Written by | Bob

Produced | Vernacular Blockchain

So far, cryptocurrencies led by Bitcoin and Ethereum have become one of the best investment varieties with an increase of more than 60% in 2023. However, from the perspective of a wider market, the encryption market is still in a bear market, and the internal capital flow and hotspot circulation are also quite frequent, making it difficult to form a joint force. L2, BRC20, Meme and other ecosystems all show short-term superficial prosperity.

How ordinary investors can obtain higher and more stable returns in a bear market has become an issue of concern to everyone. Binance CEO CZ recently forwarded the comment "When launchpad" on Twitter, bringing the public's attention back to IEO.

Source: Twitter

In the last round of bear market, Binance’s IEO (Launchpad) was one of the best options for ordinary people to fight risks. Will this bear market repeat itself? We'll take a deep dive into the Binance launchpad.

Binance Launchpad's selection tendency "changed"?

Binance launchpad has always been known for its strictness and confidentiality in terms of project selection. Except for the public rules, few people know the specific rules for selecting projects. Therefore, only public information is used here to analyze what advantages a project that can be selected by Binance needs to have.

From the perspective of the timeline, STEPN ($GMT) will be a project that Binance launchpad cannot bypass.

Binance launchpad timeline

GMT is one of the most successful projects on Binance launchpad in the past few years, with a historical increase of more than 38100%, covering nearly 5 million global Web3 users. The emergence of STEPN has changed a user's lifestyle and integrated Web3 into life. For Web3, STEPN has even opened up an X2E track that is much larger than P2E, which has attracted numerous latecomers to imitate.

After GMT, Binance changed its previous launchpad speed, slowed down IEO, and restarted after nine months. Let’s take a look at the common features of these IEOs:

Hooked Protocol ($HOOK) is the first new IEO project after GMT. It is a Web3 infrastructure that integrates Learn and Earn, and is dedicated to building Web3 portals.

Hooked Protocol's first product, Wild Cash, is the Quiz to Earn app. Before becoming a Binance launchpad, Wild Cash App has achieved 4 million installations worldwide, and has achieved first place in Google Play's Indonesian market and Nigerian game category list. At the same time, it is also the third application of BNB Chain daily active addresses.

Space ID ($ID) is Binance's first IEO project in 2023. It is a decentralized domain name service protocol dedicated to building a universal name service network. Space ID launched the ".bnb" domain name service on BNB Chain. Before becoming Binance launchpad, 225,000 users registered 418,000 domain names. In the field of decentralized domain name service, Space ID is second only to ENS (Ethereum Name Service).

Open Campus ($EDU) is a decentralized Web3 educational content platform and a recent IEO project of Binance. Open Campus is committed to creating a fairer education system through blockchain technology. Educational content producers can convert educational content into NFT and obtain financial income by selling NFT. Tiny Tap is the first app to use Open Campus.

Founded in 2012, Tiny Tap is a UGC educational game platform from Israel, focusing on providing children with content education in the game interaction mode. According to publicly disclosed information, Tiny Tap's annual revenue will reach US$7.6 million in 2022, and its cumulative revenue will reach US$17.6 million in 2019-2022. Currently, the platform has 230,000 interactive courses and 120,000 paying users. Tiny Tap App ranks among the top ten best-selling children's apps in the US App Store all year round.

By analyzing the IEO projects after GMT, it is not difficult to find that Binance Launchpad is currently more inclined to choose projects that already have products and have achieved good results in their own fields. In terms of project track selection, Binance still seems to retain STEPN path dependence, preferring projects with Earn mechanism.

Of course, this rule cannot be guaranteed to apply to future IEO projects. But it is worth noting that before restarting the launchpad, CZ said that in 2023, it will focus on education, compliance, and products and services. Therefore, it may be a better choice to focus on education, compliance, etc.

Source: Twitter

Can Binance launchpad push projects from 1 to 10?

