Author: MooMs , Crypto KOL

Compiled by: Felix, PANews

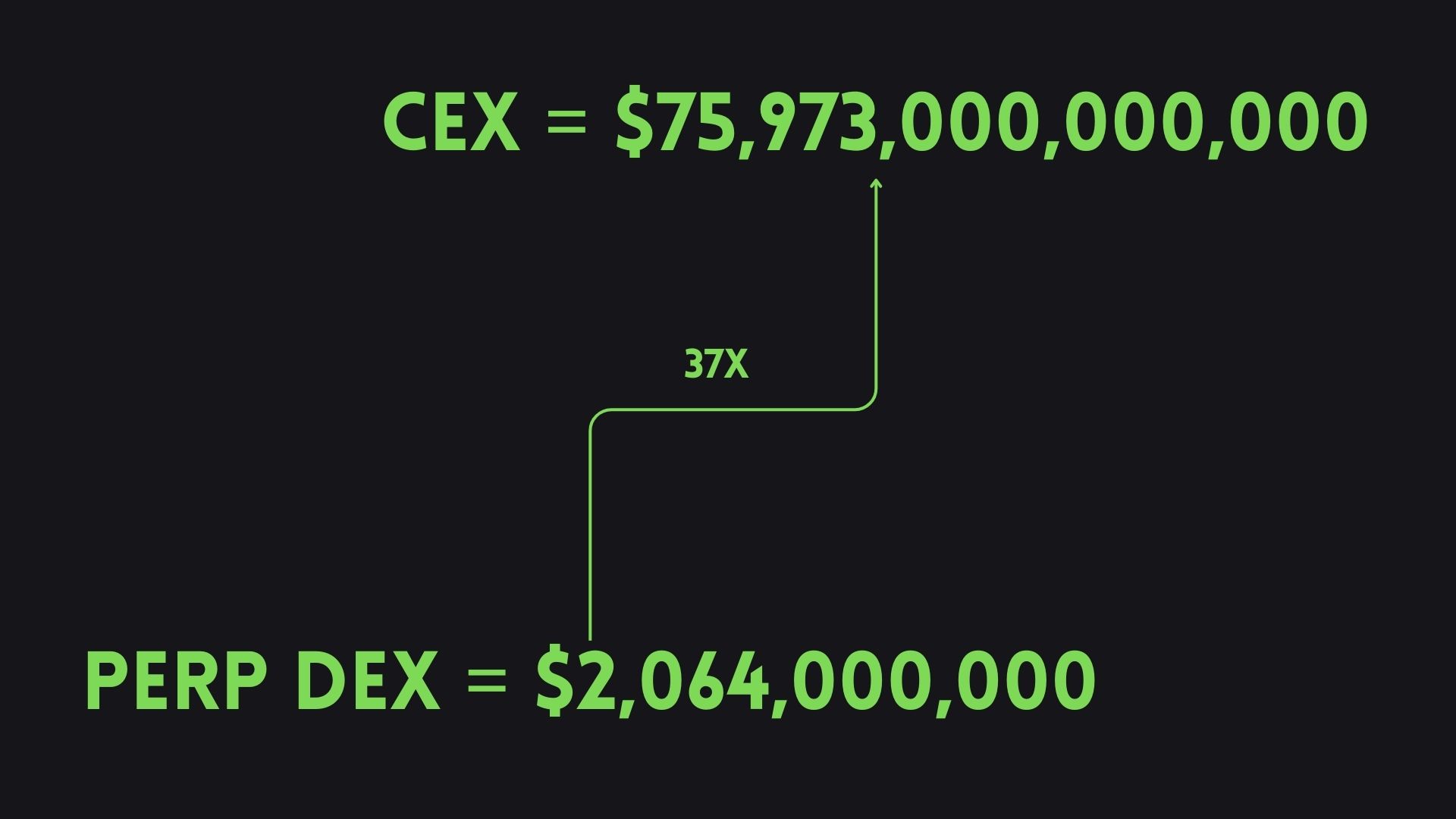

At present, more than 97% of the Derivatives trading volume is executed on CEX. However, Perp DEX only accounts for 2.72% of the total transaction volume, so Perp DEX has a huge room for growth and may dominate the next round of bull market. This article is related information about the Perp DEX track.

