Written by: arndxt

Compilation: TechFlow TechFlow

LSD perpetual products will be the next stage of development of LSDfi. This article will introduce a product in this regard - Mori Finance, which provides users with the option to create LSD assets.

LSD perpetual

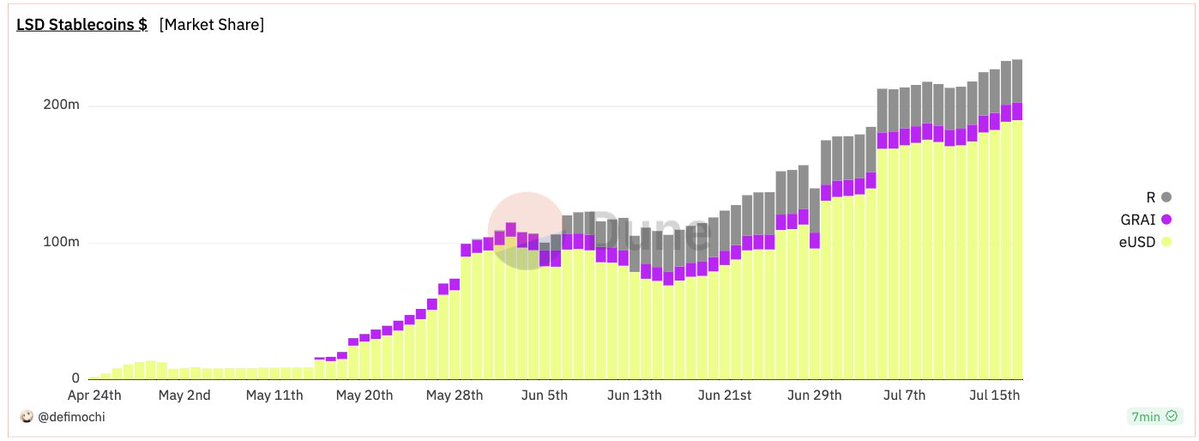

As we all know, the LSD stablecoin was first launched by Lybra Finance.

To date, it has attracted around $190 million in total value locked (TVL). Its competitors, such as Raft and Gravita Protocol, are catching up.

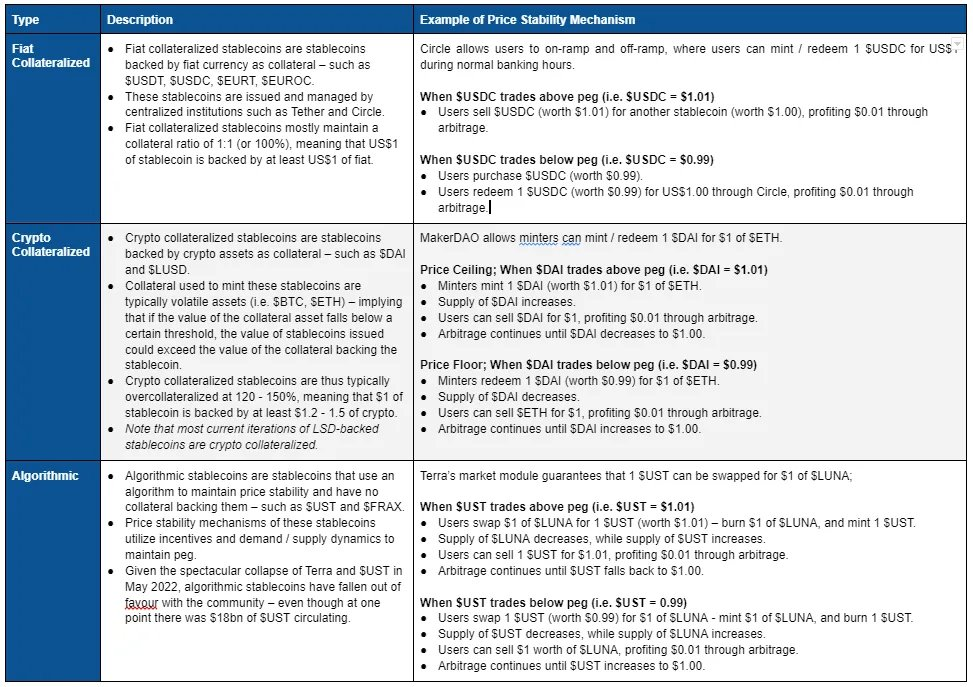

$eUSD, $GRAI, and $R are all backed by hyper-collateralized LSD. In general, follow the framework of stablecoins. However, it is believed that LSDfi will continue to promote the development of stablecoins through Mori Finance's LSD perpetual product.

