overview

Pendle Finance is a decentralized Yield trading project, helping users to optimize their Capital or profits. Through the vetoken mechanism, the project helped deflate the supply and optimize the Token's features. At the same time, the use of vetoken also created the boom of Pendle Wars. One of the events that made Pendle one of the most talked about projects in recent times was the listing of $PENDLE being listed on Binance. Through the article below, let's find out what Pendle Finance is.

What is Pendle Finance?

Pendle is a permissionless yield trading protocol that allows users to implement various profit management strategies. Basically, Pendle consists of three main components:

- Yield Tokenization: separate components and encode them into Token for trading.

- AMM: Yield Token trading platform.

- Governance: project management.

Products and applications

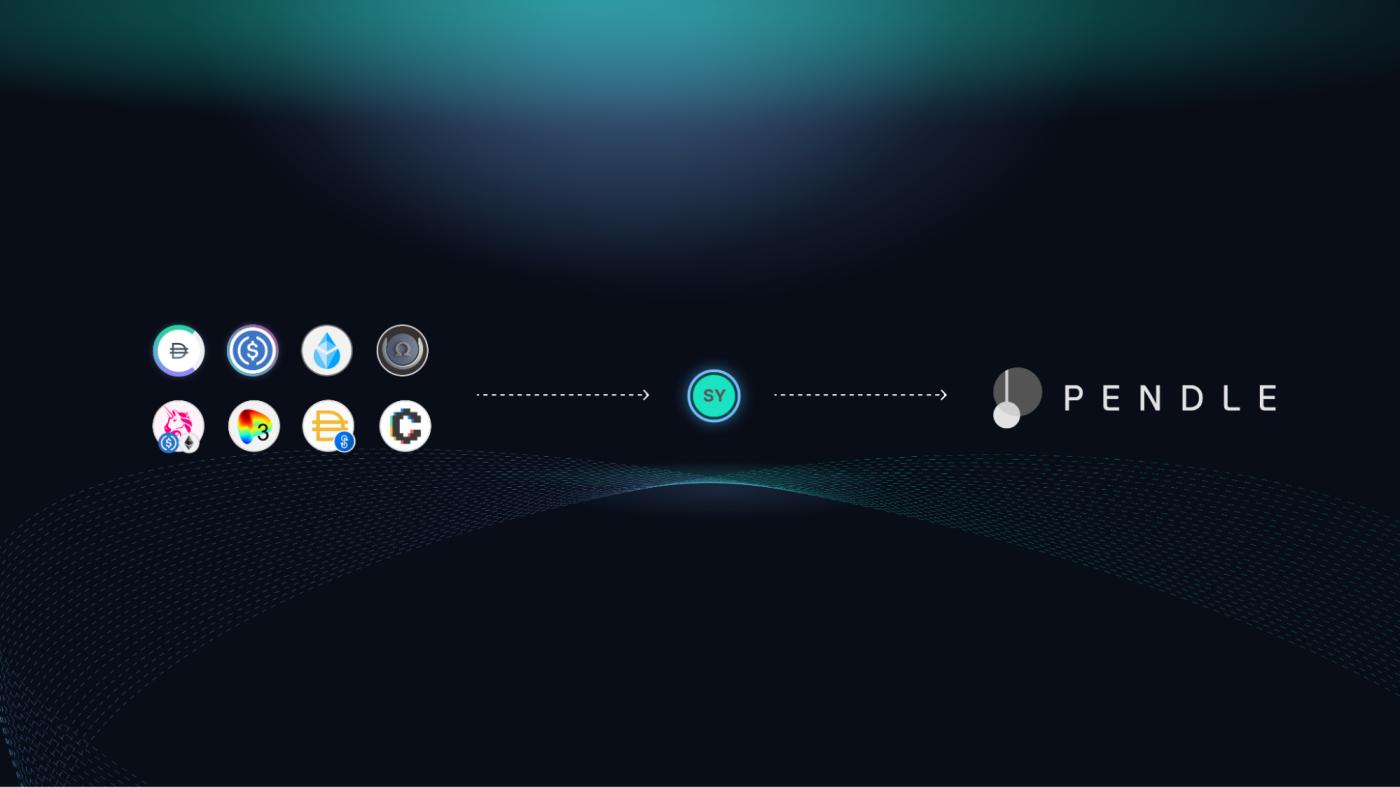

Yield Tokenization

First, Pendle wraps yield-bearing tokens into SY (standardized yield tokens), which is a version of the yield-bearing Token compatible with the wrapped Pendle AMM (e.g. stETH → SY-stETH). Then SY is divided into principal and profit, PT (native Token ) and YT (profit Token ), this process is called Yield Tokenization, where profits are tokenized into Yield Tokenization. a private Token .

- Yield-Bearing Token

Yield-Bearing Token is a general term for any Token that generates interest. Examples include stETH, GLP, gDAI or even Liquidation Token like Aura rETH-WETH.

- SY = Standardized Yield

SY is a Standardized Yield (EIP-5115) written by the Pendle team that wraps any Yield-Bearing Token and provides a standardized interface to interact with the yielding mechanism of bearer Token . that yield. However SY is considered as a technical component, the user does not interact directly with SY.

- PT = Principal Token

PT allows users to own the base portion of the Token, which carries the underlying yield, which can be redeemed upon maturity. If the user owns 1 PT-stETH with 1 year maturity, the user will be able to redeem 1 ETH worth of stETH after 1 year. PT can be traded at any time, even before maturity.

- YT = Yield Token

YT allows users to own the full yield generated by the underlying yield Token in real time, and the accrued yield can be manually claimed at any time from the Pendle Dashboard.

If a user owns 1 YT-stETH and stETH has an Medium yield of 5% during the year, the user will have accumulated 0.05 stETH at the end of the year.

YT can be traded at any time, even before maturity.

