Arkham does not adopt a payment model for advanced functions like similar platforms such as Nansen or 0xScope, but uses token economics to solve income problems on the basis of being a free public product.

Written by: defioasis

Editor: Colin Wu

Binance recently announced the listing of the 32nd Launchpad project Arkham (ARKM). As a data analysis platform, Arkham does not adopt a payment model for advanced functions like similar platforms such as Nansen or 0xScope, but uses token economics to solve income problems on the basis of being a free public product. In the field of Crypto, the data on the chain can be said to be a gold mine. The interpretation of the data on the chain can bring many opportunities for investment and arbitrage. The use of data analysis platforms is mostly based on real needs. Therefore, the number of users in this track The more realistic, the higher the quality.

TL;DR

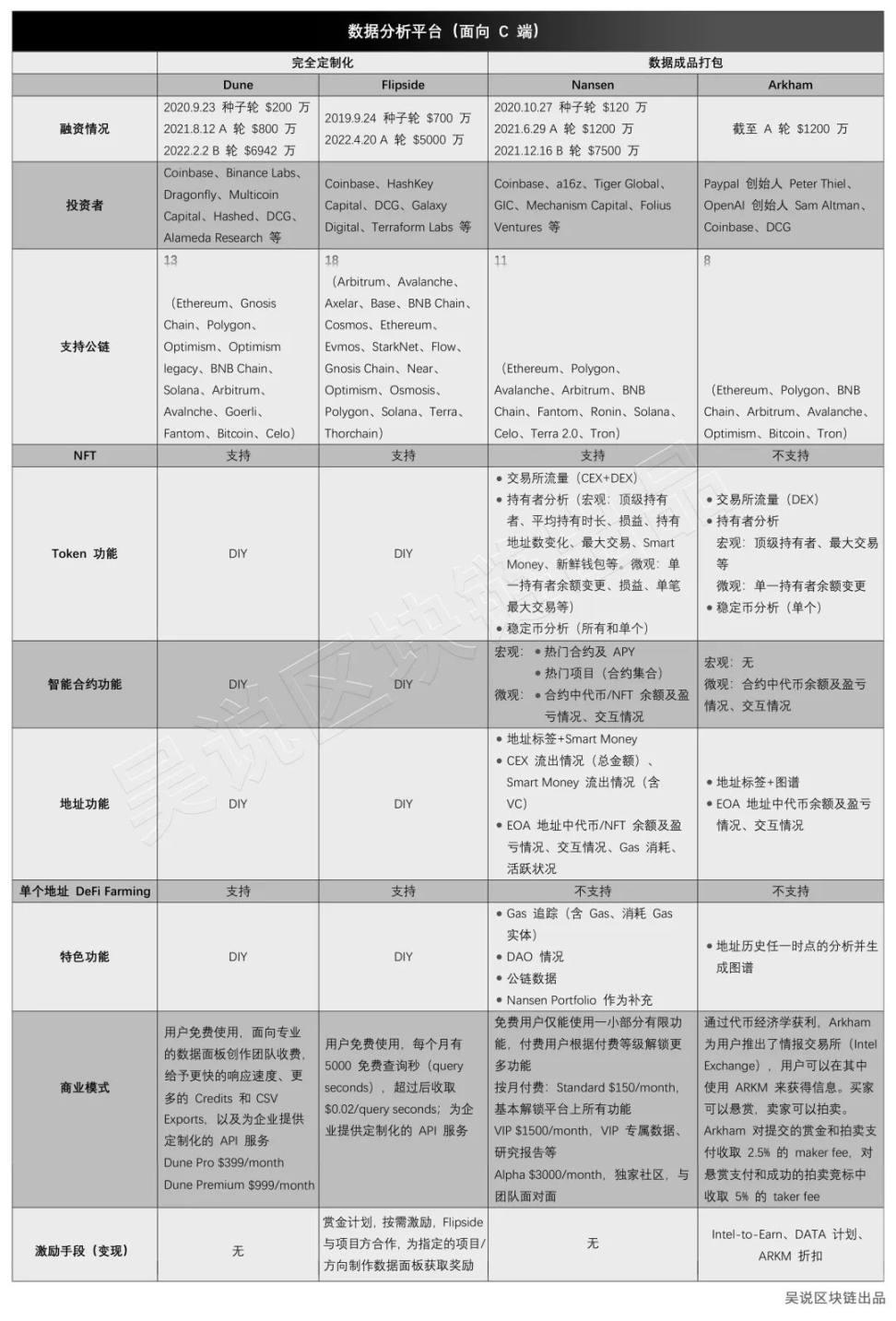

According to the degree of openness, the data analysis platform can be roughly divided into two categories, one is a fully open data analysis platform, users can define it themselves, such as Dune Analytics, Flipside and Footprint Analytics; the other is to provide packaged data For finished services, users make queries under limited definitions, such as Nansen, 0xScope (Watchers) and Arkham. At present, these six platforms have all obtained financing, among which Dune Analytics, Flipside, Nansen, and Arkham have all obtained financing of more than 10 million US dollars. Coinbase is the most active investor in this track, and the first three have their presence.

