Table of contents

key points

introduce

background

What are ordinal numbers and inscriptions?

What fields are BRC-20 tokens suitable for?

What is the market for BRC-20 like?

How does using BRC-20 tokens compare to using other standards?

Impact of BRC-20 on Bitcoin Market

Homogeneity and non-homogeneity

memory pool

transaction fee

community response

"Professional" crowd

"Low Fee" Camp

BUIDLer

Risks and Challenges

- limited to no infrastructure

- no practical utility

- high risk of fraud

future outlook

Bitcoin Layer 2

infrastructure

Innovation in Token Design

conclusion

refer to

About Binance Research

———————————

1. Key points

❖ BRC-20 tokens are the latest innovation from Ordinals Protocol and have taken over the Crypto Twitter timeline in recent weeks.

❖ BRC-20 is an experimental token standard that supports the deployment, minting and transfer of non-fungible tokens on the Bitcoin blockchain. While the total market capitalization of these tokens even reached $1 billion, the tokens themselves are relatively simple without any smart contract functionality, unlike ERC-20 or BEP-20 tokens.

❖ Due to the minting frenzy in early May, the Bitcoin memory pool was seriously congested, and network transaction fees soared.

❖ Many in the ecosystem welcome higher fees, given the importance of supplementing miner income as block rewards decline over time. Others, however, were more critical when discussing the downside of user pricing in more price-sensitive regions.

❖ At this early market stage, BRC-20 tokens pose considerable risk and require more infrastructure support. As the founders said, this is an experiment and should be closely scrutinized for potential risks.

❖ Ordinal, Inscription and BRC-20 tokens help to demonstrate that there is a clear organic demand for Bitcoin block space outside of traditional currency use cases. This could be a key factor in the long-term sustainability of Bitcoin's security model.

❖ Bitcoin Layer 2 development, infrastructure support for BRC-20, and further token design innovations could be the next step in this saga.

2. Introduction

Since the Ordinals Protocol first went live at the beginning of the year and Inscriptions (i.e. Bitcoin NFTs) started to flood in, there has been a resurgence of innovation in the Bitcoin ecosystem. The BRC-20 token is the latest in this ordinal-driven innovation that has been all the rage over the past few weeks.

First conceptualized in March 2023, BRC-20 is an experimental token standard that enables the deployment, minting, and transfer of non-fungible tokens on the Bitcoin blockchain . This latest innovation means that both fungible and non-fungible tokens (inscriptions) are part of the wider Bitcoin ecosystem. The total market capitalization (“market cap”) of these tokens has been on the rise, even surpassing $1 billion in early May. Additionally, the leading BRC-20 token - 20232023202320232023-0 - is already listed on several exchanges.

While many are excited about the increased activity within Bitcoin and the new energy that seems to be reverberating through the community, others feel this is a departure from Bitcoin's "design purpose" and are less concerned about the impact of these innovations on Bitcoin transaction fees satisfy.

In this report, we explore the origins of BRC-20, the current market outlook, how they compare to ERC-20 tokens, their impact on Bitcoin metrics, community splintering, potential risks, and our vision for the future.

Disclaimer : BRC-20 tokens are extremely risky and in the early stages of price discovery. This material is not intended to be a forecast or investment advice, nor is it a recommendation, offer or solicitation to buy or sell any securities, cryptocurrencies or to adopt any investment strategy (see General Disclosures on page 26). The creator of the BRC-20 token standard, an anonymous Crypto Twitter user named domo, himself titled the GitBook for this token standard "brc-20 experiment" and started the page with the following:

Keep this in mind as you stay abreast of the latest developments in the market with this Binance Research report.

3. Background

What are Ordinal and Inscription?

ORD is an open-source software[1] that can run on top of any Bitcoin full node, and it can track individual Satoshis based on what founder Casey Rodarmor calls "the theory of ordinal numbers." Satoshis ("sats") are the smallest unit of the Bitcoin network, 1 Bitcoin = 100,000,000 sats. **Ordinal number theory assigns a unique identifier to every person on Bitcoin. **Furthermore, these individual sats can be "inscribed" with arbitrary content (e.g. text, images, video) to create "inscriptions" (i.e. Bitcoin-native digital artifacts)[2], also known as NFTs.

...single sats can be "inscribed" with arbitrary content (e.g., text, images, video) to create "inscriptions" (i.e. Bitcoin-native digital artefacts), also known as NFTs.

For a more detailed look at Ordinals and Inscriptions, including their history, technical background, how their specifications compare to other NFTs, and their impact on the market, check out our recent report: A New Era for Bitcoin? "

What fields are BRC-20 tokens suitable for?

Since Inscription allows for the use of non-fungible tokens (“NFTs”) on Bitcoin, one of the questions that people naturally ask is, “What about fungible tokens?” This is where BRC-20 comes in.

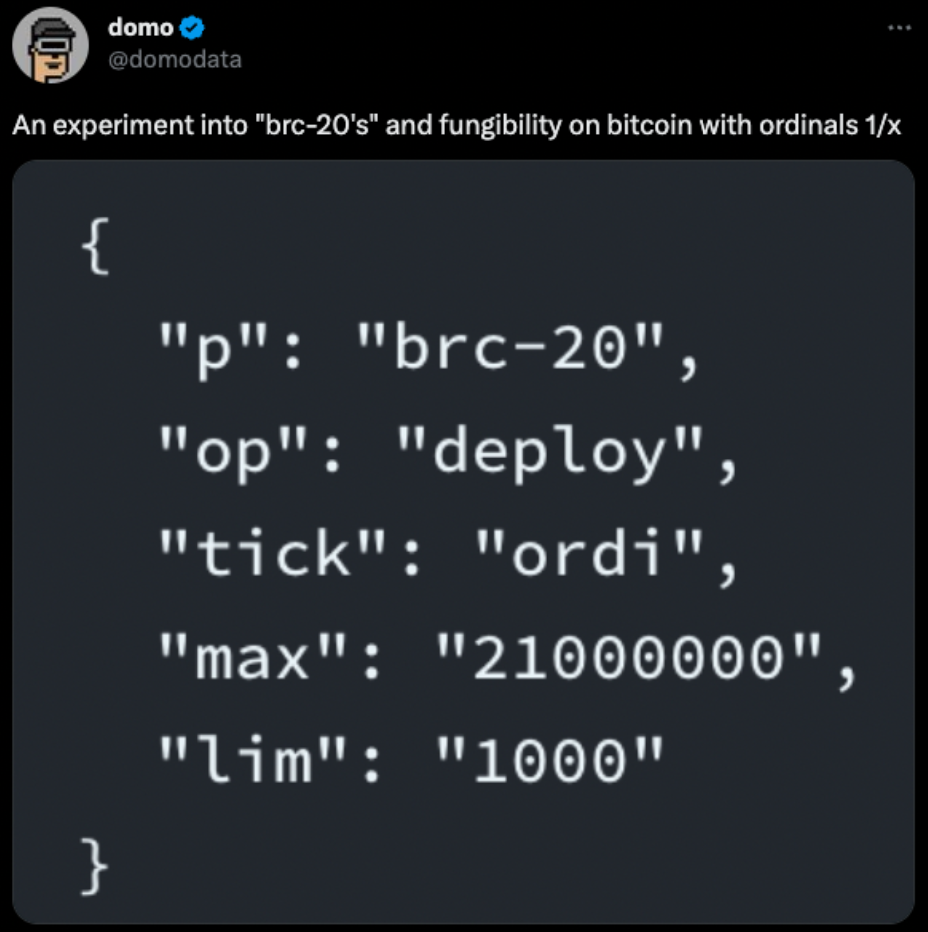

On March 9, an anonymous Crypto Twitter user named domo tweeted out a tweet theorizing about a method called BRC-20 that could create a homogeneous cryptocurrency on top of the Ordinals Protocol. standardized tokens. **The idea is that JSON[3] data can be inscribed on individual sats via ordinal numbers to deploy, mint and transfer fungible BRC-20 tokens. **JSON is essentially a text-based data format, so essentially the approach is to write text into sats to create a fungible token. The initial design allows only three distinct operations: deploying tokens, minting tokens, and transferring tokens (we explore this and other limitations later in this report).

