Written by: PEARY

Compilation: TechFlow TechFlow

This article will first explore the entire stablecoin industry, and then introduce MakerDao in three stages, past (V1), present (V2) and future (V3).

1 stablecoin

Due to the early stage, illiquid and speculative nature of cryptocurrencies, they can be volatile. The first stablecoins were launched in 2014 to mitigate this volatility, and fiat-backed stablecoins have since become an important part of the ecosystem. They create a more efficient, stable and convenient experience for all. Common uses include:

Store of value : Reduce overall volatility of digital portfolios. Without stablecoins, all crypto wallets are subject to extreme volatility.

Send money : Sending money is made simple, faster and more efficient, with no fees or red tape for everyone.

Trading : Allows trading on exchanges without a traditional bank account. Instead of all settling in U.S. dollars, exchanges can use stablecoins like USDT to settle trading pairs.

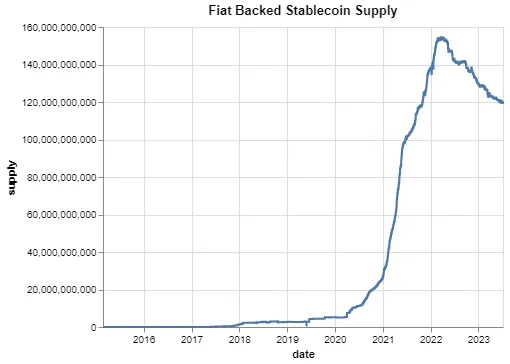

Below is a chart showing the combined market capitalization of the largest six fiat-backed stablecoins. At the peak of the last bull market, the stablecoin market capitalization reached about $160 billion, and it is now slightly over $120 billion, accounting for more than 10% of the entire cryptocurrency market capitalization. About 70% of the supply is in USDT and another 25% is in USDC.

1.1 Profitability

Stablecoins are one of the few areas of the cryptocurrency ecosystem that can be profitable because they put dollars into yield-generating assets. From Tether’s public balance sheet, we can see that they have about $81.8 billion in assets and $79.4 billion in liabilities (USDT market value), and achieved a profit of $1.48 billion in the first quarter alone . They do this by re-pledging assets held by consumers into safe investments like short-term T-bills, which can yield more than 5% in the current environment. Taking the US$80 billion investment in short-term treasury bonds as an example, USD 4.5 billion in profits can be obtained from Tether.

In an unusual measure of profitability, Coinbase, the second-largest spot exchange by trading volume, only earned $736 million in gross revenue and actually lost money after fees. Many crypto companies are privately held with limited public information, but we can surmise that Tether (and the parent company behind USDC ) may generate more revenue than the rest of the entire crypto industry (except Binance) combined . Unfortunately for the general public, it is not currently possible to invest in Tether (USDT) or Circle (USDC) as they are private companies with no current plans to go public.

1.2 Other Stablecoin Types

That’s not to say that fiat-backed stablecoins are risk-free. Just a few months ago, USDC ’s value pegged to the U.S. dollar dropped to about $0.87 as Silicon Valley Bank (SVB) froze $3.3 billion in funds. For better or worse, fiat-backed stablecoins rely heavily on external factors such as the banking system. So far, the Federal Deposit Insurance Corporation (FDIC) has not paid all depositors in full, leaving a shortfall of about $1.9 billion.

Two other types of stablecoins that have received much attention are algorithmic stablecoins and crypto-collateralized stablecoins. A famous example of an algorithmic stablecoin is UST, which plummeted in a single day, wiping $20 billion off its value. Cryptocurrency-collateralized stablecoins theoretically do not have the downward spiral pressure of algorithmic stablecoins, nor are they overly dependent on the banking system. This article will focus on the history of MakerDao, the most popular issuer of crypto-collateralized stablecoins, as well as its current role in the ecosystem, why we think it is a good current investment choice, and its future plans.

2 SAI: V1

At the same time that fiat-backed stablecoins are starting to emerge, people are starting to experiment with other ways of backing them. One of them is MakerDao, one of the largest and oldest decentralized applications in existence, focusing on using cryptocurrencies (rather than fiat currencies) to back stablecoins. Initially, the goal was to build an over-collateralized decentralized stablecoin with ETH as the only collateral, and a prototype was launched in 2017. Decentralized stablecoins offer many of the same advantages as centralized fiat-backed stablecoins, but also are trustless and mitigate counterparty risk. The first version works like this:

Jill deposits ETH into the MakerDao smart contract, and then she can mint SAI (a stablecoin) with a 150% collateralization ratio: this means that a deposit of $150 in ETH can mint up to 100 SAI. The smart contract then sends the SAI to Jill, records the amount of SAI given as a debt, and locks Jill's collateral until the debt is repaid.