- head project

- Fee Structure Comparison

- Index comparison

- growth potential

- The most potential Perp DEX

head project

GMX

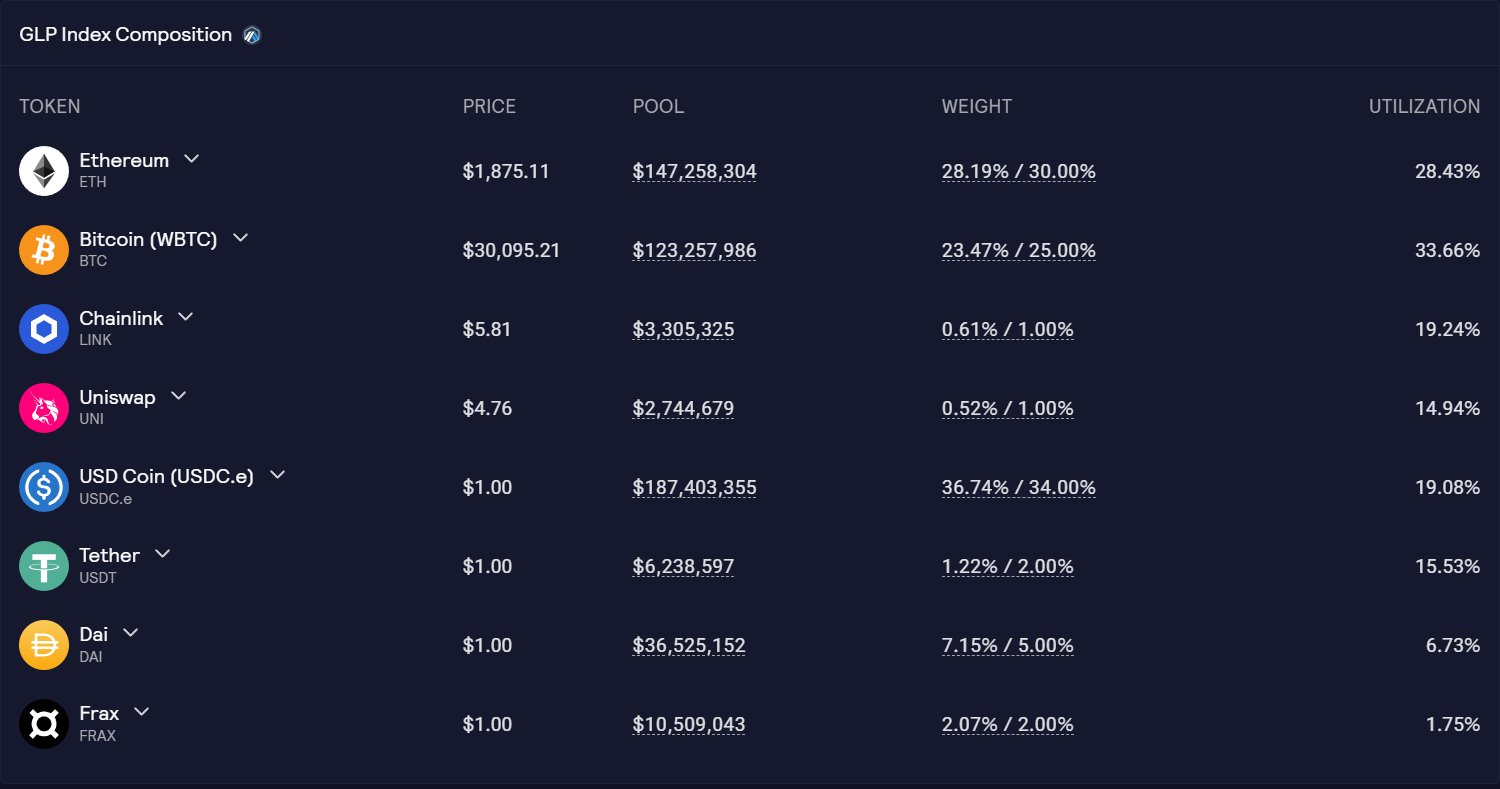

GMX allows users to trade against the GLP pool, providing spot and margin trading with zero slippage. GLP is the fund pool of GMX, including BTC, ETH, UNI , LINK and 4 Stablecoin. A huge advantage of this model is its composability; some protocols are starting to create investment products that leverage GLP and its benefits to generate additional yield.