AMM

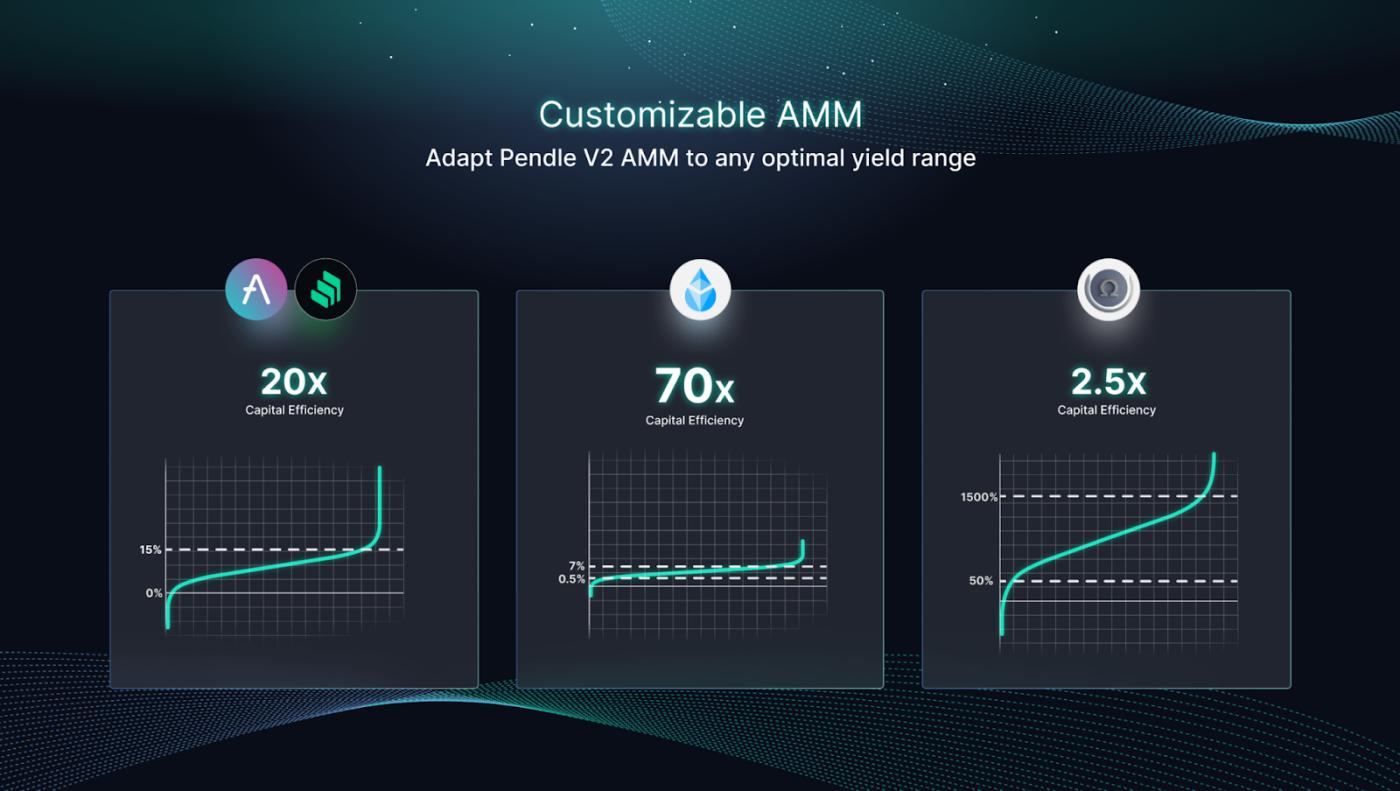

Pendle's V2 AMM is specifically designed for yield trading and leverages PT and YT features to increase Capital performance. The AMM curve changes to calculate the cumulative yield over time and narrows the price range of PT as it approaches maturity. By concentrating Liquidation in a narrow and meaningful range, Capital performance for yield trading is increased as PT approaches maturity.

In addition, Pendle V2 is designed to minimize Impermanent Loss (IL). Pendle's AMM curve takes into account PT's natural appreciation by shifting the AMM curve to push PT's price back to its base value as time goes on, minimizing temporary time-dependent losses. In addition, IL from exchange transactions is also minimized since the two LP assets are highly correlated with each other.

Pendle's customizable AMM curve can accommodate Token with varying yield fluctuations, creating better Capital performance for Liquidity Providers (LPs) and traders. LPs can earn swaps from PT and YT in a single Liquidation offering, while traders can execute larger trades without worrying about slippage and guarantee better price guarantee.

Finance – Backer

Pendle is backed and invested by major funds such as Mechanism Capital, Crypto.com Capital, Spartan, etc. with a total calling Capital of up to $3.7M .