**The first token contract to deploy is $ORDI tokens, with a limit of 1K tokens per mint and a max supply of 21M (a nod to Bitcoin's max supply). **The release caused some buzz in a subsection of the Bitcoin community, with all $21 million in ORDI tokens minted in less than a day. Other tokens appeared shortly after, such as $MEME, $PEPE (not the one that Ethereum uploaded and played like crazy) and $PUNK.

Figure 1: Humble beginnings for BRC-20 tokens (domo's first post on the topic)

Source: Twitter (@domodata)

Source: Twitter (@domodata)

Figure 2: Three possible initial operations for a BRC-20 token (p = protocol name, op = operation, tick = ticker/identifier, max = maximum supply, lim = minting limit, amt = amount)

Source: *https: //domo-2.gitbook.io/brc-20-experiment/, Binance Research*

What is the market for BRC-20 like?

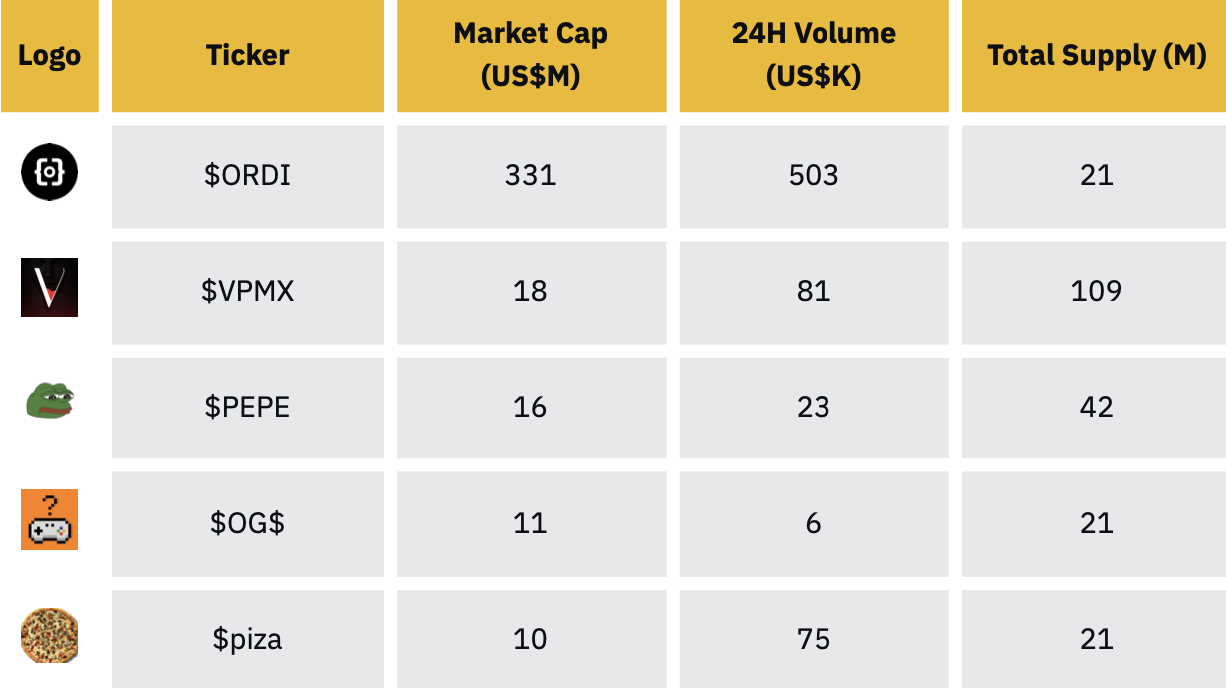

The BRC-20 was only conceptualized a few months ago -- and the ordinal and inscription are less than six months old -- and it's fair to say the market is still in its infancy. Still, developers and enthusiasts have been experimenting around the clock. As of May 16, 2023, there are more than 18,000 BRC-20 tokens with a total market capitalization of $500 million. The market cap approached $1 billion in the first few days of May, but as expected in any such frenzy, the market is correcting itself to find a more stable equilibrium.

Figure 3: The top five BRC-20 tokens by market capitalization at this stage

Source: ordspace.org , as of May 16, 2023

The ordinal ($ORDI) token was the first BRC-20 token and remains the market leader so far. This is evident in both market capitalization and trading volume, and a recent listing on several different exchanges may have contributed.

How does using BRC-20 tokens compare to using other standards?

Although the name "BRC-20" is a parody of Ethereum's "ERC-20" token standard, there are significant differences between them.

different blockchains

BRC-20 tokens exist on the Bitcoin blockchain, while ERC-20 exists on the Ethereum blockchain, BEP-20 exists on the BNB Smart Chain, etc. As such, BRC-20 tokens rely on various properties of the Bitcoin chain that differ significantly from ERC-20 or BEP-20, such as transaction speed and fees, to name just two key factors. This means your experience with BRC-20 may be very different from your experience transacting on other chains.

Lack of smart contract functionality

ERC-20 tokens and BEP-20 tokens are created using smart contracts on the Ethereum and BNB Smart Chain blockchains respectively, so they have a large degree of programmability and the ability to execute various operations and rules. This is very different from the relatively simple BRC-20 tokens, which are not based on smart contracts and have rather limited functionality (as shown in Figure 2).

market infrastructure

ERC-20 tokens and BEP-20 tokens are much more mature than BRC-20 tokens. While the former has existed for many years and has led to the establishment of various types of infrastructure (e.g., DEX, centralized exchange compatibility, fiat currency on-line, cross-chain capabilities, etc.), but for BRC-20 tokens , this is not the case. Of course, the BRC-20s have only been out for a few months, so we can't expect them to have a similar level of infrastructure. Still, this fact is worth keeping in mind as it illustrates the significant difference in risk profile between them and more established standards such as ERC-20 and BEP-20.

