Original Author: Xie Jiayin

Original source: medium

Hello everyone, I am Kayin. In the past two years, I have heard that oil on the XX platform has been frozen, so I basically only sell small amounts of less than 10,000 oil through Binance and Huobi C2C (low frequency several times a year). When the rest exceeds 10,000 oil or some friends ask me to help out oil, I only dare to give it to friends I know outside the venue (I think this is the best arrangement, and we dare not ask for money from strangers).

Let me tell you my own story, sometimes friends ask me to help out oil, because I am not a professional oil trader, so I only help friends out, and I don’t make money, it’s purely out of kindness. The most recent withdrawal was about 100,000 for my friend A who asked me to help out. After I received the oil from A, I gave it to friend B, but B was just a middleman. He asked his friend C, whom he met offline, to transfer the money to A.

For the sake of safety, A only issued 10,000-15,000 per day, and each time he charged a different card (his family's card). The first few days were fine. But in the last two days, A suddenly found that the bank card was frozen, and there was still 90,000 yuan in it. More importantly, A transferred a sum of money to his family member D's bank card, which was frozen together. D had about 200,000 yuan in the card at the time.

At this time, I was already in a panic, don't make money, and get yourself into trouble. After all, hundreds of thousands is not a small sum.

Of course it finally came out. But the shadow in my heart can no longer be dissipated, and I dare not help my friend out in the future.

Later, I talked to many business friends who specialize in bulk business in the circle, and consulted colleagues from the Huobi OTC team. Write down some risk tips on how to avoid freezing cards, hoping to help every friend.

Let me first talk about the risk comparison between off-site withdrawals and on-site C2C withdrawals:

I can tell you very clearly here! The risk of off-site gold withdrawal is much higher than that of on-site C2C! At least there are order records and kyc records for on-site withdrawals.

Secondly, why are the risks outside the market higher:

1. You can trust your friends a lot, and you can trust your friends' friends a lot. But you really have absolutely no way of judging whether the assets in the bank card of your friend or your friend's friend have funds involved in the case. Because now the public security freeze can freeze at least 6 floors, and if a department-level cadre encounters a case, it can freeze more than 12 floors at most!

2. If you ask your good friend to help you withdraw funds outside the market, and he has helped you for a year, and you also know that he does not earn your money, or only earns 2 cents. But if a certain amount of assets is suddenly frozen by the police (for example, there are 400,000 to 500,000 RMB in it), at this time, if your money has not been unfrozen within 3 days, you should panic. Everyone comforts you to wait a little longer, the next cycle will be half a year, and maybe it will be untied after half a year. But what if the police continue to freeze indefinitely after half a year? Can you still sit still at this time? Is your friend at ease? Your money is frozen and you need your friend to compensate? What if he can't get it out?

3. For example, this time I helped a friend withdraw money, and the two cards add up to more than 300,000 yuan, what should I do if it really freezes? If I don't pay, will I break the friendship of so many years? It is said that the currency circle is ruthless, but Jiayin has been in the business for many years and has been exchanging sincerity for sincerity. He would rather be blamed than others. But if I lose, do you think I'm really willing? After all, I really didn’t make any money, and I even charged a gas fee for each transaction.

As someone who has experienced it, I still recommend that you withdraw funds through C2C on the site , so that if you have any problems, you can contact the customer service of the platform to deal with the follow-up matters.

Tell me again what is C2C?

C2C trading is a peer-to-peer market where users buy and sell digital assets , such as USDT and other cryptocurrencies, which exist directly between users. The process is similar to that of OTC withdrawals and finding an intermediary for guarantee: the buyer places an order—the platform locks the seller’s assets—the buyer pays—the seller confirms the payment and releases it

For the encrypted platform for withdrawing funds, everyone must choose a regular platform. According to the data feedback from many professional merchant friends who have been engaged in OTC business for many years, the first ladder for safe withdrawal is still Binance, Huobi, and Ouyi .

Taking Huobi as an example, let’s talk about the withdrawal process (finally there is a withdrawal risk/withdrawal suggestion/freezing process)