Online assets

Cryptocurrency: up to 50x leverage

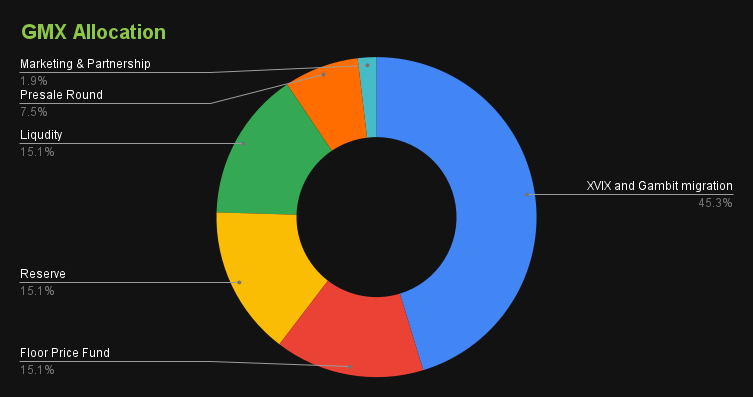

Token Economics

- Supply: 8,813,076

- XVIX and Gambit Migration: 45.3% (Note: GMX’s anonymous team has developed two other protocols, XVIX and Gambit)

- Floor Price Fund: 15.1%

- Reserve: 15.1%

- Liquidity: 15.1%:

- Pre-sale round: 7.6%

- Marketing and Partners: 1.9%

Although the platform only offers four currency pairs, the launch of GMX V2 introduces synthetic markets, offering a variety of new currency pairs, including stocks and forex. Additionally, segregated pools and lower fees are introduced for a better transaction user experience.

Gains Network

Gains offers a trading platform with multiple asset classes and high leverage. The platform utilizes gDAI vaults as counterparties, where the amount of DAI is constantly changing.

When traders win, they will receive bonuses from the vault.

When traders lose money, their losses are deposited into the vault.

Similar to GMX, Gains' model is highly composable, allowing other protocols to integrate gDAI and build products on top of it.

Online assets

- Cryptocurrencies: up to 150x leverage

- Commodities: Up to 150x/250x leverage

- Forex: up to 1000 times leverage

Token Economics

- Total supply: 100 million

- Initial supply: 38.5 million

- Developer: 5%

- Governance: 5%

- Circulation: 90%

There is no seed round, no venture capital investment, and no token lockup.

wxya

dYdX is the first Derivatives trading platform that offers leveraged trading (up to 20x) on 36 cryptocurrency pairs. dYdX is the only platform that uses an off-chain Order-book, increasing Liquidity depth at the expense of decentralization. However, the team is working hard to release v4 as soon as possible. dYdX v4 will be released on Cosmos, aiming to make the protocol fully decentralized. The new release will also introduce a highly anticipated feature: revenue sharing. DYDX stakers will earn a percentage of platform revenue.

