Written by: flowie, ChainCatcher

The LSD Stablecoin agreement may be setting off a new round of war in LSDFi.

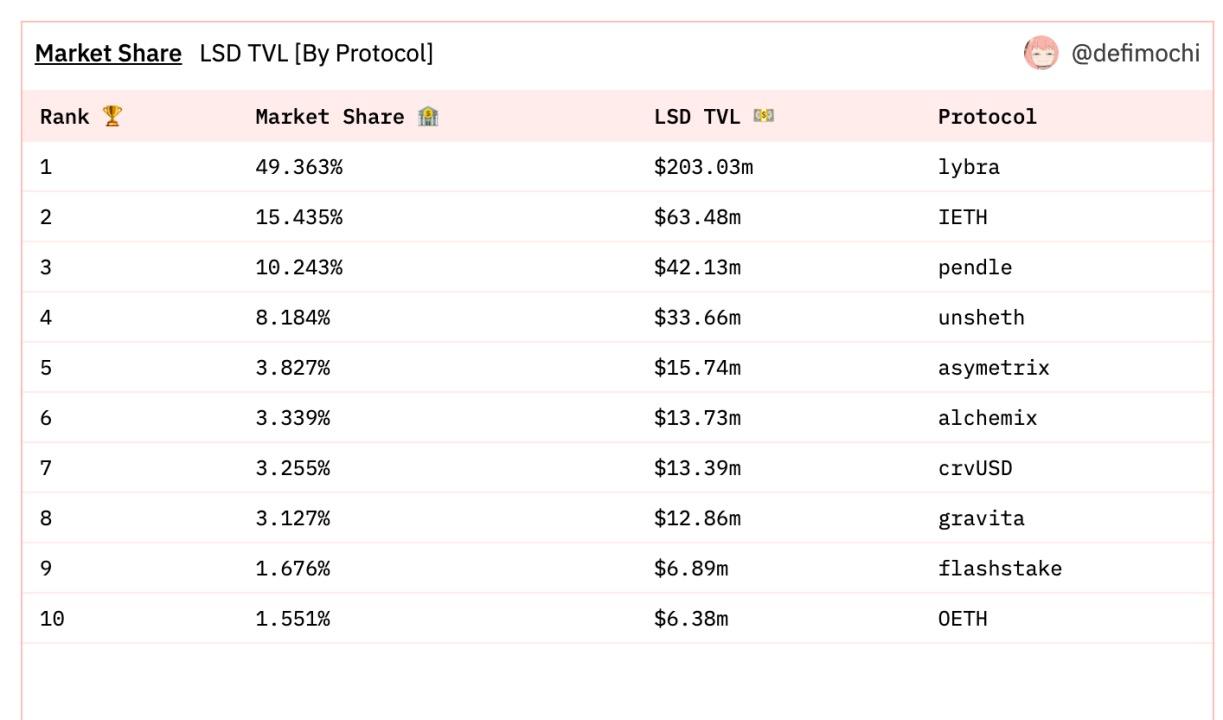

Recently, Lybra Finance, an agreement to mint interest-bearing Stablecoin with LST as collateral, has been in the limelight. It was officially launched after the IDO was launched on April 22. In just over a month, its native token LRB has skyrocketed by up to 40 times. The TVL once exceeded 200 million US dollars, and the market share was nearly 50%.

Lybra Finance is not the first agreement to eat crabs, and many agreements supporting LSD Stablecoin are emerging. The TVL of Gravita, the LSD interest-free lending Stablecoin protocol, is also rapidly rising to $21 million. On June 1, the LSD Stablecoin protocol Prisma Finance has announced the completion of a new round of financing, including Michael Egorov, founder of Curve Finance, founder of CoinGecko, OKX Ventures, Adam Cochran, research director of Eden of The Block, founder of ANKR , etc. Project parties or founders participate in the investment.

In addition, Curve recently launched a community vote to support wstETH to mint the over-collateralized Stablecoin crvUSD as collateral. Liquidity staking Layer1 blockchain Tenet Protocol, LSD protocol Agility, Raft, etc. have successively launched Stablecoin supported by LSD. Stablecoin backed by LSD may be becoming a new trend in DeFi that cannot be ignored. This article takes an inventory of the DeFi protocols represented in it, trying to understand the mechanisms and the driving reasons behind the outbreak of trends.

How does the protocol that supports LSD Stablecoin get a share in LSDF i ?

Before understanding the DeFi protocols that support LSD Stablecoin, let's briefly review the major types of Stablecoin.

