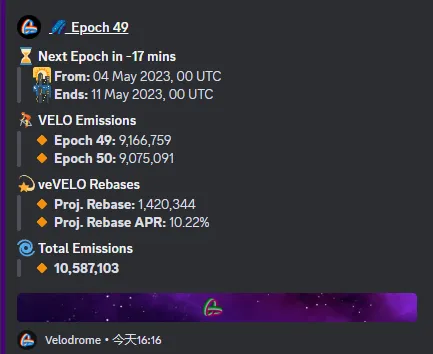

The latest weekly Liquidity incentive for Velo is 9,166,759, and the price is 0.129$, as shown in the figure below.

Then the weekly Liquidity incentive is: 9,166,759×0.129=1,182,511$. We take the TVL/weekly Liquidity incentive, that is, 289,300,000/1,182,511=244.64$, which we can roughly understand as: Velodrome currently maintains a Liquidity of 244.64$ through an incentive expenditure of 1$ per week (of course, Liquidity indicators except absolute In addition to the amount, there are differences in the composition of its assets and the algorithm of the transaction curve).

b. Transaction volume and transaction fees

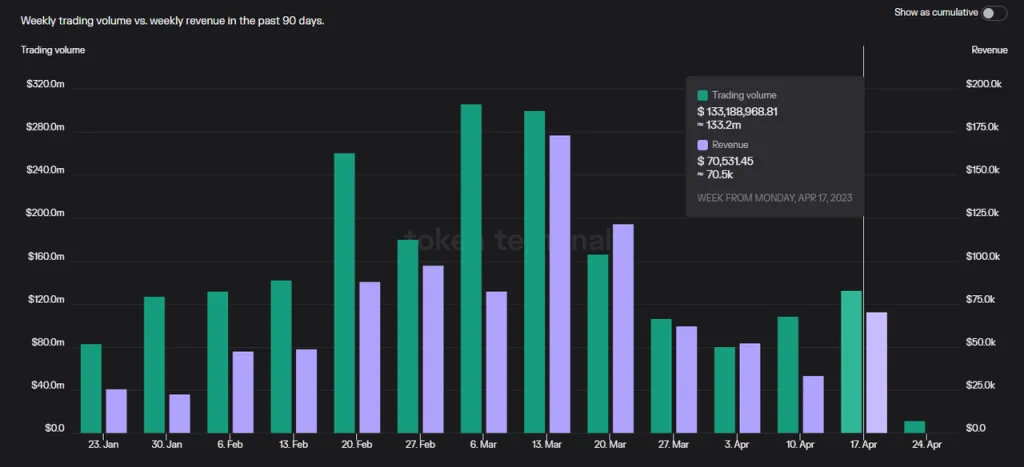

According to Tokenterminal data, the weekly trading volume of Velodrome in the past three months has been between 80 million and 300 million US dollars, most of which have a weekly trading volume of around 100-150 million US dollars.

And its weekly transaction fee income is between 25,000 and 100,000 US dollars most of the time.

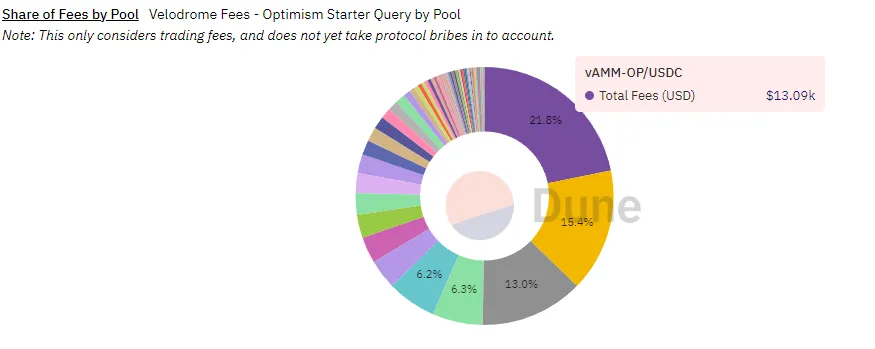

The source of Velodrome's transaction fees is mainly the non-stable trading pairs, namely Volatile AMM(vAMM). According to the Kanban data constructed by community user @msilb7 , in the ranking of Velodrome's transaction fees in the past 7 days, the top 5 are vAMM Pools. Fee contribution accounted for 62.7%.

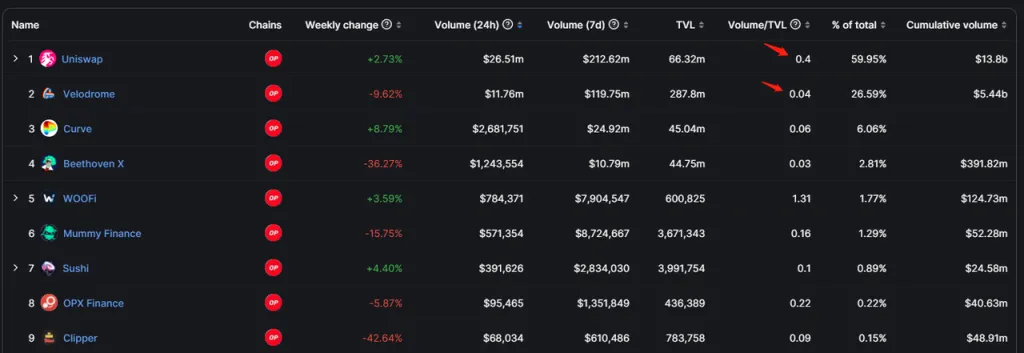

However, in terms of the capital efficiency of LP, Velodrome is significantly lower than Uniswap on OP, and the ratio of [trading volume/TVL] between the two is an order of magnitude worse, Uniswap V3 is 0.4, and Velodrome is 0.04.

This huge data difference comes from Uniswap's centralized Liquidity mechanism. Although the centralized Liquidity mechanism brings higher management difficulties to LPs, it has obvious advantages in capturing transaction volume. Liquidity is one of the core reasons for the main topic.