Jill can then spend her newly minted SAI while maintaining exposure to the ETH she deposited in the smart contract. A typical use case is to swap SAI for more ETH , essentially creating a leveraged position. In the example above, if Jill were to swap all of her SAI for ETH, she would gain $250 of ETH exposure with only $150 of ETH , achieving 1.6x leverage.

In order to protect the collateral, ensure that MakerDao does not take on bad debts, and accumulate income for the protocol at the same time, Jill needs to pay attention to the collateral ratio and the stability rate (the interest rate paid by minters). If her ETH value falls below the 150% collateralization ratio, a portion of her collateral may be liquidated to bring her back to the 150% level (set by governance).

This early version of MakerDao greatly improves the capital efficiency of holding ETH . If Jill wants to redeem her collateral, she simply "burns" her minted SAI (and any additional interest), returning it to the smart contract, which subsequently unlocks its ETH. It should be noted that the parameters governing the MakerDao decentralized application, such as the collateral ratio and the stability rate (the interest rate paid by the minter), are determined by the Maker governance through the MKR token.

2.1 Product Market Fit

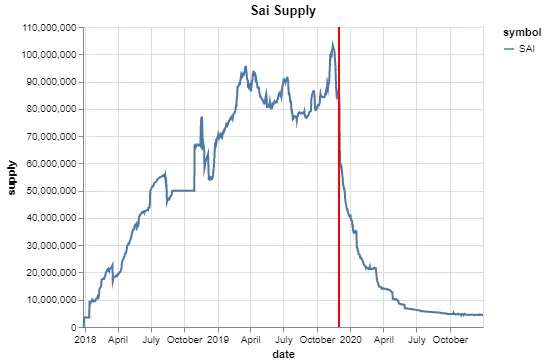

As can be seen from the Sai supply chart, there has been good progress and fit from day one, just like a fiat-backed stablecoin. The supply increased to over 100 million in November 2019, and then MakerDao upgraded to a second version, marked by a red vertical line. Perhaps even more telling about Sai’s appeal is the emergence of other cryptocurrency-collateralized stablecoins such as Frax, FEI, Liquity, RAI, and Alchemix.

3 DAI: V2

In 2019, MakerDao was upgraded to the V2 version, allowing multiple collaterals to mint DAI, another stablecoin that replaces SAI in the ecosystem. Therefore, in addition to ETH , other assets (as determined by MKR governance votes) can also mint DAI. Essentially, this update increases the amount of DAI in circulation and reduces the volatility of DAI supply based on ETH price fluctuations. Today, there are a variety of different assets that can be used as collateral, such as liquid collateral derivatives (stETH and rETH), wBTC, erc-20 LPs, and real world assets (Treasury bonds), etc.

The sections that follow describe the current state of the protocol and detail MakerDao's various revenue streams.

3.1 Overview of V2

3.1.1 Dai savings interest rate

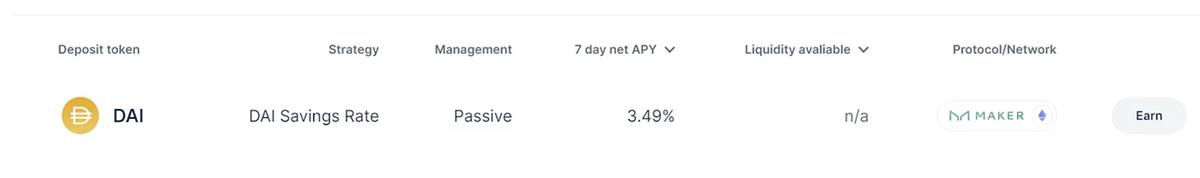

In addition to multi-collateral assets, V2 has some other notable improvements, such as the Dai Savings Rate (DSR), to incentivize people to hold Dai. The DSR is a benchmark rate that anyone who holds Dai can earn incentives by depositing it into a separate DSR contract. The current DSR is 3.49%, which can be considered the basic "risk-free" rate in cryptocurrencies. There are no minimums or fees for deposits and withdrawals, and the Maker Protocol distributes a portion of its revenue to all DAI holders who deposit into DSR.