One is a centralized Stablecoin that uses legal currency such as the U.S. dollar as collateral, such as USDT and USDC. These Stablecoin are usually issued and managed by a central authority and generally maintain a 1:1 collateralization ratio. The second is decentralized over-collateralized Stablecoin that use Bitcoin and Ethereum cryptocurrencies as collateral, such as DAI, BitUSD, and sUSD. The collateral ratio is usually 1:1.5 or 1:2, which means that $1 Stablecoin needs to be issued. Tokens need to be collateralized with cryptocurrencies worth $1.5 or $2. The third is algorithmic Algorithmic Stablecoin that use algorithms to maintain Stablecoin prices, such as Frax and the collapsed UST. These Stablecoin usually introduce elastic supply mechanisms and incentive mechanisms to regulate supply and demand and maintain price stability, and the mechanism is relatively complicated.

The role of these well-known Stablecoin is to act as a trading medium between legal tender and mainstream digital currencies and to avoid the risk of mainstream digital currency price fluctuations.

At present, a new form of Stablecoin has emerged in the encryption market, that is, decentralized Stablecoin that uses st ETH, cbETH, Sfrx ETH, rETH and other Liquidity pledged Derivatives (LSD) as collateral. way, issued by the decentralized protocol. Compared with traditional Stablecoin, its more obvious utility is that one is to release the Liquidity of LSD tokens; the other is to provide LSD token value-added scenarios, such as pledge, lending, interest generation, etc.

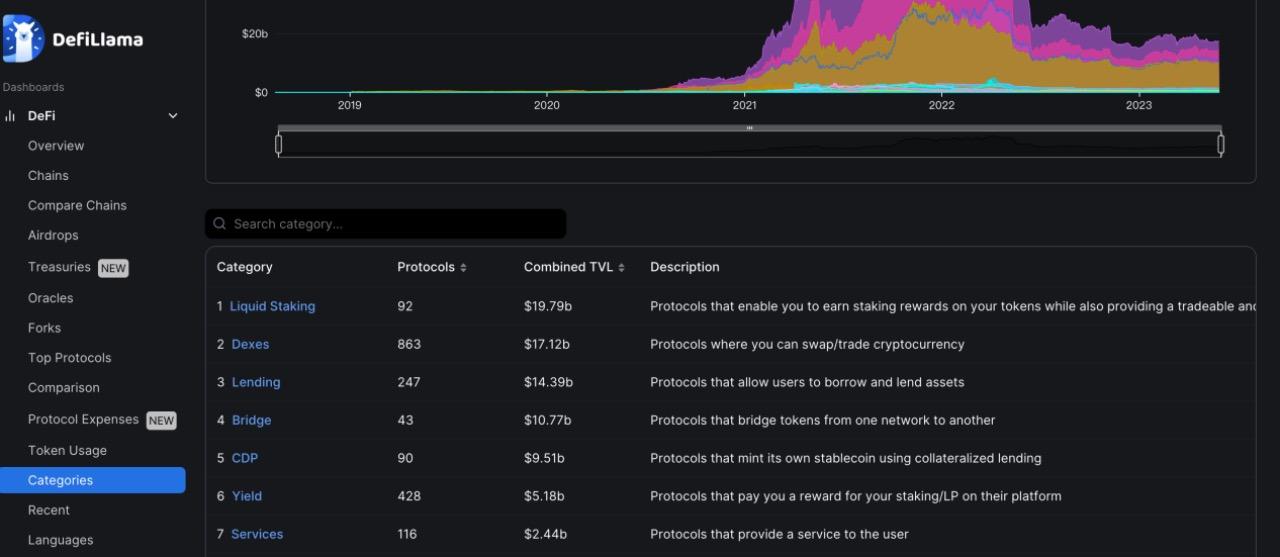

After the upgrade of Ethereum, the LSD market has grown rapidly, and its current TVL market value exceeds 19 billion US dollars, ranking first among all DeFi protocol categories. The huge LSD assets have become one of the most important battlefields of DeFi. The Stablecoin protocol supported by LSD is trying to get a share of it through the combination of Stablecoin, over-collateralization, arbitrage, liquidation and other mechanisms. Judging from the represented projects, one focuses on interest-generating LSD Stablecoin, and the other focuses more on interest-free lending of LSD Stablecoin.