c. Bribe Amount and Item Quantity

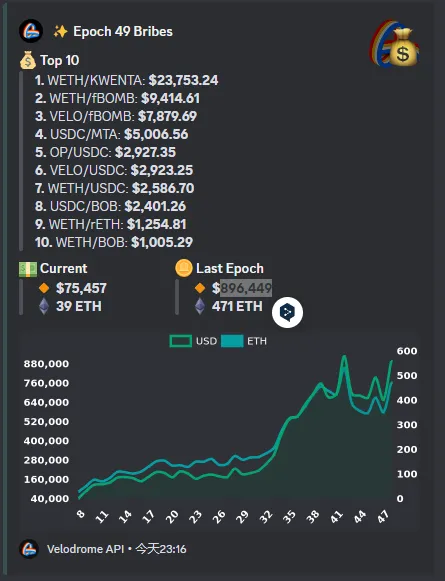

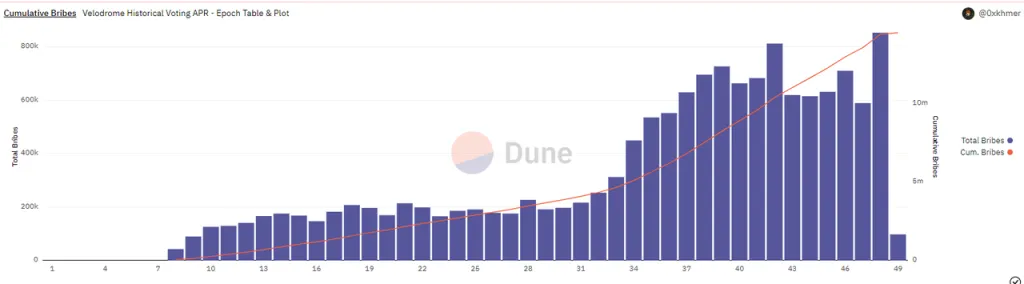

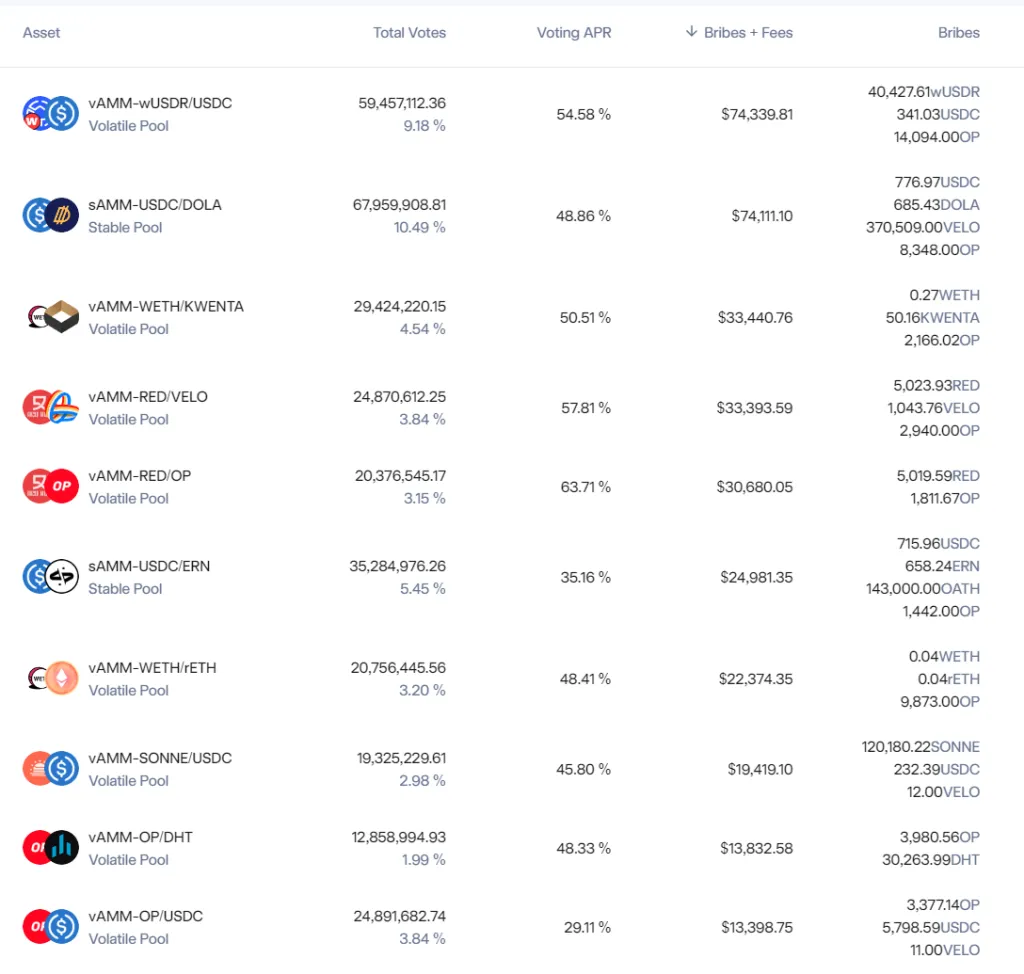

At the moment when the author writes this article, Velodrome is in the 49th voting cycle (Epoch49), and the total amount of bribes in the previous period was 896,000 US dollars.

According to past data, Velodrome’s bribes have exceeded $300,000 for 15 consecutive weeks, and have been above $500,000 for the past 12 weeks.

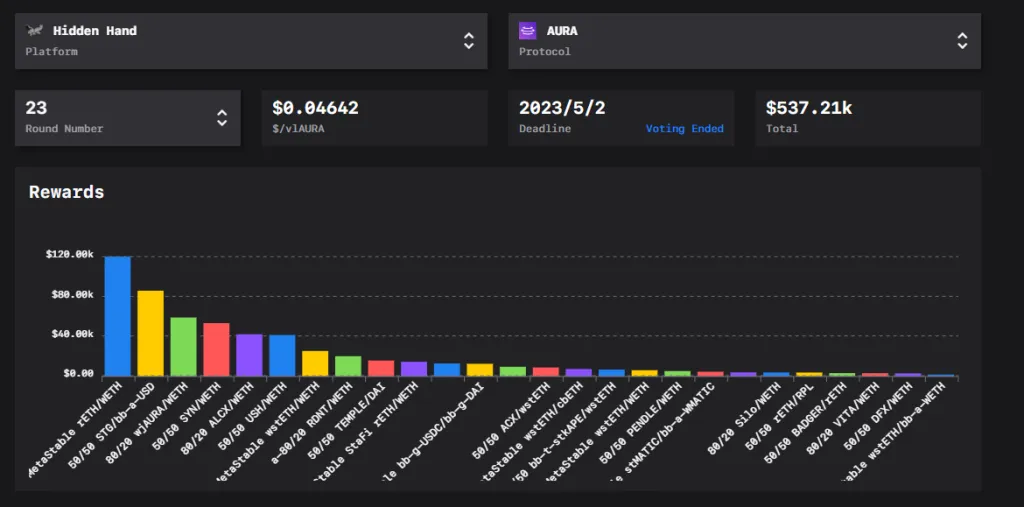

This week's bribery data has exceeded the recent bribery amount of Balancer, an established project that also uses the ve model and also operates Dex and Liquidity markets. Currently, Balancer’s most important bribery platform, hidden hand, with a TVL of US$1.2 billion, had a recent bribery amount of US$537,000, but its governance cycle is 2 weeks, so the weekly bribery amount was US$268,500.

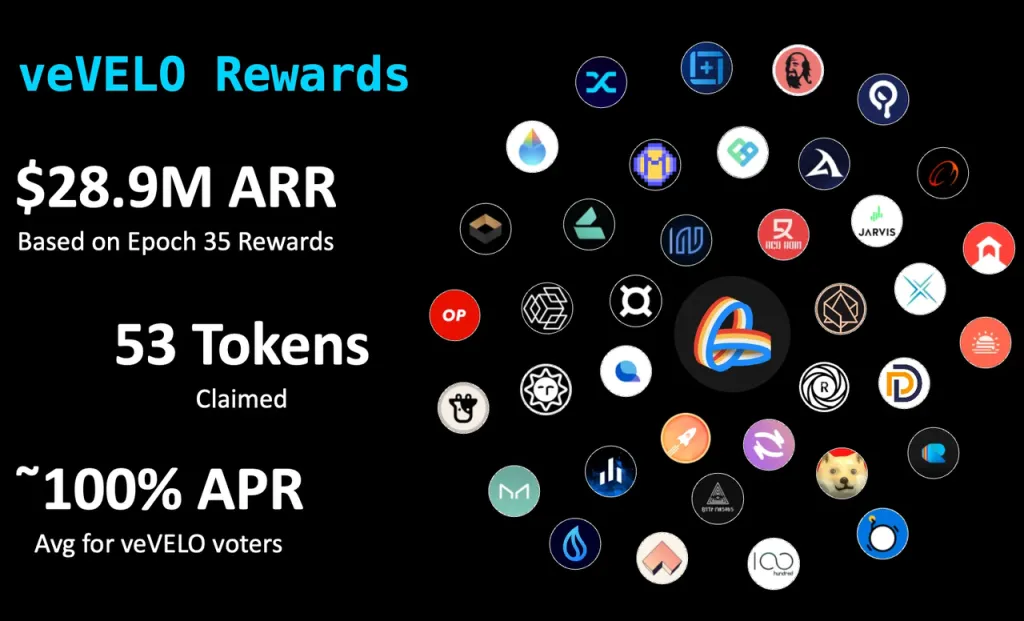

Although it needs to be considered here that Balancer’s ve governance rights in Hidden’s participation in the exchange of tickets are less than 30%, it can also confirm Velodrome’s strong bribery income. This data may also confirm that the ve(3,3) project, which directly integrates the bribery module, has more advantages than the building block services of the traditional ve project in terms of the mobilization of ve governance and the collection of bribery funds. In terms of the number of cooperation agreements, according to the data released by Velodrome in February this year, Velodrome has issued more than 53 bribery tokens.

According to Velodrome’s bribery data on April 26, there are 248 active pools, among which the top 10 pools with weekly bribes are all above 13,000$, and 49 pools have weekly bribes above 1,000$.

In the current period (Epoch47), the top 10 pools in terms of bribery amount come from 9 projects, and the project categories are relatively rich, including lending and Stablecoin protocols (Tangible, Inverse, Ethos, Sonne), Derivatives(Kwenta), and entertainment (Red). , LSD (Rocket Pool), asset management (dHedge) and L2 base layer (OP).

At present, among the top 10 DeFi protocols ranked by TVL on the OP, 5 of them conduct Liquidity procurement on Velodrome, and 3 of the 5 projects without procurement behavior are competing products (Uniswap, BeethovenX, and Curve) that are also on the Dex track. The other two are AAVE and Stargate, which have already landed in major exchanges and have sufficient Liquidity . Stargate has just recently passed a community governance proposal for Liquidity procurement on Velodrome.