About Mori

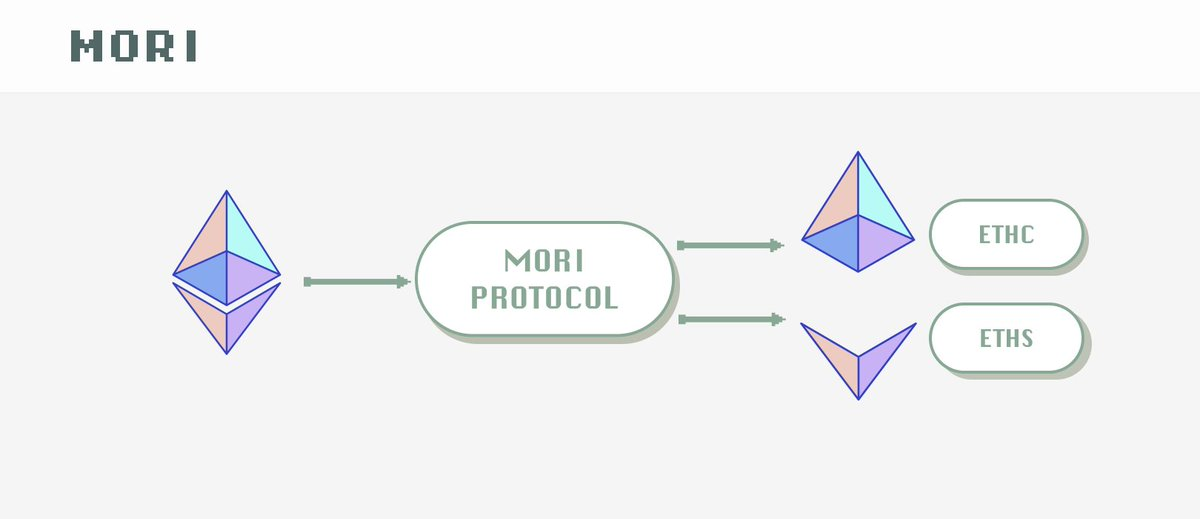

Mori Finance allows users to stake LSD as collateral and split it into :

$ETHS stable assets;

$ETHC Volatility leveraged long asset.

This provides users with a strong hedge against ETH price volatility; zero-cost long positions with no liquidation risk.

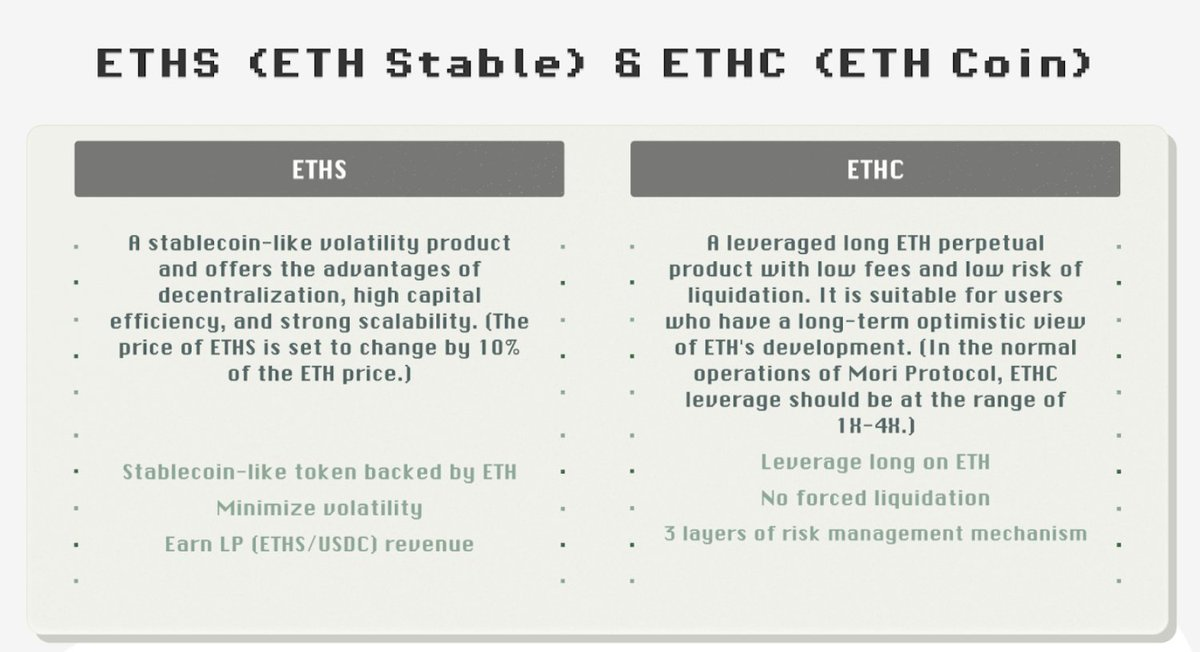

ETHS as a low volatility token :

• A stable asset backed by ETH ;

• Minimize volatility;

• Earn additional liquidity provider (ETHS/ USDC) income.