3.1.2 Dai Collateral

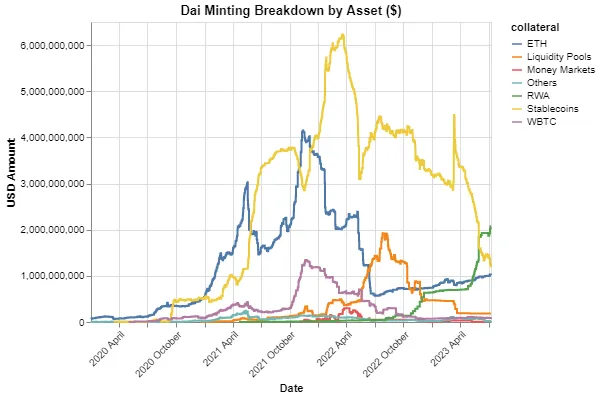

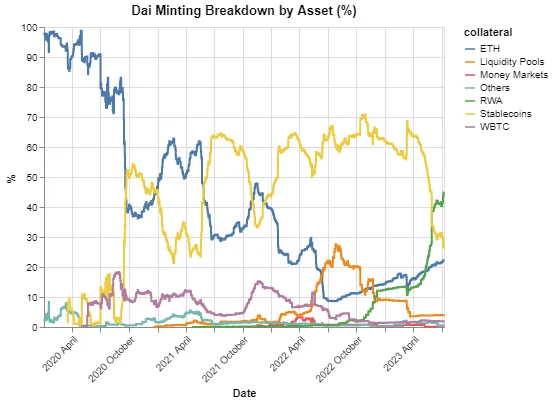

MakerDao issues Dai by charging depositors a stability fee, which is its main source of income. Currently, there is approximately $9.1 billion in Total Value Locked (TVL) in the Maker Protocol, with approximately 4.6 billion Dai issued. Initially, we saw Ethereum as the primary way to issue Dai, which was likely carried over from the days of SAI because people felt familiar with it. In the early days, DAI was always pegged because people wanted to invest DAI in liquidity mining, and DAI was kept above the peg price. MIP-21 created the Pegged Stability Module (PSM), a programmatic vault that allows stablecoins like USDC to issue Dai at a 1:1 ratio without the need to pay stability fees, which is where the stablecoins exploded. reason.

Recently, MIP-65 brought real-world assets into the Maker protocol, and the share of these assets is gradually growing. The real-world asset portion of DAI collateral has grown from zero to nearly 50% in just over a year.

3.2 V2 Profitability

3.2.1 Dai income

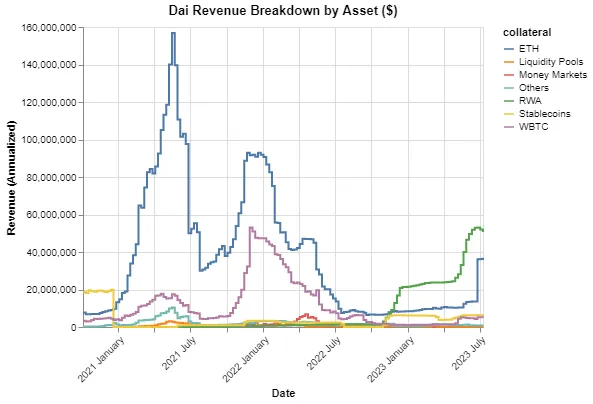

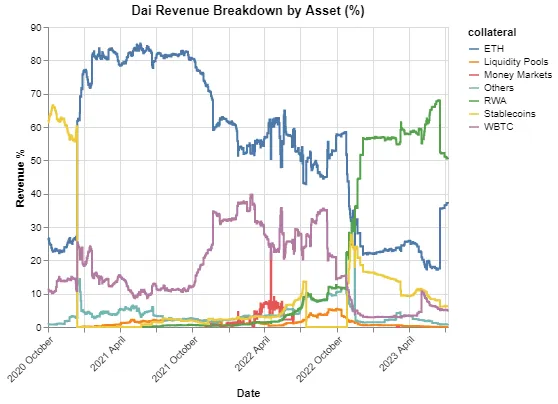

In the new multi-collateral world, where the percentage of the stabilization rate varies by asset, real world assets do not have a stabilization rate, instead the proceeds are passed on to the remaining buffer, which is effectively an insurance fund that assumes bad debts. Below is a breakdown of asset classes by income. We can see that initially most of the revenue comes from ETH stability fees (and to a lesser extent WBTC stability fees). However, since the beginning of the year, MakerDao has followed its fiat-backed stablecoin peers USDT and USDC in investing the majority of its funds in real-world assets. More than 50% of income now comes from these T-bills and other similar assets. Note that this breakdown is unrealized P&L, and future numbers will be higher as both stable rates and real-world yields improve.