1. Lybra Finance — LSD interest-earning Stablecoin protocol

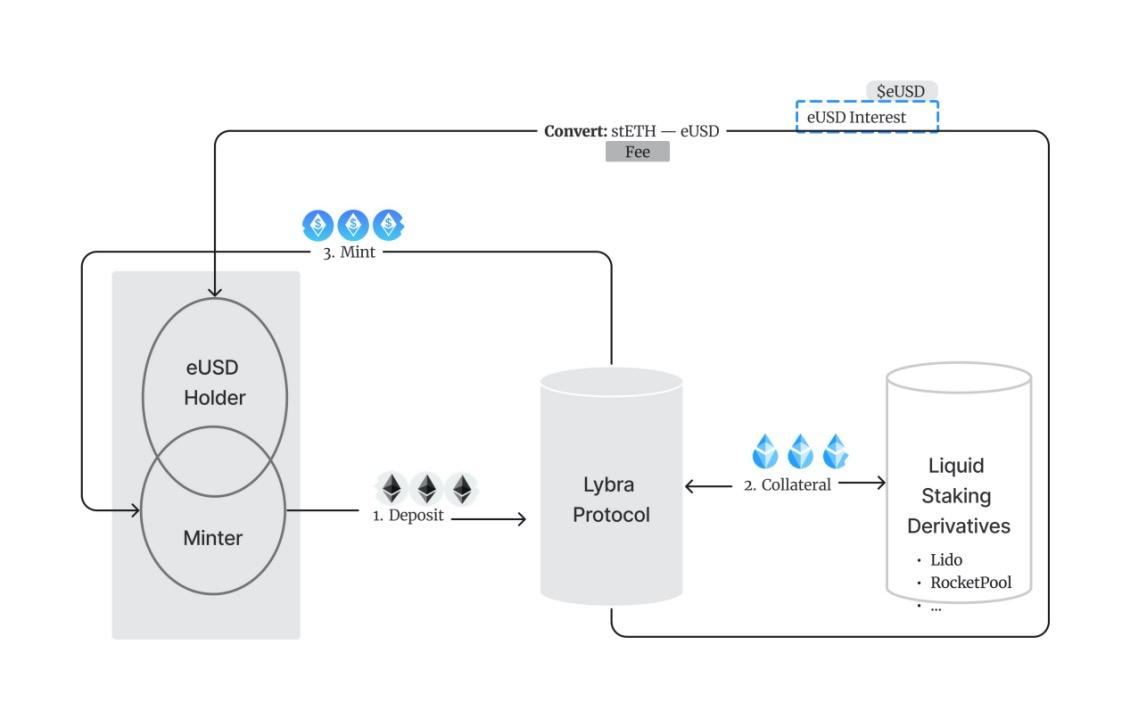

Lybra Finance has launched eUSD, an interest-bearing Stablecoin, which is pegged to the U.S. dollar at 1:1. Holding eUSD can earn 7.2% APY (annual yield). There are two ways to obtain this eUSD, one is to exchange the mainstream Stablecoin held such as USDT, USDC or FRAX into eUSD through a decentralized exchange. The other is to mint eUSD at zero cost by depositing ETH or stETH as collateral in the Lybra Finance agreement. The minimum mortgage rate is 150% (if it is lower, it will be liquidated), and it is best to ensure that it is above 200%.

The mechanism of Lybra Finance to pay users' interest and obtain income is that when users deposit ETH into Lybra, Lybra will automatically convert its pledge into stETH in Lido, and obtain income through pledge. This part of the income Lybra needs to take a commission as a handling fee, and the rest of the income is used for the interest of eUSD holders. The commission is an annual handling fee of 1.5% based on the total circulation of eUSD.

How to calculate this account, Lybra gave an example on the white paper, assuming that Alice deposits $135,000,000 in ETH and mints 80,000,000 eUSD, and Bob deposits $15,000,000 in ETH and mints 7,500,000 eUSD, then the current circulation of eUSD is 80,000,000 coins plus 7,500,000 coins, a total of 87,500,000 coins, the current collateral is $135,000,000 plus $15,000,000, a total of $150,000,000 stETH.

Then after 1 year, Lybra generates 150,000,000 USD * 5% or 7,500,000 USD in stETH through LSD,

Assuming that Bob uses his 7,500,000 eUSD to purchase increased stETH, the handling fee for the past year is eUSD circulation (87,500,000)*1.5%=1,312,500 eUSD, dividend 7,500,000 eUSD - 1,312,500 eUSD = 6,187,500 eUSD, then 6,187,500 eUSD USD Allocation For all eUSD holders, the annualized interest rate is around 7.2%. And for eUSD holders, compared with the volatility brought about by pledged ETH assets within a year, the income of Stablecoin deposits is more insured.

In addition to the income mechanism, how eUSD is linked to the US dollar is a key link. Overall, Lybra Finance uses overcollateralization, liquidation mechanisms, and arbitrage opportunities to ensure the stability of eUSD.

First of all, each eUSD requires at least $1.5 worth of stETH as collateral, over-collateralized to reduce the risk of insolvency. Second, the Lybra protocol incorporates a liquidation mechanism to protect the system from undercollateralization. If the user's mortgage rate is lower than the security mortgage rate, any user can voluntarily become a liquidator and purchase the liquidation part of the mortgaged stETH and pay the corresponding eUSD. This mechanism ensures the stability of eUSD appreciation pressure. Recently, Lybra Finance also launched a mortgage rate monitoring function to resist liquidation risks in volatile markets. That is, when the user's mortgage ratio drops below a certain threshold, it will automatically repay part of the user's debt, and once the mortgage ratio returns to a predetermined level, this automatic repayment function will stop.