ETHC as a leveraged long ETH perpetual token :

• Leveraged long ETH;

• No liquidation risk;

• Emergency control mode reduces ETHC's leverage.

These twin assets complement each other :

• ETHS is a stable asset, reflecting only 10% of ETH price changes.

• ETHC absorbs most of the ETH price movement.

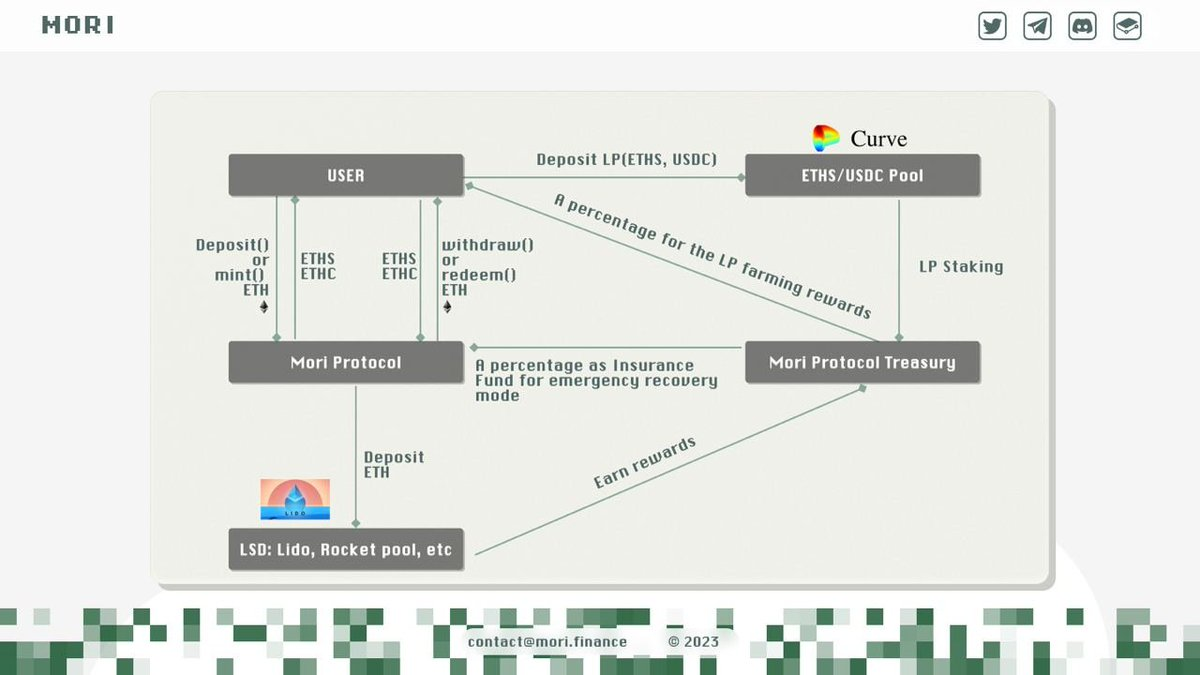

According to market conditions, users can choose to mint/redeem ETHS or ETHC according to their own strategies. The process is as follows :

User deposits ETH;

Obtain ETHS and/or ETHC;

Deposit into ETHS- USDC LP;

Deposit into ETHC- USDC LP;

Users get part of it as liquidity provider mining rewards.

Risk Management

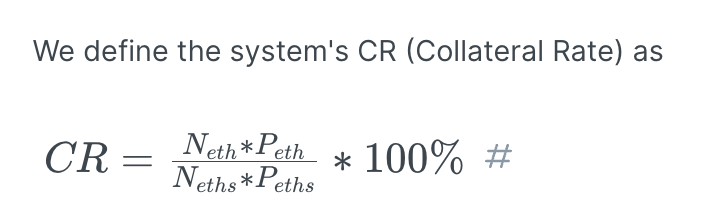

The existence of the risk management module is to ensure the stability of ETHS, and when the price of ETH changes, ETHC can absorb the price impact. When the CR value is too low, it can prevent ETHS from absorbing only 10% of ETH value fluctuations.