Overall, Velodrome's Liquidity procurement customers are rich in sources, highly dispersed, and are in a relatively good development trend.

d. Pledge ratio

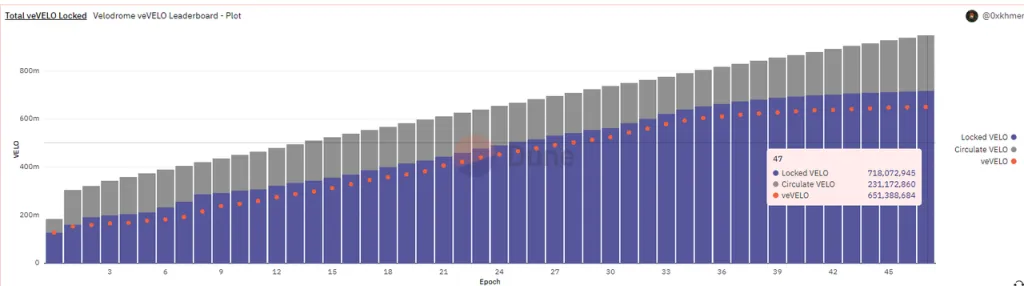

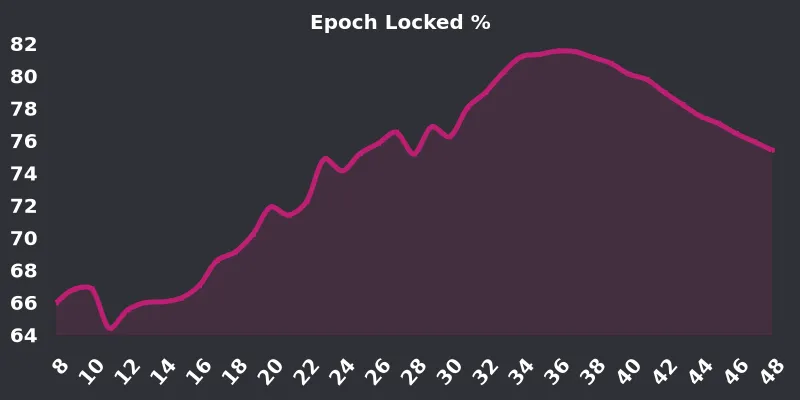

Velo’s staking ratio has been on the rise since Velodrome was launched.

However, in February-March of this year (Epoch36) the pledge rate reached its peak and began to decline. Although the total amount of pledges is still rising, the pledge ratio of newly circulated Velo tokens has dropped significantly, as shown in the table below: The current Velo pledge rate is far from high The point of 81.6% has fallen by nearly 7% to 74.67%.

There may be four reasons why the Velo pledge rate has peaked and declined:

- The price of Velo tokens has continued to rise since the end of January 2023. Although Velodrome’s transaction fees and bribe income also increased during the same period, the rate was far less than the increase in currency prices, which directly led to the rapid decline of veVELO’s APR. The yield return on staking decreases,

2. During the period from February to April, the price of Velo tokens fluctuated violently, with frequent fluctuations of several times, which made investors prefer to hold tokens to maintain better Liquidity rather than pledge.

3. The " Tour de OP " plan that started in November last year has lasted for 5 months, and the main content of the plan with a total expected span of June-August is that the 4 million OP rewards obtained through Velodrome are used to motivate Velo Locking, as the plan comes to an end and the OP's incentives come to an end, the incentives for locking will fall further, forming a potential selling pressure.

4. 70%-80% is already a high lock-up ratio, and the comprehensive marginal cost of maintaining and improving the lock-up ratio is getting higher and higher. Curve, which also adopts the ve model, currently has a pledge rate of 38.8%.

2.1.3 Summary

Velodrome is currently one of the best-developed ve(3,3) projects, TVL ranks first in OP, and the transaction volume on the same chain is second only to Uniswap. The development of its Liquidity business is also relatively smooth, and it is in the first echelon in terms of the number, quality and amount of customers. However, due to the fact that the current tokens have had a large increase from January, and the volatility is relatively large, the pledge rate has also reached a high range, and the pledge rate has fallen. After the " Tour de OP " event is over, the pledge The OP rewards of veVELO are reduced, and the pledge ratio of veVELO may be further pressured in the medium term. In the long run, the centralized Liquidity brought by Velodrome 2.0 is expected to help Velodrome further improve LP's capital efficiency, fee income and market share of trading volume on OP. In addition, Velodrome is currently in a state of being highly bound to the OP community, and its business ceiling is determined by the development of the OP ecosystem. In addition to the OP itself as an L2, how many L2 operations can its flagship Superchain L2 network based on the OP Stack eventually have? The addition of vendors and applications may also affect the development potential of Velodrome.

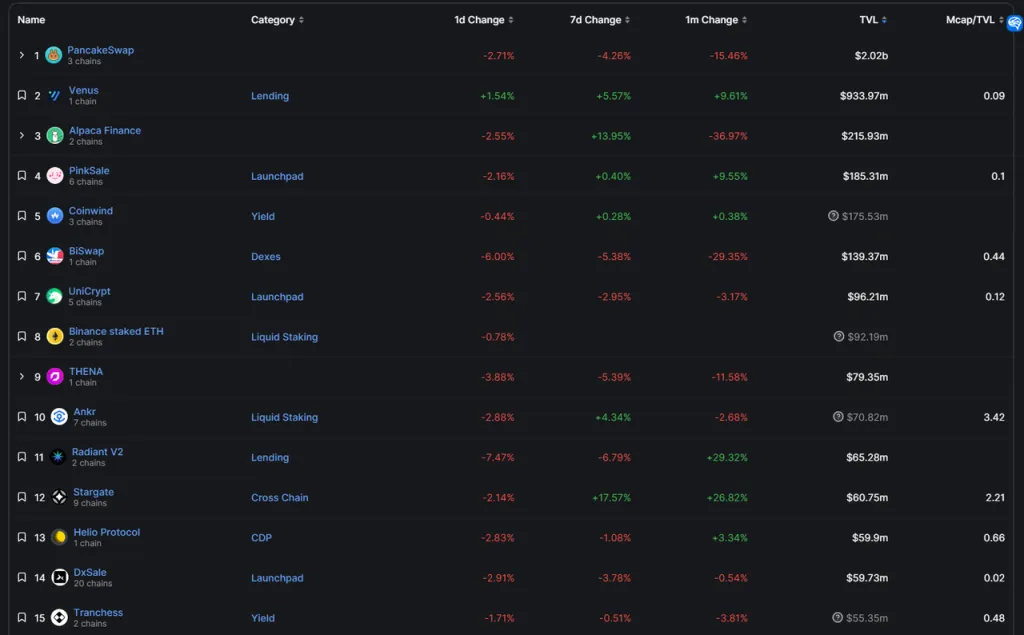

2.2 Thena: the leader of centralized Liquidity ve(3,3) on BNBchain

Thena was launched in January this year. TVL currently ranks 9th on BNBchain, and it is also the first ve(3,3)Dex to realize the centralized Liquidity function.

2.2.1 Project introduction and difference mechanism

a. Mechanism design

Thena is currently only deployed on BNBchain, which has further modified ve(3,3) on the basis of Velodrome. The important mechanism changes include:

At present, the centralized Liquidity function called Fusion has been launched, and it supports the automatic market-making interval management strategy based on centralized Liquidity

The rebase reward of ve tokens accounts for 30% of the output of each period (it is the upper limit and the current fixed value)

Introduce the recommendation mechanism, the recommender can share the transaction fee of the new user, and the new user will have a lottery reward through the recommendation

Early adoption of NFT for fundraising, NFT can share 10–20% of the agreement’s handling fee after staking

Increased fee rates to 0.02% for sAMM pools and 0.2% for vAMM pools (0.01% and 0.05% for Velodrome)

In addition, Thena, like Velodrome, adopts the Gauge application permit system, cancels the LP boost, and gives 2.5% of the tokens emitted each period (Velodome is 3%) to the project party.

Fusion: Centralized Liquidity+ Automation = Lower Barriers to Participation and Capital Efficiency

In addition to the overall mechanism design of the project, it is necessary to focus on the Fusion function launched by Thena in April. This is the biggest feature that distinguishes Thena from other ve(3,3) projects, and it is also the core function of Thena V2.

