The Saga of BEN.ETH.

This is the story of how a pseudonymous crypto influencer:

• created a multi-billion memecoin empire

• Was sent $7m in free money

• Gained the attention of Andrew Tate

• Was sued for 8 figures

Do I have your attention?

Read on:

I guess this all starts with $PEPE, a memecoin that launched in late April only to go ballistic.

Some early holders rode the coin 100x, in some cases turning a few hundred bucks into over a million.

The trend captivated crypto twitter and beyond.

Pepe still sits at a $600m market cap—and many crypto participants began to look for the next 1000x

Hundreds of coins emerged: $WOJAK, $BOB, $LAMBO, $CHAD, and $WEED just to name a few of the more popular ones.

One of the influencers who capitalized on this trend?

@eth_ben

The unknown Ben, who had only about 15k followers at the time, launched his own token, $BEN.

It chugged along until crypto influencer Bitboy came out in support of it, publicizing it across social media.

Bitboy was crucified online for this behavior: he had bought up a ton of the supply without disclosing it.

On top of that, many speculated that regulators and law enforcement wouldn't be kind towards a memecoin pump-and-dumper.

But ben.eth was the original founder.

Ben.ETH was an NFT influencer, but he wasn't particularly well-known in the space.

Until $BEN put him into the limelight: below is a list of his growing follower count over the last few weeks:

While $BEN was nowhere near the size of $PEPE, it did get some meaningful traction.

The unprofessional launch, poor planning, and clear self-promo happening by the part of Bitboy almost fed into the meme-based narrative.

Then, ben.eth announced a new token: $PSYOP

He asked people to send ETH to his wallet address and promised that the new token would be launched soon.

And oh, did the ETH come in: to the tune of $7m.

But the launch was hindered--fake tokens abounded, the pools were set up in strange ways.

Someone claiming to be a dev for Ben exposed the project, claiming that it was set up to be unfair at the very beginning.

A few days after the token launch, a lawyer threatened to file a class action lawsuit against ben.eth, claiming that he had perpetrated wire fraud against early investors.

He threatened to sue to the tune of $21 million dollars.

The beauty of $PSYOP, however, was the meme behind it.

Was all of this chaos part of the $PSYOP?

The meme continued to grow despite the 'fud.'

It all fed into the meme.

Later a rumor came out that Andrew Tate was part of the project, and he responded with a video denouncing the project.

Was Andrew Tate truly dismissing memecoins?

Or was he actually a part of the psyop?

Nobody knew--and the meme grew.

twitter.com/Cobratate/status/1...

The meme grew alongside its valuation. Meanwhile, ben.eth's wallet went from a bored ape and some ETH to having a valuation of over $1.77 billion (yes, billion).

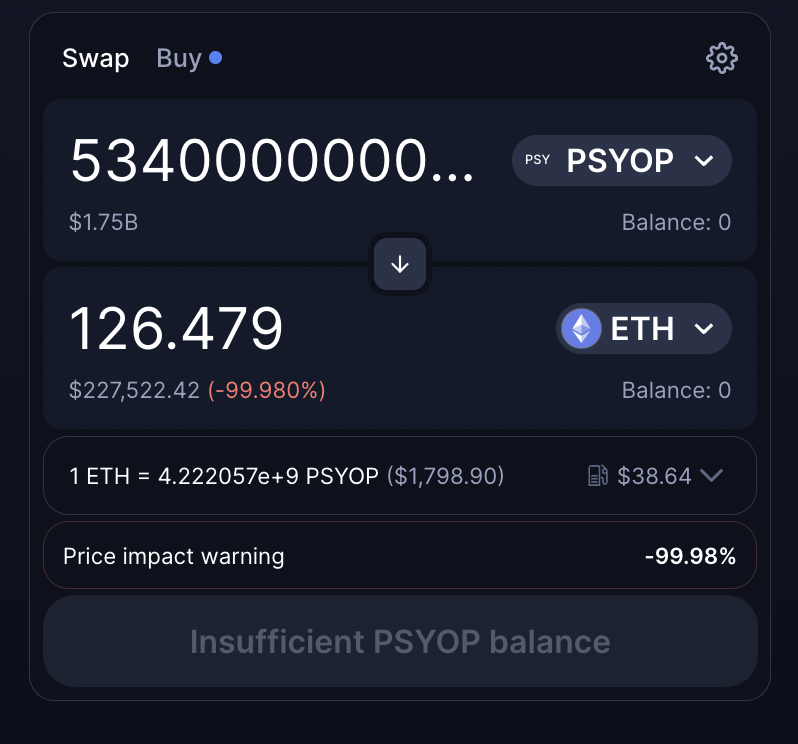

Important to note: these tokens aren't at all liquid

If Ben were to market dump it all, he'd only end up with ~$225k

Today a new piece of news came out: the Uniswap front end banned users from trading the $BEN token; the project associated with Bitboy.

We don't know why, but it's possible it has to do with potential regulatory action.

Never a dull day.

This all goes to say: crypto remains an absolute wild west.

Is the possibility of hitting it big on unregulated, scammy memecoins a feature of the new financial system?

Or is the shitcoin casino a bug?

Let me know what you think in the replies:

Want to learn more about the narratives and assets shaping crypto?

Give me a follow: @JackNiewold

Enjoyed the thread? Help me out with a RT below:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content