When CR < 130%:

• Prohibition of minting ETHS from ETH ;

• Set the redemption fee for ETHS to zero;

• Set minting fees for ETHC to zero;

• Increase the redemption fee of ETHC;

CR < 120%:

• Prohibition of minting ETHS from ETH ;

• Set the redemption fee for ETHS to zero;

• Set minting fees for ETHC to zero;

• Higher redemption fees for ETHC;

• Use the insurance fund to buy ETHS in the secondary market, and then redeem it for ETH.

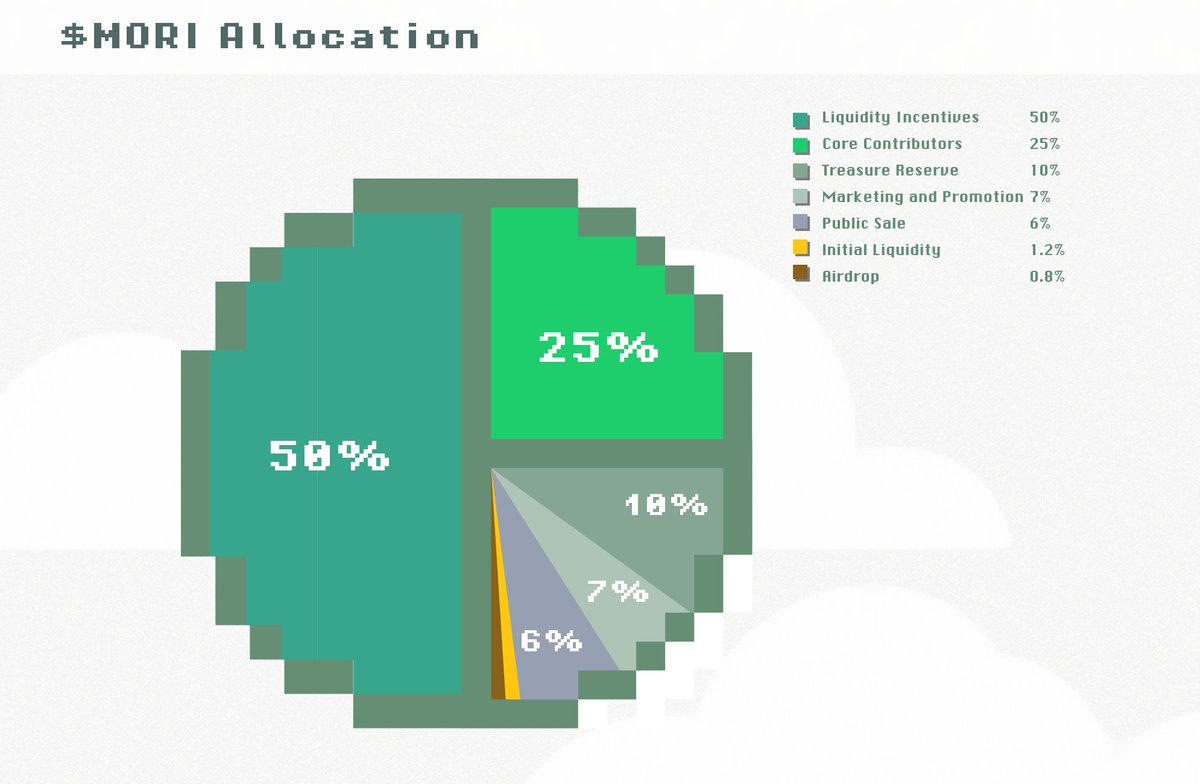

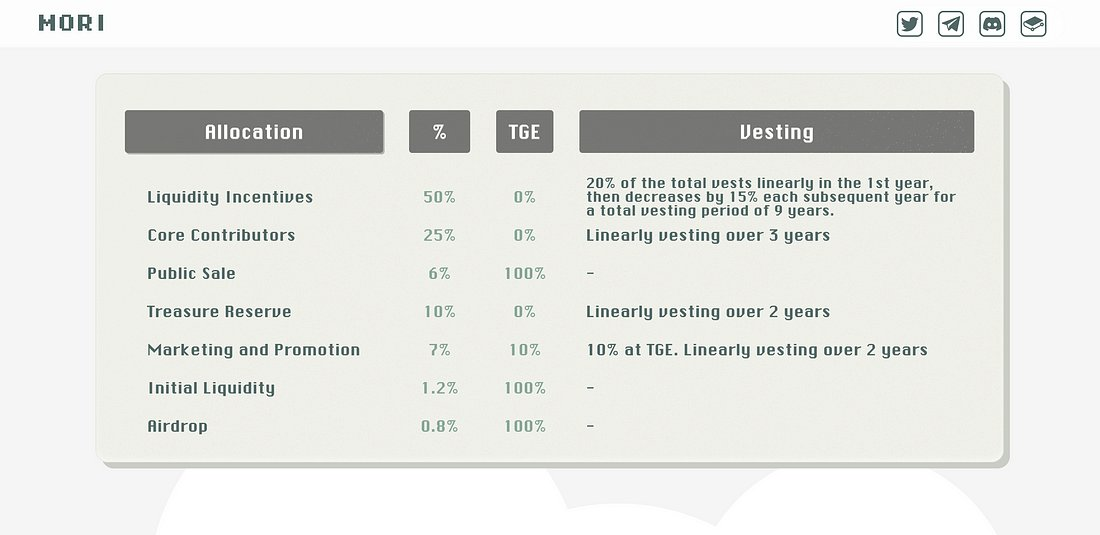

Token Economics

Uses of $xMORI:

• Staking $MORI;

• Agreement revenue sharing;

• Yield Booster;

• Governance.

Its IDO will be divided into two rounds. The first round will be at 1:00 PM UTC on July 20. Early supporters, testers, and the public can participate:

1% for whitelist, 2% for public = 30,000 $MORI;