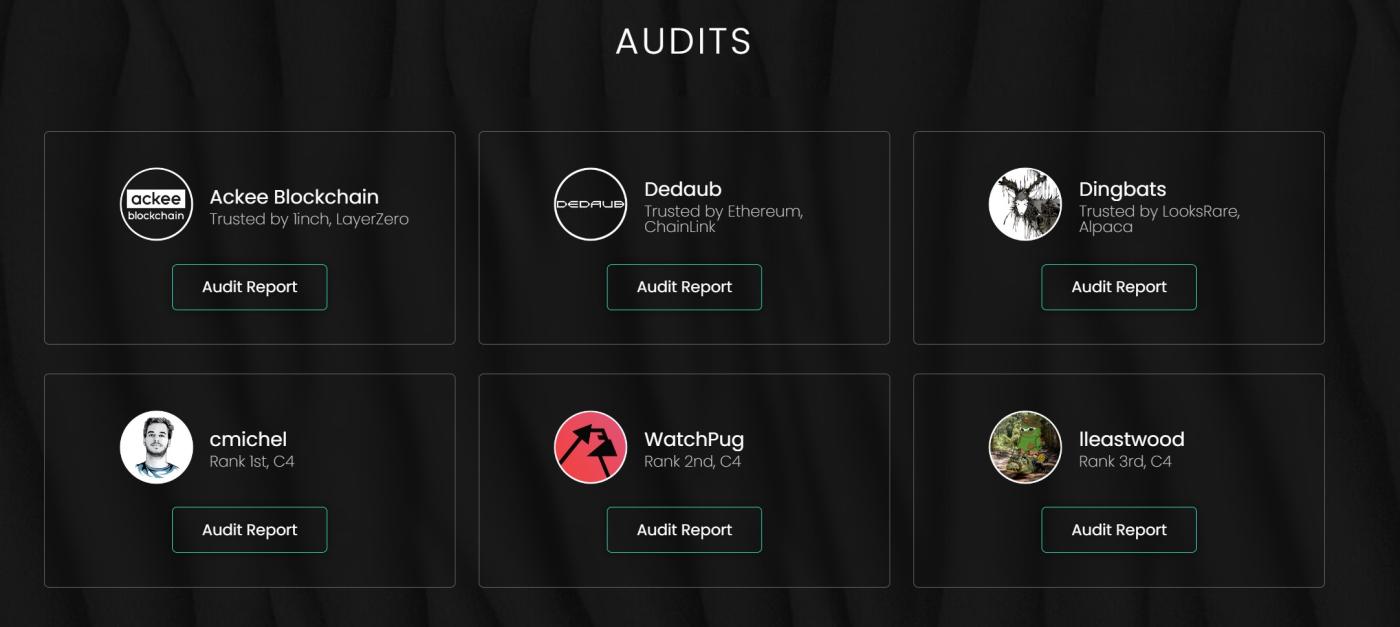

Audit

The project is also audited by reputable organizations with experience in the Blockchain field such as Ackee Blockchain, Dedaub, WatchPug, etc.

Development team

There are currently no details about the development team.

Development roadmap

Although the project does not have a detailed update schedule, the project is still actively expanding multichain, most recently Pendle announced that it will officially expand to BNB Chain.

Competitors

Competitors can be mentioned such as: Swivel , Siren , ..

Current partner

Currently, the project partners with projects in DeFi such as: Olympus Knife , Illuminate , ..