4. The impact of BRC-20 on the Bitcoin market

Homogeneity and non-homogeneity

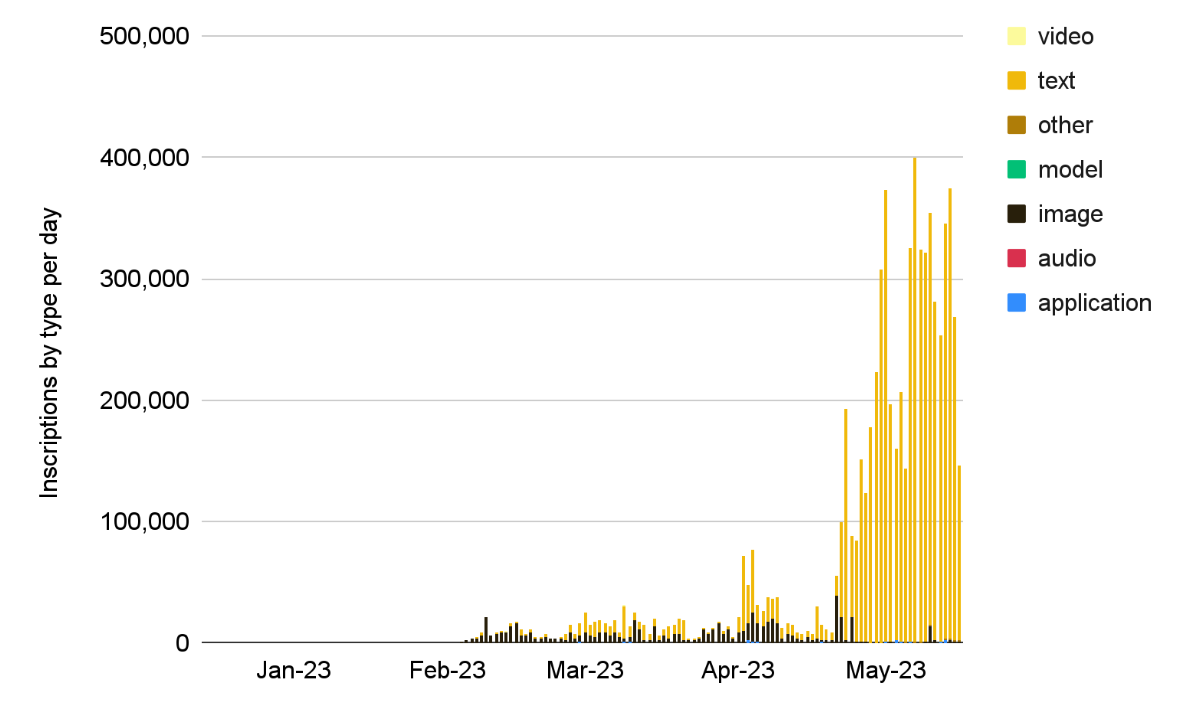

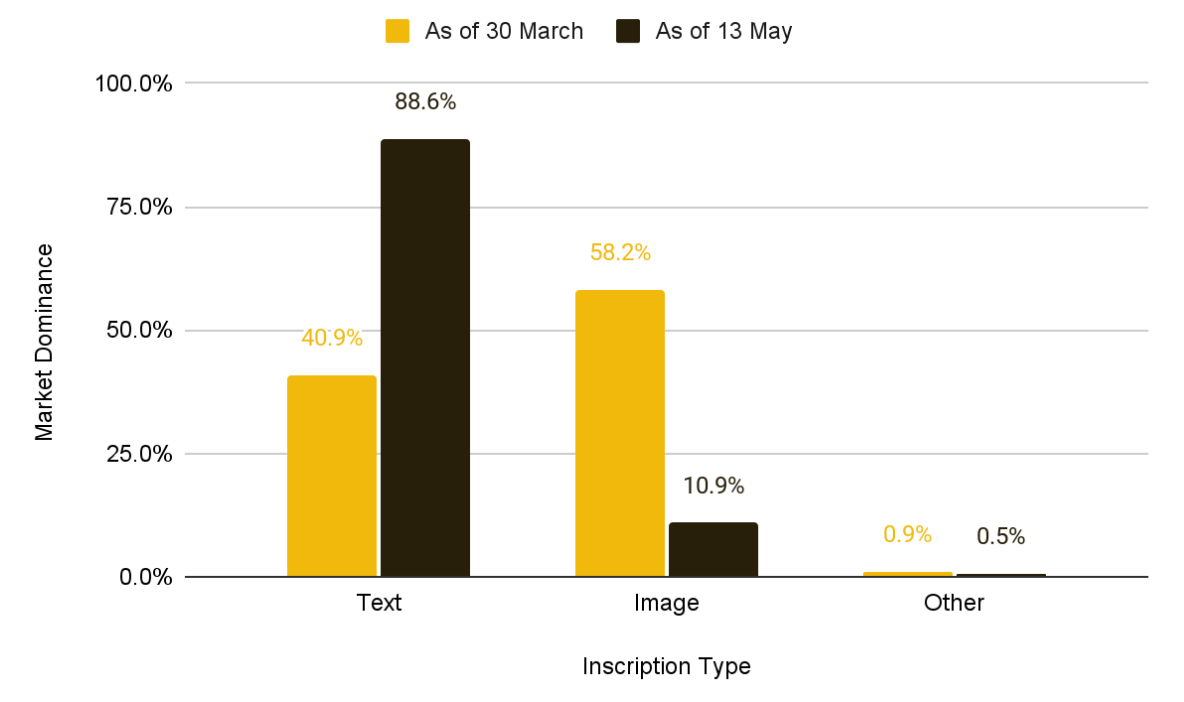

First, let’s take a quick look at how the entire inscription market has changed since the BRC-20 token. Remember, BRC-20 tokens were first conceptualized on March 9, 2023, while inscriptions have been available since December 2022. As we can see, in February, images are the main type of inscription used in the market. This is when the ordinal craze started and series of Bitcoin NFTs started popping up . Even though textual inscriptions have become more common from February to early April, there are days when images are the most widespread type of inscriptional media.

Now, if we look at the second half of April into May, we see a dramatic change . Text-based inscriptions (mainly associated with BRC-20 tokens) have been dominant , essentially crowding out any other media type. Also, the daily number of inscriptions (represented by the height of the bar) is several times the number we see from January to early April . This proves that the BRC-20 token has been able to generate huge popularity and momentum since its inception.

Figure 4: Significant increase in daily inscriptions, most of which are text-based

Source: Dune Analytics (@dgtl_assets) as of May 16, 2023

In our report -** "A New Era for Bitcoin? ** Medium - We have provided a chart of the types of inscriptions inscribed as of March 30th. We can compare these numbers with the current composition of the inscription market, and it becomes even more clear how BRC-20 tokens dominate the entire inscription market. As we see below, text-based inscriptions more than doubled their dominance in just six weeks, while image-based inscriptions dropped more than 5x . In terms of the total number of inscriptions, they increased from about 650,000 to more than 6.1 million between March 30 and May 13—an increase of nearly tenfold .