The main functions of Fusion are as follows:

Introduce the centralized Liquidity(CLMM) capability, allowing LPs to customize the market-making range. The advantage is that the same capital is concentrated in a range, so it can provide a thicker depth and lower slippage in [a specific price range], so it can capture greater transaction volume and handling fees, thereby increasing LP in [ Capital efficiency within this range. The reason why [within a specific price range] is repeatedly emphasized is because once the asset pair of LP market-making breaks through this price range, the asset pair will be converted into a single asset, and the handling fee can no longer be captured (at this time, the capital efficiency is 0 ), and this process means a higher risk of Impermanent Loss. Therefore, under the centralized Liquidity mechanism, market makers need to have a higher level of market making (prediction of price trends, energy and strategies for dynamically adjusting market-making intervals) ) to match.

Provide automated LP management strategies to partially solve the high market-making threshold of the centralized Liquidity mechanism mentioned above. Specifically, its solution is mainly aimed at two of the difficulties in market making, namely: 1. Automatically adjust the LP market-making range to avoid the problem that the price exceeds the market-making range for a long time; 2. Provide templated market-making strategies, covering 5 There are two main LP scenarios, so that users with ordinary professional ability can quickly find a suitable LP strategy, as follows:

The strategy corresponds to the negative impact of asset benefits Narrow range mode Price linkage is obvious, non-correlated assets with low relative volatility, such as: BTC and ETH earn more fees under low volatility conditions Higher Impermanent Loss under high volatility conditions Interval mode Price linkage is not obvious, non-correlated assets with high relative volatility, such as: ETH and an altcoin have less Impermanent Loss under high volatility conditions, and earn lower fees under low volatility conditions Manual mode Any asset Complete LP autonomy 1. Requires active management actions and deep transaction expertise 2. Only LP transaction fees can be obtained, no mining income (THE) Anchored mode package assets (Wrapped token), such as multiBTC1. Low fees + Low slippage 2. Liquidity is concentrated at 1% → higher handling fees. When unanchored, your LP will all become unanchored asset-associated model LSD assets, such as wstETH (characterized by the continuous growth of the net value of tokens) and automatic reassessment Balance strategy, no need for continuous manual rebalancing. When unanchored, all your LPs will become unanchored assets. Stablecoin model. Stablecoin Liquidity is concentrated at 1% → higher handling fees. When unanchored, your LP will all be Become an unanchored asset Source: Thena official Medium tabulation & translation: Mint Ventures

- A dynamic fee model is introduced. As the price fluctuations of assets in the pool increase, the fee ratio increases (to subsidize the Impermanent Loss of LP); when the price changes narrow, the fee decreases to capture more transaction volume.

Overall, Fusion brings obvious benefits to Thena, especially simplifying the complexities of market making based on centralized Liquidity. But as mentioned above, the market-making challenge under the centralized liquidity mechanism requires not only continuous adjustment of the market-making range, but more importantly, predicting the price trend (is it fluctuating or unilateral? Is it a wide fluctuation or a narrow fluctuation?), this It is a problem that automated strategies cannot help users solve, and it is also a risk that users must bear.

In addition, Fusion's centralized Liquidity mechanism and dynamic fees come from the services of Algebra Protocol, while automated LP management uses Gamma's services (LPs do not need to pay for Gamma services, and Thena provides Gamma with veTHE as a reward). The innovative approach allows Fusion to go online faster (while the centralized Liquidity module developed by Velodrome for many months has not yet been released), but on the other hand, because Fusion's core services come from a combination of three parties, it also introduces more external risks.

b. Team situation

The Thena team currently has no public real name information. Its main members come from Liquid driver, a revenue aggregation and Liquidity service project on Fantom. Previously, Liquid driver formed 0xDAO with SpookySwap, Scream, Hundred Finance and RevenantFinance, which belong to Fantom, and adopted a model similar to veDAO Absorbed Liquidity, and finally raised a Liquidity of 2 billion US dollars at the peak, and also obtained the largest ratio of ve AirDrop shares in the follow-up Solidly.

At present, the business of the Liquid driver project itself has been relatively sluggish. The TVL is only about 8 million U.S. dollars, and the token FDV is only about 17 million U.S. dollars. It is expected that the team is currently focusing more on Thena. However, although the Thena team has not disclosed the core member information at present, many members in the community said that they "know who they are", so the team is not strictly anonymous. Also according to the information provided by community members, Thena's core team has 8 members, which is a relatively capable team.

c. Milestones and Roadmap

The major events of the project are as follows:

2022.10 Project official announcement, introducing the concept of Thena and the follow-up NFT financing plan.

2022.11 Release NFT financing details and financing time, a total of 3000 founding NFTs, a single mint cost 2-2.5 BNB

2022.11 Release THE token economic model.

2022.12 NFT sale completed.

2023.1 Thena was officially launched, and the TVL exceeded 100 million US dollars in the same month.

In 2023.2, the transaction recommendation system was launched, and the service of MUON was adopted.

2023.3 Official announcement of the Fusion function.

2023.4 Fusion function is online.

2.2.2 Business Situation

a. Liquidity(TVL) and corresponding Liquidity purchase expenses

According to Defillama data, Thena's current TVL is 81.41 million US dollars (as of May 4, 23 data).

Similar to Velodrome, the Thena platform's Liquidity purchase expenditure is the emission incentive for The Pool. Currently (epoch17) Thena's total weekly emission is 2,213,790 (calculated according to official documents, the initial weekly emission is 2.6M, and the subsequent weekly decay is 1% ), the emission used for Liquidity incentives accounts for 67.5%, and the unit price of THE is 0.33$, that is, the incentive for Liquidity purchases is 1,494,308×0.33=493,121$. We divide the Liquidity by the weekly Liquidity incentive: 81,410,000/ 493,121=165.1$. We can roughly understand it as: Thena was able to maintain a Liquidity worth 165.1$ through a weekly incentive payment of 1$.

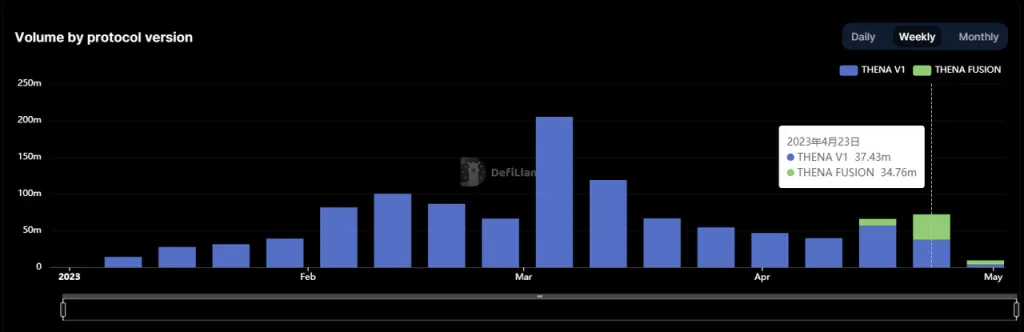

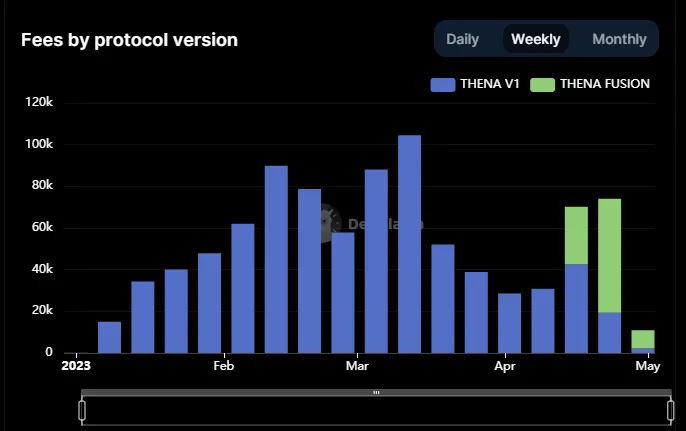

b. Transaction volume and transaction fees

According to Defillama data, Thena's weekly trading volume in the past three months has been between 50 million and 200 million US dollars, and most of the time the weekly trading volume is around 50 million to 100 million US dollars.

And its weekly transaction fee income is between 40,000 and 100,000 US dollars most of the time. Compared with Velodrome, Thena's transaction volume is lower, but overall it creates higher transaction fee income. The main reason is that its V1 version of vAMM and sAMM has a higher transaction fee ratio, vAMM is 0.2% (Velo is 0.05 %), sAMM is 0.04% (Velo is 0.01%).