Price: 1 MORI = 0.005 ETH;

FDV: 10 million;

Amount raised: About $300,000.

The time for the second round is when the Mori mainnet is launched.

There is still time to join the testnet, as the snapshot will take place on July 19th, the day before the sale.

Here's why I like Mori Finance:

no pre-sale;

no VC;

no team assignment;

Audited by Peck Shield before going live.

Roadmap/Team

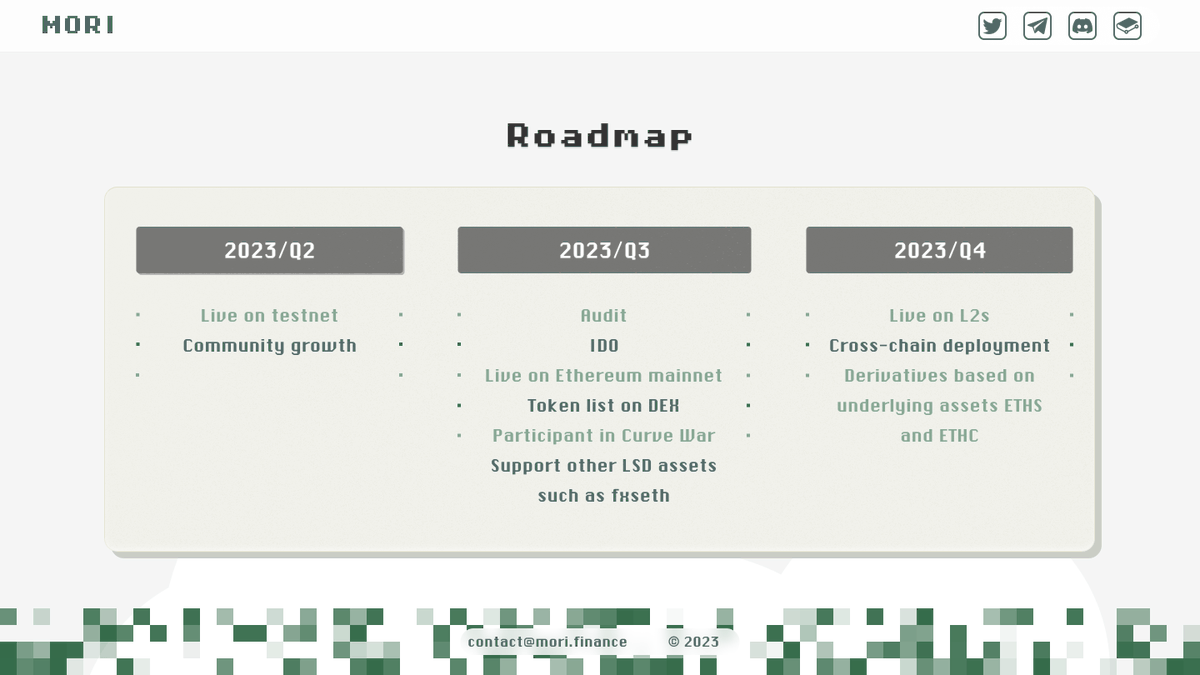

They will go live on Ethereum in the third quarter of 2023, and then expand to other second layers in the fourth quarter.

Although the team is anonymous, the lead developer is very experienced, which can be seen in the speed of their development. Also because of its fast time to market, ahead of other competitors (f(x)), Mori Finance is definitely worth watching.