Figure 5: Text-based inscriptions have dominated the market in recent weeks

Source: Dune Analytics (@dgtl_assets), Binance Research, as of May 13, 2023

memory pool

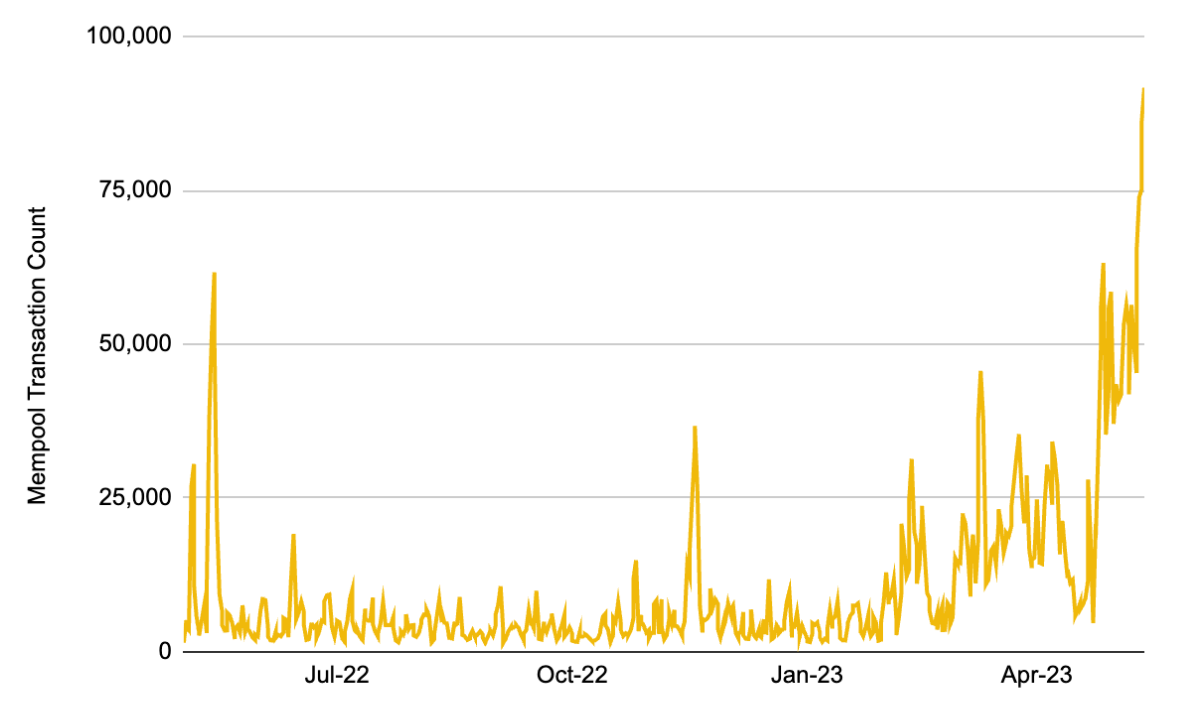

As a reminder, the mempool is essentially a waiting room for unconfirmed transactions, which have not yet been put into a block . These are ordered by additional fees, a more crowded mempool means more competition to get your transaction into the next available block.

**Bitcoin’s total unconfirmed transactions — the number of mempool transactions — have been rising so far in 2023. **Recently, the interest generated by Inscription and BRC-20 means that the number of mempool transactions (relative to last year) has spiked significantly. This in turn affects the cost of executing transactions on the Bitcoin blockchain (discussed further below).

Figure 6: The number of Bitcoin mempool transactions has been rising steadily this year, at least in part helped by ordinals, inscriptions, and BRC-20

Source: Blockchain.com , Binance Research, as of May 14, 2023

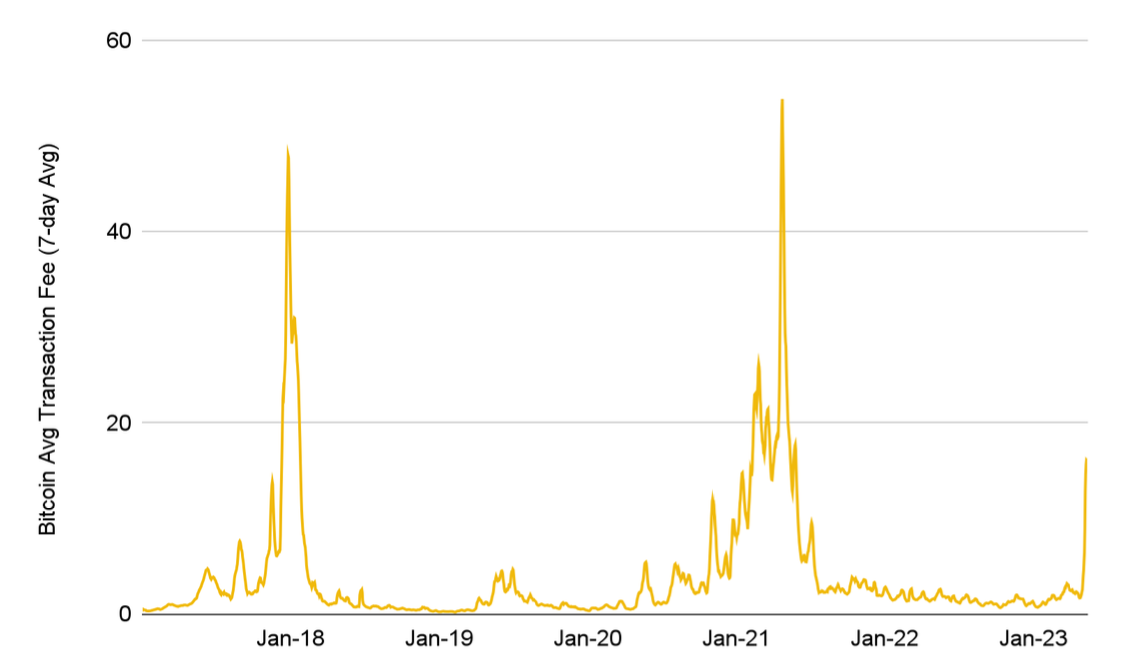

transaction fee

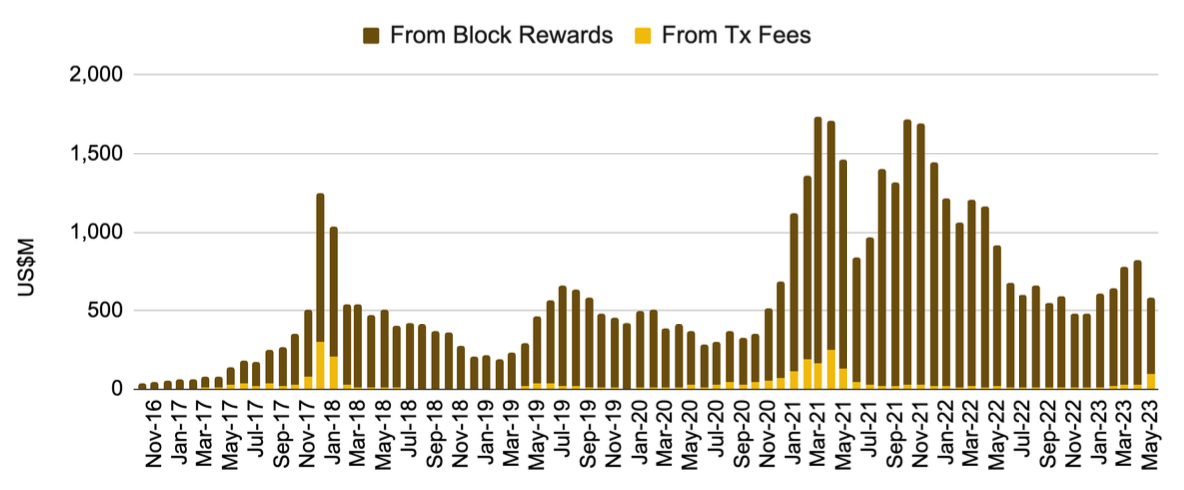

As perhaps the most discussed metric in the Bitcoin community, fees have been a bone of contention dating back to the block size wars of 2015-2017 [4].

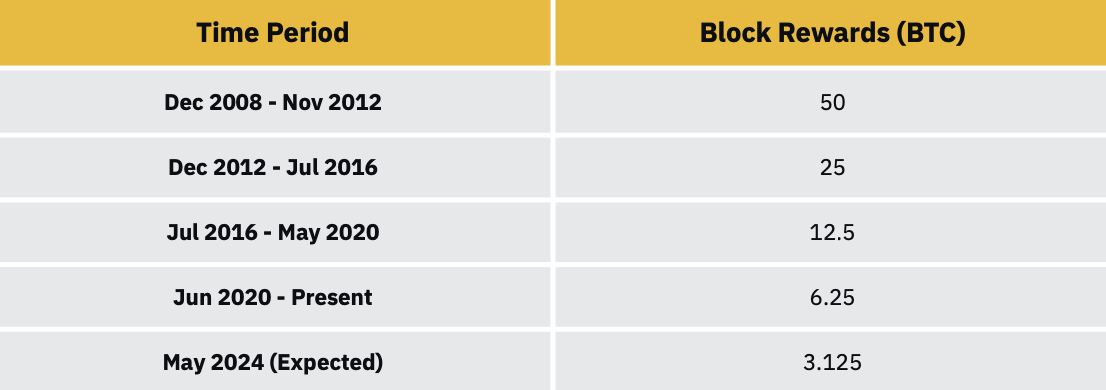

As a brief overview of the situation, let's recall that Bitcoin's model induces miners to secure the network through two economic incentives: block rewards and transaction fees . The block reward is halved roughly every four years, reducing it to zero in the long run. So, in the end, Bitcoin's transaction fees will be the only compensation to miners , i.e., the security budget for the chain. Given Bitcoin's relatively limited use cases until this year (mainly asset transfers), these fees have historically represented a small percentage of miner revenue and have been a concern for many in the Bitcoin community.