Tokenomics

Key Metrics

- Token Name: Pendle

- Ticker: PENDLE

- Blockchain: Ethereum

- Token type: Utility

- Contract: 0x808507121b80c02388fad14726482e061b8da827

- Total Supply: 231,725,335

- Circulating Supply: 96,950,723

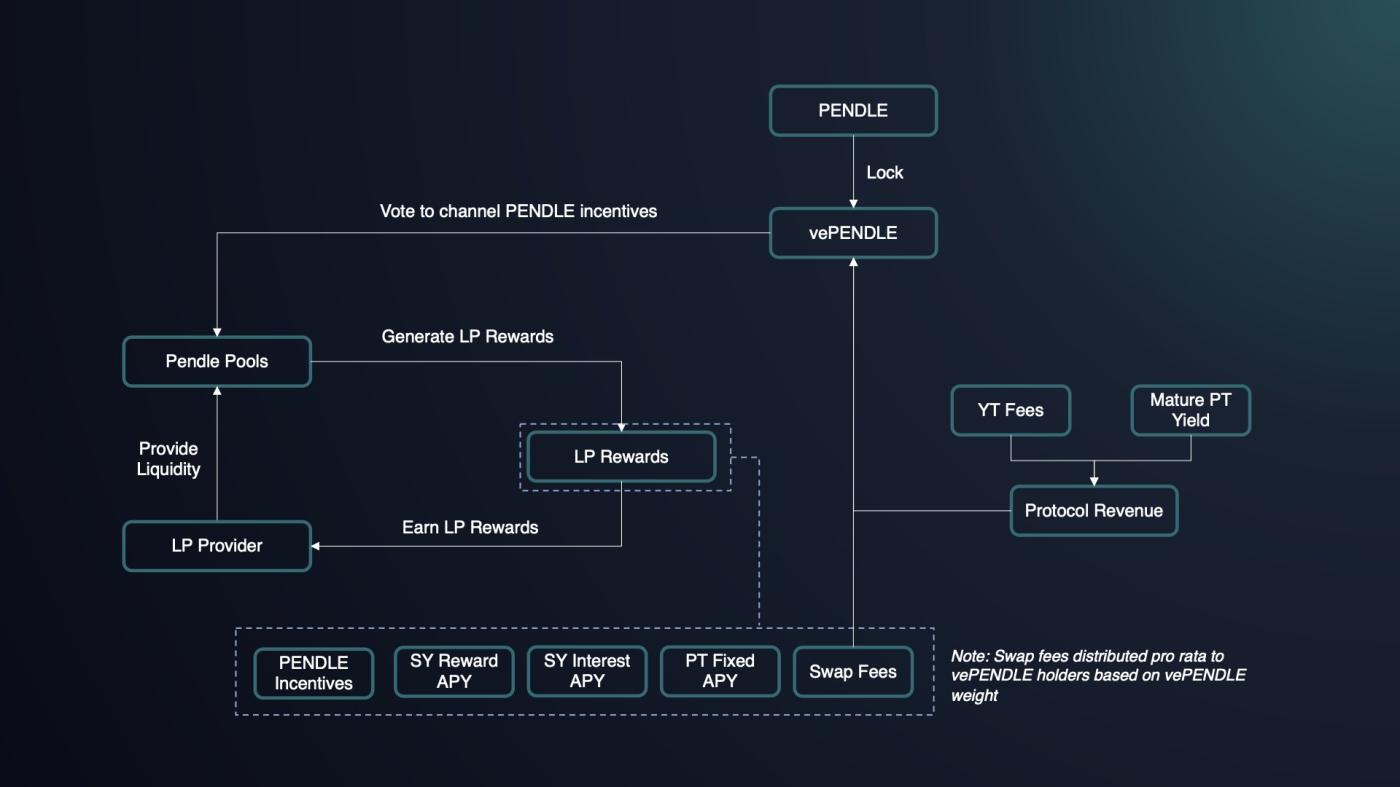

vePendle

Pendle's governance is based on the use of Vote-escrowed $PENDLE, also known as vePENDLE, which increases decentralization. By using vePENDLE, $PENDLEholders can take advantage of more PENDLE benefits.

Locking $PENDLE to obtain vePENDLE reduces the supply of $PENDLE, thereby increasing the stability of the Token and the long-term development of the protocol. This makes vePENDLE an important tool for maintaining the long-term health and success of the Pendle ecosystem.

vePENDLE holders vote and direct the rewards to the pools, driving the Liquidation in the pool they vote for. The higher the vePENDLE value, the more incentive the user will have. This is also the reason why Pendle Wars was born. Read more about Pendle Wars .

Voting for a pool also allows vePENDLE holders to receive 80% of the swaps collected by that pool. Currently Pendle takes 3% fee from all interest accrued by YT, and 100% of this fee is distributed to vePENDLE holders, while the protocol will not take this part as revenue. However, this may change in the future.