It is worth noting that after Fusion went online, both the transaction volume and handling fees generated by it have rapidly increased in the proportion of Thena's total business, especially handling fees, which have already accounted for 73.8%. More importantly, this is still generated under the condition of Thena TVL decline, which can be seen in the capture ability brought by Fusion's centralized Liquidity+ dynamic handling fee in terms of transaction volume and handling fee.

c. Bribe Amount and Item Quantity

At the time of writing, Thena is in the epoch17 stage. Due to the recent launch of fusion, most external data dashboards do not count the bribes transferred to Fusion. Most of the weekly bribes from February to April ranged from 150,000 to 300,000 US dollars. As a project that has been online for less than half a year, this part of the income has already performed well.

According to Thena’s official data, there are 146 active bribery pools (bribe amount > 0) in this period, 69 pools with weekly bribes exceeding US$100, and 41 pools with weekly bribes exceeding US$1,000.

Among the 10 projects with the highest bribery amount this week, the types include Stablecoin(Tangible), video streaming media (XCAD), LSD (ANKR, Pstake, Frax), Derivatives and synthetic assets (Deus finance), Ponzi earth dog ( Libera), etc., are rich in types. Among the top 15 DeFi projects on BNBchain, apart from Thena itself, only ANKR(LSD), Radiant (loan) and Helio (Stablecoin ) are currently purchasing Liquidity in Thena.

Excluding Thena’s competing projects Pancake and Biswap, among the remaining projects Venus, Alpaca, Chess, and Stargate have all been listed on Binance and have good Liquidity.

Overall, Thena's Liquidity procurement market business is developing well, and its customer base is relatively scattered. Although BNBchain's ecological vitality, number of high-quality projects, TVL and other indicators have stagnated and declined in the past one or two years, and it has been gradually overtaken by ecosystems such as Arbitrum, it still maintains a high number of active users and has attracted many new projects. This deployment, which is the main source of clients for Thena's Liquidity marketplace. However, as the "side chain" attribute of Binance's centralized CEX, BNBchain also limits its credit limit, resulting in many projects but not good innovation, and poor innovation; in addition, Binance itself, as the largest trading platform, is also siphoning the transaction volume of BNBchain .

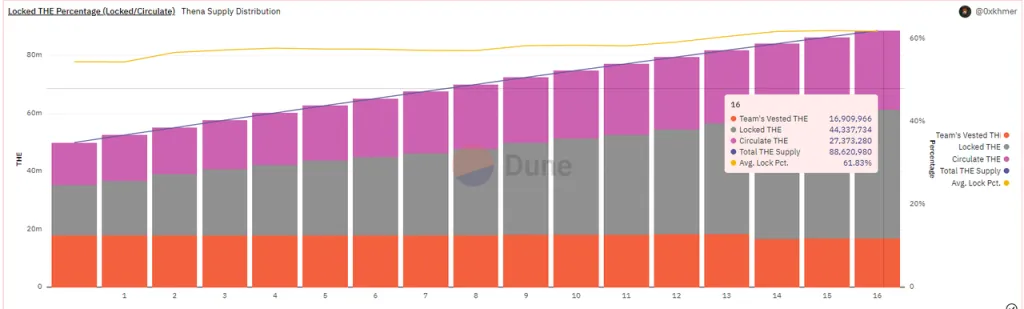

d. Pledge ratio

The lock-up rate of THE is currently 61.83%, and has been on a slow upward trend since the project went live.

The main driving force for Thena's rising pledge rate should come from the higher voting APR (Thena's average voting APR is 397%, and Velodrome has only two Pools with higher voting APR), which is caused by two aspects Driven by:

The price of THE token itself is low (the valuation suppression caused by the slow development of BNBchain is one of the main reasons)

Liquidity purchasers bid fiercely and offered higher bribe fees

If the above conditions remain unchanged, Thena's pledge rate will have a great chance to continue its upward trend.

2.2.3 Summary

As the earliest ve(3,3) project of BNBchain, Thena is currently operating well, ranking third in Dex on BNBchain (both the first and second places are invested and supported by Binance). So far, it has done a few things right:

Improvements are made on the basis of Velodrome's practice, making good use of previous experience;

Using building block innovation and cooperating with other projects for development has greatly improved the speed of product iteration, such as cooperating with Algebra Protocol and Gamma to develop centralized Liquidity, cooperating with MUON to introduce the recommendation rebate function, and cooperating with Open Ocean for transaction routing .

In addition, Thena's business data also proves that the adoption of the centralized Liquidity mechanism has significantly boosted Dex's business. After the launch of Fusion, both transaction volume and handling fees have increased significantly month-on-month. On the one hand, this confirms the general trend of the adoption of the centralized Liquidity model, and on the other hand, it may also reveal that there are also abundant opportunities in the service market around centralized Liquidity(such as Gamma).

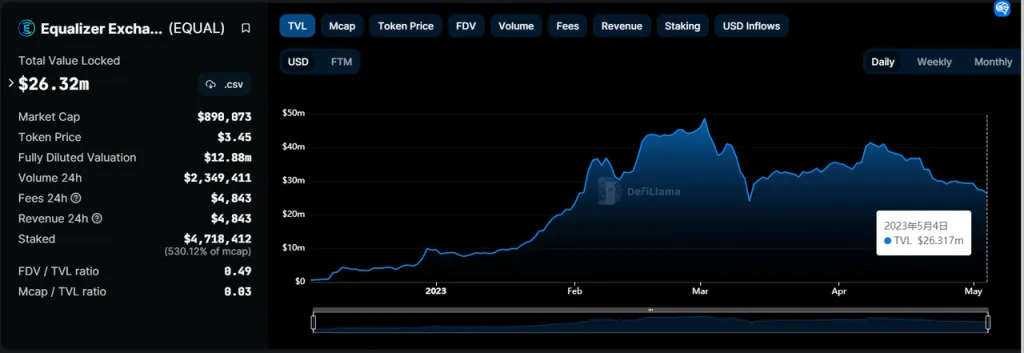

2.3 Equalizer: ve(3,3) "single seedling" on Fantom

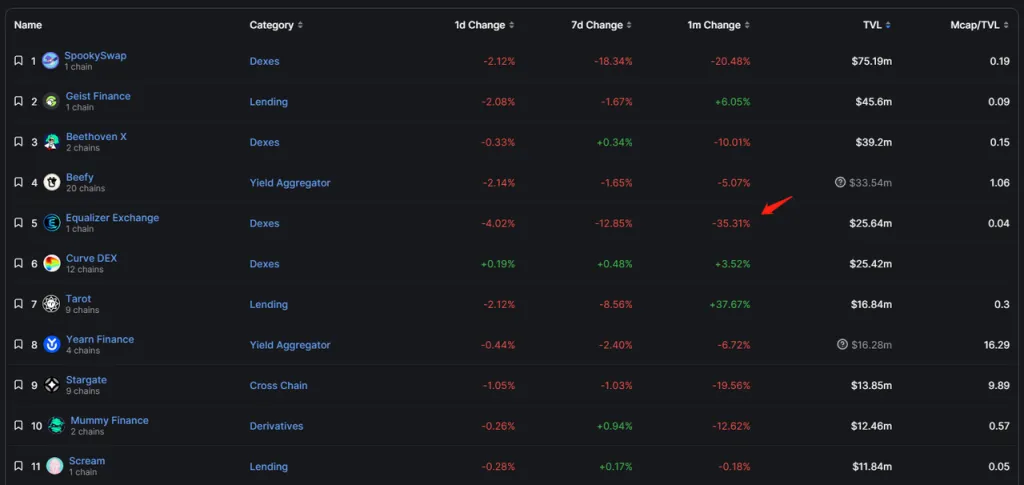

Equalizer is the Dex with the third highest TVL on Fantom, but it is also the project with the smallest TVL and market value among the ve(3,3) projects that this research report focuses on. Fierce competitive environment.