3.2.2 MakerDao rate of return

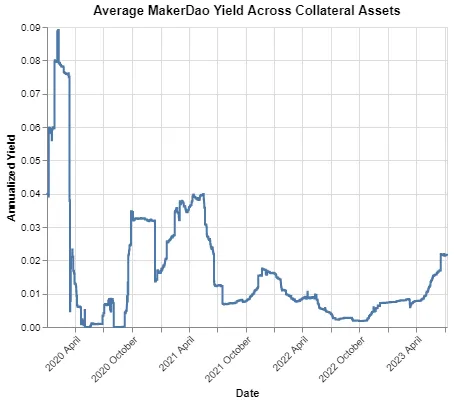

So how much income can MakerDao generate on its assets? Below we can see that the annualized rate of return is very volatile. MakerDao is gradually increasing its total revenue, primarily by converting non-revenue-generating stablecoins into productive assets.

3.2.3 Expected benefits

Specifically, the protocol earns about 3.79% from ERC-20 stability fees, or about $3.57 million per month and about $42.8 million in annual revenue. Returns on real-world assets are also more stable because interest rates are less volatile and move more slowly.

3.2.4 Other income

In addition to stabilization fees and returns on real-world assets, MakerDao also generates income through liquidations. These incomes are erratic and mainly occur when the market fluctuates, usually downwards. For reference, the average monthly liquidation P&L over the past year was $1.37 million, but some months (such as January) were 0, while others (such as October 2022) reached a P&L of $3.92 million.

In addition, there are PSM issuance fees and flash loan fees, but they are negligible in overall profitability. Adding the liquidation revenue, we get annualized projected revenue of $138.24 million and monthly revenue of $11.57 million. Note that these numbers are very high for all but fiat-backed stablecoins.

3.2.5 Expenses

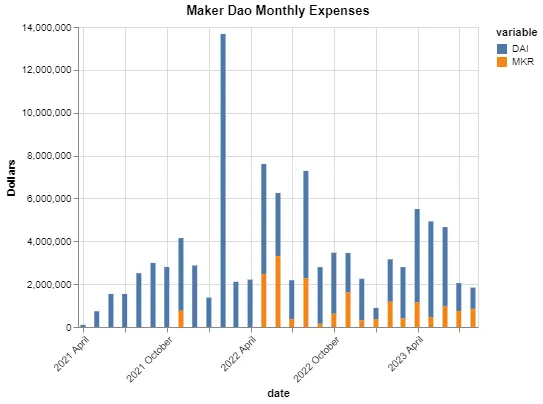

To extrapolate overall profitability, we need to factor in expenses, including the core development team, managers, risk management staff, lawyers, and a host of other expenses, to run a large decentralized organization. These numbers are constantly changing as new programs are constantly being introduced, so it is difficult to predict the future.

Spending over the past 12 months has been around $38 million: $29 million in DAI and $9 million in MKR. It is important to emphasize that while many new spending plans have been approved, most of the old core units are being retired, so past spending is not a good indicator of future spending and some approved plans may not be implemented . Expenses may rise or fall.

3.2.6 Profitability

Subtracting expenses from revenue, we get an annualized profit of about $100 million. Aside from the aforementioned stablecoins and some exchanges, there are few decentralized applications that are more profitable. MKR has a market capitalization of approximately $820 million. We (and many in the crypto space) prefer not to use traditional financial metrics to value crypto protocols, preferring to use internal KPIs, but this equates to a P/E ratio of 8.2. The market is pricing MakerDao as a full-fledged bank stock with revenue based on earnings generated and stripped of all future growth potential.