Figure 7: Bitcoin’s annual security budget (block rewards + transaction fees) consists mostly of block rewards, which are halved every four years and eventually return to zero

Source: Dune Analytics (@niftytable), Binance Research, as of May 16, 2023

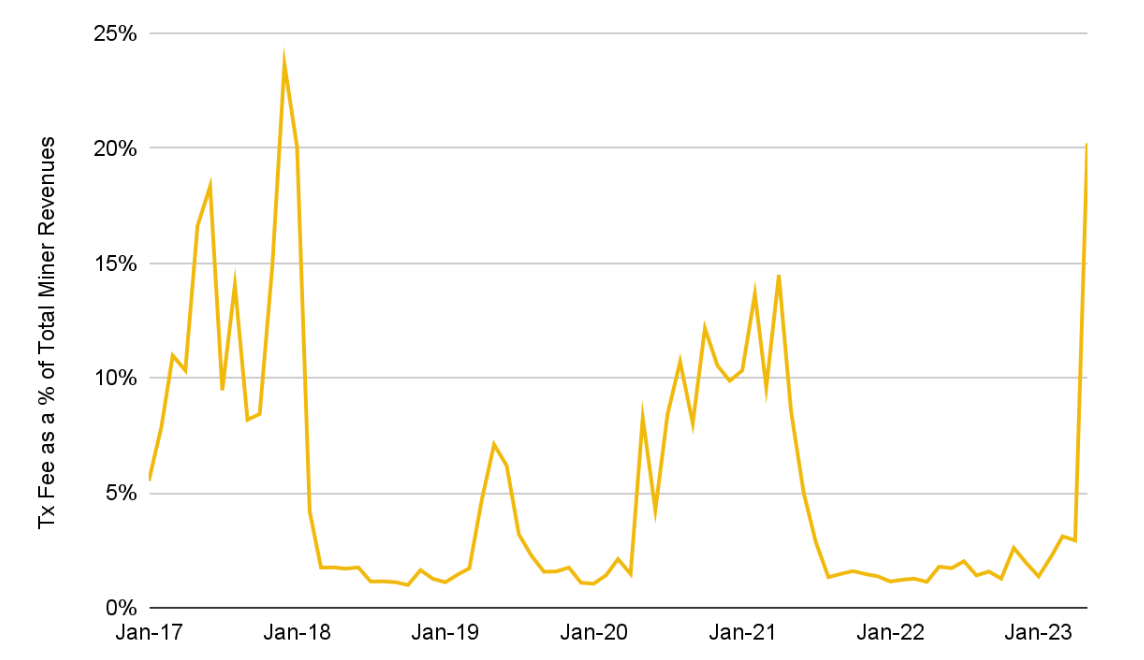

However, taking a closer look at the latest data from last year, we can see that transaction fees increased from 1-2% of total miner rewards to 2-3% at the beginning of the year and spiked to over 20% in May . While we cannot conclude that this is solely due to Inscription and BRC-20, there is relatively good reason to believe that a large part of this move is due to these innovations within Bitcoin.

Figure 8: Transaction fees as a percentage of miner revenue are near all-time highs (note that the previous peak was in December 2017, when Bitcoin was in the midst of a historic bull market)

Source: The Block Data, Binance Research, as of May 14, 2023

Of course, not everyone is happy about the ever-increasing transaction fees on the Bitcoin blockchain. Another effect of this is a corresponding increase in the fees required to send bitcoins to another party (which many consider to be the "true" utility of bitcoins - more on that later).

**Bitcoin transaction fees have spiked before, notably in December 2017 and April 2021. However, both times were amidst strong bull markets in Bitcoin and the crypto space. ** This is the first time fees have spiked significantly in the middle of what many consider a bear market.

Figure 9: The average fee for a transaction on Bitcoin has soared recently

Source: The Block Data, Binance Research, as of May 14, 2023

Still, it's worth remembering that Bitcoin transaction fees have spiked before ; this wasn't a unique or extreme event. The recent surge could even be seen as some sort of warning, an event that shows that Bitcoin needs to innovate in preparation for further gains in the future.

**Ultimately, ordinals, inscriptions, and BRC-20 tokens helped unleash a lot of demand on the Bitcoin blockchain. **They create a demand for block space, which has not been the case for Bitcoin in a while. Many thought Bitcoin lost the spotlight game to the likes of Ethereum, but Inscription and the creation of BRC-20 seem to be changing that narrative. From a financial standpoint, Bitcoin miners need to continue to get paid, and even if block rewards decrease, fees must compensate for this loss of revenue , like any business that might expect core revenue to continue to decrease until it goes to zero.

Many thought Bitcoin lost the spotlight game to the likes of Ethereum, but Inscription and the creation of BRC-20 seem to be changing that narrative.

5. Community Response

The original innovation of using ordinal number theory to track individual sats and further inscribing them with data to create inscriptions sparked a heated debate within the Bitcoin community. As you can imagine, BRC-20 tokens have taken this debate to a new level.

"Professional" crowd

As we discussed above, the sustainability of the Bitcoin security model has been a major concern for many in the community [5]. How will miners be paid in the future as block rewards continue to decrease? If miners are not compensated enough to secure the chain, what does this mean for Bitcoin in the long run? The fact that miners need to be compensated for providing security cannot be avoided, and for this reason, Bitcoin transaction fees need to be higher. For this reason, many in the community were pleasantly surprised by the level of attention Ordinal and BRC-20 received, and the impact this had on the relatively depressed Bitcoin fee market.

Figure 10: Many prominent cryptocurrency personalities are optimistic about this new unlock

Source: Twitter (@danheld, @nic_carter)

The fact that miners need to be compensated for providing security cannot be avoided, and for this reason, Bitcoin transaction fees need to be higher.

One specific community subsector that has particularly benefited from Bitcoin's recent development is the mining community . To add more context to our above discussion, see Figure 11 for the Bitcoin block reward halving cycle that has occurred so far.

Figure 11: Bitcoin block reward per successful block

Source: Bitcoin Visuals, Binance Research

While bitcoin prices have risen substantially since the 50 BTC block reward era, the table illustrates the tricky side of the bitcoin miner business model. With transaction fees supplementing their income and potentially heralding a brighter future for block space demand, the equation looks more favorable for miners and could attract more people to the network. Remember, the more independent miners there are, the better the decentralization and ultimately the better the security of the Bitcoin blockchain.