2.3.1 Project introduction and difference mechanism

a. Mechanism design

Equalizer is currently only deployed on Fantom, and its mechanism is also inherited from Solidly. The differences in mechanism include:

The Rebase mechanism has been cancelled, and ve certificates are no longer assigned tokens

The upper limit of the ve token lockup period is 26 weeks, that is, half a year

Increase the fee rate, the fee rate of sAMM pool is 0.02%, and the fee rate of vAMM pool is 0.2%

There is no initial AirDrop of ve token governance rights to other project parties

Among them, the design of Rebase is originally the most important item in the ve(3,3) mechanism. AC believes that through Rebase, users' willingness to pledge can be improved. However, most of the more successful ve(3,3) projects in the follow-up have greatly reduced the rebase rate, because they all found that: too high rebase compensation for existing ve token holders will lead to governance rights Solidification, the cost and threshold for latecomers to obtain governance rights will become higher and higher, so they will completely give up joining. This situation will eventually lead to the rigidity of the system. By adjusting the ratio of Rebase rewards to total emissions for ve certificate holders, it is actually a trade-off between "incentivizing and introducing early users" and "leaving equal opportunities for latecomers".

As for whether to keep the Rebase mechanism and what the ratio should be, I think it should be decided according to the situation of the chain where the ve (3, 3) is located.

If we predict that the more stable the ecological pattern on a chain, the more likely the existing leading projects will remain ahead in the future, then the ve (3, 3) project should tend to lock these "customer agreements" early and give them enough ve governance rights and the right to purchase Liquidity for free in the early stage through governance rights; if the competition situation in the chain is still chaotic, and the real "big customer agreement" has not yet emerged, then the ve (3, 3) project should avoid giving early Owners of ve governance rights distribute too many benefits, but instead leave opportunities for equal competition to later entrants.

But the problem is: most of the leading projects on mainstream public chains have already been listed on large exchanges and have good Liquidity, so their motivation to purchase Liquidity on Dex will also weaken. In the long run, emerging projects will always be the main customers of Liquidity procurement. For this reason, reducing or canceling Rebase has become the main choice for ve(3,3) projects.

b. Team situation

The founder of Equalizer is Blake Hooper, who has a marketing background in software and hosting services, and most of the project's appearance videos were recorded by him. At present, there are 5 core members in the team, which is also a very capable personnel structure.

c. Memorabilia

2022.7 The project was launched and officially announced.

2022.11Equalizer announced the launch time and AirDrop plan, users will start to receive AirDrop on November 21

2022.11Equalizer project officially launched.

2022.12 TVL exceeded 10 million US dollars.

In 2023.3, the V2 version of Equalizer will be released. The main update points are UI interaction (integrating Firebird transaction routing) and some mechanism repairs at the smart contract level.

On the whole, Equalizer does not have too many outstanding products at the product level. Compared with the other three ve(3,3) projects, its delivery ability and innovation ability are relatively ordinary.

2.3.2 Business Situation

a. Liquidity(TVL) and corresponding Liquidity purchase expenses

According to Defillama data, the TVL of Equalizer on May 4 was 26.32 million US dollars, and the weekly EQUAL emissions during the same period were 45,435. The price on that day was 3.45$, and the corresponding weekly Liquidity incentive value was 156,842$. We also use the TVL/weekly emission incentive to calculate: 26,320,000/156,842=167.81$, that is, the Equalizer can maintain Liquidity worth 167.81$ through a weekly incentive expenditure of 1$.

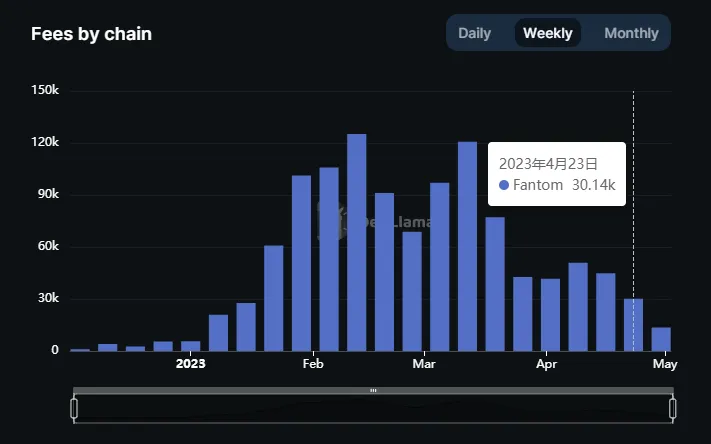

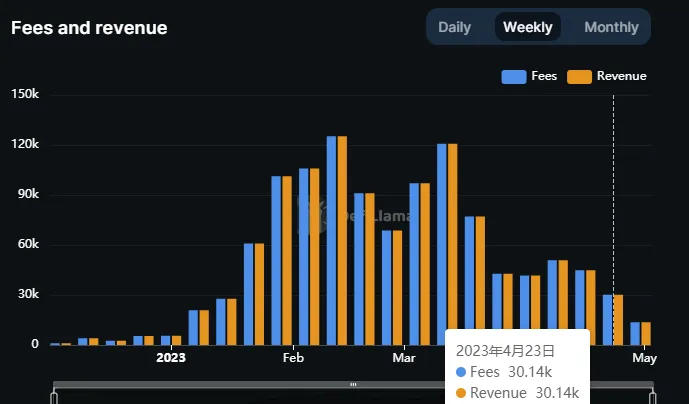

b. Transaction volume and transaction fees

According to Defillama data, the weekly trading volume of Equalizer in the past three months has fluctuated between 30 million and 120 million US dollars. However, since April, the trading volume has remained sluggish. The trading volume in the past two weeks is only about 30 million. The fee income in the latest week is About 30,000 US dollars.

c. Bribe Amount and Item Quantity

The author has not found the amount of Equalizer’s previous bribes in the public information. According to the data of the latest period (epoch25), there are currently 73 Pools that are open to bribes, of which 50 Pools have submitted bribes (some of them include The team’s own bribery), but the author was in the early stage of this epoch when he wrote the article, so the amount is not very high, and the data reference is not high.

However, judging from the screenshot of epoch23’s official announcement, the total amount of bribes paid to the top 20 Pools is about 95,544 US dollars. Based on this, it is estimated that the total amount of bribes paid to all pools this week should be around 100,000 US dollars.

Among them, the top 10 bribery project types are mainly Defi projects, including revenue aggregators, Derivatives, loans, etc., and there is also a domain name project.

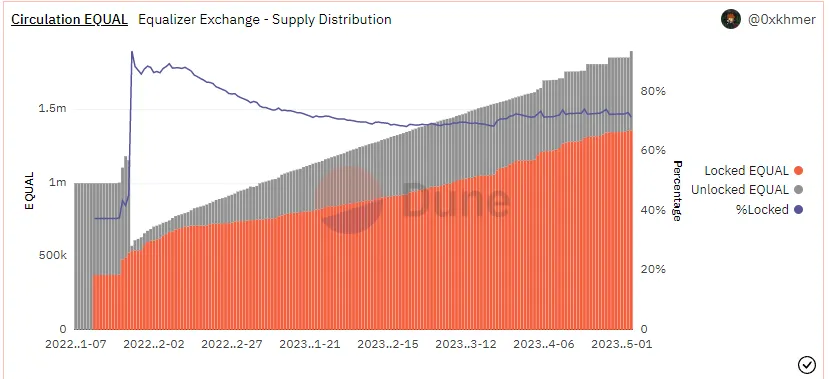

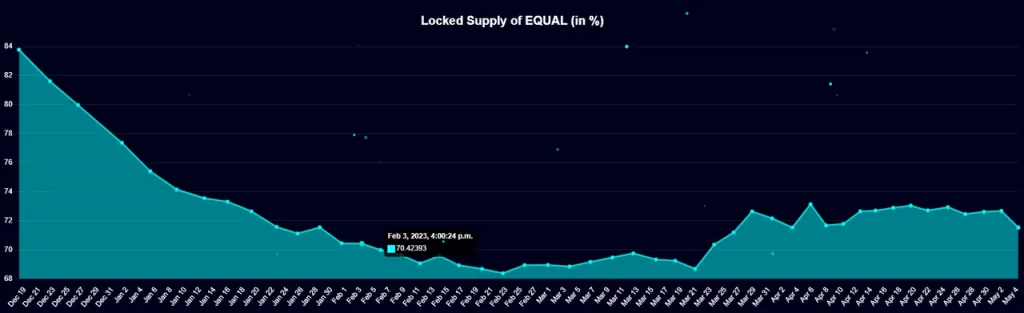

d. Pledge ratio

After the launch of Equalizer, the token pledge rate was as high as 94%, but it gradually fell back to around 70%. The current pledge rate is 71.55%.

The newly added token pledge data provided by the official also shows that the ratio of newly added tokens pledged every day is about 71%.