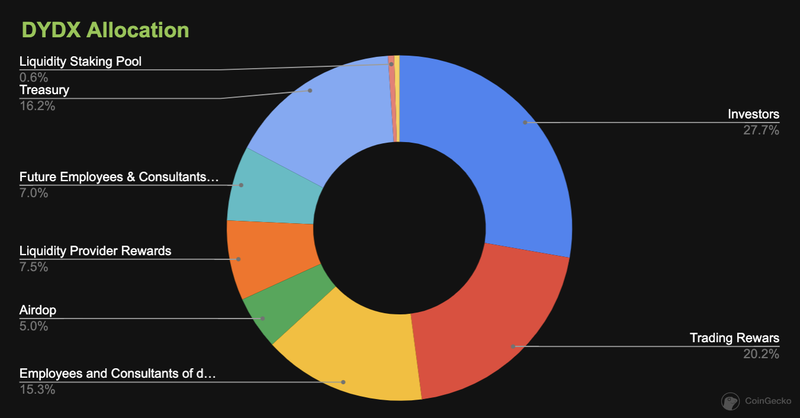

Token Economics

- Total supply: 1 billion

- Investors: 27.7%

- Transaction reward: 20.2%

- Employees and consultants: 15.3%

- AirDrop: 5%

- Liquidity Provider reward: 7.5%

- Future employees: 7.0%

- Fiscal: 16.2%

- Liquidity staking pool: 0.6%

- Security pledge pool: 0.5%

Kwenta

Kwenta is a decentralized Derivatives trading platform that offers perpetual futures and options trading on Optimism. Currently, the platform offers more than 42 pairs of cryptocurrencies, foreign exchange and commodities with leverage up to 50 times.

Kwenta has a partnership with Synthetix, which provides the underlying protocol for managing Liquidity and offering Perps directly. This partnership allows Kwenta to focus on user experience and interface design, while Synthetix focuses on Liquidity mechanics.

Similar to dYdX and GMX, Synthetix will release a new version of the platform in September. The new version, which has been in development for more than a year, will offer features such as a permissionless market, cross-margin mode, and multi-collateral staking.