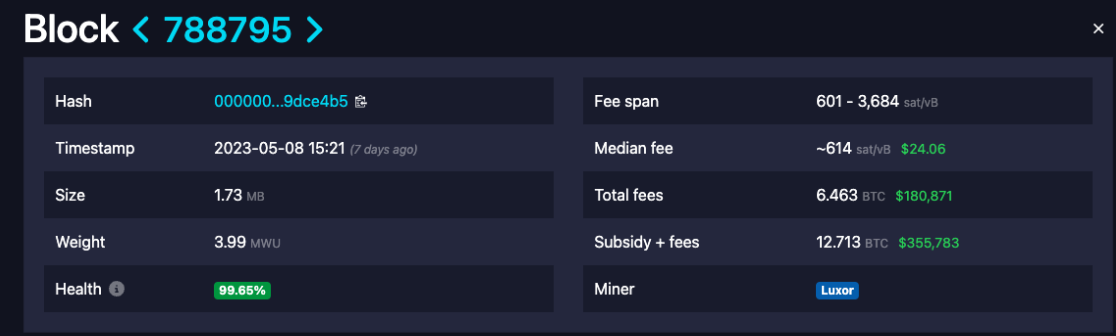

Notably, there were even Bitcoin blocks with transaction fees higher than the 6.25BTC block reward in early May . This is a remarkable achievement, considering that transaction fees will average 1-2% of miner revenue for most of 2022, and not much higher in earlier years (see Figure 8). This proves that ordinal numbers and BRC-20 helped introduce ever-increasing block space requirements - and this is without the backdrop of a major bull market.

Figure 12: The total fee for block 788795 is 6.46BTC, while the block reward is 6.25BTC

Source: mempool.space

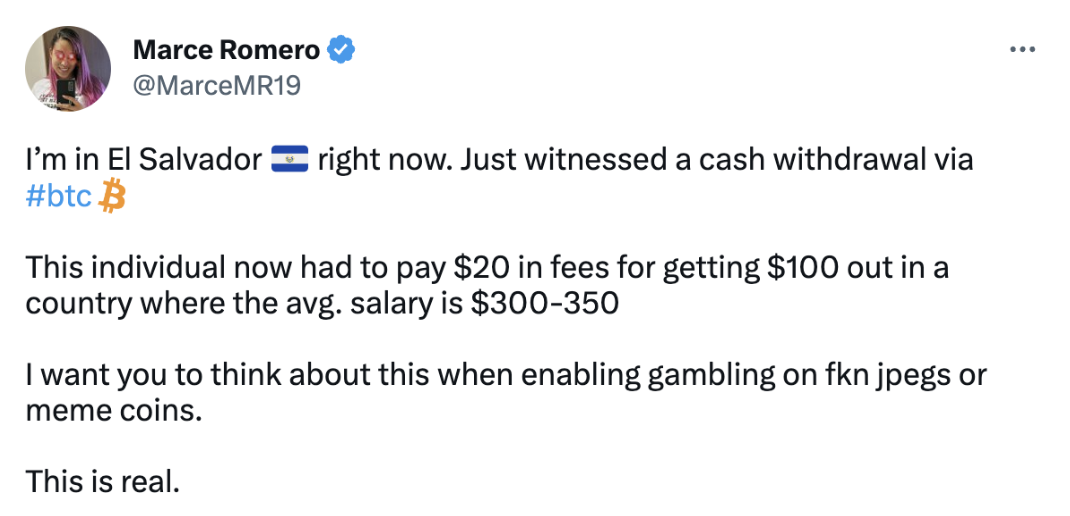

"Low Fee" Camp

While many were excited by the increased activity and buzz around the Bitcoin ecosystem and encouraged by the increased fees from a sustainability standpoint, others were more critical. **Those in this camp are more interested in the fact that Bitcoin's "true purpose" is as a hard currency, not fiat money, and that the chain should be used exclusively to facilitate peer-to-peer transactions. **The group believes that data-intensive transactions associated with ordinal numbers, namely inscriptions and BRC-20, primarily congest the Bitcoin network and drive up fees, ultimately hindering peer-to-peer transactions.

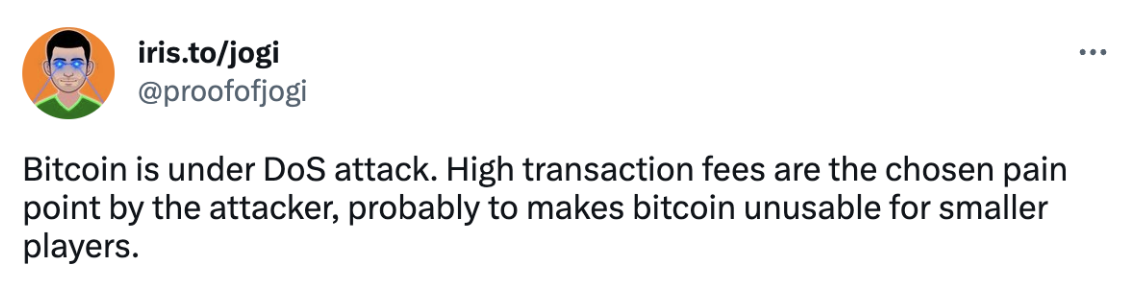

While some argue that fee increases lead to pricing for users in countries that rely on Bitcoin as an alternative to local fiat systems, others take a more extreme view, even arguing that ordinals and BRC-20 are attacks on the chain.

Figure 13: Some worry that Bitcoin users are overpriced

Source: Twitter (@MarceMR19)

Figure 14: Others hold more extreme views

Source: Twitter (@proofofjogi)

Some in the community have even suggested that Bitcoin Core developers should review transactions related to ordinal numbers. We don’t need to explain why this kind of censorship would be completely against the spirit of Bitcoin, given its incredible focus on decentralization.

While it is true that transaction fees on the Bitcoin network are rising and this will inevitably cost some consumers around the world, is this really a problem? The question we're asking is, if a user wants to transfer $10 to their friend, do they have to use base Bitcoin L1 to do so? This is what the Lightning Network was created for, and why Bitcoin was chosen for a fast and secure peer-to-peer payment solution. In fact, as you reported in our recent report , A New Era for Bitcoin? As seen in , the Lightning Network continues to grow in capacity year over year, and the fees remain affordable.

The question we're asking is, if a user wants to transfer $10 to their friend, do they have to use base Bitcoin L1 to do so? This is what the Lightning Network was created for, and why Bitcoin was chosen for a fast and secure peer-to-peer payment solution.

Transacting on the underlying L1 was never guaranteed to remain very cheap.

**Even if Bitcoin's popularity increased substantially, attracting a few million new users to use it for peer-to-peer transactions, it would have the same effect on transaction fees. **Therefore, it is not true that more Bitcoin usage is bad because it deprives consumers of price, especially given the future growth prospects of the network. In fact, the focus should be on making it more efficient and easy to join the Lightning Network, and doing further work on Bitcoin's L2 solution so that transactions can happen at layers other than base Bitcoin L1.

BUIDLer

Before entering this section, we would like to remind readers to read the disclaimer on page 3 and the general disclosure on page 26. As mentioned, we are here to discuss things that are at the forefront of the cryptocurrency market and report on them to better educate and inform our readers. These technologies are very new and extremely risky. Please use extreme caution when interacting with any of these items or builders.

Perhaps the most important group -- those who are building the tools and infrastructure to take these innovations to the next level. Of course, the key builders to mention first are Casey Rodarmor , founder of the Ordinals Protocol, and domo , creator of the BRC-20 token standard. Trevor.btc and Leonidas.og have also contributed heavily to the ordinal and BRC-20 saga , and helps host the Ordinals Show podcast, which provides updates on this segment of cryptocurrencies.

In terms of key projects, the UniSat wallet has been an early stage player in the ordinal/BRC-20 story. While initially offering a wallet for ordinals and then BRC-20, UniSat now also helps users subscribe to sats, and recently released a BRC-20 marketplace (currently labeled "experimental testing"). It's worth noting that at the start of the market, in order to trade on UniSat, you need to have made a certain number of trades before being allowed to trade. This means that early traders are extreme crypto natives (i.e. DeFi degens). These restrictions were later lifted, and other trading venues continued to pop up. UniSat has also been developing a BRC-20 indexer and has released some preliminary features related to this (more on that later). The website further notes that UniSat is in beta, so again, please proceed with caution if interacting with the protocol.