According to past data, the voting APR of Pool with a large amount of bribes is mainly in the range of 80%-150%.

2.3.3 Summary

Although the Liquidity scale of Equalizer is obviously smaller than that of Velodrome and Thena, its income and bribe amount are not inferior to its scale. However, in the past month, its TVL has experienced a wave of rapid decline that is significantly larger than that of its opponents. This has a lot to do with the decline in its currency price. The relationship between token prices and the Liquidity of its purchases is still highly correlated.

In addition, the Fantom ecosystem where Equalizer is located has been sluggish since the previous AC left. Even after AC returned to serve as a consultant, the ecological situation has not improved. The DeFi TVL on its chain has fallen to the 10th place, and the decline rate in the past year is only Terra, which was next to zero, and Solana, which was affected by the SBF incident and the FTX crash, did not improve significantly even after the return of AC. Recently, even AC expressed vague dissatisfaction with Fantom team's slow marketing on Twitter (and later deleted). With the rise of Arbitrum, OP, Base and other L2s that siphon developers, users and funds, the future of Fantom and other L1s may be even more difficult.

2.4 Chronos: ve(3,3) new force on Arbitrum

Chronos was just launched not long ago (April 26). Although it is not the first ve(3,3) project on Arbitrum, the initial business performance after the launch is far more successful than previous attempts, and it also introduces A new mechanism for the traditional ve(3,3) model problem is proposed. Although it is in the early stage of business development, the overall quality of the project is good at present, coupled with the good development momentum of Arbitrum, I think it is necessary to continue to pay attention.

2.4.1 Project introduction and difference mechanism

a. Mechanism design

The mechanism design of Chronos deployed on Arbitrum widely refers to Velodrome, Thena and Equalizer, and the mechanism difference with the traditional ve(3,3) is reflected in:

Cancel the Rebase mechanism, ve users will no longer be allocated tokens (consistent with Equalizer)

The maximum time for ve lockup is 2 years (consistent with Velodrome)

In the early days, NFT was used for fundraising. After NFT is pledged, it can share 10–20% of the agreement’s handling fee. There will be a recommendation rebate mechanism in the future (consistent with Thena)

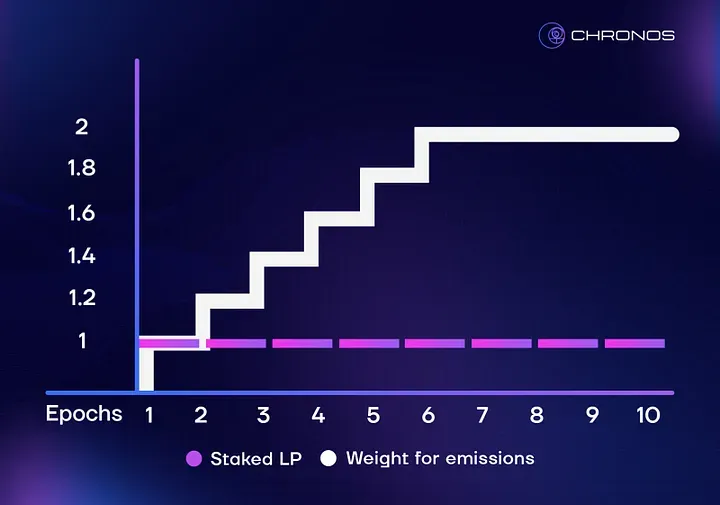

Introduce the concept of "staking time" for the LP certificate of the Liquidity Provider. After the user pledges the LP token again, he will obtain maNFT (Maturity-Adjusted NFT, that is, dynamic maturity NFT). MaNFT is used as the certificate for obtaining Liquidity incentives. The higher the value, the stronger the incentive bonus effect (up to 2 times)

The rate of vAMM is 0.2% (consistent with Thena and Equalizer), and the rate of sAMM is 0.01% (consistent with Velodrome)

The most important innovation lies in the application of maNFT. The (3,3) game design of the traditional ve(3,3) mechanism is mainly aimed at the pledge of tokens, but the retention of Liquidity is still the responsibility of ve(3,3) Dex major problem. Using maNFT as an LP with a time-weighted attribute to distribute Liquidity incentives will increase the willingness of LPs to retain for a long time and increase the "time value loss" of withdrawing Liquidity. In addition, users of maNFT can also transfer Liquidity through resale, and maNFT with a longer pledge time will naturally have a higher "time premium".

The introduction of maNFT has further upgraded the protocol's incentives for Liquidity"quantity" to incentives for Liquidity"quantity" + "retention". Of course, if the weight of the time element in incentive distribution is too high, it will also cause new LPs to face the efficiency disadvantages of old LPs in Yield Farming, resulting in inability to attract new Liquidity. How to balance the two still needs practice to prove.

b. Team situation

The core team of Chronos is anonymous, and the officially announced nine core members only marked their job functions and did not provide more personal information. At present, the agreement has completed the audit of Certik.

c. Memorabilia

2023.3 The project was launched and the product was announced to be released on Arbitrum.

On April 1, 2023, the details of NFT fundraising and rights and interests, as well as the list of cooperation agreements (which can obtain ve governance rights AirDrop) will be released.

On April 14, 2023, the rules for the initial distribution of tokens and the details of the AirDrop will be announced.

On April 20, 2023, the specific launch rules and initial Liquidity information were given.

On April 27, 2023, the project was launched, Epcoh0.

2.4.2 Business Situation

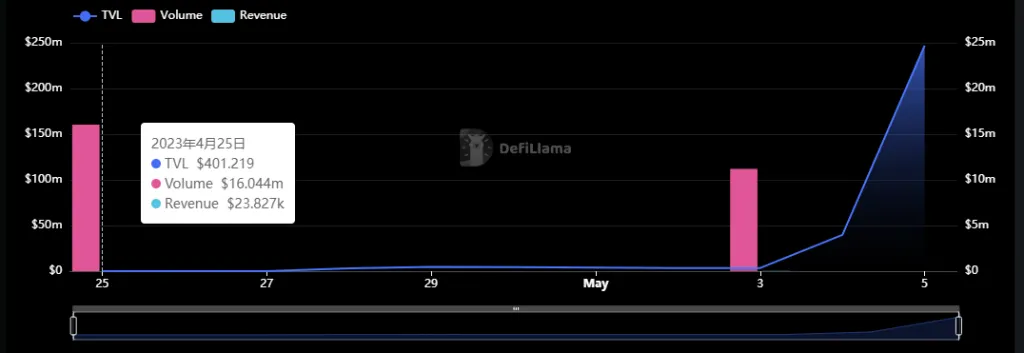

It should be noted that Chronos is still a new project that has been launched for less than two weeks when the author wrote this article, and its various business indicators and prices are in a state of violent fluctuations. Readers should take this factor into consideration when reading and referencing .

a. Liquidity(TVL) and corresponding Liquidity purchase expenses

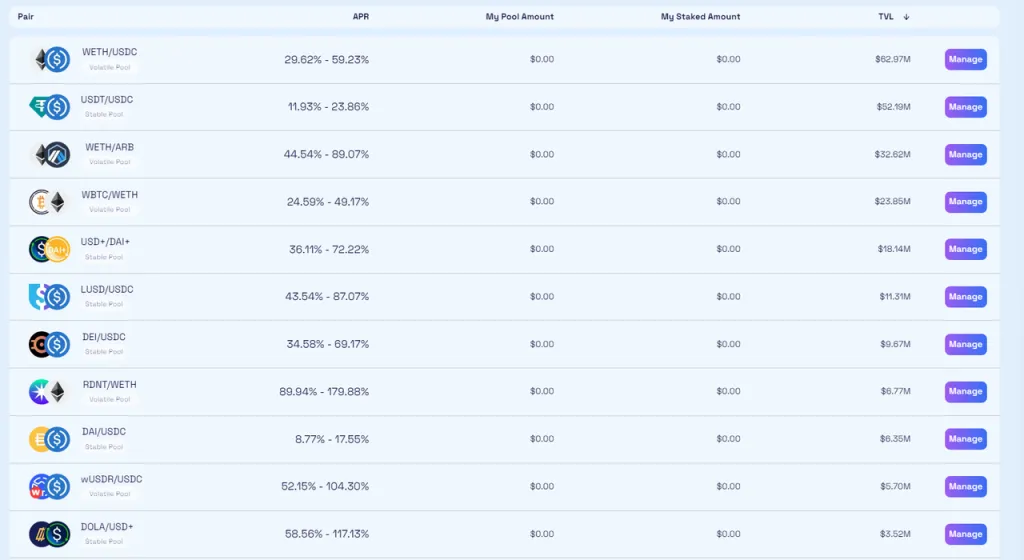

At present, Chronos is only in the second week (5.5) of its launch, and Liquidity has reached 263 million US dollars. Among the top 10 pools in terms of TVL, 6 belong to Stablecoin pools, and the TVL ratio of Stablecoin pools is 37%, which is not high.