3.3 MKR token (instant catalyst)

In the cryptocurrency space, there is often friction between the cumulative value of protocols and the cumulative value of tokens. It is known that DYDX does not return profits/revenues to token holders. But MKR is different. Once the remaining buffer reaches a certain level, the protocol buys back and burns MKR. A few weeks ago, the smart burn feature was introduced, which, unlike buyback MKR , uses half of the remaining funds to buy back MKR and provides liquidity to the MKR/DAI Uniswap V2 pool for the rest. Unlike burning, buying and providing liquidity will reduce the volatility of MKR on the way up and down, while capturing transaction fees.

3.3.1 SmartBurn

The upper limit of the remaining buffer zone was recently adjusted from US$ 250 million to US$ 50 million. If there is excess DAI, a smart destruction mechanism will be used. Given that we currently have ~$80M remaining, the protocol will exchange and pool $5,000 of DAI every half hour until the remaining buffer returns to $50M; this equates to 125 days of TWAP buy-in.

Please note that the smart destruction mechanism has not yet started, and the launch will mark the beginning of the third version of the MakerDao protocol - Endgame. This protocol has a 50/50 MKR/DAI UniV2 pool, dubbed Maker Elixir, which will increase MKR 's liquidity, give it constant buying pressure, and capture transaction fees.

3.3.2 More income

There are 500 million US dollars of USDC stored in PSM, which has not generated any income. PSM's outflow of funds has finally slowed down and contracted with Blocktower to gradually leverage these dollars and was able to generate a yield of more than 4.5% on these assets, providing MakerDao with an additional $22.5 million in annual income. If rates hold steady, we expect MakerDao to easily achieve over $150 million in annual revenue by the end of the year, giving it a P/E ratio of 6 (if prices hold).

3.4 Questions

There are some significant issues with V2, some of which are related:

MakerDAO was overly complex and disorganized, leading to many disagreements and rifts. This in turn leads to inefficiencies.

DAI supply is trending down and needs to be reversed.

MKR tokens have no real purpose other than governance and there is not enough incentive to vote on most proposals.

3.4.1 Governance issues

A major problem with V2 is governance apathy, which in turn creates a very lazy environment, which is often the opposite of its competitors. On average, each MIP takes more than 2 months from proposal to approval, and virtually no one participates in governance. Fewer than 40 unique individuals vote on each action, and votes typically pass with 5-10% of the total supply. In a recent poll, typically, one person provided 88% of the voted MKR.

In Voter's defense, MakerDao is so comprehensive that making informed decisions is essentially a full-time job, as they need to be educated on issues ranging from RWA to proper liquidation parameters. However, this long lag makes MakerDao inefficient and does not maximize value capture. Especially when it comes to stabilizing rates, governance has historically been too slow to adjust rates on ups and downs.

3.4.2 Inefficiency of revenue optimization

Proper revenue optimization requires constant review, precise monitoring and accurate reporting. For many RWA vaults, these characteristics do not apply.

3.4.3 DAI supply reduction

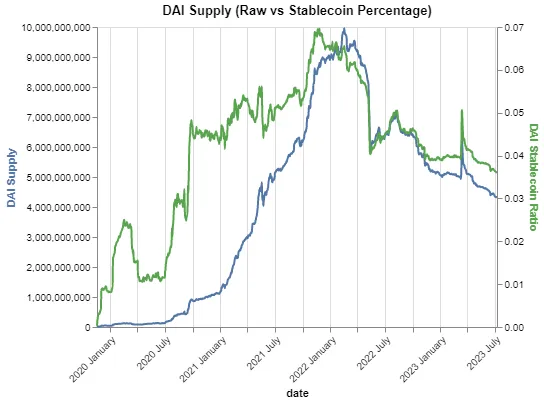

Below is a time-series graph of raw DAI supply and DAI as a percentage of the entire stablecoin market cap. During the entire rise, the stability rate was too low, causing DAI's share of the entire stablecoin market value to rapidly increase from 1% to 7% near the peak, but failed to capture enough revenue. Since November 2021, the situation has reversed because the stability rate was too high, especially compared to other protocols. DAI's market share has dropped from a peak of 7% to about 3.5% of the market, from 10 billion to just over 4 billion, mostly due to higher fees compared to other Defi lending markets.

It's worth noting that the remaining 4 billion+ DAI supply is fairly stable, as many of the top 50 wallets are smart contracts and hackers/scammers.

