Binance, one of the world’s largest cryptocurrency exchanges, has recently announced its departure from the Dutch market.

According to a notice published by the company, the company had failed to secure registration as a virtual asset service provider (VASP) – despite exploring “many alternative avenues” with Dutch regulators.

Binance to leave the Dutch Market

As reported by Binance, no new users residing in the Netherlands will be accepted from now on.

Starting from July 17, 2023, existing Dutch resident users will only be able to withdraw assets from the Binance platform.

No further purchases, trades, or deposits will be possible for Dutch residents, leaving them with limited options in the cryptocurrency market.

The firm encouraged existing users to remove their balances.

Binance’s Struggles with Compliance in the Netherlands

Binance said it had been striving to obtain approval for its products and services in the Netherlands.

However, despite being compliant with EU standards in other countries, such as France, Italy, Spain, Poland, Sweden, and Lithuania, the company was unsuccessful in the Netherlands.

This raises questions about the future of crypto exchanges operating within the EU, particularly as the new EU rules on crypto-assets (MiCA) are set to take effect.

The company said it will continue engaging “productively and transparently” with Dutch regulators.

Latest Binance Stories

Disclaimer: Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

On June 15, Chainalysis reported that cybercriminals are exploiting mining pools to mix their criminal proceeds with freshly mined cryptocurrencies.

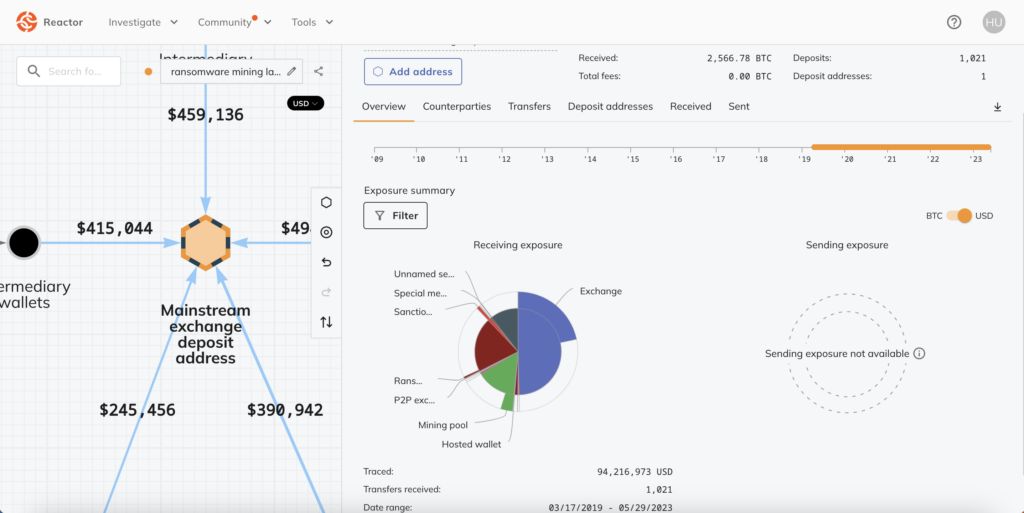

The report pointed to a highly active deposit address at a mainstream crypto exchange. This wallet received a large number of cryptocurrencies from both mining pools and wallets linked to ransomware.

The address received a staggering $94.2 million worth of cryptocurrency, of which around 20%, or $19.1 million, came from ransomware-linked wallets. The address also received $14.1 million from mining pools.

Chainalysis found that both the ransomware wallet and the mining pool address sent funds to the exchange deposit wallet via intermediaries. However, in some cases, the ransomware wallet also sent funds directly to the mining pool.

This tactic is a “sophisticated attempt at money laundering,” Chainalysis said. The bad actors funnel funds to the exchanges through mining pools to create the illusion that the tainted funds are mining proceeds rather than linked to cybercrime. Therefore, the criminals are using the mining pools as a crypto mixer to avoid triggering alarms at the exchange.

This is a growing trend — Chainalysis found 372 exchange wallets that have received funds from mining pools and at least $1 million from ransomware-linked wallets. In total, these exchange addresses have received $158.3 million from ransomware wallets since 2018.

Scammers are also using mining pools to launder funds

Scammers are also employing the same tactic as ransomware attackers. For instance, funds linked to the BitClub Network scam, in which over $700 million was stolen, were mixed with Bitcoin obtained from a Russia-based mining operation in 2019, as per Chainalysis.

Moreover, the wallets on the exchanges also received funds from BTC-e, a defunct Russian crypto exchange. BTC-e was shut down in 2017 for facilitating the laundering of funds, including those linked to the Mt. Gox hack.

The criminals allegedly commingled funds from BitClub, BTC-e, and the Russian mining operation to obfuscate the origin of funds. The report stated,

“We believe it’s possible that the money launderers in this case purposely mingled funds from BitClub and BTC-e with those gained from mining in order to make it look like all of the funds sent to the two exchanges came from mining.”

Since 2018, such exchange addresses have received nearly $1.1 billion from scam-linked wallets. Additionally, such exchange wallets have received at least $1 million from mining pools during the period.

To combat this growing issue of illicit funds, Chainalysis suggests that mining pools and hashing services should implement strict wallet screening and know-your-customer procedures. Mining pools should verify the source of funds and reject all deposits from illicit addresses, it said.

Chainalysis’ full report is available here.

Latest Bitcoin Stories

Disclaimer: Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

The link between US Treasuries, the dollar-yen carry trade and Bitcoin

CryptoSlate's latest market report dives deep into the connection between the Japanese yen and U.S. Treasuries and its potential impact on Bitcoin.