In addition, Lybra ensures that the eUSD price does not break the anchor by providing users with arbitrage opportunities . If 1eUSD>1USD, users can mint new eUSD by depositing ETH as collateral, and then sell the newly minted eUSD on DEX. As more eUSD is sold, the market supply increases, pushing the price back to $1. For users, they can profit from the price difference by buying back eUSD at a lower price or using it to repay loans.

When 1eUSD < 1USD, users can buy eUSD at a discounted price in the market, and then exchange it for $1 worth of ETH/stETH within the Lybra protocol. As eUSD demand increases, pushing the price back to $1. And users can hold the redeemed ETH/stETH or sell it, profiting from the difference.

In addition to issuing the interest-bearing Stablecoin eUSD, Lybra Protocol also issued its native token LBR, and launched an IDO on April 22, allocating 5 million (accounting for 5% of the total supply) LBR tokens.

As mentioned earlier, Lybra Protocol obtains all the benefits through staking, part of which is to pay the interest of eUSD holders, and the other part is used as a handling fee, and this part of the handling fee Lybra will be distributed to LBR holders. If the user holds 1% of LBR in the LBR pledge pool, then the user will get 1% of the total transaction fee accordingly.

In general, through the Lybra Protocol, users can choose to hold the interest-bearing Stablecoin eUSD to obtain interest, mortgage and mint eUSD to obtain LRB rewards, or pledge LRB as a way of providing Liquidity for LP to obtain income.

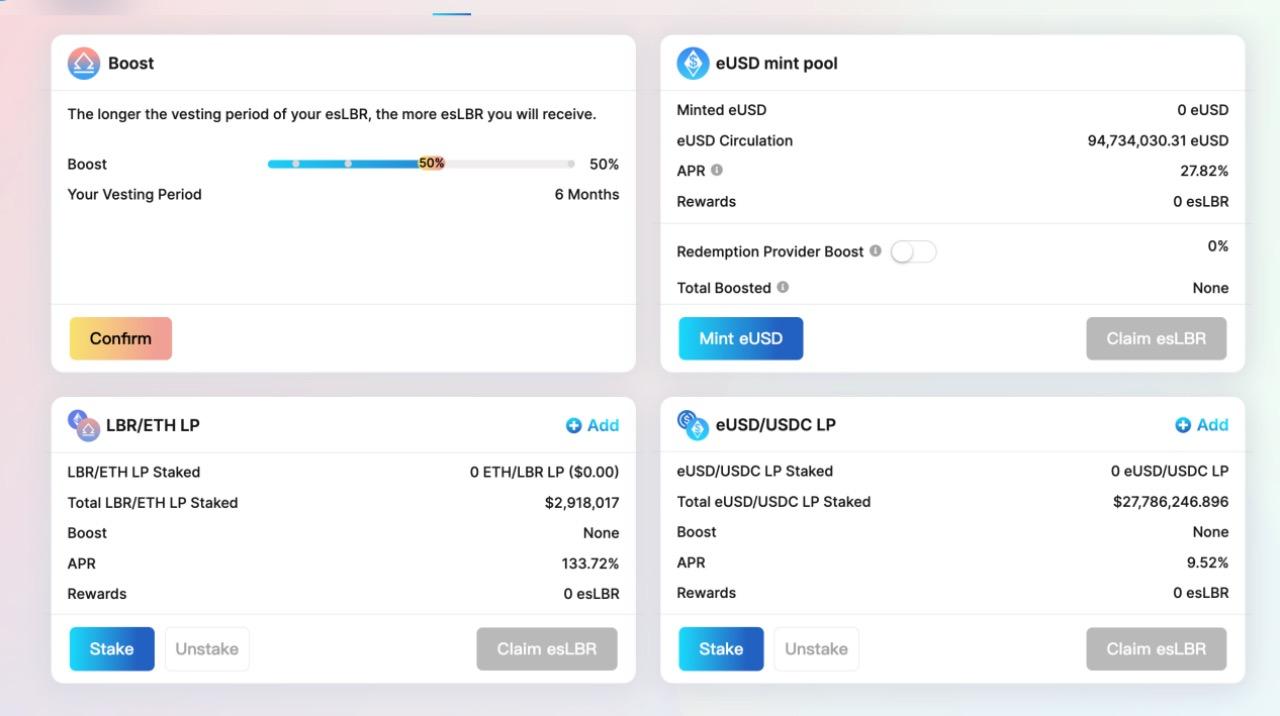

At present, the yield of Lybra's first pool (eUSD mint pool) is 27.82%, the yield of the second pool (LBR/ ETH LP) is 133.72%, the yield of the third pool (eUSD/USDC LP) is 9.52%, and the yield of single-pledged LBR is 74.56%. Due to the large fluctuations in the price growth of LBR currency and its protocol income, its yield also fluctuates greatly.