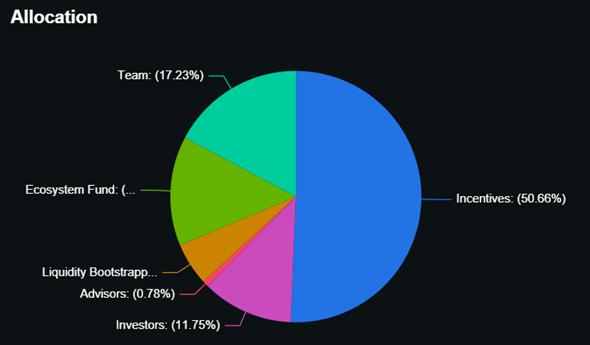

Token Distribution

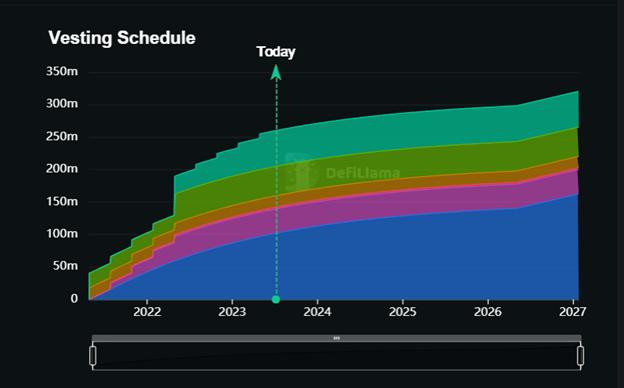

Vesting Calendar

Community

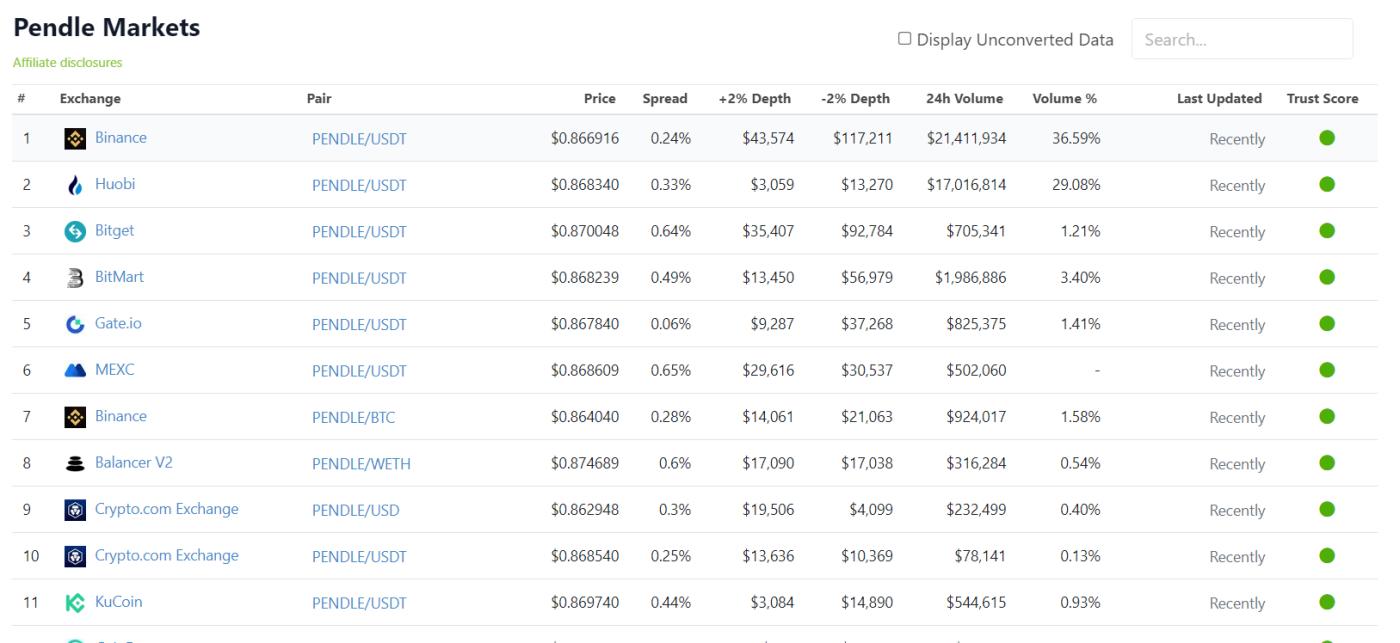

Buy $PENDLE where to buy?

Currently you can buy $PENDLE at major Cex exchanges like Binance, Bitget, etc.

Conclude

Above I have summarized the important information of the Pendle project, what do you think about this project? Is Pendle one of the important projects in the upcoming period? Leave your thoughts below in the comments!

All for informational purposes only, this article is not investment advice at all.

Hopefully the above information will help you have an overview of the Pendle project. The latest project information will always be updated quickly on GFI's website and official channels. Interested people do not forget to join the GFI community group to discuss and exchange knowledge and experiences. with other members.