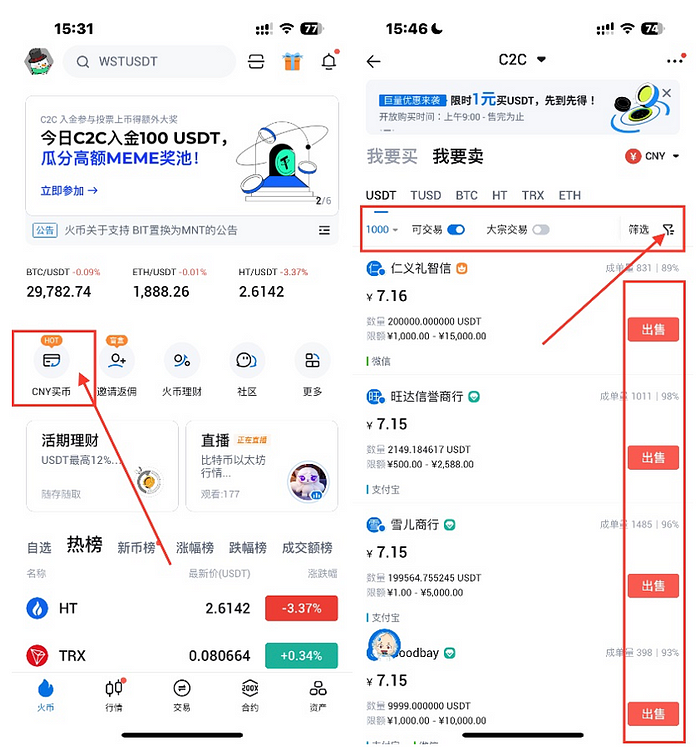

- Click CNY to buy coins on the home page of the APP (or click Transaction-Fiat Currency)

- Select the C2C self-selected area transaction, click I want to sell

- a. Screen the transaction amount, or view the transaction limit of merchant advertisements, and select the appropriate merchant

- b. Screening of tradable merchants: according to the amount of deposit, Blue Shield merchants can be selected first (high security, frozen with compensation) followed by super V merchants , plus V merchants

- c. Screen the supported payment methods

3. After selecting a suitable merchant, click Sell

3. After selecting a suitable merchant, click Sell

a. Click Sell by Amount/Sell by Quantity

b. Enter the withdrawal amount/quantity

c. Enter the Google verification code or fund password to complete the order

4. The order is placed successfully

a. Confirm the order amount, unit price, quantity and other information, and click the chat in the upper right corner of the order to communicate with the buyer.

b. It is very important to confirm the buyer's real name, and resolutely do not accept payment without real name.

c. Waiting for the buyer to pay. After the payment is completed, the buyer needs to log in to the receiving account (Alipay, WeChat, bank card) to check whether the payer's name, amount and other information are consistent with the information on the order interface.

d. Confirm that the buyer pays with the account that matches the real name of the platform, and the payment amount is correct.

e. Click I confirm that I have received the payment release order, and enter the Google verification code or fund password.

5. Complete the withdrawal

5. Complete the withdrawal

Precautions! memorize! ! ! memorize! ! ! memorize! ! !

1. If the buyer's order window states that payment is not required in real name, family members or friends will pay on behalf of the buyer, resolutely reject and appeal the order, or contact customer service to deal with it.

2. If the buyer requests to add WeChat or other contact information, you can choose to refuse and ask the buyer to pay in real time in real time.

3. If the buyer asks for a high price payment but needs to pay in a non-real name, please be sure to refuse and complain to the customer service.

4. If the buyer agrees, a flow check can be conducted with the buyer.

5. Before placing an order, please make sure that the receiving account is normally available.

Here comes the risk! ! ! Common risks of withdrawing money!

1. Fraud risk: The buyer uses P-pictures, SMS, delayed arrival, pretending to be customer service and other means to defraud USDT.

Solution: Make sure to receive the buyer's payment and confirm that the received funds are available (check the buyer's funds, at least 3 days).

2. Offline transaction risk: The buyer conducts robbery through offline transactions.

Countermeasure: trade on reliable large platforms, such as Binance, Huobi, and Ouyi, and try to avoid offline transactions. If offline transactions are necessary, the transaction location should be conducted in a crowded and safe place.

3. Risk of freezing: There is a direct or indirect problem with the buyer's funds, which leads to the freezing of the seller's payment method.

Solution:

a. Choose a safer platform for merchant transactions. Generally speaking, the security level:

Blue Shield Merchant>Super Merchant>Add V Merchant

b. Resolutely do not accept non-real-name payments, and only trade with real-name payment merchants;

c. If the buyer agrees, you can do a flow verification with the buyer, and it will be safer to deposit funds for more than three days;

d. Risk of difficulty in confirming real-name information: If the buyer pays with a method that cannot verify the name of the payer (Alipay to bank card, cloud flash payment, etc.), he can contact the buyer to provide relevant video proof of real-name payment, etc.;

Tips for withdrawing money! Focus! ! !

1. Choose a regular platform, the first echelon: Binance, Huobi, Ouyi.

2. It is recommended to use Alipay to collect money. After receiving the money, put it in Yu'e Bao to deposit for a few days, and then transfer it to other bank cards; or use an uncommonly used bank card to collect money. Check the status of the card before each collection. After receiving the money, transfer it to Alipay's Yu'e Bao for deposit.