In the field of encryption, Binance's influence and resources inside and outside the industry naturally have advantages. Binance launchpad is one of the ways Binance cashes in on this influence and resources, which is one of the main reasons why projects are rushing towards it. When the project has a certain scale and product capabilities, Binance can help the project quickly accumulate potential energy and help it complete the transformation from 1 to 10. This is why, as analyzed above, Binance now prefers products with certain competitiveness.

It is difficult for the outside world to guess, when GMT completed the nine-month gap period after the IEO, Binance will change the launchpad. However, from the data of several subsequent IEOs, it can be found that Binance is forming a set of templates for the gameplay applied on STEPN to help the project grow rapidly and iterate.

According to data from the site traffic analysis website Similarweb, after the launch of Binance launchpad, the cumulative installation volume of Hooked Protocol reached 10 million, an increase of about 6 million installations compared to before, and the number of Google Play downloads exceeded 5 million, successfully entering Vietnam, Turkey, Pakistan and other countries.

Google play, Wild Cash downloads

Driven by Binance launchpad, Wild Cash has grown by 150% in just a few months. According to the roadmap, Hooked Protocol will launch more Web3 applications in the future , such as AI-driven chat learning application Hooked Academy Sensei, news aggregation application Wild News, MPC technology hosting wallet Hooked Wallet, etc.

Dune Analytics, BNB Chain top15 Daily Activity Ranking

After Space ID completed the IEO, the number of ".bnb" domain names increased by 89.95% compared with before, and the number of users increased by 158.2%. At the same time, the ".arb" domain name service was successfully launched on the Arbitrum network.

Source: Space ID

Open Campus is different. As a project focusing on the Web3 UGC education field, after launching Binance launchpad, it did not achieve a large amount of data growth. Instead, it attracted more investors' attention to this track. Sequoia China, Kingsway, Liberty City Ventures, Polygon and other venture capitals have invested $8.5 million in Open Campus for enterprise development and to accelerate the layout of the education technology industry. According to official disclosures, Open Campus is about to launch a $10 million educator fund to support teachers and creators.

Figure: blockbeats news

From the changes before and after Hooked Protocol, Space ID, and Open Campus launched on Binance launchpad, it can be seen that Binance launchpad not only provides users with a way to make profits, but also empowers the industry based on its own capabilities, and promotes projects from 0 to 10 to achieve a win-win situation for the platform, project parties and users.

Is the ROI of Binance launchpad stable for investors?