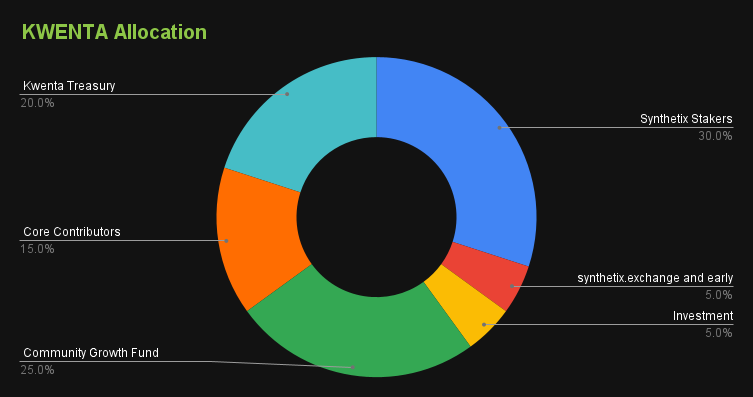

Token Economics

- Total supply: 1 million

- Synthetix stakers: 30%

- Synthetix + early Kwenta traders: 5%

- Investment: 5%

- Community Development Fund: 25%

- Core contributors: 15%

- Kwenta Treasury: 20%

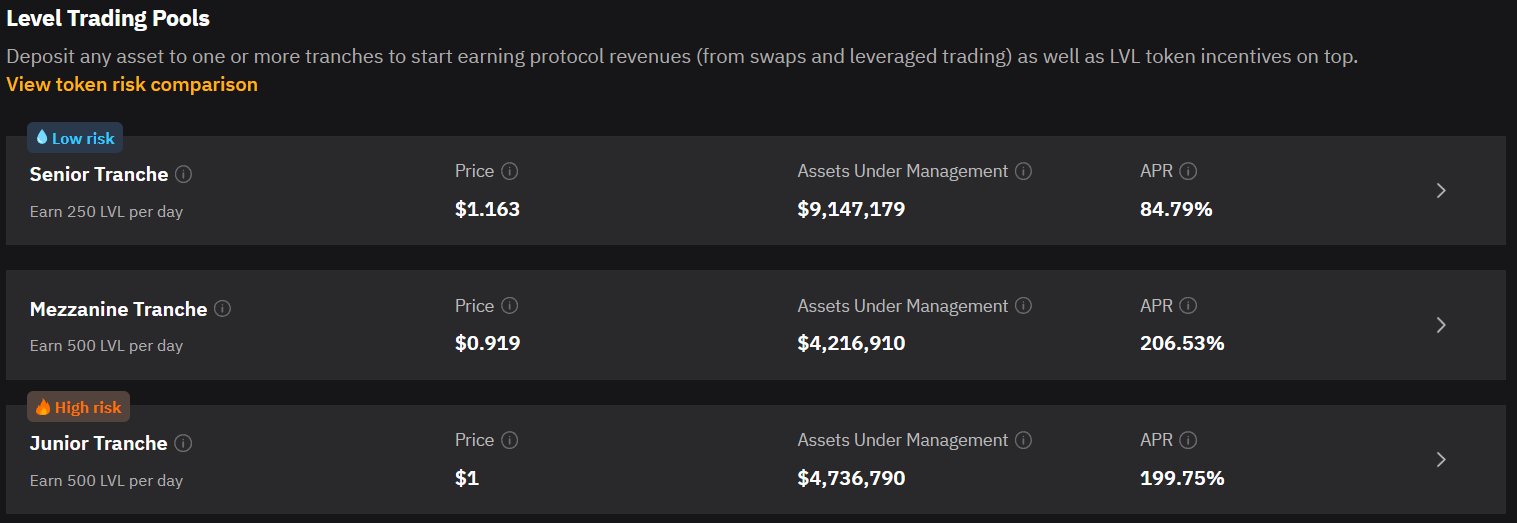

Level Finance

Launched in December 2022, Level offers spot and leveraged trading (up to 50x) of BTC, ETH, and BNB. The reason Level is getting huge attention is its "loyalty program" which rewards traders with 16,000 LVL per day. Much of the volume and fees come from the program, and through the three-tier model, users can earn anywhere from 85% to 206% APR on their assets. Miners can choose whether to deposit assets in less risky pools and earn less APR, or vice versa.

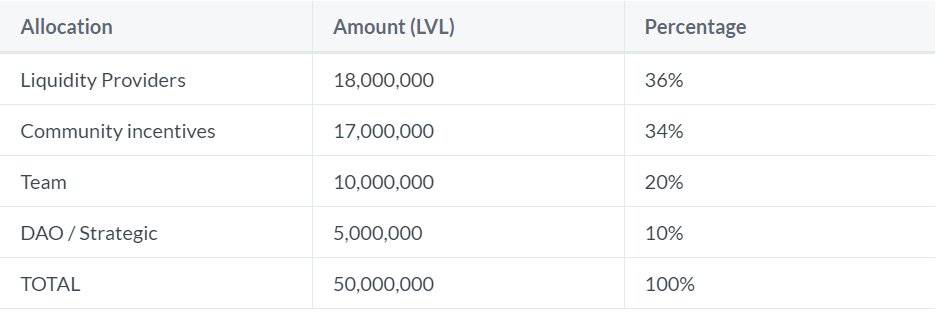

Token Economics

- Total supply: 50 million

- Liquidity Provider: 36%

- Community Incentives: 34%

- Team: 20%

- DAO:: 10%

MUX Protocol

MUX Protocol is a perpetual DEX deployed on five chains, providing traders with deep Liquidity and leverage up to 100 times.

The two main features are:

• Leverage trading: users trade with MUXLP, which is the same model adopted by GMX and GLP pools.

• Aggregator: Choose the most suitable Liquidity path to minimize, compare the transaction price and Liquidity depth of each Perp DEX.

Token Economics

The protocol involves four tokens:

- MCB: the main token of the protocol

- MUX: Non-transferable tokens, obtained by staking veMUX or MUXLP

- veMUX: Governance Token

- MUXLP "Liquidity Provider Token

Now that the six main protocols and their key features have been discussed, let's explore the current landscape of the Derivatives industry.