3. Reduce the number of withdrawals. For example, if I withdraw once a month, I can reduce it to once every 2 or 3 months, reducing the number of withdrawals and reducing the frequency.

If you are very careful, the bank card is still frozen, what should you do? ? ?

Type 1: Bank freeze

Banks in some countries and regions do not allow bank accounts to participate in digital asset transactions (for example, because BTC, ETH, USDT, etc. are noted during transfers, which lead to monitoring by the bank’s risk control system), so when an account involves digital asset transactions, the bank will freeze or suspend some transaction permissions;

It may also be because certain behaviors of this account triggered the bank's anti-money laundering system (for example, large transfers late at night, frequent transactions with multiple people, no balance in the card for a long time, fast in and fast out, etc.).

Generally speaking, the bank will not directly freeze the bank card, but will only restrict your non-counter business or "only pay but not receive", that is, suspend part of your transaction authority.

How to deal with this situation?

Contact your bank directly and provide relevant information as required by the bank, generally explaining the reason for the transfer of funds.

How to prevent bank freezes?

First, when dealing with buyers, remind the other party not to note USDT, BTC and other sensitive words.

Second, don't use mortgage cards, life cards, and don't just use one bank card. You can prepare a few more and change them after a while.

If you are very careful, the bank card is still frozen, what should you do? ? ?

The second type: the most troublesome judicial freeze

First of all, it is necessary to understand the logic of judicial freezing: according to the judicial procedures of different countries, they are different. But it's roughly the same:

1. After being defrauded, the victim reports the case to the police. The police will freeze all the bank accounts on the relevant fund line according to the bank account number that the victim's money has passed through. For example, the victim’s money is called to bank account A, A calls to bank account B, B calls to bank account C, and then extends to D, E, and F; then it is possible that A, B, C, D, E, and F will all be frozen, and B, C, D, E, and F may not know the source of the funds.

2. Freezing, generally it is not that you will be frozen immediately after receiving the funds in question. You may be blocked for transactions older than 1 month. But generally speaking, it's because a transaction from a few days ago was frozen.

How to deal with this situation?

If your bank card is frozen by the judiciary, you need to check how long your freezing period is through the account opening bank or the bank's hotline. Where was it frozen? These two pieces of information are very important, and the bank's background will definitely display them. It is best to get these two pieces of information.

Most of the judicial freezes are only temporarily frozen to cooperate with the police investigation, and will be automatically unfrozen within 3 working days. No need to worry about this, it will be automatically thawed when it expires. But we should also pay attention to transfer the money when the deadline is due, because it is possible that the implicated case has victims in more than one place, then it may be frozen by more than one place, and it may be frozen again in the future. In addition, this 48 or 72 hours is not thawing on time, and some will be delayed for several hours or even half a day.

The second case is that the display is frozen for half a year. Generally, if you have directly received the problematic funds, or you are relatively close to the source of the problematic funds, you may be frozen for half a year. Of course, due to the different handling methods of various local judicial organs, in some areas, it is directly frozen for half a year.

What should I do if it shows frozen for half a year?

Contact the local police as soon as possible, and ask the police to provide which payment you received, which led to being implicated. If they do, provide the relevant information as requested by the local police. (Relevant information is generally used to explain why you transferred the funds?)

Therefore, generally speaking, it includes your order records traded in Huobi OTC within a certain period of time (you can log in to your Huobi OTC account and click the order in the upper right corner to export and print), your frozen bank card flow, etc.

In addition, if the police need you to provide the personal information of a counterparty, please contact OTC customer service and follow the legal procedures provided by the customer service.

When the above materials are provided to the police, they will give some feedback according to the different handling methods of the public security systems in various places and according to the different cases. For example, some will strictly require that the case be solved or withdrawn before it can be unfrozen; some can only freeze the funds involved in the case, while some places can be unfrozen directly.

If the police refuses to unfreeze directly after you have made the record, you can ask about the funds involved in the case. If the funds involved in the case are much smaller than the frozen funds, you can apply to unfreeze the funds that are not involved in the case. In a legal sense, if you really did not participate in telecommunications fraud or money laundering, but were frozen because of the sale of digital assets, then you should be a bona fide victim involved, and it is recommended to consult a relevant lawyer.

Because there are at least order records and kyc records for on-site withdrawals, it is the safest.

Thanks for watching. For your freedom and safety of withdrawal, please read more!

Huobi muscle man representative - Xie Jiayin

July 22, 2023