At present, Chronos is in epcoh1, and the weekly emission for Liquidity purchase is 2,509,650 CHR (initial emission × 99% × 97.5%). Calculated at the current price of 1.18$, the Liquidity purchase fee of Chronos this week is 1.18×2,509,650=2,961,387$.

We also use the TVL/ Liquidity purchase fee to get: 263,000,000/2,509,650=104.8, that is, the CHR incentive worth 1$ can currently maintain a TVL of 104.8$.

b. Transaction volume and transaction fees

According to data from Defillama, the transaction volume of Chronos in the first week of its launch was 16 million US dollars, and the transaction fee was 23,827 US dollars. In the second week starting on May 3, the trading volume began to increase rapidly.

c. Bribe Amount and Item Quantity

According to the official disclosure, the Liquidity purchase amount of Chronos in the first week (epcoh0) exceeded 180,000 US dollars.

Among them, the projects with a bribe amount of more than 5000$ (according to the descending order of the bribe amount) are: Overnight (Stablecoin), Yield Farming index (yield aggregation), GMD (yield aggregation), Deus (synthetic assets and Derivatives), Radiant (loan) , Tangible (Stablecoin), etc.

In addition, before the official launch of Chronos, the veNFT AirDrop cooperation agreement list released by the project party in advance is very detailed. In addition to specifying the positioning and allocation of cooperation projects, it also discusses the cooperation intention and value reached by the two parties at the business level. For exposition, it's impressive. As of now (epoch1), there are already 100 bribe pools established on Chronos.

d. Pledge ratio

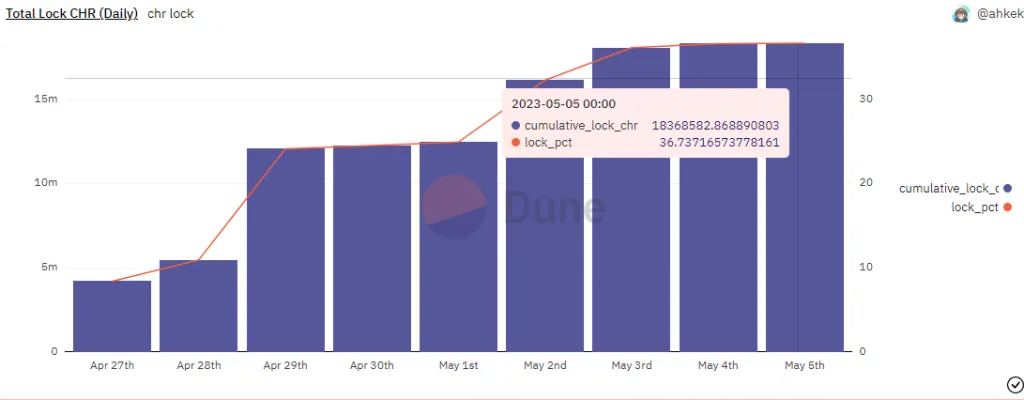

According to the data dashboard built by * @impossiblefinance *, the lock-up rate of Chronos showed a trend of opening low and gradually rising, but it entered a plateau after reaching 36%. The current (May 5th) token lock-up rate is 36.7% .

In contrast, the pledge rates of Velodrome, Thena and Equalizer's other three ve(3,3) projects are mostly between 60–80%, and the Chr lock-up rate still has a lot of room for improvement.

2.4.3 Summary

Chronos has further innovated on the basis of Velodrome, Thena and Equalizer, and introduced the time weight of LP as an important dimension of Liquidity incentives, which is an active attempt to address the existing ve(3,3) challenges. In addition, Chronos is on the ecologically prosperous Arbitrum public chain, and has a higher space for business development. However, Chrono is still in the epoch1 stage, and its tokens are in a period of rapid inflation. At present, the weekly inflation rate of CHR relative to the initial total amount is about 5%, and the overall willingness of users to lock positions is not high. greater selling pressure.

3. Summary

In this chapter, starting from the market value, business data and project characteristics of the project, the author will compare the four projects covered in this article and Curve and Balancer, which also use the ve model and also operate the spot transaction and Liquidity procurement market, and then combine The ve(3,3) project sorts out the future development and competition of Dexs.

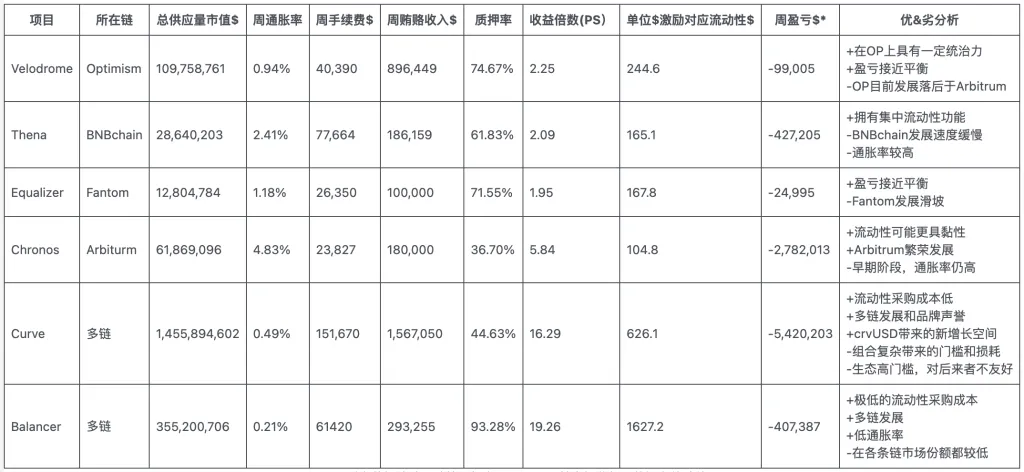

3.1 Comparison between ve(3,3) and ve projects

From the above table, we can see that due to the fierce competition on the Dex track, all veDEXs are currently at a loss stage only from the comparison of revenue and incentive fees (not considering the purchase of governance tokens by Liquidity purchasers). However, due to the direct integration of the bribery module by ve(3,3) type Dex, and the looser Liquidity procurement conditions (no governance voting is required to determine the authority to enter the Gauge, and a centralized application system is adopted), they have achieved "same Liquidity under" higher bribe income.

Due to the brand and trust advantages brought about by the longer development history, the old Dex has a significantly lower Liquidity procurement cost than the emerging Dex. This may be one of the main reasons why Curve and Balancer can enjoy higher PS valuations, because revenue Net profit is net profit after deducting costs and expenses.

3.2 ve(3,3) and the future of Dexs

From the perspective of business data performance, Velodrome has firmly established its TVL position on OP, Thena, as a latecomer, can rank in the forefront on the mature BNBchain, and Chronos has topped Arbitrum's TVL top three within two weeks of its launch. The superiority of the ve(3,3) pattern in practice.

In the author's opinion, ve(3,3) proposed by AC and carried forward by the latecomers is a valuable exploration of Dex, and some experiments have proved to be quite effective, such as:

Integrate the Liquidity procurement (bribery) module directly into Dex to improve the convenience of procurement and avoid the "taxation" of the tripartite voting platform

Emphasize the "TOB" attribute, pay attention to the incentives for Liquidity purchasers (other project parties) (such as AirDrop governance rights to potential customers), and significantly increase the income of bribery

Allocate pool fees based on voting, and direct incentives to pools that can create more fees

Some important mechanisms of ve(3,3) have also been gradually falsified and eliminated in experiments. The most typical one is the Rebase mechanism set up to ensure that the governance rights of ve users are not diluted. First, Velodrome has greatly reduced the rebase ratio, while newer projects such as Equalizer and Chronos have completely canceled rebase to ensure that late-stage Liquidity purchase customers will not have obvious disadvantages compared to early users.

More importantly, the strong Liquidity purchase income of ve(3,3) projects seems to further prove the feasibility of the Dex model pioneered by Curve, which is "concurrently operating spot transactions and Liquidity trading".

In *