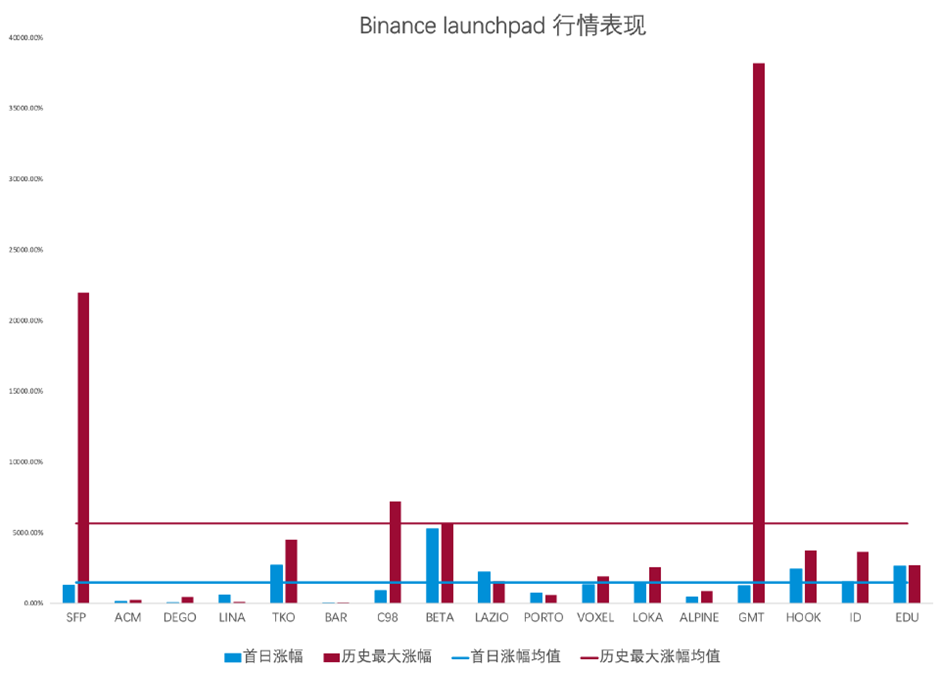

For users, participating in IEO is more concerned about the return on investment. For this reason, we have counted the first-day increase of Binance launchpad and the largest increase in history since 2021.

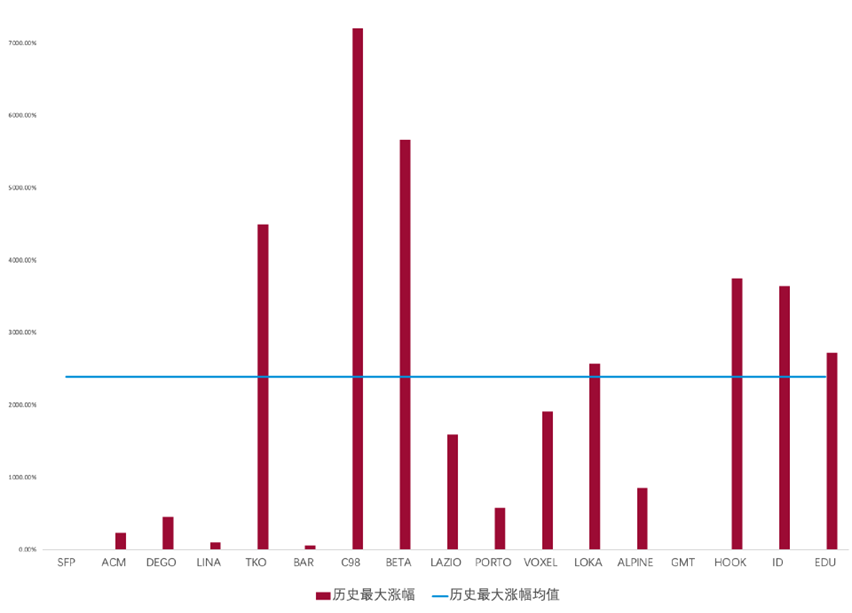

Since 2021, Binance launchpad has conducted a total of 17 IEOs, with an average increase of about 1466% on the first day of listing, and an average increase of about 5644% in history. According to calculations, the variance of the largest increase in the history of these 17 IEOs is 9702.79.

It can be seen from the data that the maximum increase of different IEO projects before $GMT varies greatly. After deducting the two projects with huge increases of $SFP and $GMT, the average value of the largest increase in history will be reduced to 2386 %. The variance of the largest gain in history was also reduced to 481.68.

The reduced variance means that the largest increase of Binance launchpad will tend to be more stable ($HOOK: 37 times, ID: 36 times, EDU: 28 times). From the data point of view, the probability of excess returns has decreased, but the average rate of return has increased. The main reason may be that the comprehensive level of recently launched projects and the fundamentals are higher than those of previous projects. At the macro level, the cryptocurrency market is in a bear market environment, and funds prefer projects with solid fundamentals. For the majority of investors, Binance launchpad is one of the few investment directions that can maintain ultra-high profitability in a bear market. The stabilization of investment returns may also mean that the game of funds on the market has intensified and there is less inflow of external funds.

After multi-dimensional and aspect analysis, it can be concluded that the quality of the Binance launchpad project is higher than before, and the return on investment ratio brought to users tends to be more stable . Among them are not only the reasons of the external macro environment, but also Binance's own preference factors in "selection". Of course, considering the background of the current bear market, compared with the brilliance of GMT, it is indeed unfair that current projects are often compared, but as far as the data that can be seen so far, Binance launchpad is still the leader of the entire encryption industry. One of the highest return investment opportunities in the market.