From the perspective of the number of supported public chains, the number of public chains supported by the data analysis platform that needs to be made by users is significantly more than that of the packaged platform, which has higher requirements for data sorting and service capabilities of start-up companies. Currently Dune Analytics supports 13 public chains, Flipside supports 18, Footprint supports 27, Nansen supports 11, Watchers supports 3, and Arkham supports 8. Ethereum, BNB Chain, and Arbitrum are generally supported public chains, but support for zk-based public chains and Bitcoin is less.

From a functional point of view, Nansen is the most complete of the three platforms. From the token level, we can see the increase and decrease of Smart Money over a period of time, the inflow and outflow of CEX and DEX exchanges, the overall and individual inflow and outflow of stablecoins, the overall average holding time, profit and loss of token holders , Smart Money, individual holder balance changes, transactions, etc.; from the smart contract level, it is possible to clearly track the APY provided by popular contracts and LP trading pairs, as well as the token/NFT interaction in the contract, etc.; label With a complete system, Smart Money has become the daily focus of the community. Both Watchers and Arkham are much younger than Nansen. The biggest feature of Watchers is that it provides data visualization graphs, which reduces the time and cost of on-chain research. Another point is that it supplements the entity analysis of correlation under the tag system, helping professional investors to explore the relationship between tags and tags close address. Arkham is the only data analysis platform among the three that does not support NFT, and pays more attention to the address/entity situation at the individual level, so Arkham basically cannot see some global data. Basically, the functions on Arkham can be found on Nansen. It also launched a visual data map like Watchers, but in addition to being free, it also has a distinctive archive function, which can provide any two addresses/entities in history. Portfolio situation and graph at a point in time. (Since Dune, Flipside and Footprint can mostly make applicable panels with SQL and creative will, they will not be discussed for now.)

Before Arkham, it was generally believed that data analysis platforms did not have a high direct demand for tokens. Platforms that provide data packaging services mainly adopt the paid membership model, which is more similar to Web2, and only provide limited functions for free users as a trial. According to different levels of payment plans, differentiated functions and services are provided, but the prices are often too high to discourage ordinary investors. Nansen has three levels of payment gradients, (monthly payment) are $150, $1500 and $3000 a month; Watchers provides more functions for free users than Nansen, which are $198 and $2000 a month, and also provide customization pay. On the other hand, DIY data platforms have fallen into the helplessness of being only public products, and data analysts are often on the side of being prostituted without rewards, especially for independent data analysts, who are capable but not motivated. At present, the business models of Dune, Flipside, and Footprint are relatively similar, allowing users to use them for free, and charging creators or data teams with further needs to improve response speed and provide better CSV and API services.

Arkham combined token economics to give another way of business exploration. First of all, the most important thing is to combine the core function of data analysis to create token consumption scenarios and needs. In response, Arkham launched the Intel Exchange. The intelligence exchange is an important place to link data analysts and ordinary users on the chain. Its daily use scenario is similar to the current on-chain detective ZachXBT who helps ordinary users identify scams and assists in recovering defrauded funds on Twitter through the analysis of on-chain data. Behavior is similar. However, ZachXBT is a free assistance based on good morals without asking for anything in return, but it is basically difficult to find a second person who does this kind of thing for free. Arkham provides a channel for experts with excellent on-chain analysis capabilities to realize knowledge. Whether it is a security issue or an investment issue, as long as the information on the chain can be used to find the answer, it can be used for transactions. After the platform is built, the introduction of ARKM is a matter of course. Any user can pay for the valuable information they want from data analysts by using ARKM. Buyers can offer rewards, and sellers can auction. For both parties to the transaction, Arkham maintains the long-term operation of the platform by drawing a certain fee - Arkham charges a 2.5% maker fee for submitted listings and auction payments, and a 5% fee for bounty payments and successful auction bids taker fee.

However, the model of data analysis platform launching tokens may not be universal. There is a classic "sell me this pen" question in "The Wolf of Wall Street". The important thing is not the pen, but creating the needs and scenarios for using the pen. It is not difficult for any Web3 data analysis platform to launch tokens, but it is not easy to create usage scenarios for tokens. In essence, Arkham does not launch tokens based on the positioning of a data analysis platform, but on the core basis of data analysis, to create a platform that uses data value transactions on the chain, and the medium of platform value transactions is The needs and scenarios of this "pen". In addition, after Arkham logged into the Binance IEO, the founder of Dune recently reiterated his attitude that Dune will not issue coins, and launched an ironic NFT.

Reference link:

https://www.arkhamintelligence.com/careers-details/data-scientist