3.4.4 No real value accumulation

Crypto Twitter is at its best a place where ideas exist on their own merits because everyone is anonymous. And at worst, Crypto Twitter is a repeating machine full of bullshit with few independent thinkers. A well-known account called DegenSpartan has been critical of MKR for the past four years. He asks some legitimate questions, but more importantly, the charts dovetail with his point.

This is one of the worst charts we have seen recently, especially when we look at the red MKR/ ETH ratio. The chart looks like it has a persistent seller with no buying support, first because of the negative contagion in the stablecoin space caused by the UST crash, and then because MakerDao has been returning captured value to the token over the past year and a half Before holders, the surplus buffer was increased to 90 million, then 250 million, and the buyback and burning plan was suspended. However, smart destruction has been adopted to solve this problem.

3.5 V2 Conclusion

The current version of Maker is one of the most profitable protocols in the cryptocurrency space. Profiting $100M per year (and growing), the market is valuing the token price like a stock in a full-fledged bank, with no upside or future plans. If we break down MakerDao's cash flow, and assume the Maker token has no further utility , it will be the cheapest cryptocurrency from a P/E perspective.

This is not to say that MakerDao V2 is without drawbacks, such as inefficient revenue capture due to core governance flaws, tokens that currently do not accumulate value, declining demand for DAI, and a poor image of sentiment and price from the wider crypto community .

All of these issues are responsible for the huge disconnect between fundamentals and prices. The new version V3 of MakerDao aims to inject strong momentum into the protocol, increase TVL (total value locked), stabilize fee rates, and bring a series of new value capture methods to the MKR token, hoping to turn sentiment and price.

4 Endgame: V3

Rune, the founder of MakerDao, has been working on the development of V3 for more than a year. The new version will introduce massive changes in governance operations, token economics, and numerous decentralized applications in order to develop MakerDAO into the largest and most widely used stablecoin project in the next few years. Appropriately named "Endgame", the goal of this upgrade is to create a strong and long-lasting end-state so that the core of MakerDao does not change.

The following objectives are highlighted in the document and include but are not limited to the following:

Achieve global mass accessibility to DAI;

Create steps to expand the Maker ecosystem in a decentralized manner;

Reduce MKR centralization through new token economics and issuance methods;

Reduce the governance burden on MKR holders.

Perhaps more importantly, it attempts to address all major pain points in V2.

4.1 Overview

4.1.1 subDAO (Efficient Income Extraction)

To achieve the above goals, tasks will be reorganized into smaller, more flexible subDAOs. For example, a subDAO could focus on RWA to extract the highest yield. Voters in subDAOs will have smaller mandates, allowing them to iterate faster and engage in deeper discussions and reflections.

Each subDAO will be independently profitable, run its own business, and have its own subDAO Token (SDT). These new tokens will be used as rewards to help specific parts of the protocol like DAI adoption and create a synergistic relationship between MakerDao and the various subDAOs.

subDAOs allow members to focus on specific tasks and develop specific expertise, creating a more efficient and valuable capture protocol. Going back to the RWA optimization example, currently, the RWA vault is yielding about 2.6% annualized on $500 million. Please note that the U.S. government’s treasury bond yield is 5.5%, and USDC is basically backed by treasury bonds, so why not go directly to the issuer of the treasury bond and give Coinbase a 3% handling fee? Of course, this has the benefits of custody and slight risk diversification, and there is also a time lag problem in the traditional financial field, where all transactions take 3 business days to settle. Last month, Coinbase launched Coinbase Earn, where anyone can earn 4%. That extra 1.4% might not seem like much, but for a deposit of $500 million, that's an extra $7 million. Each subDAO can perform many other low-cost optimizations to increase the revenue of the protocol.

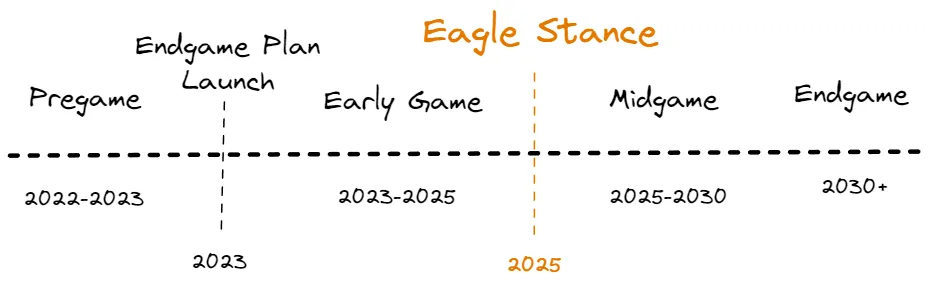

Endgame will contain many breaking changes, many of which will stack on top of each other, so the order of upgrades is very important. Here's a vague timeline:

4.2 New tokens

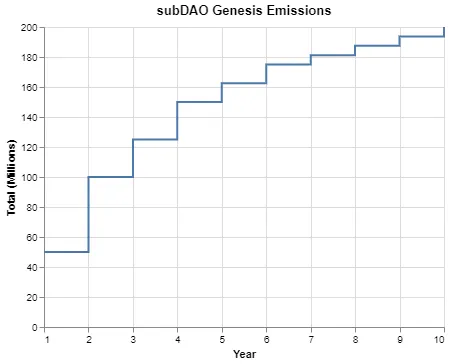

There will be a token split where each MKR token will be converted into 1200 New Governance Tokens (NGT). Likewise, a new stablecoin (NSC) will also be launched as a wrapper for DAI. To drive initial adoption of NSC, several liquidity mines will be set up, one for NGT (10 million NGT per year, approximately 1.2% of total supply), and six mines per independent subDAO (10 million NGT per year) 35 million SDT, about 1.75% of the total supply), these liquidity mining only accept NSC.

Note that the tokenomics of each subDAO in the first year is 230 million SDT, so 35 million is more than 15% of the first year supply. These liquidity mining will be a powerful marketing technique to get NSC off the ground and focus on each individual subDAO. They will reverse the trend of decreasing DAI supply.

4.3 subDAOs

Six subDAOs will be established initially, with two FacilitatorDAOs focusing on operational DAO governance and four AllocatorDAOs focusing on generating use cases for NSC and allocating various collateral assets.

Of the 230 million SDT, 200 million is used for mining, and the specific distribution is as follows:

Similar to how MKR currently uses residual income to purchase and pool MKR , the subDAO will do the same. MKR Elixir is a 50/50 MKR/DAI pool, while each SDT will have its own Elixir, which is 50/50 SDT/ MKR. Basically, any profits in the ecosystem are used to buy and pool MKR, providing it with permanent buying pressure and deep liquidity. It is easy to see that on-chain, MKR is poised to become the third most liquid asset after ETH and BTC .

4.4 Sagittarius Locking engine

The final piece of the tokenomics puzzle is the Sagittarious Engine (SE), a MKR voter incentive and governance lock-up mechanism. A major problem with the current version of MakerDao is that very few people are voting and/or delegating, so the participation rate is very low (typically between 5-10%). SE locks up MKR(or NGT) for a long period of time, requires participation in governance, and opens exclusive private liquidity mining for DAI and other subDAO tokens.

If depositors want to withdraw MKR tokens from SE, they will bear a substantial 15% impairment, which will be destroyed. Additionally, when subDAO tokens are launched, 30% of all token mining will be allocated to SE participants.

4.5 MKR value accumulation

Unlike Meme , the worthless governance token, MKR has many uses in V3 beyond governance:

Mining various SDTs in the best way through SE;

Maker Elixir Surplus Buyback;

subDAO Elixir Surplus Buyback;

Stake to validate the new MKR chain.

5 Investment overview and conclusions

In this article, a rough overview of the entire stablecoin industry is given and it is illustrated that it is one of the most profitable areas of cryptocurrency. Maker is the oldest and largest investable stablecoin, and by traditional measures of value, it is extremely cheap, underestimating all future growth.

At the protocol level, we introduce V1 and V2, and analyze some shortcomings. We then examine how V3 fixes and reverses many of V2's problems, and explains the complex new token economics that rule V3. MakerDao is by far the largest decentralized stablecoin, and the new offerings on V3 will only strengthen its lead. It is also the most profitable decentralized stablecoin protocol, and the efficiencies created by the subDAO will accelerate this profitability. In my opinion, these fundamental changes, combined with the rebranding of the token (one MKR worth $900 into 1200 NGT worth $0.75), are all positive catalysts for the token.

Some short-term liquidity to watch out for: A16Z has unstaked MKR from governance and sent it to Coinbase for sale. They've sent about 15,000 and have 34,000 left (19,000 in the wallet and 14,000 in governance), which we can safely assume will be sold.