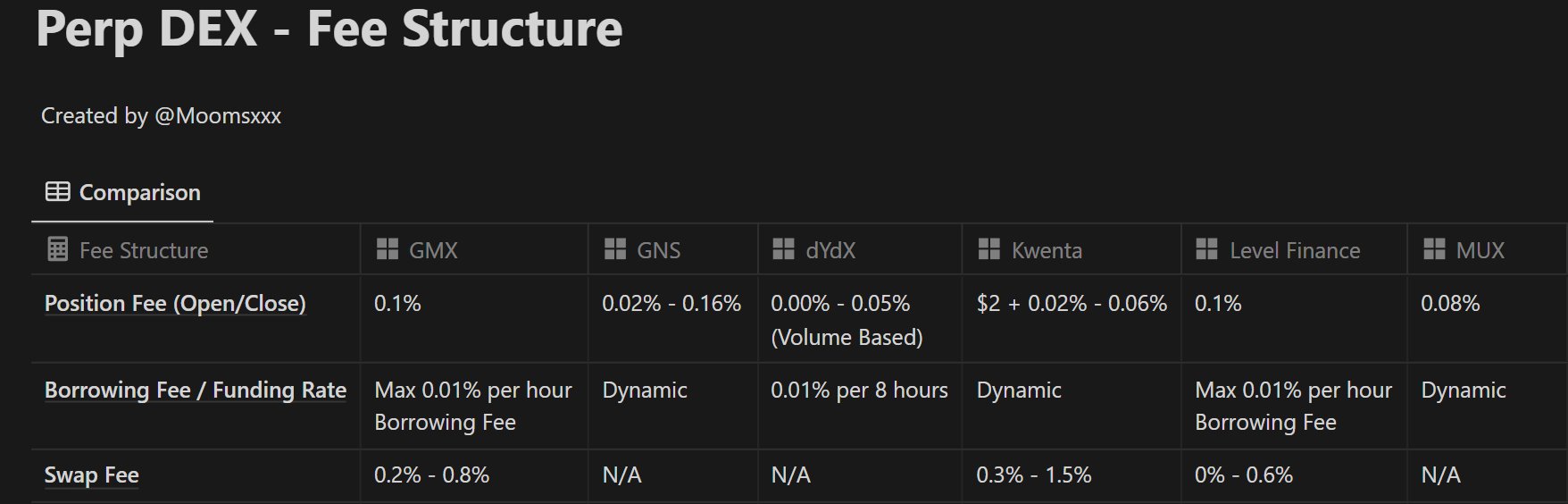

Fee Structure Comparison

Trading fees (opening/closing positions): dYdX has the lowest trading fees, 0 to 0.05% (based on transaction volume); MUX is next at 0.08%; GMX and Level are both 0.1%.

Funding rate: dYdX is 0.01% every 8 hours; GMX and Level are up to 0.01% per hour; GNS, Kwenta, and MUX are all dynamic.

Index comparison

Currently, dYdX provides the best trading platform with the highest Liquidity and lowest transaction fees, currently occupying 64.4% of the market share among the top 6 DEXs. However, dYdX’s model doesn’t allow them to list synthetic products like other protocols, so its competitors can use this to grab market share.

As mentioned, dYdX is working hard to launch a fully decentralized platform with a revenue sharing mechanism, so expect more users to support it in the coming months.

GMX, on the other hand, currently charges the highest fees, but they are working on that. Interestingly, however, GMX trades about one-fifth as much as dYdX but generates about 2x as much fees as dYdX.

A similar situation also occurs on Level and GNS. The transaction volume of Level and GNS is the same, but the fees generated by Level are about twice that of GNS.

growth potential

According to the metrics, Level Finance is the most undervalued platform. In addition, Level Finance has the best token economics, and the LVL + LGO momentum is indeed very strong.

GMX can also be considered undervalued as it is the 3rd largest protocol in all DeFi (excluding public chains) by generation fees (YTD) and only 79th by market capitalization.

MUX has the best TVL/Volume ratio, which indicates high capital efficiency.

GNS and Kwenta are great options for the next bull market as they generate high revenue and have low to mid market caps.

In the end, dYdX is the safest choice because dYdX is the leader of the track, backed by top capital, and its upcoming new version should motivate users to hold the token DYDX.

The most potential Perp DEX

Listed below are the top DEXs that will enter the market in the coming months, and these DEXs are likely to occupy a larger market share in the future.