At present, the TVL of Lybra Finance has fallen back to US$182 million (up to over US$200 million), and the price of LRB has also been greatly reduced to US$1.22 (up to over US$4).

The innovative model of Lybra Finance's interest-bearing Stablecoin and zero-interest lending does provide a solution for groups who need stability and pursue certain pledge returns. But for users, this also means that they have to bear the security risk of an additional layer of contracts, and because of the commission of the agreement, a part of the pledge income needs to be discounted. Although Lybra Finance's TVL and currency prices have skyrocketed in the short term, there has been a recent decline. How Lybra Finance can ensure long-term sustainability is worthy of attention.

Recently, Lybra Finance announced that it plans to launch the v2 testnet in mid-June to solve the current TVL growth bottleneck and eUSD’s lack of scenario applications through the following aspects: First, it plans to expand the entire chain through LayerZero. According to the analysis of encryption KOL@qiaoyunzi1, the team has already started to talk about cooperation with the agreement on Arbitrum. Layer2 is the preferred direction of Cross-chain. In the future, Lybra Finance may Cross-chain eUSD to other alt-layer1 to expand its scenarios. The second is to add more LST asset types; the third is to update the Tokenomics of LBR and introduce VC and other investors to the protocol Lybra. In addition, change the agreement income and fee mechanism, let LBR introduce deflationary elements and increase the vesting period of esLBR (increased to 60 days), and allow a longer lock-up period. In addition, the LBR Liquidity Derivatives esLBR is introduced into DAO governance, allowing the community to participate in the decision-making power of the agreement.

Lybra Finance's current team is also anonymous. Recently, because of its rapid rise in data, it has also sparked a lot of discussions. It was speculated that it is a project under Lido, but then Lido clarified that the two have nothing to do with each other, and reminded users to do a good job of project background before interacting.

2. Gravita - LSD interest-free loan Stablecoin protocol

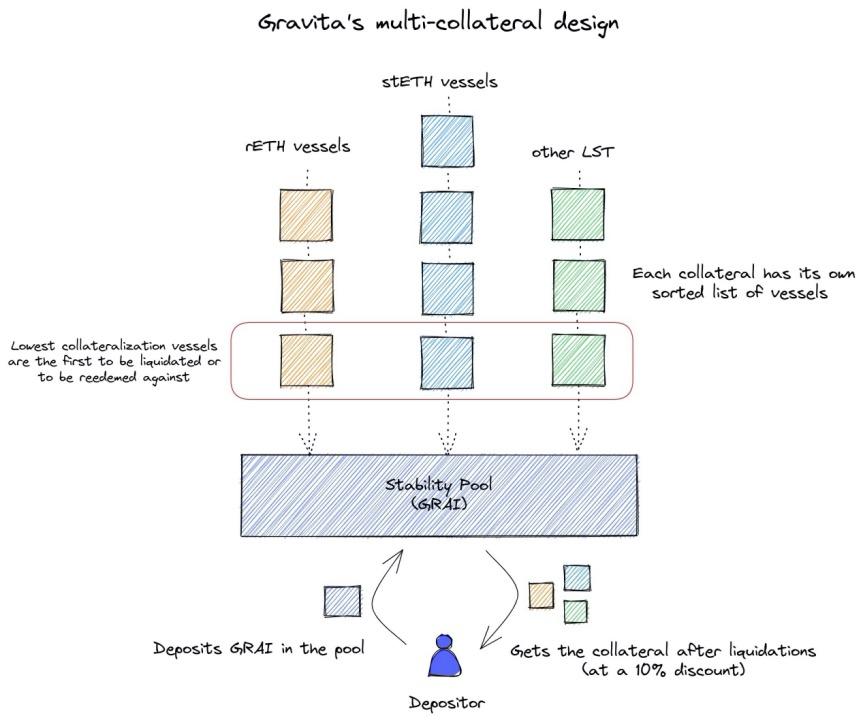

Gravita Protocol is a decentralized lending protocol built on Ethereum. It supports users to deposit wstETH (Lido), rETH (rocketpool), and blusd (ChickenBonds) to obtain Gravita's native Stablecoin GRAI as a return. It also supports mortgage loans to GRAI , used for consumption, or deposited in the stable pool to purchase liquidated LST collateral at a discounted price. As a fork project of Liquity, Gravita's native Stablecoin GRAI is a token that has a similar volatility suppression mechanism to Liquity's native Stablecoin LUSD.