Another participant worth mentioning is ALEX. **ALEX is a project built on the basis of Bitcoin L2 and Stack, and is trying to develop DeFi on Bitcoin, while using Bitcoin as the settlement layer and Stack as the smart contract layer . **Before BRC-20, they focused on swaps, liquidity pools, staking, farming and bridging (classic DeFi primitives). They recently entered the BRC-20 token space and launched a beta version of a decentralized exchange (“DEX”) for trading B20. In order to trade BRC-20, users can bridge USDT from the Ethereum or BNB chain to Stack USDT (“sUSDT”), and then they use sUSDT to trade BRC-20. As mentioned, the DEX is currently in beta and was recently launched. built, so of course, please strongly keep that in mind if you consider viewing it.

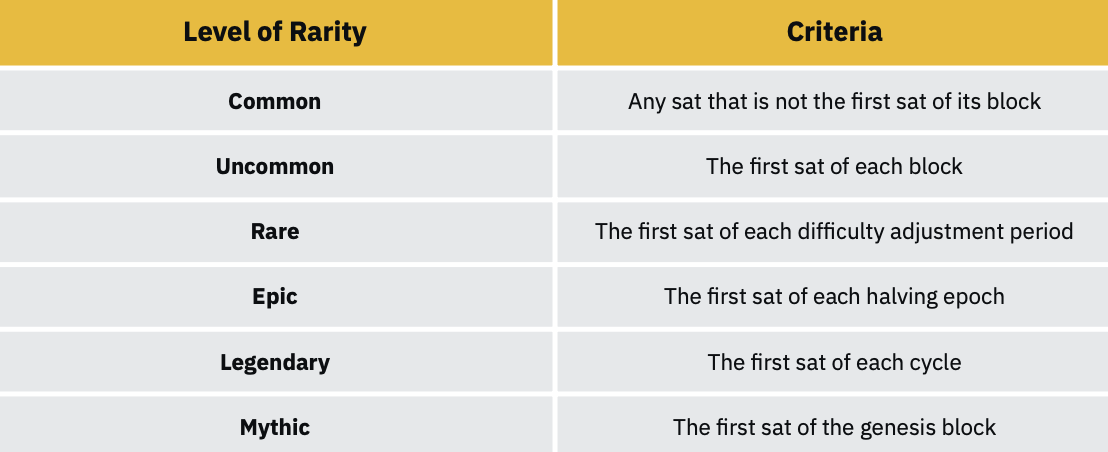

The last project we're going to mention here is doing something a little different. ** The Rare Satoshi Society is in the business of finding the rarest bitcoins on the market and connecting them to collectors. **They used Casey Rodarmor's description of different rarities to define these bitcoins, a novel method of collecting bitcoins, and software to scan each bitcoin for uncommon and rare bitcoins. We all know from the collector's market that people collect anything - from first-page newspapers to postage stamps to sports cars - so it's no surprise that this group decided to enter the sats collecting market. Some are looking for an uncommon bitcoin to be inscribed with a specific picture, while others are looking for a specific block of bitcoin, for example, the famous 10,000 BTC pizza transaction in 2010.

Figure 15: Casey Rodarmor's Ordinal Scarcity Index

Source: rodarmor.com/blog/ordinal-theory

6. Risks and challenges

As mentioned, ordinals, inscriptions, and BRC-20 tokens are recent innovations, risky at this early stage, and at the forefront of cryptocurrency. These are neither the same tools nor do they occupy the same market as Ethereum, BNB or Bitcoin itself. This is at the forefront of cryptocurrency work today. Accordingly, there are some key risks that all readers should be aware of.

1. Limited to no infrastructure

To put it bluntly, the BRC-20 token is just an idea born of an experimental token standard created by a Twitter user whose name is not real . While we don't mean to downplay the innovation and potential of this idea by saying this, we must start by stating how early we are in this story.

Token Standard has been around for a few months and has only seen considerable activity in the past few weeks. While builders are working quickly, and we highlighted some project teams working to ship relevant tooling and infrastructure, nothing exists at this stage. Yes, we've seen the beginnings of marketplaces and DEXs, but the majority of trading is still happening over-the-counter (“OTC”) through Discord servers. Without a full-fledged indexer, tracking tokens and holders is a tricky process.

In fact, the risk of centralized indexing is considerable, because in theory, if one exchange is not using the same indexer, they may not be able to identify what you buy on another exchange. These tools are not native to the Bitcoin blockchain, but come from ordinal number theory, which basically "associates" certain sats with certain characteristics. If we do not have a social consensus on this approach, some parties may not recognize certain ordinal numbers and thus specific BRC-20 tokens.

There is still a lot of work to be done if we are going to see a market with more than a few thousand holders, and while we remain optimistic about what BRC-20 tokens will unlock and what they can offer, the infrastructure is still A long way to go .

2. Has no practical utility

Most, if not all, of the BRC-20 tokens currently exchanged are meme tokens. Almost by definition, these tokens have no utility and are largely influenced by social media and community sentiment. While this brought attention and created hype, the lack of utility and, therefore, a serious holder base meant that these tokens could crash suddenly and without warning .

This risk is something every reader should keep in mind, and at the same time, if you see a new token offering some form of utility, you should dig deeper and question whether it is real or just a marketing gimmick.

3. High risk of fraud

In keeping with how new the subject of this whole experiment is, we should remember that this implies a high risk of fraud. For example, OTC token trading on Discord servers is naturally a very high-risk activity that has resulted in many people being scammed out of their money. Projects to build infrastructure for ordinal or BRC-20 are also uncertain and could pose potential security risks at this early stage. While we don’t mean to scare off readers, given this is the early days of these tokens and this new technology, the risk of scams is high and should be taken seriously.

7. Future Outlook

Bitcoin Layer 2

This whole frenzy has seen Bitcoin not scale to its grand goals, if not ordinals, inscriptions, or BRC-20, then something else. ** As long as a few million more people decide to use Bitcoin for peer-to-peer transactions, we will have the same result, with transaction fees skyrocketing; it doesn't matter that this spike is caused by BRC-20. **If anything, we should take this as a warning to the future and understand that much work remains to be done if Bitcoin is to truly become a global peer-to-peer payment system for millions, if not billions of people.

This further illustrates that the scaling methods used by other chains are also critical for Bitcoin. Do we need to send a $5 transaction on Bitcoin L1, or can it be done at the L2 level? Many would argue that underlying transactions are a scarce commodity that cannot be expected to remain cheap forever if the chain is to grow. The conclusion to be drawn here is simple: the use case for Bitcoin L2 is clear, and this is where developers should focus . Scalability solutions are the next critical step for Bitcoin if it is to become a technology that millions of people can use regularly.

In our report A New Era for Bitcoin? , we take a closer look at potential solutions, including the Lightning Network, Stack, and Rootstock, as well as quickstarts on Liquid Network and Rollkit. Stack's upcoming sBTC release [6] looks particularly interesting and may offer a significantly more decentralized way to spend BTC on L2 than is currently possible. Lightning Network usage continues to rise, with Binance recently announcing that they are looking to integrate it , And start-ups like Lightspark [7] are creating “enterprise-grade” web portals for businesses to join. Spiral, the Bitcoin open-source development platform backed by Jack Dorsey , recently released an ambitious new roadmap for its Lightning Development Kit (“LDK”) project[8] .