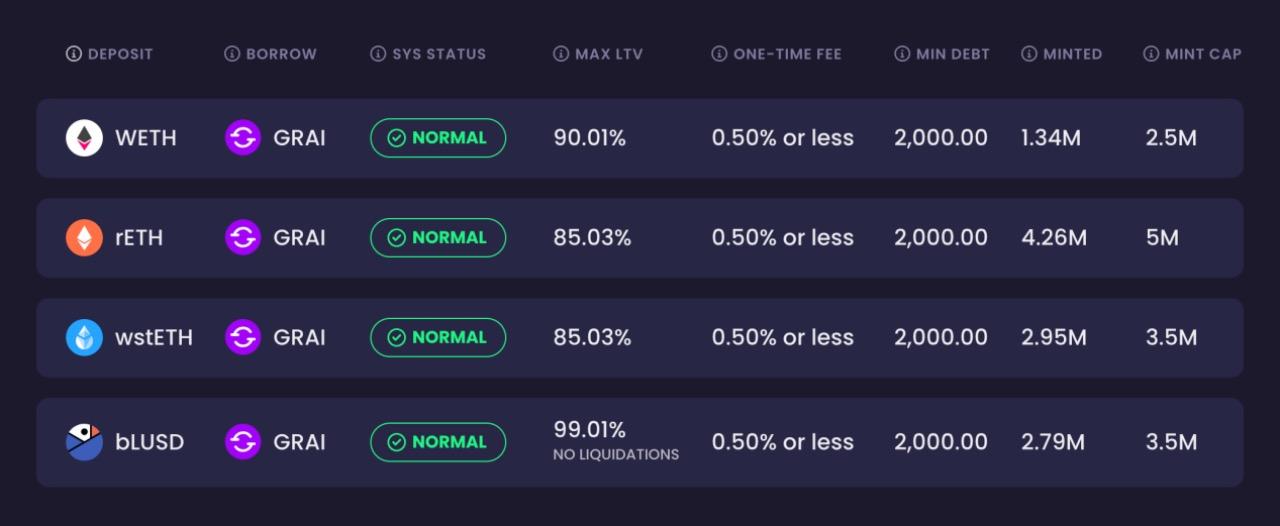

Gravita has set up independent lending pools for each type of collateral to isolate their own risks. Different collaterals have different liquidation lines, and the highest LTV can reach 90%. For example, when the price of ETH is 2000 US dollars, the user can lend up to 2000*0.9=1800GRAI, and the price of Ethereum will be liquidated if it is lower than 2000. Considering the higher risk of LST, the LTV of LST collateral is lower.

Compared with Lybra Finance, which encourages users to hold the interest-earning Stablecoin eusd to reduce the risk of LST income (aside from an additional layer of contract risk), Gravita focuses more on improving the user's capital turnover rate, using a low-fee mechanism and a clearing mechanism, Meet the needs of users' capital turnover, especially short-term lending needs.

On the one hand, when the user's LST is used as collateral, it should not be affected by the pledged APR, but the user can choose to use it to obtain income opportunities in other DeFi to obtain GRAI. This means that if the price of ETH remains stable or grows, the LTV will decrease over time, and the risk of liquidation or redemption for users is also reduced.

On the other hand, Gravita has a lower rate mechanism and a lower liquidation line than MakerDao. Currently using the Gravita protocol, there is a one-time maximum fee of only 0.5% for positions older than 6 months. For users who repay their debts before six months (approximately 182 days) are due, a fixed borrowing fee of 0.5% will be refunded proportionally to the time used, subject to at least one week's interest. MakerDao has an annual fee ranging from year to year. In addition, Gravita's LTV is about 85%, which translates to a liquidation line of about 116%, while MakerDao's liquidation line is at least 160%.

In terms of how GRAI is guaranteed to be pegged to the U.S. dollar, the upper limit of GRAI's price is $1.1 and the lower limit is $0.97. The highest LTV of 90% creates a price ceiling. When the market price of GRAI is 1.2 USD, ETH holders can mortgage Ethereum and mint GRAI at 90% LTV and sell it in the market for arbitrage. The profit of an arbitrage can reach nearly 8 %(0.9*1.2). The agreement can redeem GRAI at a price of $0.97 in exchange for collateral (that is, 1 GRAI in exchange for collateral worth $0.97), which forms the price floor of the GRAI Stablecoin.

At present, Gravita's TVL is also steadily rising to more than 21 million US dollars.

3. Agility —— LSD Liquidity distribution platform + aUSD trading platform

Agility's official description positions it as an LSD Liquidity distribution platform + aUSD trading platform, aiming to allow LSD holders to obtain higher returns and release LSD Liquidity. However, neither the LSD Liquidity distribution system nor the aUSD trading platform has been officially launched yet.

Agility currently supports ETH pledge and generates aETH; it also supports stETH, rETH and frxETH various LSD pledges and generates aLSD. After users obtain aETH and aLSD, they can choose to hold aLSD to obtain the corresponding LSD pledge income; or use aLSD or aETH to participate in the LSD Liquidity distribution system to provide Liquidity for the selected treasury and obtain income; in addition, they can also pledge aLSD or aETH mints Agility's native Stablecoin aUSD for trading or hedging risks.

Here we will focus on Agility's aUSD trading system. aUSD is similar to the eUSD and other Stablecoin mentioned above. It is also an over-collateralized Stablecoin. Users can mint aUSD by mortgaging aLSD or aETH. Its initial mortgage rate is 130%, and the minimum cannot be lower than 110%, otherwise it will be liquidated.

After users obtain aUSD, they can trade or hedge, such as long/short ETH, GMX, GNS, Pendle, Gear and other assets, long/short LSD yield, option trading, gambling games, etc. In its roadmap, Agility plans to attract external developers to build more aUSD transaction scenarios, including external application scenarios of aUSD.

Agility also issued its native token AGI, which was officially launched on 1INCH/airswap on April 7th. On April 10, Agility launched "Fair Launch" (fair launch), and opened five mining pools for Yield Farming, including four single-currency mining pools of ETH, stETH, rETH, and frxETH, as well as AGI-WETH LP mining pool, ankrETH mining pool.

The initial high yield allowed Agility to reach a peak of nearly US$500 million (US$487 million) in TVL in the first two weeks of its launch, and the price of its governance token AGI rose from the initial issue price of US$0.04 to US$0.79. But it fell back quickly, and the current TVL is only 2.25 million US dollars, and the price of AGI is only 0.015 US dollars.

Recommended reading: "Interpretation of LSDFi Protocol Agility: Two weeks after its launch, tokens soared 20 times"

4. Prisma Finance — LSD interest-earning Stablecoin protocol

Prisma Finance is a very early project. Its official Twitter was launched in May. The official website is only a single page with a one-sentence introduction. Its application has not yet been launched, and its team is also anonymous.

But now Prisma Finance has announced the completion of a round of financing, the specific amount is not disclosed, Curve Finance founder Michael Egorov, Convex Finance founder C2tP, FRAX Finance, Conic Finance, Tetranode, Llama Airforce, CoinGecko founder, OKX Ventures, DeFiDad, MrBlock , Impossible Finance, 0xMaki, GBV, Agnostic Fund, founder of Swell Network, Adam Cochran, research director of Eden of The Block, ANKR Founders, MCEG, Eric Chen, etc. participated in the investment.

Judging from the only introduction article of Prisma Finance, Prisma Finance will support more LSD assets than Lybra Finance, such as supporting wstETH (Lido), cbETH (Coinbase), rETH (Rocket Pool), sfrxETH (Frax Ether) , WBETH (Binance) as collateral to mint the over-collateralized Stablecoin acUSD. Prisma's over-collateralization model supports automatic repayment, allowing the use of Ethereum staking proceeds to automatically repay debts.

In addition, users can stake their Stablecoin on the Curve pool, and receive rewards in addition to Ethereum staking income in the form of Prisma Finance’s native token PRISMA in the form of CRV(Curve) and CVX (Convex Finance). Prisma mentions that its codebase is based on the decentralized lending protocol Liquity. Liquity has launched a Stablecoin LUSD pegged to the U.S. dollar. ETH holders can mint LUSD with zero interest on Liquity by mortgaging ETH .

As the data growth of Lybra Finance, the LSD Stablecoin model, has received a lot of attention recently, Prisma Finance, an early project, not only has a similar model, but has also received financing from many well-known institutions. Many users are concerned about the further planning of Prisma Finance, especially the IDO time, but the Prisma Chinese community said that there is no IDO timetable for the time being.

5. Raft - LSD interest-free lending Stablecoin agreement

Gravita Protocol supports users to deposit wstETH (Lido), rETH (rocketpool), blusd (ChickenBonds) to get Gravita's native Stablecoin GRAI in return, and also supports their mortgage GRAI for consumption, or deposit it in the stable pool for Buy liquidated LST collateral at a discount.

Raft, similar to Gravita Protocol, is also a decentralized lending protocol built on Ethereum. It issued the Stablecoin R, which supports users to deposit R or mortgage stETH or wstETH to borrow R, and obtain pledge income. At the same time, they can also use R to spend in other protocols in the ecosystem to improve the utilization rate of funds. The current minimum mortgage rate is 110%. The user borrows at least 3000 R. Raft currently requires a 00.1% fee.