The future of the Bitcoin secondary market looks promising, and as more users and developers see clear use cases for Bitcoin’s scalability, we remain optimistic about the development of this space in the next year.

infrastructure

As mentioned in the Risks and Challenges section above, at this early stage, the infrastructure around BRC-20 tokens is very limited. While many different parties, such as Unisat and ALEX, have released beta versions or are working on solutions, we are still in a very early and experimental stage.

The transaction process must become significantly smoother, with peer-to-peer Discord server transactions ideally phased out over the coming weeks and months. The full deployment of a fully functional and efficient DEX is a critical step in taking BRC-20 to the next level and should be followed closely.

Also, as domo, founder of the BRC-20 token standard, said in a recent twitter space, his first goal is to have a fully on-chain and trustless indexer launch . Indexers are software that read the Bitcoin chain and compile all transactions to create an agreed-upon global state of balance . Both UniSat and ALEX are working on solutions in this regard and an effective indexer will be crucial as it will further increase the legitimacy of the BRC-20.

We anticipate significant developments in the associated infrastructure over the next few months. For example, the Bitcoin Frontier Fund recently announced [9] that they have accepted 8 new startups into their accelerator program. These startups are working on solutions ranging from ordinal lending, to dev kits for Bitcoin Web3 games, to ordinal cross-chain bridges. Developer interest in the Bitcoin ecosystem is clearly fueled by this recent upsurge, and we're excited to see what innovations can emerge from it.

Innovation in Token Design

Finally, in terms of specific BRC-20 innovations, we should note again that this is a very simple token standard with limited flexibility.

A key feature is that all BRC-20 token minting is fairly issued , that is, you cannot resort to team assignments or have traditional "whitelist" features that allow some users to mint before others. While the original design used this feature to reduce the prevalence of carpet pulls and scams, of course there are legitimate reasons to have "whitelists" and have team allocated tokens, etc. Builders are working on solving this problem, and it remains to be seen whether the solution emerges in BRC-20, or perhaps in other token standards.

**Similarly, builders are trying to find a solution to "burn" tokens. **Given that BRC-20 lacks smart contract functionality, which is currently not possible, again, there could be some very real and legitimate use cases, especially when considering adding different utilities to these tokens.

Builders have been innovating at a rapid pace outside of the BRC-20. ORC-20 tokens have recently appeared on the timeline and are designed to address some of the limitations of BRC-20. For example, BRC-20 tokens are currently restricted to a four-word naming convention. ORC-20 has no such restrictions, adding a degree of flexibility to developers. We also saw the prototype of the SRC-20 token, which is related to " bitcoin stamps ". SRC-20 tokens store data differently than BRC-20 tokens, potentially making them more secure than BRC-20 due to some technical specifications, but this also means they can store much less data than BRC-20 .

These are just a few examples of symbolic design features builders are trying to innovate. We're sure there are many others on the horizon, and we'll be keeping an eye on how the development process progresses.

8. Conclusion

Ordinals, inscriptions, and BRC-20 tokens have helped demonstrate to the world that there is indeed a demand for Bitcoin blockspace beyond the classic peer-to-peer payment model. Users expect the same thing to be done on the Ethereum and BNB chains, but on Bitcoin. While Casey and domo helped spur innovation with their unlocks, it's now up to the community and developers to take it to the next level.

The lack of revenue for miners from transaction fees has been a key concern for many Bitcoin proponents, and this latest wave of activity just proves that there is a possibility out there. Recent developments are encouraging and help represent a potential path for Bitcoin to develop sustainably in the long-term .

Bitcoin Layer 2 scaling solutions will be critical and we expect to see growth in this area. Further infrastructure development and token innovation are also on the menu.

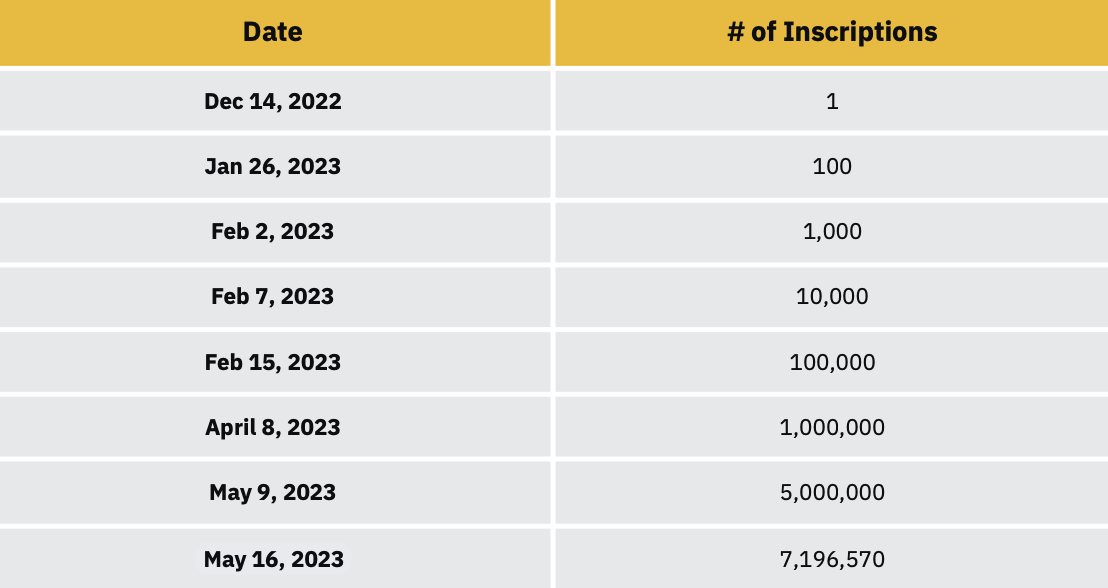

Before closing, we would like to remind readers that the growth of cryptocurrencies tends to be exponential. For example, after the first inscription on December 14, 2022, it took over a month to reach 100. However, between February 2 and February 15, the number of inscriptions went from 1K to 100K. By April , we've reached 1 million, and now we're over 7 million. The market grew slowly at first, then all at once. Although we cannot say how big this market will be, we can predict that we will soon pass the 10 million inscription milestone. Please keep an eye on this space.

Figure 16: The exponential growth of inscriptions so far

Source: Dune Analytics (@dgtl_assets) Binance Research as of May 16, 2023

refer to

- https://github.com/casey/ord#readme

- https://docs.ordinals.com/digital-artifacts.html

- https://en.wikipedia.org/wiki/JSON

- https://www.bitrawr.com/bitcoin-block-size-debate-explained

- https://medium.com/@hasufly/research-paper-a-model-for-bitcoins-security-and-the-declining-block-subsidy-11a21f600e33

- https://www.stacks.co/learn/sbtc

- https://twitter.com/lightspark

- https://lightningdevkit.org/blog/ldk-roadmap/

- https://twitter.com/BTCFrontierFund/status/1658072237927268353?s=20

About Binance Research

Binance Research is the research arm of Binance, the world's leading cryptocurrency exchange. The team strives to provide objective, independent and comprehensive analysis and aims to be a thought leader in the cryptocurrency space. Our analysts regularly publish insightful, thought-provoking articles on topics related to, but not limited to, the cryptocurrency ecosystem, blockchain technology, and the latest market topics.

Shivam Sharma

macro researcher

Shivam is currently working at Binance as a macro researcher. Before joining Binance, he worked as an investment banking associate/analyst in the Debt Capital Markets division of Bank of America, specializing in European financial institutions. Shivam holds a BA in Economics from the London School of Economics (“LSE”) and has been active in the cryptocurrency space since 2017.