Raft said that it allows users to obtain up to 11 times leverage on stETH, and at the same time provides users with a very simple operation process. Users only need to set the amount of stETH deposited, target leverage and slippage, and users can follow automatic steps to perform operations. The maximum leverage Raft is calculated based on the stETH mortgage coefficient in AAVE v3 and Maker, and the annual fee is calculated based on the difference between the APY of stETH supply and the APY of USDC borrowing on AAVE v3 and the DAI stability fee.

According to Raft’s official website, Raft’s investors include well-known market makers such as Wintermute, Jump, and GSR.

Raft was launched on June 5, and in less than a day, the current TVL has reached 16.43 million US dollars.

6. Tenet Protocol ——Liquid Liquidity Layer1+ interest-free Stablecoin lending agreement

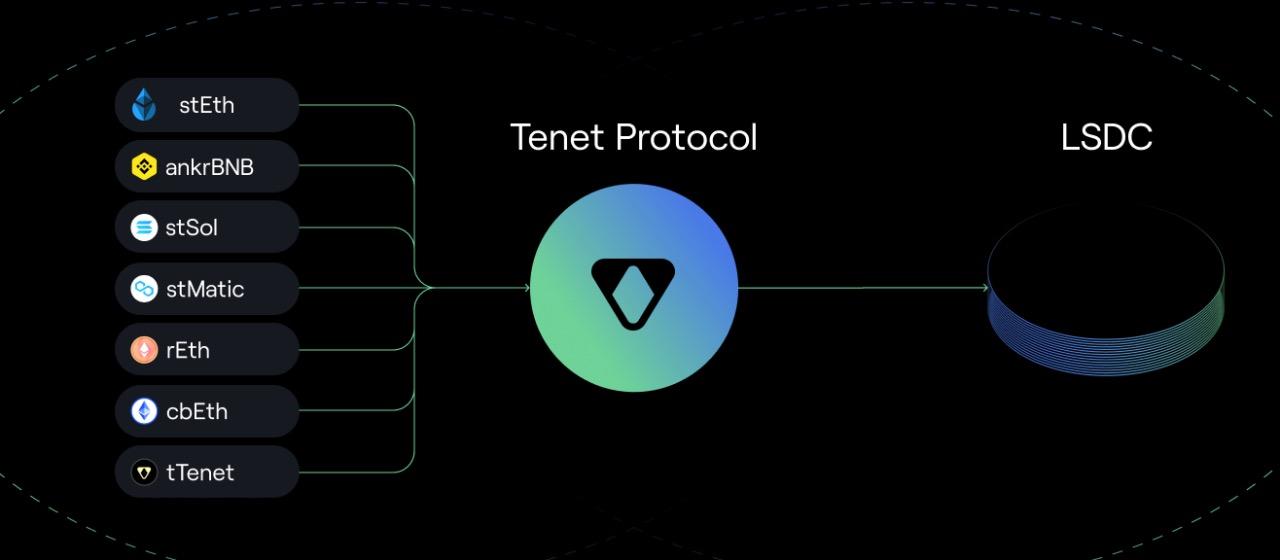

Tenet Protocol is a Cosmos-based EVM-compatible layer 1 blockchain and an interest-free Stablecoin lending protocol, providing LSD holders with multi-layered income opportunities.

First of all, users can mortgage LSD to Tenet network validators to obtain pledge income. Users can borrow LSDC Collateral asset without interest, and deploy consumption LSDC in the DeFi ecosystem in addition to guaranteeing the original LSD asset income; release additional Liquidity and utility through LSDC.

In addition, in the stability module, it is also possible to provide Liquidity for LSDC pairs, etc., to obtain additional income in the form of liquidation within the Lucidity system, and to obtain Tenet token rewards from the local reward pool. The minimum mortgage rate of LSDC is 125%, and users must borrow at least 500 LSDC. The Stablecoin section of Tenet Protocol is also a fork to build Liquity. Recently, Tenet Protocol stated that it is building on LayerZero for full-chain expansion.

Tenet Protocol's project team has extensive experience in product and marketing. Greg Gopman, CEO of Tenet Protocol, is the former CMO of ANKR , the growth director of Kadena, and the co-founder of Akash. COO Dan Peterson is the former Blockdaemon's revenue operations specialist. CPO Alex Cheng is the former senior product manager of Tendermint-Cosmos and Composable Finance. CTO Dan Lashin is the former CTO of Minter.

Tenet Protocol is currently on the test network, and will launch the Mainnet on Ethereum in the near future. Tenet Protocol opened an IDO in May at a price of $0.02, raising a total of $3.36 million.

Recommended reading: "A Very Interesting IDO Project Tenet Protocol"